IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS & MAINS Focus)

Syllabus

- Prelims & Mains – POLITY

Context: The sixteenth Finance Commission headed by former Niti Aayog Vice-Chairman Arvind Panagariya has begun its work by inviting suggestions from the public on the mandate set for it by the Centre.

Background:-

- The most recent Finance Commission, composed of five members including the chairman, was established in December last year. It is anticipated to present its recommendations by October 2025, which will be applicable for five years starting April 1, 2026.

About Finance Commission

- The Finance Commission is a constitutional body that recommends how tax revenues collected by the Central government should be distributed among the Centre and various States in the country.

- Article 280 states that : The President shall, within two years from the commencement of this Constitution and thereafter at the expiration of every fifth year or at such earlier, time as the President considers necessary, by order constitute a Finance Commission which shall consist of a Chairman and four other members to be appointed by the President.

- The Commission is reconstituted typically every five years and usually takes a couple of years to make its recommendations to the Centre.

- The Centre is not legally bound to implement the suggestions made by the Finance Commission.

How does the Commission decide?

- The Finance Commission decides what proportion of the Centre’s net tax revenue goes to the States overall (vertical devolution) and how this share for the States is distributed among various States (horizontal devolution).

- The horizontal devolution of funds between States is usually decided based on a formula created by the Commission that takes into account a State’s population, fertility level, income level, geography, etc.

- The vertical devolution of funds, however, is not based on any such objective formula. The last few Finance Commissions have recommended greater vertical devolution of tax revenues to States.

- The 13th, 14th and 15th Finance Commissions recommended that the Centre share 32%, 42% and 41% of funds, respectively, from the divisible pool with States.

- The 16th Financial Commission is also expected to recommend ways to augment the revenues of local bodies such as panchayats and municipalities.

- It should be noted that, as of 2015, only about 3% of public spending in India happened at the local body level, as compared to other countries such as China where over half of public spending happened at the level of the local bodies.

What are the disagreements between centre and states?

- States argue that the Centre does not allocate even the recommended funds from the Finance Commissions, which they believe are already insufficient. Analysts point out that, under the Fifteenth Finance Commission, the Centre has devolved an average of only 38% of the funds from the divisible pool to the States, compared to the Commission’s recommendation of 41%.

- States have complaints about what portion of the Centre’s overall tax revenues should be considered as part of the divisible pool out of which the States are funded.

- Cesses and surcharges, which do not come under the divisible pool and hence not shared with the States, can constitute as much as 28% of the Centre’s overall tax revenue.

- The increased devolution of funds from the divisible pool, as recommended by successive Finance Commissions, may be offset by rising cess and surcharge collections. In fact, it is estimated that if cesses and surcharges that go to the Centre are also taken into account, the share of States in the Centre’s overall tax revenues may fall to as low as 32% under the 15th Finance Commission.

- More developed States such as Karnataka and Tamil Nadu have also complained that they receive less money from the Centre than what they contribute as taxes. Tamil Nadu, for example, received only 29 paise for each rupee that the State contributed to the Centre’s exchequer while Bihar gets more than ₹7 for each rupee it contributes. In other words, it is argued that more developed States with better governance are being penalised by the Centre to help States with poor governance.

- Critics also believe that the Finance Commission, whose members are appointed by the Centre, may not be fully independent and immune from political influence.

Source: Hindu

Syllabus

- Prelims – GEOGRAPHY

Context: Rwanda’s President Paul Kagame has been re-elected with 99.18% of the vote, the National Electoral Commission said, extending his near quarter-century in office.

Background:

- Rights groups says that election was marred by crack-down on journalists, the opposition and civil society groups , a criticism which government has rejected.

About Rwanda

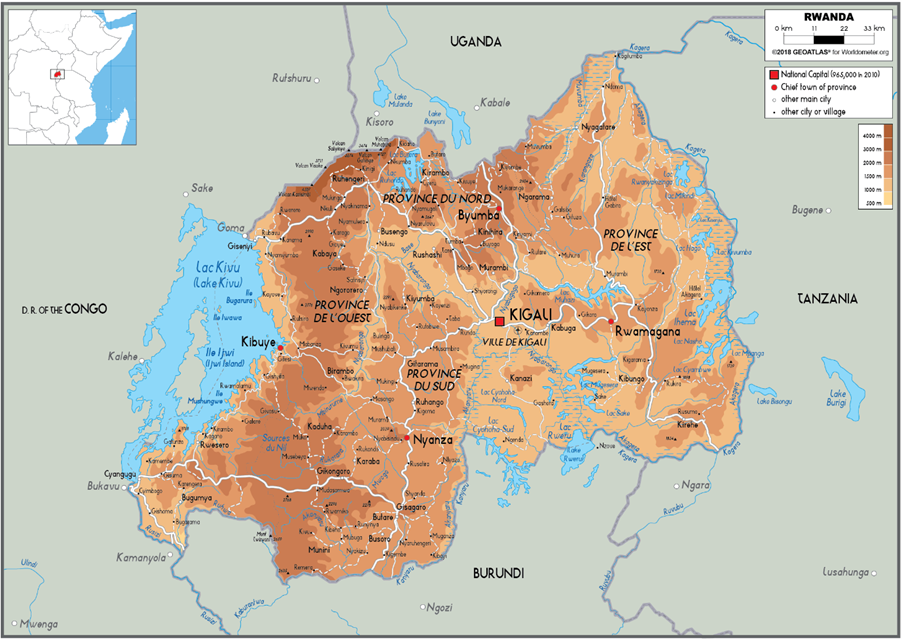

- Rwanda, officially the Republic of Rwanda, is a landlocked country in the Great Rift Valley of Central Africa, where the African Great Lakes region and Southeast Africa converge.

- Located a few degrees south of the Equator, Rwanda is bordered by Uganda, Tanzania, Burundi, and the Democratic Republic of the Congo.

- It is highly elevated, giving it the soubriquet “land of a thousand hills”), with its geography dominated by mountains in the west and savanna to the southeast, with numerous lakes throughout the country.

- The climate is temperate to subtropical, with two rainy seasons and two dry seasons each year.

- It is the most densely populated mainland African country; among countries larger than 10,000 km2, it is the fifth-most densely populated country in the world.

- Its capital and largest city is Kigali.

- Coffee and tea are the major cash crops that it exports. Tourism is a fast-growing sector and is now the country’s leading foreign exchange earner.

- The country is a member of the African Union, the United Nations, the Commonwealth of Nations, COMESA, OIF and the East African Community.

- Although Rwanda has low levels of corruption compared with neighbouring countries, it ranks among the lowest in international measurements of government transparency, civil liberties and quality of life.

- The population is young and predominantly rural; Rwanda has one of the youngest populations in the world.

Source: Reuters

Syllabus

- Mains – GS 2

Context: Today, India is the world’s third-largest energy consumer after China and the United States. Given the enormous import dependence for energy needs, relations with Gulf states are crucial.

Background:

- A seamless energy supply is crucial to ensure energy security, which means meeting domestic demands and protecting energy infrastructure from threats.

Energy consumption

- According to Energy Statistics India, 2024, prepared by the National Statistical Office under the Ministry of Statistics and Programme Implementation, India’s total primary energy production in 2022-23 was 19.55 exajoules and total consumption during the same period was 35.16 exajoule.

- This means that about 68 per cent of the demands were met through domestic production, underlining significant external dependence.

- Coal is India’s largest source of primary energy supply, comprising 58.12 per cent of the total in 2023.

- Despite significant domestic coal production, India has to source part of its coal demands externally, given the huge consumption.

Oil and gas

- External dependence becomes starker when it comes to oil and gas, which is the second largest source of primary energy supply in India.

- India’s total oil consumption was 5.44 million barrels per day in 2023, while total oil production was 0.73 million barrels per day.

- Similarly, natural gas consumption was 62.6 billion cubic metres, while natural gas production was only 31.6 billion cubic metres.

- This meant that most oil and gas are sourced externally, underlining India’s dependence on imports for its energy security, especially in meeting the oil and gas demands.

Gulf countries, the most dependable suppliers

- Historically, the Persian Gulf states, namely the six Gulf Cooperation Council (GCC) countries—Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and United Arab Emirates (UAE)—and Iran and Iraq have been the primary oil and gas suppliers to India contributing nearly 55-60 per cent of total oil and gas imports.

- According to the Directorate General of Commercial Intelligence and Statistics of the Ministry of Commerce, in 2023-24, five of the Gulf countries, namely Iraq (second), Saudi Arabia (third), UAE (fourth), Qatar (seventh) and Kuwait (ninth), were among top ten petroleum suppliers to India while Russia (first), United States (fifth), Australia (sixth), Indonesia (eight) and Nigeria (tenth) were other five.

- Notably, the Gulf countries have been among India’s top petroleum suppliers since the 1980s and have remained the most dependable suppliers despite the fluctuations in the international oil and gas market and supply chains.

Continued significance of the Gulf

- In recent years, India has made deliberate efforts to diversify its sources of energy consumption and petroleum imports.

- This has meant that the focus on clean and renewable sources has increased, and simultaneously, countries such as Russia, the United States, Australia and Nigeria have emerged as important sources.

- Nonetheless, several factors contribute to the continued significance of the Gulf region, remaining critical to India’s energy security. The most important factors are:

- its geographical proximity to India

- established buyer-seller networks.

- the capacity and commitment of the Gulf states to supply oil and gas at special prices.

Trade and investment

- The attraction of the Indian market as one of the biggest global consumers has worked in India’s favour, given it provides Gulf suppliers with a stable and large market for crude oil and natural gas.

- This has made India an attractive destination for Gulf investments in the energy sector, with mega Gulf energy corporations such as Saudi Aramco and Emirati ADNOC committing big long-term investments.

- In 2023-24, of the total US$1.11 trillion foreign trade, US$208.48 billion came from the Gulf and West Asia region, comprising 18.17 percent of India’s foreign trade. Notably, 14.28 percent of this came from the six GCC countries. The region’s economic importance has accorded the Gulf region a special place in India’s Look West policy.

- Besides commodity and petroleum trade, the flow of Indian expatriates to the GCC countries, the remittances they send and the two-way flow of investments are important components of economic relations.

- According to the Department for Promotion of Industry and Internal Trade, the total FDI from the GCC countries into India between April 2000 and March 2024 was US$24.09 billion.

Bilateral ties

- Indian investments and participation in the GCC market have witnessed a sharp rise, with companies such as Larsen & Toubro, Shapoorji-Pallonji and Tata increasing their presence while Indian businesses, such as Lulu hypermarket chain, making their mark in the GCC market.

- Besides the strong economic relations, the strengthening of bilateral political and strategic ties, especially since the early 2000s, has played a crucial role in making the Gulf a dependable partner.

- The bilateral ties, especially with the UAE, Saudi Arabia and Qatar, have further flourished under Modi, and this has helped India overcome challenges due to sanctions on major global oil and gas suppliers such as Iran and Venezuela, impact of regional conflicts during and after the Arab Spring (2010-12), as well as during the global COVID-19 pandemic (2020-22).

Source: Indian Express

Syllabus

- Prelims – CURRENT EVENT

Context: The Indian government has recently taken a significant step to auction properties classified as “enemy properties.”

Background:

- Over 9,400 ‘enemy’ properties, worth more than Rs 1 lakh crore, are set to be auctioned with the home ministry starting the process of identifying all such estates.

About Enemy properties :

- Enemy properties are those that were once owned by individuals who took Chinese or Pakistani citizenship after India fought wars with these countries.

- Enemy properties include both immovable (real estate) and movable (such as bank accounts, shares, and gold) properties left behind by those who migrated to Pakistan and China.

- These properties are vested with the Custodian of Enemy Property for India (CEPI), an authority created under the Enemy Property Act, 1968.

- The Enemy Property Act, 1968 governs the allocation and management of these properties. It was enacted in the aftermath of the 1965 Indo-Pakistani war.

The Enemy Property (Amendment and Validation) Act 2017:

- In 2017, the Enemy Property (Amendment and Validation) Act clarified that

- Successors of those who migrated to Pakistan or China no longer have a claim over these properties.

- The law of succession does not apply to enemy properties.

- Transfers of such properties by enemies, enemy subjects, or enemy firms are prohibited.

- The custodian preserves these properties until they are disposed of according to the Act’s provisions.

- CEPI currently manages 13,252 enemy properties across India.

- Their total value exceeds Rs 1 lakh crore.

- Most of these properties belong to individuals who migrated to Pakistan, while a smaller number are associated with those who migrated to China.

State-wise Distribution:

- Uttar Pradesh has the highest number of enemy properties (5,982).

- West Bengal follows closely with 4,354 properties.

Source: Hindu

Syllabus

- Prelims & Mains – CURRENT EVENT

Context: Artificial intelligence is all over news as companies try to come up with AI loaded products and services. Governments across the globe are trying to enter the race for an AI powered future.

Background:

- It was Vladimir Putin who famously put AI on every country’s priority list when he declared back in 2017 that the nation that leads in AI “will be the ruler of the world”. Every world leader has echoed this in some way.

About India AI mission :

- The Cabinet approved the IndiaAI Mission with an allocation of Rs 10,300 crore in march, 2024.

- The Mission will be implemented by ‘IndiaAI’ Independent Business Division (IBD) under Digital India Corporation (DIC) and has the following components:

- IndiaAI Compute Capacity: The IndiaAI compute pillar will build a high-end scalable AI computing ecosystem to cater to the increasing demands from India’s AI start-ups and research ecosystem. The ecosystem will comprise AI compute infrastructure of 10,000 or more Graphics Processing Units (GPUs), built through public-private partnership.

- IndiaAI Innovation Centre: It will undertake the development and deployment of indigenous Large Multimodal Models (LMMs) and domain-specific foundational models in critical sectors.

- IndiaAI Datasets Platform – The IndiaAI Datasets Platform will streamline access to quality non-personal datasets for AI Innovation.

- IndiaAI Application Development Initiative – It will promote the AI applications in critical sectors for the problem statements sourced from Central Ministries, State Departments, and other institutions.

- IndiaAI FutureSkills – It is conceptualized to mitigate barriers to entry into AI programs and will increase AI courses in undergraduate, masters-level, and Ph.D. programs. Further, Data and AI Labs will be set-up in Tier 2 and Tier 3 cities across India to impart foundational level courses.

- IndiaAI Startup Financing: It is conceptualized to support and accelerate deep-tech AI startups and provide them streamlined access to funding to enable futuristic AI Projects.

- Safe & Trusted AI – Recognizing the need for adequate safeguards to advance the responsible development, deployment, and adoption of AI, the Safe & Trusted AI pillar will enable the implementation of Responsible AI projects including the development of indigenous tools and frameworks, self-assessment checklists for innovators, and other guidelines and governance frameworks.

Source: Indian Express

Syllabus

- Prelims – ENVIRONMENT

Context: Scientists from the Zoological Survey of India (ZSI) recently discovered a new species named Squalus Hima..

Background:

- The discovery of this new species is crucial for conservation efforts, as dogfish sharks are exploited for their fins, liver oil, and meat.

About SQUALUS HIMA :

- Squalus belongs to the genus of dogfish sharks (commonly known as spurdogs) in the family Squalidae.

- These sharks are characterized by their smooth dorsal fin spines.

- Squalus hima was discovered off the coast of Kerala, specifically at the Sakthikulangara fishing harbor along the Arabian Sea.

- In the Indian coast, two species of Squalus are found from the southwest coast of India and the new species, Squalus hima n.sp. very similar to Squalus lalannei, but differs in many characteristics.

- Squalus hima sp.nov differs from other species by the number of precaudal vertebrae, total vertebrae, teeth count, trunk & head heights, fin structure and fin colour.

Importance and Conservation:

- The shark species belonging to the genus Squalus and Centrophorus are exploited for their liver oil, which contains high levels of squalene (or squalane when processed for products).

- This oil is in demand for pharmaceutical industries, especially for high-end cosmetic and anti-cancer products.

- The discovery of the new species is important to conserve such varieties of shark

Source: Hindu

Practice MCQs

Q1.) Consider the following countries

- Rwanda

- Botswana

- Chad

- Zambia

How many of the countries given above are landlocked?

- One only

- Two only

- Three only

- All four

Q2.) Squalus Hima, recently found in news is a

- green pit viper

- wolf snake

- burrowing frog

- dogfish shark

Q3.)With reference to the Enemy properties in India, consider the following statements:

- Enemy properties are those that were once owned by individuals who took Chinese or Pakistani citizenship after India fought wars with these countries.

- Enemy properties include immovable properties only.

- The law of succession does not apply to enemy properties.

Which of the statements given above is/are correct?

- 1 and 2 only

- 1 and 3 only

- 2 and 3 only

- 1,2 and 3

Comment the answers to the above questions in the comment section below!!

ANSWERS FOR ’ 20th July 2024 – Daily Practice MCQs’ will be updated along with tomorrow’s Daily Current Affairs.st

ANSWERS FOR 19th July – Daily Practice MCQs

Q.1) – a

Q.2) – b

Q.3) – d