Economics

Context: The payments arm of big technology companies Amazon and Google have been given in-principle approval by the RBI to operate as online payment aggregators.

About Payment Aggregators:

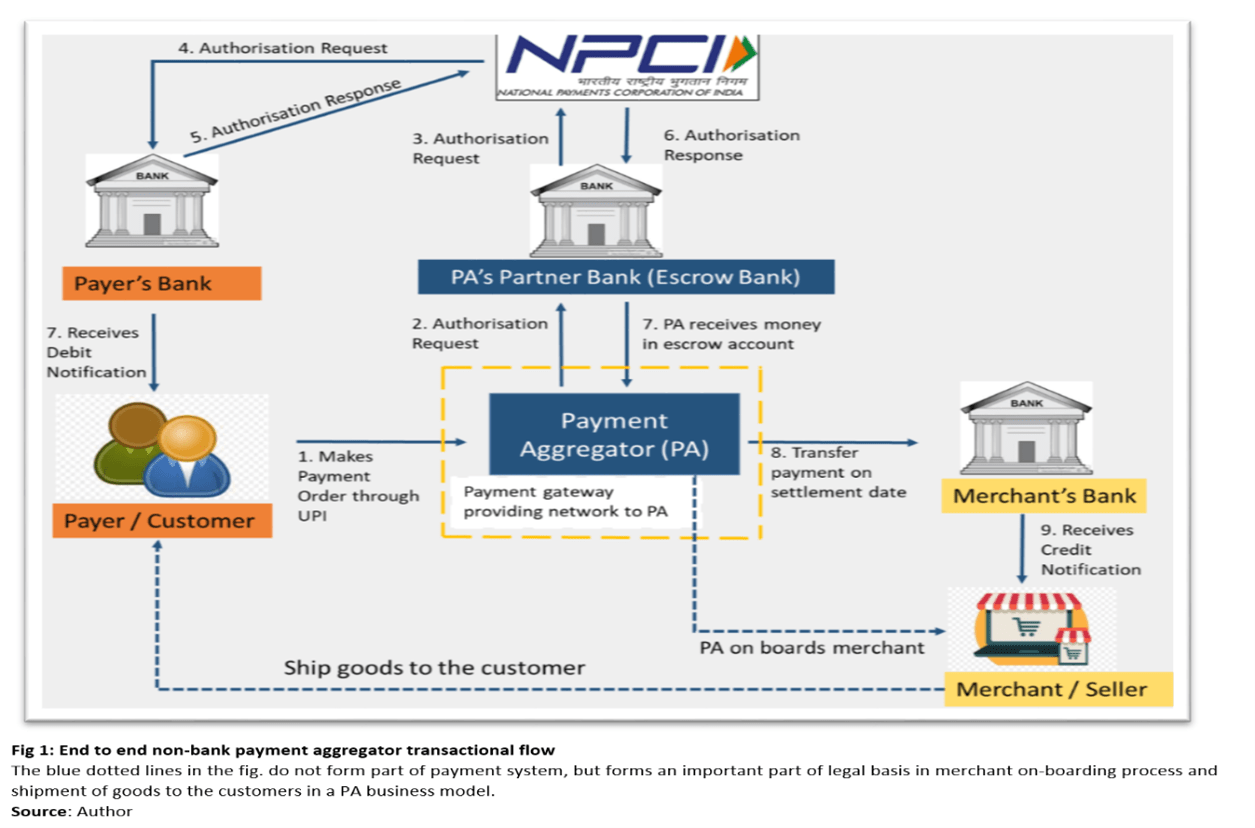

- A payment aggregator or merchant aggregator is a third-party service provider that allows merchants to accept payment from customers by integrating it into their websites or apps.

- A payment aggregator bridges the gap between merchants and acquirers.

- A merchant need not have a merchant account directly with the bank.

- At its core, payment aggregators bear the heavy load of integration with various payment providers to provide an all-inclusive solution for payment acceptance.

Types of payment aggregators in India

- Third-party payment aggregators:

- Third-party PAs offer innovative payment solutions to businesses.

- Their user-friendly features include a comprehensive dashboard, easy merchant onboarding, and quick customer support.

- Bank payment aggregators:

- They lack many of the popular payment options along with detailed reporting features.

- Bank payment aggregators are not suitable for small businesses and startups because of the high cost and difficult to integrate.

Source: Indian Express

Previous Year Questions

Q.1) Which one of the following situations best reflects “Indirect Transfers” often talked about in media recently with reference to India? (2022)

- An Indian company investing in a foreign enterprise and paying taxes to the foreign country on the profits arising out of its investment

- A foreign company investing in India and paying taxes to the country of its base on the profits arising out of its investment

- An Indian company purchases tangible assets in a foreign country and sells such assets after their value increases and transfers the proceeds to India

- A foreign company transfers shares and such shares derive their substantial value from assets located in India

Q.2) Consider the following:

- Foreign currency convertible bonds

- Foreign institutional investment with certain conditions

- Global depository receipts

- Non-resident external deposits

Which of the above can be included in Foreign Direct Investments? (2021)

- 1, 2 and 3

- 3 only

- 2 and 4

- 1 and 4