Economics, Governance

Context: With the Insurance Regulatory and Development Authority of India (Irdai) increasing the maximum number of tie-ups for corporate agents and insurance marketing firms, insurance companies are approaching microfinance institutions for partnerships to leverage their last-mile connectivity for deeper penetration into the rural market.

About Microfinance and Microfinance Institutions:

- Microfinance is a form of financial service which provides small loans and other financial services to poor and low-income households.

- The definition of “small loans” varies between countries.

- In India, all loans that are below Rs. 1 lakh can be considered as microloans.

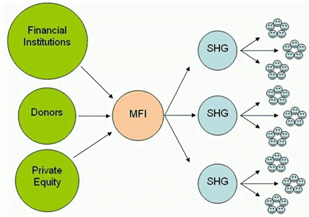

- Microcredit is delivered through a variety of institutional channels viz:

- Scheduled commercial banks (SCBs) (including small finance banks (SFBs) and regional rural banks (RRBs)).

- Cooperative banks.

- Non-banking financial companies (NBFCs).

- Microfinance institutions (MFIs) registered as NBFCs as well as in other forms.

- MFIs are financial companies that provide small loans to people who do not have any access to banking facilities.

- MFI promotes financial inclusion which enables the poor and low-income households to come out of poverty, increase their income levels and improve overall living standards.

- It can facilitate achievement of national policies that target poverty reduction, women empowerment, assistance to vulnerable groups, and improvement in the standards of living.

Significance of Microfinance Institutions:

- It makes credit available easily thereby bettering the income and employment scenario.

- It helps in serving the under-financed sections such as women, unemployed people and those with disabilities.

- It helps low-income households to stabilize their income flows and save for future needs.

- In good times, microfinance helps families and small businesses to prosper, and at times of crisis it can help them cope and rebuild.

- Families benefiting from microloans are more likely to provide better and continued education for their children.

Challenges of MFI:

- Inadequate Data: Despite the fact that total loan accounts have been rising, it is unclear how these loans will actually affect clients’ levels of poverty because the available information is dispersed.

- Over-indebtedness: The two main issues that are straining the microfinance sector in India are the expanding trend of consumers taking out multiple loans and ineffective risk management.

- The microfinance industry offers loans with no security, which raises the possibility of bad debts.

- Eroding social objective: The social goal of MFIs—to enhance the lives of society’s marginalised groups—seems to have been weakening over time as they pursue development and profitability.

- Regulatory Issues: Microfinance institutions have entirely different needs and organisational structures than other traditional lending institutions.

- The microfinance sector is finding it difficult to survive due to a lack of an adequate regulatory framework.

- Poor structuring of organization: Lack of standardised data and fraud management system creates more NPAs and affects the credibility of the institution.

- Lending for Non-income Generating Purposes: The percentage of loans used for non-income generating purposes may be significantly greater than the RBI’s limit of 30% of the MFI’s total loans.

Way Forward:

MFIs should concentrate on developing a scalable and sustainable microfinance strategy with a clear mission for both economic and social welfare. The microfinance institutions should be encouraged by RBI to use a “social impact scorecard” to track their social impact. Best usage of technological integration will be able to assist MFIs in providing services as well as repayment collection processes.

Source: Financial Express