International Relations

Context:

- Semiconductors are becoming a critical geopolitical focal point. Technology alliances and diplomatic initiatives are being championed as the pathway toward building supply chain resilience.

- India, as a fledgling semiconductor power, has an important role in the current setup of the industry.

- India must aim to utilise diplomacy and collaboration to become an indispensable part of the global semiconductor ecosystem.

Semiconductors are the brains of modern electronics:

- Semiconductors, with specified electrical properties, that sit between the conductor and insulator.

- They typically have four electrons in their valence shell (outermost shell), which helps in binding with other atoms to form crystals such as silicon crystals.

- They are an essential component of electronic devices, enabling advances in communications, computing, healthcare, military systems, transportation, clean energy, and countless other applications.

- A diode, integrated circuit (IC) and transistor are all made from semiconductors.

- A semiconductor chip controls and manages the flow of electric current in electronic equipment and devices.

Current Techno-Democratic Alliances:

- The Quad Semiconductor Supply Chain Initiative

- The Quad in 2021 decided to include semiconductors as an area of collaboration, as part of The Quadrilateral Security Dialogue.

- primary objective is to ensure a competitive market, prevent monopolies, and strengthen the current supply chain against future shocks.

- US leads the world in chip design with its private sector design behemoths (such as Intel, Qualcomm, NVIDIA and AMD).

- US owns all Electronic Design Automation (EDA) software licences used in chip design.

- Japan has expertise in the production of silicon wafers (substrates on which designs are imprinted) and semiconductor manufacturing materials such as photoresists or etching gas, and remains critical to the fabrication process.

- Australia is an important source of critical minerals such as silica, gallium and indium, which are essential for developing silicon-based and composite semiconductor products.

- India can provide the required human resources, especially in the chip design services segment.

- The Chip4 Alliance

- It is a semiconductor industry alliance with US, South Korea, Japan and Taiwan, to keep mainland China’s fledgling semiconductor industry at bay.

- It covers all the key areas of the value chain of the semiconductor ecosystem.

- Taiwan is the global epicentre of semiconductor manufacturing, with over 60 percent of the world’s chips being manufactured.

- South Korea is home to semiconductor behemoth Samsung, which has design and manufacturing capability.

- Japan has dominance over the production of critical manufacturing equipment and materials such as

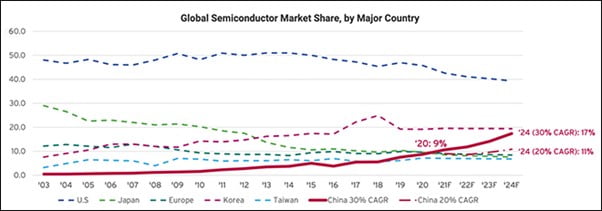

- In 2021, China imported US$350 billion worth of semiconductors, with the US and South Korea being its biggest suppliers.

- US-EU Trade and Technology Council (TTC)

- to coordinate their respective chip investments so that they do not end up engaging in a ‘subsidy race’

- Cross-border information dissemination

Challenges of semiconductors:

- As a political weapon including use of semiconductors as a punitive tool to hurt certain economies.

- Various restrictions have been imposed on exports, trade, and access to semiconductor technology that prevent certain states from moving up the value chain.

- Export control mechanisms have been put in place for semiconductor technology considering its dual-use and military capabilities such as the Wassenaar Agreement.

- Possibility of unilateral controls on countries’ export of emerging technologies, which can hamper the chances of other countries accessing critical materials and equipment.

- US’s Export Control Reform Act (ECRA 2018), which identifies export controls essential for technologies directly related to the country’s national security.

- 2020 US sanctions on China related to semiconductors and chips.

- US also directed other companies, such as ASML Holding, a Dutch company known for their photolithography lithography tools—an integral semiconductor manufacturing equipment—to halt any exports to China

- Extensive dominance of US – The most recent sanctions are so extensive that they could cause an economic fallout for China and other semiconductor manufacturers.

- They can create high-end weapon systems which poses risks to national security.

- Semiconductor technology is being used in the diplomatic and geopolitical space as a tool of punitive action.

- In Russia-Ukraine war, West, imposed technology sanctions to punish Russia. Semiconductors and chips were central to the sanctions.

Suggestions for future:

- Quad Semiconductor Resilience Fund Building to cover import duties and license fees.

- Joint setting up of fabrication facilities focusing on emerging industries like AI, Quantum, Electric Vehicles, and 5G/6G Communications.

- Building Centres of Excellence (CoEs) in all Quad countries

- Japan can build a CoE dedicated to semiconductor manufacturing

- Australia can host a CoE on critical materials for developing chips.

- India, has design workforce and can build design architecture

- Increase cooperation amongst other semiconductor alliances.

- Semiconductors can be one of the central focus areas in the EU-India TTC agreement signed in 2021

- In India-Taiwan collaboration, India can convince Taiwan to focus on building a low-investment trailing edge fab in the country to improve output volume and build redundancy into the ecosystem.

- India must position itself as a credible alternative for Taiwan’s ATMP giants (Foxconn, Winstron) and its design behemoths (MediaTek) to outsource the assembly and design processes to the country.

- The availability of a skilled workforce in semiconductor design, as well as the low-cost labour needed for Assembly, Testing, Marking and Packaging (ATMP) facilities, can help India attract other potential.

- Champion free and open semiconductor technologies

- Open standards provide a royalty-free alternative on which technologies and platforms can be built

- The current industry standards remain licensed and hard to adopt for startups. Hence, it can level the playing field across the global ecosystem.

- For example, RISC-V, currently being developed to reduce the dependency on the licensed Arm instruction set architecture.

- Open-Source Hardware (OSH) projects related to EDA tools (currently dominated by three American companies) can be funded to remove existing bottlenecks.

- India can pave the way for procurement and deployment of open-source alternatives for design firms while saving their resources on licences and royalty fees.

Way forward:

- The Covid-19 pandemic exposed the fragilities of the semiconductor supply chain in the form of dependencies and bottlenecks

- Hence, multilateral cooperation in the industry is no longer a choice but a necessity.

- India’s market share may be negligible, but key partnerships and alliances can help the local ecosystem grow.

- In this era of silicon diplomacy, India must tread a path favourable to international cooperation, which can help its domestic industry specialise in a specific area of the supply chain.