IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs September 2015, International, National, UPSC

Archives

IASbaba’s Daily Current Affairs- 2nd September, 2015

INTERNATIONAL

Chinese yuan devaluation : Risk and opportunity

- The sudden devaluation of the yuan to make it more market-determined and

facilitate its inclusion in the IMF’s Special Drawing Rights (SDR) basket has conveniently come at a time when China’s exports have sharply slowed.

facilitate its inclusion in the IMF’s Special Drawing Rights (SDR) basket has conveniently come at a time when China’s exports have sharply slowed. - It signals that China is struggling to rebalance its economy as it tries to internationalise its currency.

Reasons for Chinese yuan devaluation?

- In China , the value of the Chinese currency (especially in relation to the U.S. dollar) is largely been fixed by the government.

- China wants to see the Renminbi emerge as a currency for international trade and finance, like the dollar.

- As a preliminary step, China is trying to get the Renminbi included in the basket of currencies in International Monetary Fund (IMF)’s Special Drawing Rights (SDRs).

- The IMF had set a precondition that China should remove restrictions on foreign capital flows and shift to a flexible exchange rate system.

- At this backdrop, the devaluation marked the transition to a flexible, more market-based system of determining China’s exchange rates.

What can be the probable risks that India can encounter?

- The rupee has fallen almost 4 per cent against the dollar in the last two weeks, however the rupee-yuan exchange rate remains more or less unchanged.

- Trade relations between India and china have increased substantially though India faces a huge and growing trade imbalance with China. India has a trade deficit of around US$ 48 billion with China.

- Chinese investments in India remain quite small, at less than 0.5 per cent of all FDI in the country — less than even Poland, Malaysia and Canada.

- Huge trade deficit and less FDI from China, makes Indian currency and the economy more vulnerable to further yuan devaluation.

- With devaluation of yuan , manufacturing exports from china increases which may further hinder the growth of domestic manufacturing sector in India.

What can be the probable opportunities that India can encounter?

- Many problems could arise for china in executing this strategy of devaluation in future.

- ASEAN countries involved in the South China Sea dispute are wary of China’s intentions.

- The US is creating the Trans-Pacific Partnership with 12 Pacific Rim countries, which so far excludes China.

- As China takes over the chairmanship of the G20 in 2016, expect more risk as well, perhaps, as more opportunity — in Chinese both mean the same.

- The yuan may weaken further and China may pursue more aggressive external policies to distract attention from domestic problems.

- But if China becomes a riskier prospect, India could emerge as a more stable investment opportunity if it is able to pursue economic reforms and improve its business climate.

- India must also remain proactive on the economic and diplomatic fronts and ensure that China sees that competition with India will be costly, and cooperation will benefit both.

Way ahead:

- India needs to reduce its trade imbalance with China by attracting more FDI from China to get Chinese companies to “Make in India” .

- India has joined the NDB(New Development Bank) and the Asian Infrastructure and Investment Bank, AIIB (as its second-largest shareholder after China). These new banks are a potential, although small, source of long-term infrastructure finance for India, and they represent a visible and tangible symbol of cooperation between India and China that can fructify and grow.

- India should materialize the above opportunities that exist to become a regional super power in Asia.

Background:

Special drawing rights (SDR’s) : SDR’s are supplementary foreign exchange reserve assets defined and maintained by the International Monetary Fund (IMF). It is made up of a basket of four currencies which include US Dollors, Euro, Pounds Sterling and Japanese Yen.

Connecting the dots..

- Comment on the impact of recent devaluation of yuan by China , on the Indian economy with special emphasis on manufacturing sector.

- Critically analyse the steps taken by India to counter influence of China in Asian continent , at the backdrop of achieving it’s dream of becoming a regional super power.

NATIONAL

Farmer’s Suicide: Potential of agribusiness to address agrarian distress

- Despite being the Second largest producer of Cotton, the Indian Cotton Farmers are still marginalized and deprived. Amid the debates upon new Land Acquisition Bill,it is seen that some Provisions of the Bill will adversely affect the farmers interests at large.

Why is LAB (Right to Fair compensation and transparency in Land Acquisition,Rehabilitation and Resettlement) controversial among Farmers Community?

- Some promulgated amendments of the bill is supposed to aggravate the Farmers Socio-economic condition to a great extent.

- Removal of ” consent clause” – The new provision of the Bill envisages to remove the clause of “Consent” of the Land owners for acquiring lands for five purposes : Industrial Corridors, PPP Projects,Rural Infrastructure, Affordable Housings and Defence.

- As per new Bill, Land can be acquired by PRIVATE entity also which was earlier limited only to Private COMPANY.

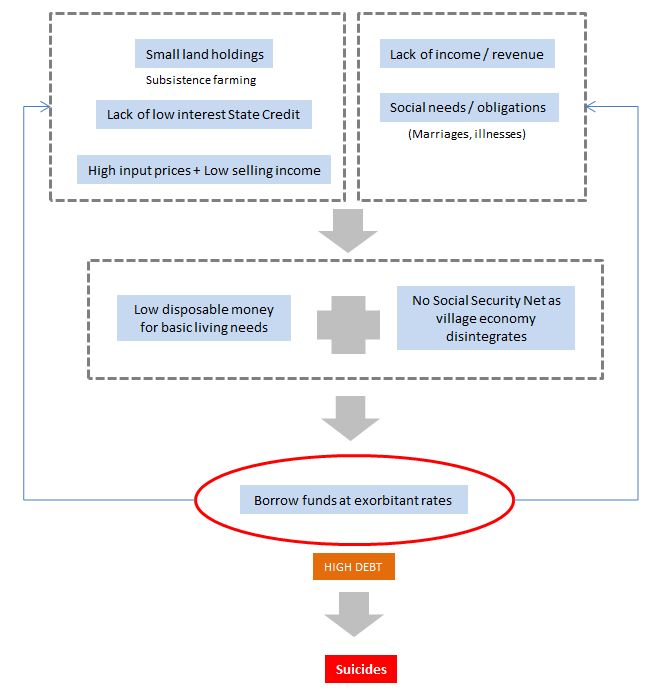

Agrarian Distress and Farmers Suicide : An Overlook

- The Agrarian distress in India is amounted to the Neo liberal agricultural Policies and the increased Indebtedness and agricultural costs it generates. It is observed that Farmer’s Suicides are tragic consequences of rising Corporate Dominance and the Transfer of Credit and other resources to the wealthy elites.

Causes of Farmers Suicide in general in Indian Scenerio:

The below figure depicts the causes of Farmers suicide-

Fact Sheets:

- Even though in staples such as pulses,rice and wheat , food companies do well , Cotton Farmers continue to be in distress.

- Share Prices of Textile Companies are performing well and attracting huge Private Investment. But the Cotton farmers are still in dilapidated condition.

Way forward:

- Institutional mechanism for the Farmers’ Support :

FPO(Farmer Producer Organisation) and its operational challenges-

FPO is a farmer owned producer companies and new types of self reliant co -operatives broadly called Farmer Producer Organization ,i.e AMUL dairy. Though FPOs are the means of alleviation of deprivations and poverty of the cotton farmers, they have many managerial, structural as well as operational challenges.

- Managerial Capability is below standard in FPOs. Therefore its operational jurisdiction is limited in terms of mobilisation of resources.

- Processing Unit isn’t integrated to most of the FPOs. Hence the cost benefit of agricultural produces gets circumscribed ( limited) to the farmers.

- Processing Units are largely owned by the Private Companies. Therefore Public accountability towards Farmers can’t be assured.

- Capital Constraint(deficiency) is another challenge for the operation of FPOs. Without Capital Induction(Investment) from outside, Capital Mobilisation and financial inclusion of farmers becomes difficult.

- Moreover Working Capital Deficiency is also another impediment for FPOs operation. FPOs have to buy in cash as their member farmers need the money at harvest time to repay crop loans and run their households.

- Significant losses in FPOs due to its ineffective working.

- Scope for banking loan is very limited to FPOs. Moreover High Interest rates and tax regime for FPOs are very inflexible.

IASbabas View:

- Bridge Financing without Collateral based on joint venture is required which will help in initial capital formation. As joint venture permitted in Indian Producer Company Act allow very little outside share capital, Innovative ways of inducting working capital to FPOs are urgently needed.

- Financial Inclusion through banking: As banks are not willing to come forward without collateral, the RBI has important role to categorise lending to FPOs as priority sector. Otherwise a special fund for FPOs outside Bank should be considered. Along with Huge interest burden should be reduced.

- Taxes and regulations should be made agro -comfort and flexible for FPOs with Processing Unit.

- FPOs with Processing Unit have to pay VAT on its sale produces as well as on its purchasing of raw materials. Therefore the proposed GST Bill has to be made compatible for the concession to FPOs.

- Strong political will is strongly needed for the greater cause of the Cotton farmers. And SEZ like privileges should be rendered to FPOs effective operationalization.

- Managerial and technological deficiencies as such computerization etc should be tackled with proper training to staffs and other stakeholders.

Connecting the dots..

- Discuss the problems of FPOs ? How can the new proposed GST bill change the working culture of FPOs?

- Do you think only Political will can bring Agricultural Revolution in Indian Economy?

- Critically discuss the controversial provisions of new Land Acquisition Bill ,2015 from the farmers perspective.

- Do you think Neo liberalism is not a boon, but a bane to farmers?