UPSC Articles

ECONOMY/ GOVERNANCE

- GS-3: Indian Economy; Infrastructure

- GS-2: Government policies and interventions for development in various sectors and issues arising out of their design and implementation

National Monetisation Pipeline (NMP)

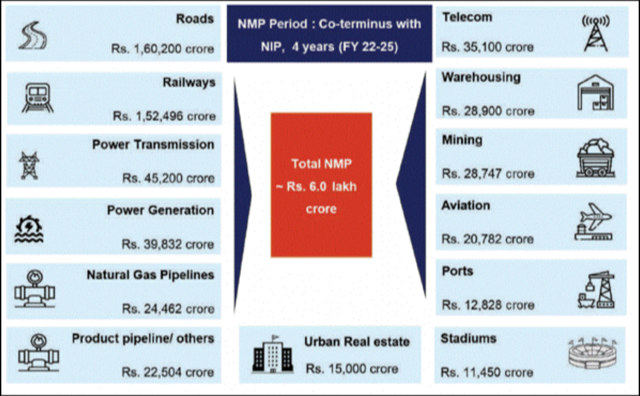

In news Union finance minister recently launched the National Monetisation Pipeline (NMP), through which the government aims to raise $81 billion by leasing out state-owned infrastructure assets over the next four years (from FY22 to FY25)

What is asset monetisation?

- Asset Monetization involves the creation of new sources of revenue by unlocking of the value of existing unutilized or underutilized public assets.

- Many public sector assets are sub-optimally utilized and could be appropriately monetized by involving private sector (leasing or selling) to create better value from the assets.

Key features of the National Monetisation Plan

- The NMP’s roadmap has been formulated by NITI Aayog in consultation with infrastructure line ministries, under the ‘Asset Monetisation’ mandate of the Union Budget 2021-22.

- NITI Aayog has a Public Private Partnership Cell and has engaged transaction advisors to handhold any ministry for any support it needs in pursuing the monetisation roadmap.

- The sectors in which assets are being identified to monetise include roads, ports, airports, railways, power generation and transmission, telecom, warehousing, gas & product pipeline, mining, stadium, hospitality and housing.

- For now, the government has only included the assets of infrastructure line ministries and Central Public Sector Enterprises (CPSEs) working in the infrastructure sectors.

- Monetisation through disinvestment and monetisation of non-core assets have not been included in the NMP.

- The framework for monetisation of core asset monetisation has three key imperatives:

- Monetisation of rights not ownership which means the assets will have to be handed back at the end of transaction life. The overall transaction will be structured around revenue rights.

- Brownfield de-risked assets: There is no land here, this entire (NMP) is about brownfield projects where investments have already been made and there is a completed asset which is either languishing or it is not fully monetised or is under-utilised.

- Structured partnerships under defined contractual frameworks & transparent competitive bidding, where Contractual partners will have to adhere to Key Performance Indicators and Performance Standards.

- The assets and transactions identified under the NMP are expected to be rolled out through a range of instruments.

- These include direct contractual instruments such as public private partnership concessions and capital market instruments such as Infrastructure Investment Trusts (InvIT) among others.

- For Ex: Under the plan, private firms can invest in projects for a fixed return using the InvIT route as well as operate and develop the assets for a certain period before transferring them back to the government agency.

- The choice of instrument will be determined by the sector, nature of asset, etc.

- NMP aims to provide a medium term roadmap of the programme for public asset owners; along with visibility on potential assets to the private sector.

- The NMP will run co-terminus with the National Infrastructure Pipeline of Rs 100 lakh crore announced in December 2019.

- An empowered committee has been constituted to implement and monitor the Asset Monetization programme. The Core Group of Secretaries on Asset Monetization (CGAM) will be headed by the Cabinet Secretary.

- Real time monitoring will be undertaken through the asset monetization dashboard. The government will closely monitor the NMP progress, with yearly targets and a monthly review by an empowered committee

- The top 5 sectors (by estimated value) capture ~83% of the aggregate pipeline value. These include: Roads (27%) followed by Railways (25%), Power (15%), oil & gas pipelines (8%) and Telecom (6%)

Merits of the NMP

- Resource Efficiency: It leads to optimum utilisation of government assets.

- Fiscal Prudence: The revenue accrued by leasing out these assets to private sector will help fund new capital expenditure without pressuring government finances.

- Streamlining the Process: Monetisation of assets is not new, but the government has finally organised it in baskets, set targets, identified impediments, and put in place a framework.

- Mobilising Private Capital: Since the assets are de-risked as it is brownfield projects, it will help in mobilising private capital (both domestic & foreign). Global investors have revealed that they are keen to participate in projects to be monetised through a transparent/competitive bidding process.

- Less Resistance: The plan involves leasing to private sector without transferring ownership or resorting to fire sale of assets. Therefore, it is going to face less resistance from the opposition.

- Cooperative Federalism: To encourage states to pursue monetisation, the Central government has already set aside Rs 5,000 crore as incentive.

- If a state government divests its stake in a PSU, the Centre will provide a 100 per cent matching value of the divestment to the state.

- If a state lists a public sector undertaking in the stock markets, the Central government will give it 50 per cent of that amount raised through listing.

- If a state monetises an asset, it will receive 33 of the amount raised from monetisation from the Centre.

- Promoting Public-Private Partnership: The end objective of NMP is to enable ‘Infrastructure Creation through Monetisation’ wherein the public and private sector collaborate, each excelling in their core areas of competence, so as to deliver socio-economic growth and quality of life to the country’s citizens.

Potential Impediments to NMP

Among the key challenges that may affect the NMP roadmap are

- Lack of identifiable revenue streams in various assets.

- Inadequate level of capacity utilisation in gas and petroleum pipeline networks.

- Lack of dispute resolution mechanism.

- Regulated tariffs in power sector assets.

- Low interest among investors in national highways below four lanes.

- Lack of independent sectoral regulators.

Conclusion

- In terms of annual phasing by value, 15 per cent of assets with an indicative value of Rs 88,000 crore are envisaged to be rolled out in the current financial year.

- While unlocking assets worth Rs 6 lakh crore is an ambitious plan, resolving the impediments is expected to bring investors.

Connecting the dots:

- National Infrastructure Pipeline

- Hybrid Annuity Model

- Public-Private Partnership