Economics

Context:

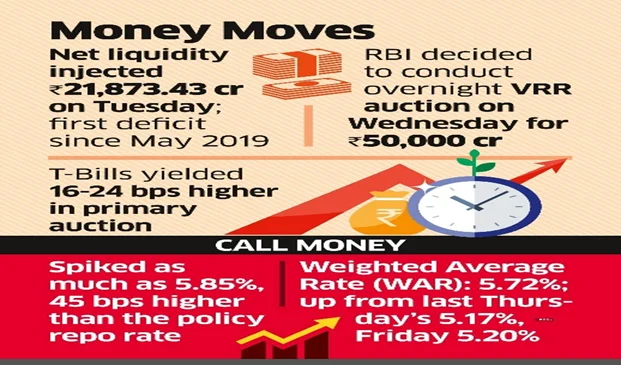

- Recently, For the first time since May 2019, the banking system liquidity situation turned into a deficit mode in September, 2022, by comparison, the liquidity surplus was to the tune of Rs 8 lakh crore in November 2021.

- As the Reserve Bank of India (RBI) was providing liquidity support to the economy, which was dealing with the after-effects of the Covid pandemic.

In this context let us know about Banking system liquidity:

What is banking system liquidity?

- Liquidity in the banking system refers to readily available cash that banks need to meet short-term business and financial needs.

- On a given day, if the banking system is a net borrower from the RBI under Liquidity Adjustment Facility (LAF), the system liquidity can be said to be in deficit and if the banking system is a net lender to the RBI, the system liquidity can be said to be in surplus.

- The LAF refers to the RBI’s operations through which it injects or absorbs liquidity into or from the banking system.

What has triggered present banking liquidity deficit?

- Economists say that there are various factors over the last few months that have led to the current situation.

- If an improvement in demand for credit has led to the same, the recent advance tax outflow has further aggravated the situation.

- Besides, there is the continuous intervention of the RBI to counter the fall in the rupee against the US dollar.

- As per the, chief economist, India Ratings.

- “The deficit in the liquidity situation has been caused by an uptick in the bank credit, advance tax payments by corporates, intervention of the RBI into the forex market, and also incremental deposit growth not keeping pace with credit demand.”

Latest data by RBI:

- The outstanding bank credit stood at Rs 124.58 lakh crore in August 26, 2022 and has increased by 4.77% (Rs 5.7 lakh crore) from Rs 118.9 lakh crore in March 25, 2022.

- However, deposit growth was just 3.21% (Rs 5.3 lakh crore) at Rs 169.94 lakh crore in August 26, 2022, from Rs 164.65 lakh crore in March 25, 2022.

How can a tight liquidity condition impact consumer?

- A tight liquidity condition could lead to a rise in the government securities yields and subsequently lead to a rise in interest rates for consumers too.

- The 10-year government bond yield increased to 7.23% on September 21, 2022, from 7.18% on August 20, 2022.

- Short-term rates would increase at a faster pace as the direct reflection of tighter liquidity and RBI’s rate hike would be on these papers.

- Expected rise in repo rate: A rise in the repo rate will lead to a higher cost of funds. Banks will increase their repo-linked lending rates and the marginal cost of funds-based lending rate (MCLR), to which all loans are linked to. This rise will result in higher interest rates for consumers.

What can RBI do to deal with this situation?

- As per the Economist, RBI’s actions will depend upon the nature of the liquidity situation. If the current liquidity deficit situation is temporary and is largely on account of advance tax flow, the RBI may not have to act, as the funds should eventually come back into the system.

- However, if it is long-term in nature then the RBI may have to take measures to improve the liquidity situation in the system.

Way Forward:

- Slow deposit growth could constrain robust credit growth. Banks need to increase deposit rates to incentivize greater deposit mobilization. Many banks have started special deposit schemes over the past month, offering more than 6 per cent interest on fixed deposits.

- RBI will have to infuse liquidity through different tools to ensure a steady flow of credit. Going forward, the rise in inflation and interest rates could also pose a threat to credit growth.

MUST READ: RBI’s monetary policy

Source: Indian Express