Economics, Governance

Context: Recently Watershed Organization Trust organized a webinar themed “Promoting FPOs for resilient incomes and sustainable farming practices in India”.

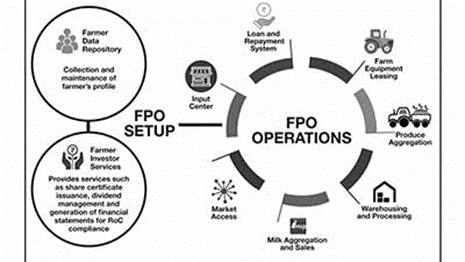

- To address these issues of water stress, natural disasters, uncertainty in yields, etc. the concept of Farmers Producer Organization (FPO) was introduced in 2003 in the Indian agricultural landscape.

About Farmer Producer Organizations (FPOs):

- FPOs are voluntary organizations controlled by their farmer-members who actively participate in setting their policies and making decisions.

- The FPOs are formed to leverage collectives through economies of scale in production and marketing of agricultural and allied sectors.

- The FPOs are incorporated as a legal entity under the Companies Act or Co-operative Societies Act of the concerned States.

- To facilitate and support the State Governments in the formation of the FPOs the Small Farmers Agribusiness Consortium (SFAC) was set up by the Department of Agriculture and Cooperation.

- The FPO membership is open to all persons able to use their services and willing to accept the responsibilities of membership, without gender, social, racial, political, or religious discrimination.

- FPOs in various states including Gujarat and Rajasthan among others have shown encouraging results and have been able to realize higher returns for their produce.

- For Instance, tribal women in the Pali district of Rajasthan formed a producer company and they are getting higher prices for custard apples.

Challenges of FPOs: Studies of NABARD shown the following challenges for building sustainable FPOs:

- Low capital base: A report from Azim Premji University (2022) reveals that less than 4% of the FPOs have paid up capital of more than ₹10 lakh.

- Many FPOs are unable to access required financial support from banks/financial institutions for want of collateral security and credit history.

- Credit guarantee cover from Small Farmers Agri-Business Consortium (SFAC) in respect of collateral free-lending is available only to the FPOs with a minimum membership of 500 and above.

- Poor human resources: Majority of the FPOs struggle to comply with statutory norms viz., audited financials and filing Goods and Services Tax returns due to lack of skilled manpower, expertise, and other resources.

- Not in a position to hire talent from the market for this purpose, they depend on Cluster Based Business Organizations (CBBOs)/Promoting organizations.

- Lack of commercial viability: Commercial viability refers to procurement of inputs at reasonable rates and marketing of output at remunerative prices.

- As Indian farmers’ share is close to 25% of consumers’ Rupee of expenditure vis-a-vis 70 % in the US and Europe, commercial viability of FPOs is less than satisfactory.

- Absence of market linkages: An NIRDPR recent study shows that most of the FPOs depend on the local market without exploring the export market.

- Apni Saheli, an FPO based in Dholpur, Rajasthan is working with NCDEX in commodity derivatives/futures markets (wheat and bajra) for better price realization for its members.

- Infrequent patronage of members: Field survey indicates the majority of members of FPOs are largely unaware of operations of the collectives, their responsibilities, and exhibit insignificant levels of ownership.

- The FPOs for dairy, small ruminants, and vegetables offer more regular cash flows than the seasonal crops based FPOs which also reduces interaction with the group members.

- Obsolete technology: Most of the FPOs are unable to mobilize requisite funds for mechanization of farming, good agricultural practices, through advanced technologies (drones and nanotechnology) which need to be replicated.

- Negligible value addition to Agri-produce: Field surveys show that about 40% of the farmer members avail themselves of agricultural value chain activities from FPOs.

- Majority of the FPOs sell their produce without value addition due to inadequate working capital, information asymmetry on demand-supply gaps, and lack of post-harvest infrastructure facilities.

Government’s Initiatives for the promotion of FPOs: Since 2011 the government has been intensively promoting FPOs under the ambit of the Small Farmers’ Agri-Business Consortium (SFAC), NABARD, state governments and NGOs.

- Financial support: A grant of matching equity (cash infusion of up to Rs 10 lakh) to registered FPOs.

- A credit guarantee cover to lending institutions (maximum guarantee covers 85 percent of loans not exceeding Rs 100 lakh).

- Tax exemption and other budgetary support: The government announced a five-year tax exemption in the 2018-19 budget.

- In the 2019-20 budget the government revealed its plan of setting up 10,000 more FPOs in the next five years.

- One District One Product Cluster: The Ministry of Agriculture has been stressing on developing large production clusters, wherein agricultural and horticultural products are grown/cultivated for leveraging economies of scale and improving market access for members.

- “One District One Product” cluster will promote specialization and better processing, marketing, branding and export.

- Collective Farming: FPOs can be used to augment the size of the land by focusing on grouping contiguous tracts of land as far as possible.

Suggestive measures to make FPOs financially sustainable:

- Need to focus on business strategy: Indian agriculture needs to give due weightage to business strategy along with focus on enhanced production.

- So FPOs may be linked to Agri-export zones/e-commerce (Big Basket and Sabziwala) to supply sanitary and Phyto sanitary-compliant Agri-products.

- Diversify cropping pattern and integration of Agri-allied activities: FPOs have to diversify their cropping pattern (power shift to high value crops like kiwi, and roses) and adopt integrated farming along with dairy, poultry, and fisheries, without compromising on food security.

- Promotion of extension and knowledge augmenting agencies: They need a lot of data on markets and prices and other information and competency in information technology.

- So, the promoting agencies should nurture and build FPOs and educate them on

- Enhancement of product quality.

- Reduction of wastage and

- aspects of business management along with value addition.

- Free access to institutional finance for FPOs should be made available to enable them to invest in Agri-value chains from ‘farm to fork’.

- Banks must have structured products for lending to FPOs.

Way Forward:

It is time for funding agencies to focus on financing a few pilots in such Agri block-chain technology to facilitate this transformation. Currently, only a few FPOs have developed mobile phone-based extension guidance to help reduce cost of cultivation and access information about market prices of commodities.

While FPOs do a good job in the provision of inputs, which is a kind of low-hanging fruit, linking the farmers to the markets with quality products is a challenge. The success of farmer organizations is critical for ensuring the success of smallholder and marginal farmers in India.

Since agriculture is the key to fulfill half of the 17 Sustainable Development Goals (SDGs), strengthening FPOs in multiple dimensions is the key to achieve the SDGs which will ensure food security and eventually national security.

Source: The Hindu

Previous Year Questions

Q.1) What is the purpose of setting up Small Finance Banks (SFBs) in India? (2017)

- To supply credit to small business units

- To supply credit to small and marginal farmers

- To encourage young entrepreneurs to set up business particularly in rural areas.

Select the correct answer using the code given below:

- 1 and 2 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Q.2) Which of the following activities constitute real sector in the economy? (2022)

- Farmers harvesting their crops

- Textile mills converting raw cotton into fabrics

- A commercial bank lending money to a trading company

- A corporate body issuing Rupee Denominated Bonds overseas.

Select the correct answer using the code given below:

- 1 and 2 only

- 2, 3 and 4 only

- 1, 3 and 4 only

- 1, 2, 3 and 4