IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS + MAINS FOCUS)

Forest Rights Act, 2006 to be implemented in J&K

Part of: Prelims and GS III – Policies and interventions

Context The Jammu and Kashmir government has decided to implement the Forest Rights Act, 2006.

- It will elevate the socio-economic status of tribals and nomadic communities, including Gujjar-Bakerwals and Gaddi-Sippis.

- The decision will address the prolonged suffering of tribal people and also ensure forest conservation.

About Forest rights act, 2006

- The law deals with the rights of forest-dwelling communities to land and other resources, denied to them over decades as a result of the continuance of colonial forest laws in India.

- Eligibility is confined to those who “primarily reside in forests” and who depend on forests and forest land for a livelihood.

- Further, either the claimant must be a member of the Scheduled Tribes scheduled in that area or must have been residing in the forest for 75 years.

News source: TH

Petrol, diesel under GST purview

Part of: Prelims and GS III – Economy

Context The GST Council might consider taxing petrol, diesel and other petroleum products under the single national GST regime.

- Instead of GST, as of now, taxes like ‘Excise Duty’ and ‘VAT’ are being imposed on Petroleum goods like petrol, diesel, Air Turbine Fuel (ATF), natural gas and crude oil

- When GST was implemented in 2017, States did not allow these goods to be included in GST, because they were getting huge revenues (through VAT) on these goods.

- They thought that if these petroleum goods were included in the GST, then they would lose the freedom to decide the tax rate on these goods.

- So, at that time it was agreed that within 5 years i.e. by 2022, these petroleum goods will be included in GST.

About GST Council

- The GST Council is a constitutional body established under Article 279A of Indian Constitution

- It makes recommendations to the Union and State Government on issues related to Goods and Service Tax (GST).

- The GST Council is chaired by the Union Finance Minister.

- Its other members are the Union State Minister of Revenue or Finance and Ministers in-charge of Finance or Taxation of all the States.

News source: TH

WPI inflation

Part of: Prelims and GS -III – Economy

Context Inflation in wholesale prices resurged to 11.39% in August, staying in the double digits for the fifth month in a row.

Key inflation data

- Inflation in manufactured products: 11.4%

- Inflation in manufactured products: 26.1%

- Food price inflation: 3.43%

- LPG, petrol and diesel inflation: 48.1%, 61.5% and 50.7% respectively

The Difference between WPI and CPI

| Context | WPI (Wholesale Price index) | CPI (consumer price index) |

| Definition | Amounts to the average change in prices of commodities at the wholesale level. | Indicates the average change in the prices of commodities at the retail level. |

| Publishing office | Office of Economic Advisor (Ministry of Commerce & Industry) | Central Statistics Office (Ministry of Statistics and Programme Implementation) & Labour Bureau |

| Commodities | Goods only | Goods and Services both |

| Base Year | 2011-12 | 2012

Note: Base Year to be revised. |

| Published | Monthly | Monthly |

Linking of Unified Payments Interface (UPI) and PayNow

Part of: Prelims and GS III – Economy

Context The Reserve Bank of India (RBI) and the Monetary Authority of Singapore (MAS) announced a project to link their respective fast payment systems — Unified Payments Interface (UPI) and PayNow.

- PayNow is the fast payment system of Singapore that enables peer-to-peer fund-transfer service.

- The linkage is targeted to be operationalised by July 2022.

- The UPI-PayNow linkage will enable users of each of the two fast-payment systems to make instant, low-cost, cross-border fund transfers on a reciprocal basis without a need to get on boarded onto the other payment system.

What is Unified Payments Interface (UPI)?

- UPI is a payment system launched in April 2016 by National Payments Corporation of India(NPCI), that allows money transfer between any two bank accounts by using a smartphone.

- It facilitates customers to make round-the-clock payments instantly using a virtual payment address created by the customer.

- UPI allows a customer to pay directly from a bank account to different merchants, both online and offline, without the hassle of typing card or bank details.

- It also caters to the “Peer to Peer” collect request which can be scheduled and paid as per requirement and convenience.

- More than 100 million UPI QRs have been created in the last 5 years

- BHIM UPI in 2020-21 has processed 22 billion transactions worth Rs 41 lakh crore.

T+1 settlement system

Part of: Prelims and GS III – Economy

Context Securities and Exchange Board of India (SEBI) has offered T+1 settlement system for stock Market exchanges.

- If the stock exchange agrees to the proposal, investors will get money for shares they sold or bought in their accounts faster, and in a safer and risk-free environment.

What Is T+1 (T+2, T+3) cycles?

- T+1 (T+2, T+3) are abbreviations that refer to the settlement date of security transactions.

- The “T” stands for transaction date, which is the day the transaction takes place.

- The numbers 1, 2, or 3 denote how many days after the transaction date the settlement—or the transfer of money and security ownership—takes place.

- Stocks and mutual funds are usually T+1 and bonds and money market funds vary among T+1, T+2, and T+3.

CRISPR to control growth of mosquitoes

Part of: Prelims and GS III – Sci and tech

Context Researchers from California have developed a CRISPR-based system to safely restrain mosquito vectors via sterilization.

- It is called the new precision-guided sterile insect technique, or pgSIT.

Mechanism

- pgSIT uses a CRISPR-based approach to engineer deployable mosquitoes that can suppress populations.

- It alters genes linked to male fertility — creating sterile offspring — and female flight in Aedes aegypti.

- The mosquito species is responsible for spreading wide-ranging diseases including dengue fever, chikungunya, and Zika.

- pgSIT uses CRISPR to sterilize male mosquitoes and render female mosquitoes, which spread disease, as flightless.

Why is this significant?

- pgSIT eggs can be shipped to a location threatened by mosquito-borne disease

- Once the pgSIT eggs are released in the wild, sterile pgSIT males will emerge and eventually mate with females, driving down the wild population as needed.

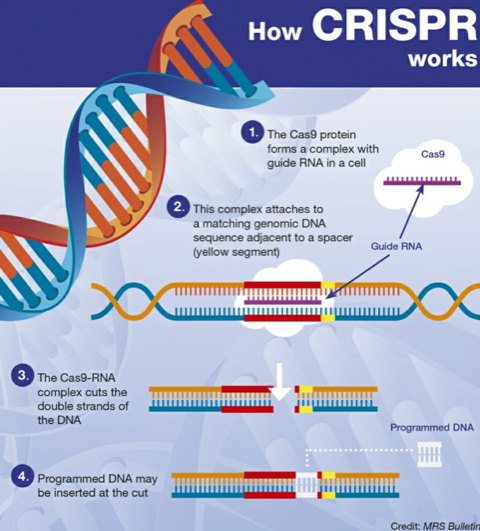

What is CRISPR?

- CRISPR technology is basically a gene-editing technology that can be used for the purpose of altering genetic expression or changing the genome of an organism.

- It can be used for targeting specific genetic code or editing the DNA at particular locations.

- Potential applications: Correcting genetic defects, treating and preventing the spread of diseases and improving crops.

Battle of Saragarhi

Part of: Prelims and GS I – Modern History

Context: September 12 marked the 124th anniversary of the Battle of Saragarhi.

- The Battle of Saragarhi was a last-stand battle fought before the Tirah Campaign between the British Raj and Afghan tribesmen.

- Saragarhi was the communication tower between Fort Lockhart and Fort Gulistan.

- The two forts in the rugged North West Frontier Province (NWFP) were built by Maharaja Ranjit Singh but renamed by the British.

- On 12 September 1897, an estimated 12,000 – 24,000 Orakzai and Afridi tribesmen attacked the outpost of Saragarhi, cutting off Fort Gulistan from Fort Lockhart.

- The soldiers of 36th Sikh, led by Havildar Ishar Singh, fought till their last breath, killing 200 tribals and injuring 600.

- In 2017, the Punjab government decided to observe Saragarhi Day on September 12 as a holiday.

(News from PIB)

Part of: GS-Prelims

- Celebrated every year on 14 September marking the declaration of the Hindi language as one of the official languages of Union government of India.

- On 14 September 1949, Hindi was adopted as one of the official languages of India.

News Source: PIB

Digital Agriculture

Part of: GS-Prelims and GS III-Agriculture

Context: Ministry of Agriculture and Farmers welfare signs 5 MOUs with private companies for taking forward Digital Agriculture

- A Digital agriculture mission has been initiated for 2021 -2025 by government for projects based on new technologies like artificial intelligence, block chain, remote sensing and GIS technology, use of drones and robots etc.

-

- To imbibe an ecosystem thinking and a digital ecosystem.

- The Agriculture value chain extends from crop selection to crop management and the market; it involves public and private players in agricultural inputs and services and also logistics.

- Establishing a digital ecosystem of agriculture needs to take a long-term view of aspects like interoperability, data governance, data quality, data standards, security and privacy, besides promoting innovation.

- A significant requirement is adoption of a decentralized, federated architecture that assures autonomy to the service providers and all other actors and ensures interoperability at the same time.

- Creation of a federated Farmers Database and building different Services around this Database – to build Digital Ecosystems of Agriculture.

- Federated farmers’ database will be linked by the land records of farmers from across the country and unique Farmer ID will be created – Information of all benefits and supports of various schemes will be provided.

Advantage:

- Based on these pilot projects farmers will be able to take informed decisions on what crop to grow, what variety of seed to use and what best practises to adopt to maximise the yield.

- Plan their procurement and logistics on precise and timely information.

News Source: PIB

18th ASEAN-India Economic Ministers’ (AEM) Consultations

Part of: Prelims and GS – II – International Relations

In News: The meeting was attended by the Economic Ministers of all the 10 ASEAN countries Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam.

Points discussed:

- Took stock of the current pandemic situation and reaffirmed their commitment to take collective actions in mitigating the economic impact of the pandemic and ensuring resilient supply chains in the region.

- Appreciated the deepening trade and investment between ASEAN and India and the trade partners’ mutual support in combating the pandemic. India is ASEAN’s 7th largest trading partner and one of the largest sources of FDI.

- Actively discussed the early commencement of the ASEAN India Trade in Goods Agreement (AITIGA) Review.

India –

- Highlighted that the trade arrangement has to be reciprocal, mutually beneficial and should balance the aspirations of both the partners.

- Need for securing the FTA provisions to prevent misuse of the preferential treatment

- Suggested that both sides should make earnest efforts to finalize the Scoping Paper before the ASEAN-India Leaders’ Summit

- Requested ASEAN to establish Joint Committees for the Review of the India-ASEAN Services and Investment Agreements without any delay.

- Highlighted India’s current focus on the mass vaccination, capacity enhancements and the economic initiatives to address the pandemic challenges, the widespread reforms undertaken by India in various sectors including agriculture, banking, insurance, logistics, corporate laws, investment regime etc.

- Invited ASEAN countries to invest in India in potential sectors, including health and pharmaceutical sector.

News Source: PIB

India-ASEAN Connectivity Partnerships

In News: Union Minister for Ports, Shipping & Waterways and AYUSH Shri Sarbananda Sonowal has underlined the importance of cross-border connectivity among India and developing nations of South-East Asia.

On connectivity

- Extension of the Trilateral Highway to Cambodia, Laos and Vietnam will enable greater connectivity and economic integration of India’s northeast with its eastern neighbours.

- India has helped construct two key stretches of the 1,360-km trilateral highway in Myanmar, but work on several other sections and the upgrade of nearly 70 bridges has been held up by a variety of factors. This highway will allow access to markets across the ASEAN region and boost people-to-people ties.

- Emphasised upon setting up of National Transport Facilitation Committees (NTFCs) to facilitate cross-border transportation and trade. The physical connectivity will enable small and medium-sized enterprises in the border areas to explore new business opportunities.

On digital and data connectivity

- India and ASEAN are fast-growing consumer markets – important for two regions to explore ways to enhance digital connectivity.

- The Government of India has been making efforts to turn India into a “Global Data Hub” through various policies and reforms. India’s data centre industry is expected to add 560 MW during 2021-23 leading to a real estate requirement of 6 million sq ft. The industry is expected to grow exponentially to reach 1,007 MW by 2023 from 447 MW

News Source: PIB

(Mains Focus)

GOVERNANCE/ JUDICIARY

- GS-2: Government policies and interventions for development in various sectors and issues arising out of their design and implementation

Internet Shutdowns

Context: In January, 2020, the Supreme Court in Anuradha Bhasin vs Union of India case, held that access to information via the Internet is a fundamental right under the Indian Constitution.

- It held that any restriction on Internet access by the Government must be temporary, limited in scope, lawful, necessary and proportionate.

- Also, Government’s orders restricting Internet access are subject to review by Courts.

- The expectation was that the Internet suspension will be ordered in only those exceptional situations where there is a public emergency or a threat to public safety

Criticisms of Internet Shutdowns

- SC directions sidelined: Government has not done enough to give statutory recognition to direction in Anuradha Bashin case. In fact, the year following the SC decision, India saw more instances of Internet shutdown than the year preceding it.

- Non-Publication of orders: The internet suspension orders by authorities are not uploaded on the government’s websites, as was mandated by SC in Anuradha Bhasin case.

- Hurdles in Judicial recourse: Unless these orders are published, aggrieved citizens cannot approach the court of law.

- Trust deficit: Restrictions without publicly disclosed reasons create a trust deficit & undermines public confidence in the Government.

- Lack of awareness: The experience with Section 66A of IT Act has shown that if SC decisions are not statutorily recognised, the officials enforce the law incorrectly simply because of a lack of awareness.

- Economic Loss: In 2020, the Indian economy suffered losses to the tune of $2.8 billion due to 129 separate instances of Internet suspension, which affected 10.3 million individuals.

- Wide-ranging Impact: The harm — economic, psychological, social, and journalistic — caused by such suspensions is more than any benefits of such suspension.

Conclusions

More faithful compliance with the Supreme Court guidelines on the part of the government is needed to rid ourselves of the tag of the “internet shutdown capital” of the world and fulfil Digital India’s potential

Connecting the dots:

- New Social Media Code

- Dominance of Big tech

- Australia’s News Media Bargaining Code

GOVERNANCE/ POLITY

- GS-2: Issues and challenges pertaining to the federal structure

- GS-2: Parliament and State legislatures—structure, functioning, conduct of business, powers & privileges and issues arising out of these

Local Reservation and its implementation

Context: Recently, Jharkhand assembly passed the Jharkhand State Employment of Local Candidates Bill, 2021 becoming the third state in the country, after Andhra Pradesh and Haryana, to pass a law which promises reservations for locals in private jobs.

Jharkhand law accords 75% reservation to locals in jobs, with the condition that this will apply to those who earn ₹40,000 or below.

Why local reservation?

- The idea of local reservation is driven by issues of scarcity of employment, and the need for governments to satisfy their domestic electorate

What is the government’s rationale in bringing such laws?

- Needs such policies to achieve substantial equality: With public sector jobs constituting only a minuscule proportion of all jobs, legislators have talked about extending the legal protections to the private sector to really achieve the constitutional mandate of equality for all citizens

- Legitimate Right to ask Private Sector to share Burden: Since private industries use public infrastructure in many ways (infrastructure, subsidised land & credit, etc) the state has a legitimate right to require them to comply with the reservation policy.

- Similar Reservation in Education was upheld: A similar argument was made in requiring private schools to comply with the Right to Education Act, which the Supreme Court also upheld.

- Similar Affirmative Action in other countries: In the US, although there is no statutory requirement for employers to have quotas, courts can order monetary damages and injunctive relief for victims of discrimination(US Civil Rights Act of 1964 prohibits employment discrimination on the basis of race, colour, national origin, religion, and sex). The Employment Equity Act in Canada also protects minority groups, especially aboriginals from discrimination in federally regulated industries, even in the private sector.

States announce reservations for locals, but fail to implement it

While it has gained political traction, reservations for locals has met with both legal challenges and industry resistance, and has been barely implemented in any state

The Andhra story

- The Andhra Pradesh Employment of Local Candidates in the Industries and Factories Act was passed in the state assembly first, on July 17, 2019.

- The law mandates 75% reservation for locals in both existing and upcoming industries

- The law has provisions that a company be exempted if it writes to the government that it requires specialised manpower not available locally, but this will require an examination by the state industries department.

- The government has also asked industries what skill sets they need, so that they can train people and supply the requirements as well.

- Industry is unhappy as it imposes restraints on them and that there are no sops and no rebates for investors.

- The law has been challenged on the grounds that it violates Article 16(2) and 16(3) of the constitution.

- The law continues to be operative, although in an ineffective manner, as there is no stay from the Judiciary, which is yet to give final verdict.

The debate in Haryana

- Haryana government passed a law which provides for 75% reservation in private sector jobs to those having a resident certificate (domicile).

- The law will be applicable for a period of 10 years.

- Legal experts say that the new law would not withstand judicial scrutiny. This is because preference in jobs to the local candidates domiciled in Haryana was in contravention of Article 14 and Article 19(1)(g) of the Constitution.

- India is one national and there is only one citizenship. To regard a person as an outsider merely because he is not resident of one state goes against the essential integrity of the nation.

Conclusion

Though the responsibility is with district collectors, no strict implementation is done due to paucity of the staff with the industries/labour departments. This clearly shows that these reservations have barely taken off the ground.

Read Related Articles

- Haryana Job Quota Law

- Andhra Pradesh Locals First Policy

- Madhya Pradesh domicile based quota

- Reservation is not a fundamental right

(AIR Spotlight)

Spotlight Sep 12: Discussion on India-Australia 2+2 Dialogue and the outcomes – https://youtu.be/InClTB9SywE

INTERNATIONAL/ GOVERNANCE

- GS-2: International Relations

India-Australia

In News: Recently, India’s Defence Minister and External Affairs Minister held the inaugural ‘2+2’ talks with their Australian counterparts.

Significance of India-Australia 2+2 meeting

- India and Australia elevated their bilateral strategic partnership to a Comprehensive Strategic Partnership in June 2020.

- These inaugural 2+2 discussions are a cornerstone of the Australia-India Comprehensive Strategic Partnership, which is founded on a shared commitment to a secure, stable and prosperous Indo-Pacific region.

- There is a growing convergence of views on geo-strategic and geo-economic issues backed by a robust people-to-people connection.

- Given their common security challenges (terrorism & China’s aggression) and in order to enhance regional security architecture, both countries have intensified bilateral security cooperation.

- Both countries have stepped up collaborations through institutions and organisations on many issues in trilateral, plurilateral (QUAD) and multilateral (Ex: UN) formats.

- Beyond bilateralism, both countries are also entering into partnerships with like-minded countries, including Indonesia, Japan and France, in a trilateral framework.

Key Highlights of the meeting

A. On maritime security in Indo-Pacific:

- Maintain an open, free, prosperous and rules-based Indo-Pacific region (in line with the United Nations Convention on the Law of the Sea (UNCLOS)).

- Support India’s Indo-Pacific Oceans’ Initiative

- Need for renewed efforts by the Quad member countries to expand cooperation in the region.

B. On Trade: Emphasis on

- Ensuring free flow of trade

- Adherence to international rules

- Sustainable economic growth in entire region

C. In-depth discussion on bilateral & regional issues:

- Displayed a common approach to the Afghan crisis

- To continue to work together on counter terrorism; countering of radicalization and on the proposed UN Comprehensive Convention on International Terrorism.

- Cooperation in multilateral formats – bilateral trade, vaccines, defence production, community links, maritime security, cyber and climate cooperation

- Welcomed the launch of the Supply Chain Resilience Initiative by the Trade Ministers of India, Australia and Japan.

- Agreement was reached to deepen cooperation in vaccine manufacturing and to deliver high quality vaccines to their Indo-Pacific partners (Australia-India Strategic Research Fund)

- Australia has invited India for participation in future Talisman Sabre exercises which will raise interoperability while both sides explore longer term reciprocal arrangements in logistics support.

- Renewed support expressed for finalization of bilateral Comprehensive Economic Cooperation Agreement.

- Pitched for early resolution of the issue of taxation of offshore income of Indian firms under the India Australia Double Taxation Avoidance Agreement.

D. Invitation to Australia to engage in India’s growing defence industry

- Expand military engagements across services

- Facilitate greater defence information sharing and to work closely for mutual logistic support

- Invited Australia to engage India’s growing defence industry

- To collaborate in co-production and co-development of defence equipment

Both the countries have decided to meet at least once every two years in this format to keep up the momentum.

Bilateral economic and trade relationship between India and Australia

- The India-Australia economic relationship has grown significantly in recent years.

- India’s growing economic profile and commercial relevance to the Australian economy is recognized, both at the federal and state level in Australia.

- India’s exports to Australia stood approximately at US$ 4.6 billion (A$6.1 bn) in 2016 while India’s import from Australia during the same period stood at US$ 11 billion (A$14.6 bn).

- India’s main exports to Australia are Passenger Motor Vehicle & machinery, Pearls, Gems and Jewellery, Medicaments and Refined Petroleum while India’s major imports are Coal, Non-monetary Gold, Copper, Wool, Fertilizers and Education related services.

Areas of concern

India and Australia need to resolve old issues that pose a barrier to deeper economic integration.

- India has a high tariff for agriculture and dairy products which makes it difficult for Australian exporters to export these items to India.

- At the same time, India faces non-tariff barriers and its skilled professionals in the Australian labour market face discrimination.

Conclusion

- It is expected that the ‘2+2’ dialogue will provide substance to this partnership.

- The Quad has gained momentum in recent months. The time is ripe for these countries to deliberate on a ‘Quad+’ framework.

- The geo-political and geo-economic churning in international affairs makes it imperative for India and Australia to forge a partnership guided by principles with a humane approach

Connecting the dots:

Can you answer this question?

- Collaboration between India and Australia can limit the dangers of the growing geopolitical imbalance in the Indo-Pacific. Comment.

(TEST YOUR KNOWLEDGE)

Model questions: (You can now post your answers in comment section)

Note:

- Correct answers of today’s questions will be provided in next day’s DNA section. Kindly refer to it and update your answers.

Q.1 Gujjar Bakerwal tribal communities belong to which of the following states?

- Manipur

- Jammu and Kashmir

- Gujarat

- Rajasthan

Q.2 Consider the following statements regarding GST Council

- It is a statutory body

- It is chaired by the union Cabinet Secretary

Which of the above is or are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Q.3 Who benefits from inflation?

- Fixed income earners

- lenders/Creditors

- borrowers/debtors

- Bank depositors

ANSWERS FOR 14th Sept 2021 TEST YOUR KNOWLEDGE (TYK)

| 1 | D |

| 2 | C |

| 3 | A |

Must Read

On early harvest trade deals:

On role of communities in Health reform:

On Internet shutdown: