UPSC Articles

ECONOMY/ GOVERNANCE

- GS-2: Government policies and interventions for development in various sectors.

- GS-3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Oil Bonds

In news: The Centre has argued that it cannot reduce taxes on petrol and diesel as it has to bear the burden of payments in lieu of oil bonds issued by the previous UPA government to subsidise fuel prices.

Brief Background

- Before fuel prices were deregulated, petrol and diesel as well as cooking gas and kerosene were sold at subsidised rates.

- Government would intervene in fixing the price at which retailers were to sell diesel or petrol. This led to under-recoveries for oil marketing companies, which the government had to compensate for.

- Instead of paying direct subsidy to oil marketing companies from the Budget, the then government issued oil bonds totalling Rs 1.34 lakh crore to the state-fuel retailers in a bid to contain the fiscal deficit

What are Oil bonds?

- Oil bonds are special securities issued by the government to oil marketing companies in lieu of cash subsidy.

- These bonds are typically of a long-term tenure like 15-20 years and oil companies are paid interest.

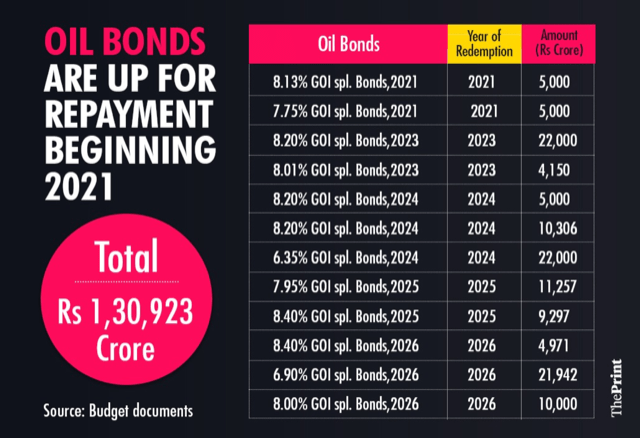

- Budget documents show that such bonds will be up for redemption from 2021-2026

Why do governments issue such bonds?

- Compensation to companies through issuance of such bonds is typically used when the government is trying to delay the fiscal burden of such a payout to future years.

- Governments resort to such instruments when they are in danger of breaching the fiscal deficit target due to unforeseen circumstances that lead to a collapse in revenues or a surge in expenditure.

- These types of bonds are considered to be ‘below the line’ expenditure in the Union budget and do not have a bearing on that year’s fiscal deficit, but they do increase the government’s overall debt.

- However, interest payments and repayment of these bonds become a part of the fiscal deficit calculations in future years.

Is issuance of such special securities restricted to UPA era?

- Besides oil bonds, the UPA era also saw the issuance of fertiliser bonds from 2007 to compensate fertiliser companies for their losses due to the difference in the cost price and selling price.

- Over the years, the NDA government has issued bank recapitalisation bonds to specific public sector banks (PSBs) as it looked to meet the large capital requirements of these PSBs without allocating money from the budget.

- Since 2017-18, the government has infused more than Rs 2.5 lakh crore of recapitalisation bonds to banks and paid interest of more than Rs 20,000 crore over these three years.

Why were oil prices deregulated, and how has it impacted consumers?

- Fuel price decontrol has been a step-by-step exercise, with the government freeing up prices of aviation turbine fuel in 2002, petrol in 2010, and diesel in 2014.

- The prices were deregulated to make them market-linked, unburden the government from subsidising prices, and allow consumers to benefit from lower rates when global crude oil prices tumble.

- Price decontrol essentially offers fuel retailers such as Indian Oil, HPCL or BPCL the freedom to fix prices based on calculations of their own cost and profits.

- However, the key beneficiary in this policy reform of price decontrol is the government.

Has Oil Price deregulation benefitted Consumers?

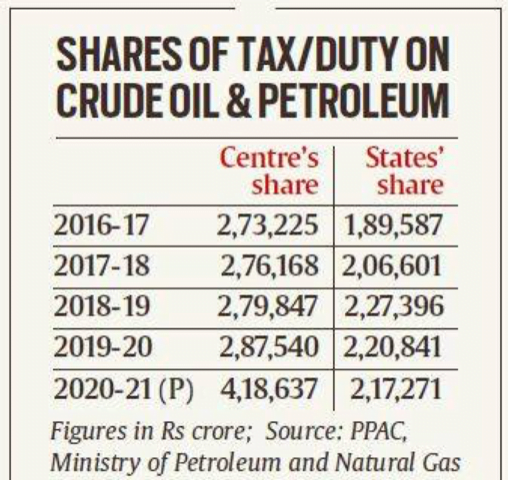

- While oil price deregulation was meant to be linked to global crude prices, Indian consumers have not benefited from a fall in global prices as the central as well as state governments impose fresh taxes and levies to raise extra revenues. This forces the consumer to either pay what she’s already paying, or even more.

Connecting the dots:

- Oil Price Rise

- 2020 Oil Market meltdown

- India’s GDP fall

- Strategic Oil Reserves in India