Governance

In News: The Paris Club, an informal group of creditor nations, will provide financial assurances to the International Monetary Fund on Sri Lanka’s debt.

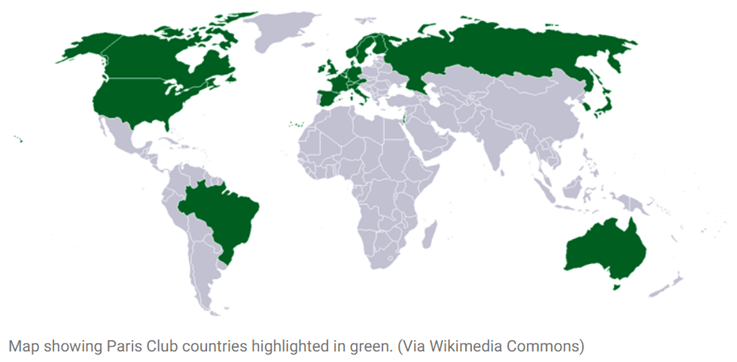

The Paris Club

- It is a group of mostly western creditor countries that grew from a 1956 meeting in which Argentina agreed to meet its public creditors in Paris.

- Objective is to find sustainable debt-relief solutions for countries that are unable to repay their bilateral loans.

- It describes itself as a forum where official creditors meet to solve payment difficulties faced by debtor countries. All 22 are members of the group called Organisation for Economic Co-operation and Development (OECD).

- The members are: Australia, Australia, Belgium, Canada, Denmark, Finland, France, Germany, Ireland, Israel, Japan, Netherlands, Norway, Russia, South Korea, Spain, Sweden, Switzerland, the United Kingdom and the United States.

How has Paris Club been involved in debt agreements?

- Since its beginnings, the Paris Club has reached 478 agreements with 102 different debtor countries.

- Since 1956, the debt treated in the framework of Paris Club agreements amounts to $ 614 billion.

- It operates on the principles of consensus and solidarity. Any agreement reached with the debtor country will apply equally to all its Paris Club creditors.

- A debtor country that signs an agreement with its Paris Club creditors, should not then accept from its non-Paris Club commercial and bilateral creditors such terms of treatment of its debt that are less favourable to the debtor than those agreed with the Paris Club.

The role of the Paris Club over time: The Paris group countries dominated bilateral lending in the last century, but their importance has receded over the last two decades or so with the emergence of China as the world’s biggest bilateral lender.

News Source: Indian Express