UPSC Articles

ECONOMY/ GOVERNANCE

- GS-2: Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

- GS-3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Budget: Critical Analysis of Fiscal Consolidation

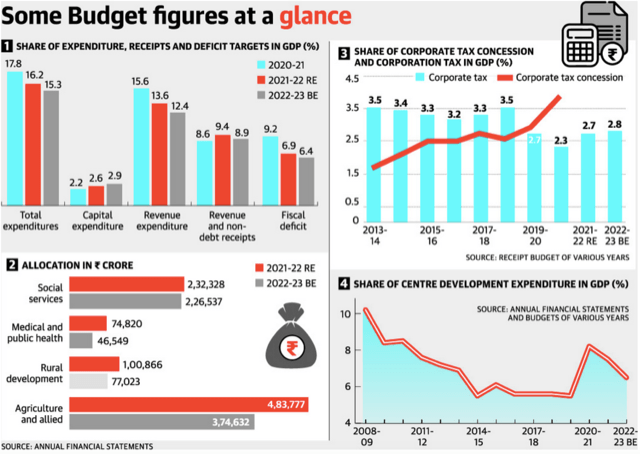

Context: The Union Budget for FY23 has projected a fiscal deficit of 6.4% of nominal GDP, a narrowing from the 6.9% assumed in the revised estimates of FY22.

- Finance Minister said the move was consistent with the broad path of fiscal consolidation announced in 2021 in order to reach a fiscal deficit level below 4.5% by 2025-26.

What was the economic context to this year’s Budget formulation?

- Sharper reduction in Labour Incomes: Though every economic crisis involves sharp reduction in output growth rate, the uniqueness of the present crisis in India lies in the sharper reduction in labour income as compared to profits.

- Low Consumption: The consequent reduction in income share of labour was associated with fall in consumption-GDP ratio as well as absolute value of consumption expenditure during the pandemic.

- While the GDP in 2021-22 is estimated to attain the pre-pandemic level, real consumption expenditure remains to be lower as compared to 2019-20.

- Pre-Pandemic Slowdown: The slowdown during the pandemic was itself preceded by what turned out to be the longest episode of growth slowdown in the Indian economy since the liberalisation period.

What were the broad challenges with the budget 2022?

- The first challenge is specific to the pandemic and pertained to the need of undertaking policies that boosts labour income and consumption expenditure.

- The second challenge pertained to addressing the structural constraints of the Indian economy that restricted growth even during the pre-pandemic period.

How has the Budget fared in this backdrop and what are the key shortcomings?

Continuing with the objective of fiscal consolidation, the Budget falls short of addressing both the above said challenges. There are three distinct features of this fiscal consolidation process.

1. Revenue Expenditure Cut Down as path for Fiscal Consolidation

- Firstly, while share of revenue and non-debt receipts in GDP has remained more or less unchanged, the objective of fiscal consolidation has been sought to be achieved primarily by reducing the expenditure-GDP ratio (see figure 1).

- The brunt of this expenditure compression fell on revenue expenditure.

- The allocation of capital expenditure as a share of GDP has been marginally increased in 2022-23 as compared to 2021-22. Additional capital expenditure could be financed either by postponing fiscal consolidation process or by increasing revenue.

- However, the budget has sought to increase capital expenditure and achieve fiscal consolidation by reducing the allocation for revenue expenditure-GDP ratio.

2. Labour Income not given boost

- Secondly, since the bulk of the revenue expenditure comprises of expenses in social and economic services like subsidies, reduction in the allocation for revenue expenditure has adversely affected the income and livelihood of labour (see figure 2).

- For example, allocation for both agriculture and allied activities and rural development registered a sharp decline in nominal absolute terms in 2022-23 as compared to 2021-22.

3. Increased Tax Concessions

- Thirdly, despite sharp increase in profits during the pandemic, the corporate tax-GDP ratio has continued to remain below the 2018-19 level due to tax concessions.

- The last decade registered a sharp rise in the share of corporate tax concessions in GDP, which reached its peak at 3.9% by 2020-21 (see figure 3).

- As a result, corporate tax-GDP ratio registered a decline particularly since 2018-19 when corporate tax-ratio declined sharply from 3.5% to 2.7%.

- Despite the objective of fiscal consolidation, the corporate tax ratio continues to remain low and restrict revenue receipts.

What are the implications for development spending?

- The objective of fiscal consolidation along with the inability to increase revenue receipts has posed a constraint on development expenditure.

- With non-development expenditure comprising of interest payments, administrative expenditure and various other components, the brunt of expenditure compression has fallen on development expenditure.

- Figure 4 shows the trend in share of centre’s development expenditure (development expenditure is calculated as the sum of expenditures on social services and economic services) in GDP since 2008-09.

- While the decade of 2010s was characterised by different governments meeting fiscal targets by adjusting their expenditure, it registered a sharp decline in the development expenditure ratio till the advent of the pandemic in 2019-20.

- The fiscal stimulus implemented in the first year of the pandemic brought about a brief recovery in 2020-21.

- The fiscal consolidation strategy carried out in the last years has once again led the development expenditure ratio to slide downward.

- The reduction in the allocation for development expenditure ratio for 2022-23 reflects reduction in the allocation for food subsidies, national rural employment guarantee program, expenditure in agriculture, rural development and social sector.

- The reduction in the allocation for development expenditure would have adverse impact on labour income and consumption expenditure.

- The positive impact of higher capital expenditure on the recovery process would be largely curtailed by the adverse impact of more than proportionate fall in revenue expenditure.

What are the prospects of export-led growth?

- Given the fiscal consolidation strategy of the Government, the prospect and extent of economic revival at the present remains heavily dependent on external demand.

- Despite the limited recovery in exports in the last few quarters, the possibility of sustained economic recovery relying exclusively on the export channel appears to be bleak at the present as different countries have already started pursuing fiscal consolidation.

Conclusion

- What the Indian economy lacks at the moment is an effective policy instrument that can boost labour income and aggregate demand.

Can you attempt this?

Analyse the relevance of FRBM Act for a developing economy like India. Also elaborate on the recommendations of the N K Singh panel in this regard