IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS + MAINS FOCUS)

Andaman and Nicobar gets Large Area Certification

Part of: GS Prelims and GS – III – Economy

In news

- 14,491 ha area under Car Nicobar and Nancowry group of islands in Union Territory of Andaman &Nicobar Islands becomes the first large contiguous territory to be conferred with organic certification under ‘Large Area Certification’ scheme.

- Department of Agriculture, Cooperation and Farmers Welfare (DAC&FW) is working to identify Traditional Organic Areas to transform them into certified organic production hubs.

Important value additions

Large Area Certification (LAC) programme

- Department of Agriculture and Farmers Welfare under its flagship scheme of Paramparagat Krishi Vikas Yojna (PKVY) has launched a unique quick certification programme “Large Area Certification” (LAC) to harness these potential areas.

- LAC is a Quick certification process that is cost-effective and farmers do not have to wait for 2-3 years for marketing organic certified products.

- Under LAC, each village in the area is considered as one cluster/group.

- Documentations are simple and maintained village-wise.

- All farmers with their farmland and livestock need to adhere to the standard requirements and on being verified get certified en-mass without the need to go under conversion period.

- Certification is renewed on annual basis through annual verification by a process of peer appraisals

RBI fixes the tenure of top functionaries in a private sector bank

Part of: GS Prelims and GS-III – Banking

In news

- The RBI has fixed the tenure of MD, CEO and whole-time director (WTD) in a private sector bank at 15 years and prescribed the maximum age of 70 years for such functionaries.

Key takeaways

- These directives form part of the instructions issued by the RBI with regard to the chair and meetings of the board, composition of certain committees of the board, age, tenure and remuneration of directors, and appointment of the WTDs.

- The RBI would also come out with a Master Direction on Corporate Governance in banks in due course.

- The post of the MD & CEO or WTD cannot be held by the same incumbent for more than 15 years.

- Thereafter, the individual will be eligible for re-appointment as MD & CEO or WTD in the same bank, if considered necessary and desirable by the board, after a minimum gap of three years, subject to meeting other conditions.

- It added that during this three-year cooling period, the individual shall not be appointed or associated with the bank or its group entities in any capacity, either directly or indirectly.

- Also, the maximum age limit for chairman and non-executive directors has been fixed at 75 years.

Breakthrough Infection

Part of: GS Prelims and GS – II – Health & GS-III – Sci & tech

In news

- The Indian Council of Medical Research (ICMR) has reported that around two to four of 10,000 people given two doses of the COVID-19 vaccine have tested positive for the disease.

- Contracting COVID-19 after vaccination is known as breakthrough infection.

Important value additions

- Breakthrough infections are infections that occur in people who have been vaccinated.

- Such cases are not out of the ordinary as the vaccines that have been approved so far the world over are made to protect against disease and not the transmission of the virus.

- Phase 3 clinical trials conducted before vaccines which were approved showed a fairly constant proportion of infections among those vaccinated.

- In the AstraZeneca trial, for instance, 30 out of 5,807 vaccinated — about 0.5% — were symptomatic and tested positive 14 days after the second shot.

Oxygen extracted from the carbon dioxide in Martian atmosphere

Part of: GS Prelims and GS-III – Sci & tech; Space

In news

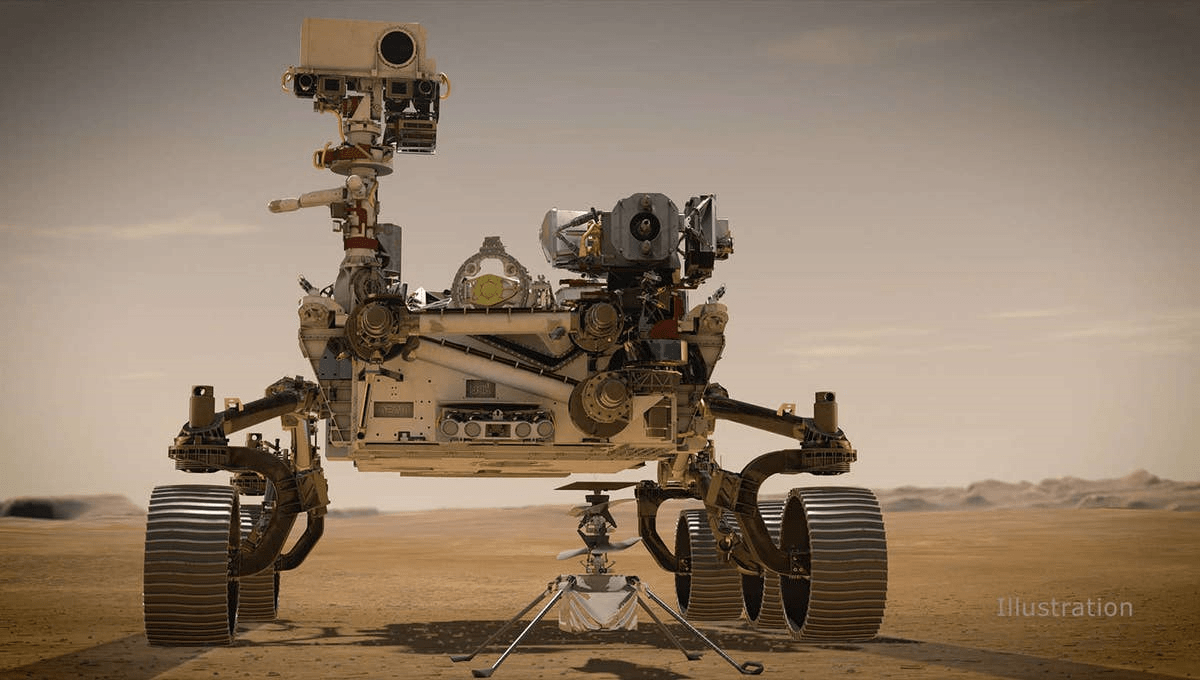

- NASA has extracted oxygen from the carbon dioxide in the thin Martian atmosphere.

Key takeaways

- The unprecedented extraction of oxygen on Mars was achieved by a device called Mars Oxygen In-Situ Resource Utilization Experiment (MOXIE)

- It is aboard Perseverance, a six-wheeled science rover.

- It produced about 5 grams of oxygen, equivalent to roughly 10 minutes’ worth of breathing for an astronaut.

- NASA is planning that future human missions would take scaled-up versions of Moxie with them to the Red Planet rather than try to carry all the oxygen needed to sustain them.

- Mars’ atmosphere is dominated by carbon dioxide (CO₂) at a concentration of 96%.

- The expectation is that it can produce up to 10 grams of O₂ per hour.

- This is the first extraction of a natural resource from the environment of another planet.

(Mains Focus)

SOCIETY/ GOVERNANCE

Topic:

- GS-1: Society & Population issues

- GS-2: Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

Maharashtra’s Two-Child Norm

Context: A woman officer from the Maharashtra Prison Department was dismissed from service after an inquiry revealed that she violated the Maharashtra Civil Services (Declaration of Small Family) rules because she suppressed the information from the authorities that she has three children.

What is the ‘two children’ service rule for Maharashtra government employees?

- Maharashtra is one of the few states in the country that have a ‘two children’ policy for appointment in government jobs or even for the elections of some local government bodies.

- The Maharashtra Civil Services (Declaration of Small Family) Rule of 2005 defines a small family as wife, husband and two children and stipulates that a person is not eligible for a job with Maharashtra Government if he or she has more than two children after 2005.

- The rules mandate filing a small family declaration at the time of applying for a government job.

- The definition of child under these rules does not include adopted children.

- The rules also empower the state government to give relaxation in ‘just and reasonable’ manner and mandates recording such reasons.

- Other states such as Rajasthan, Madhya Pradesh, Andhra Pradesh and Telangana, Gujarat, Odisha, Uttarakhand and Assam have similar kind of children policy for appointment to government services

Analysis of the Provision

- Leading by example: These mandatory norms were formulated for Civil servants with an intention to set an example before citizens for following two-child policy for population control.

- Tool of Population Control: As a policy it was also meant to discourage people from having more than two children by barring them from the prospects of government service.

- Penal Provisions to deter violations: There have been many cases in the past where employees have continued lying about the number of children by using various means. Some people have also been charged with IPC provision for ‘criminal breach of trust by public servants

- Lackadaisical Implementation: The disqualifications of serving employees under the rules has been done in rare cases. In most instances, cases come to light when someone complaints to authorities about an employee having more than two children.

Conclusion

While only a few states in the country have made mandatory rules for government employees and local level elections, the two child norm is something that calls for more informed consensus on the issue and wider implementation.

INTERNATIONAL/ ECONOMY

Topic:

- GS-2: Effect of policies and politics of developed and developing countries on India’s interests

- GS-3: Indian Economy and issues relating to planning, mobilization, of resources

Global Minimum Corporate Tax Rate

Context: US has proposed for a global corporate minimum tax rate and is working with G20 countries to agree on a global minimum, which it said could help end a “30-year race to the bottom on corporate tax rates.

WHY A GLOBAL MINIMUM TAX?

- Major economies are aiming to discourage multinational companies from shifting profits – and tax revenues – to low-tax countries regardless of where their sales are made.

- Increasingly, income from intangible sources such as drug patents, software and royalties on intellectual property has migrated to these jurisdictions, allowing companies to avoid paying higher taxes in their traditional home countries.

- With a broadly agreed global minimum tax, the US administration hopes to reduce such tax base erosion without putting American firms at a financial disadvantage, allowing them to compete on innovation, infrastructure and other attributes.

- The Trump administration took a first stab at capturing revenues lost to tax havens with a U.S. corporate offshore minimum tax in 2017. The “Global Intangible Low-Taxed Income,” or GILTI, tax rate was only 10.5% – half the domestic corporate tax rate.

WHERE ARE INTERNATIONAL TAX TALKS?

- The Paris-based OECD has been coordinating tax negotiations among 140 countries for years on two major efforts: setting rules for taxing cross-border digital services and curbing tax base erosion, with a global corporate minimum tax part of the latter.

- The OECD and G20 countries aim to reach consensus on both fronts by mid-year, but the talks on a global corporate minimum are technically simpler and politically less contentious.

- Since the talks are consensus based, countries are expected to go along with agreement no matter how unpalatable it may be for some low tax countries.

- The minimum tax is expected to make up the bulk of the $50 billion-$80 billion in extra corporate tax that the OECD estimates companies will end up paying globally if deals on both efforts are enacted.

HOW WOULD A GLOBAL MINIMUM TAX WORK?

- The global minimum tax rate would apply to companies’ overseas profits. Therefore, if countries agree on a global minimum, governments could still set whatever local corporate tax rate they want.

- But if companies pay lower rates in a particular country, their home governments could “top-up” their taxes to the agreed minimum rate, eliminating the advantage of shifting profits to a tax haven.

- US has said it wants to deny exemptions for taxes paid to countries that don’t agree to a minimum rate

- The OECD said last month that governments broadly agreed already on the basic design of the minimum tax although the rate remains to be agreed. International tax experts say that is the thorniest issue.

- Other items still to be negotiated include whether industries like investment funds and real estate investment trusts should be covered, when to apply the new rate and ensuring it is compatible with the 2017 U.S. tax reforms aimed at deterring tax-base erosion.

WHAT ABOUT THAT MINIMUM RATE?

- The Biden administration wants to raise the U.S. corporate tax rate to 28%, so it has proposed a global minimum of 21% – double the rate on the current GILTI tax. It also wants the minimum to apply to U.S. companies no matter where the taxable income is earned.

- That proposal is far above the 12.5% minimum tax that had previously been discussed in OECD talks – a level that happens to match Ireland’s corporate tax rate.

- The US is eyeing to get $2.5 trillion in 15 years by raising corporate tax rates from 21% currently to 28%. However, doing so in isolation will put the US at a disadvantage vis-à-vis tax havens. Therefore, it wants everyone to follow its lead.

Not Good for Low Income/Middle Income Countries

- Multinationals are a source of foreign direct investment. These corporations help to generate demand with efficient utilisation of resources and create employment in low-income countries.

- Nations have used their freedom to set corporation tax rates as a way to attract such businesses. Smaller countries such as Ireland, the Netherlands and Singapore have attracted footloose businesses by offering low corporate tax rates.

- The global minimum tax rate will finish off every opportunity for such countries whose only weapon to attract these companies is lower taxes.

- In a world where there are income inequalities across geographies, a minimum global corporation tax rate could crowd out investment opportunities.

- A lower tax rate is a tool for India to alternatively push economic activity. If the proposal comes into effect, India may experience a longer economic hangover than other developed nations with less ability to offer mega stimulus packages.

- The policy itself puts a question on globalisation as it will be beneficial only for the US to become a monopoly.

Connecting the dots:

- Base Erosion and Profit Sharing (BEPS)

(TEST YOUR KNOWLEDGE)

Model questions: (You can now post your answers in comment section)

Note:

- Correct answers of today’s questions will be provided in next day’s DNA section. Kindly refer to it and update your answers.

- Comments Up-voted by IASbaba are also the “correct answers”.

Q.1 Which Union Territory became the first large contiguous territory to be conferred with organic certification under ‘Large Area Certification’ scheme?

- Puducherry

- Daman and Diu

- Jammu and Kashmir

- Andaman and Nicobar Islands

Q.2 Consider the following statements regarding Large Area Certification (LAC) programme:

- It is programme under scheme of Paramparagat Krishi Vikas Yojna (PKVY).

- Under LAC, each village in the area is considered as one cluster/group.

Which of the above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Q.3 Which of the following is correct about Breakthrough infection?

- It is an infection that occurs in people who have been vaccinated with two doses.

- It is an infection that occurs in people who have not been vaccinated.

- It is an infection that occurs in people who have been vaccinated once.

- It is an infection that occurs in people who have been infected with Covid-19 once.

Q.4 On which Planet was oxygen extracted recently from its atmosphere for the first time?

- Jupiter

- Neptune

- Mars

- Saturn

ANSWERS FOR 27th April 2021 TEST YOUR KNOWLEDGE (TYK)

| 1 | C |

| 2 | A |

| 3 | A |

Must Read

On U.S. COVID-19 aid to India:

On Armenian genocide:

On need for woman Chief Justice: