IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs November 2015, Science and Technology, UPSC

Archives

IASbaba’s Daily Current Affairs – 3rd November, 2015

SCIENCE & TECHNOLOGY

TOPIC: General Studies 3

- Science and Technology – developments and their applications and effects in everyday life Achievements of Indians in science & technology; indigenization of technology and developing new technology.

Nuclear power: Fast forwarding to thorium

- Nuclear power is the fourth-largest source of electricity in India after thermal, hydroelectric and renewable sources of energy.

- As of 2013, India has an installed nuclear capacity of around 5780 MW, also 6 more reactors are under construction and are expected to generate an additional 4,300 MW.

- The nuclear power generation in India is very less compared to 63130 MW in France, 99244 MW in USA and 42388 MW in Japan.

India’s power crises:

- India is facing a huge demand supply mismatch in power sector. As the country’s population grow the gap also widens, creating a headache for policy makers and the common people.

- Coal remains an essential staple to India’s energy needs and even though the country produced 500 million tonnes of coal in 2012-13, it is still not enough to satiate the country’s growing demand for energy, what with growing population and increasing affluence.

- Domestic natural gas production has fallen in recent years, with further drop-offs expected in 2014-15. India currently imports over 35% of its gas demand and this number is set to increase over the years.

- According to one census, 77 million households in India still use kerosene for lighting. The problem is even more acute in rural India where up to 44 percent of households lack access to electricity.

Solution lies with nuclear energy :

- One solution which India can rely upon to solve power crises is the nuclear energy.

- However the problem is, India lacks uranium fuel which is very important for the generation of nuclear energy.

- It is very difficult for India to access uranium through imports as India is not a signatory to NPT and CTBT.

Panacea lies with Thorium:

What is the single greatest factor that prevents the large-scale deployment of thorium-fuelled reactors in India?

- Most people would assume that it is a limitation of technology, still just out of grasp.

- After all, the construction of the advanced heavy-water reactor (AHWR) — a 300 MW, indigenously designed, thorium-fuelled, commercial technology demonstrator has been put off several times since it was first announced in 2004.

- However, scientists at the Bhabha Atomic Research Centre have successfully tested all relevant thorium-related technologies in the laboratory, achieving even industrial scale capability in some of them.

- In fact, if pressed, India could probably begin full-scale deployment of thorium reactors in ten years.

But why is India not stressing on thorium as a fuel ?

The single greatest hurdle, to answer the question, is the critical shortage of fissile material.

- A fissile material is one that can sustain a chain reaction upon bombardment by neutrons.

- Thorium is by itself fertile, meaning that it can transmute into a fissile radioisotope but cannot itself keep a chain reaction going. In a thorium reactor, a fissile material like uranium or plutonium is blanketed by thorium.

- The fissile material, also called a driver in this case, drives the chain reaction to produce energy while simultaneously transmuting the fertile material into fissile material.

- India has very modest deposits of uranium and some of the world’s largest sources of thorium.

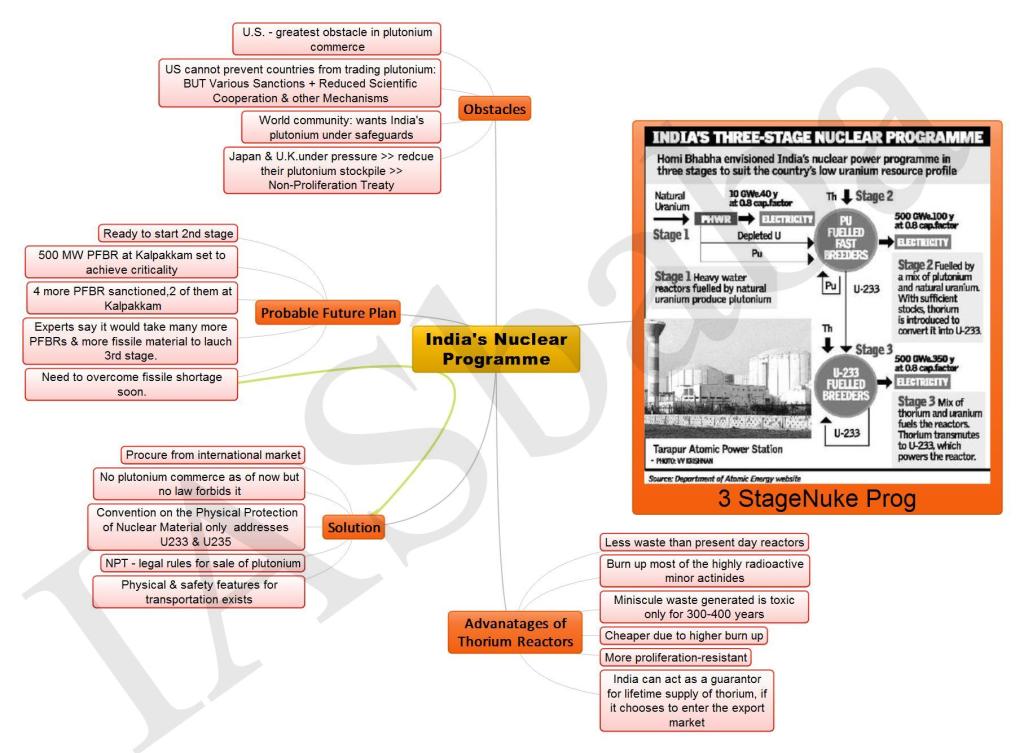

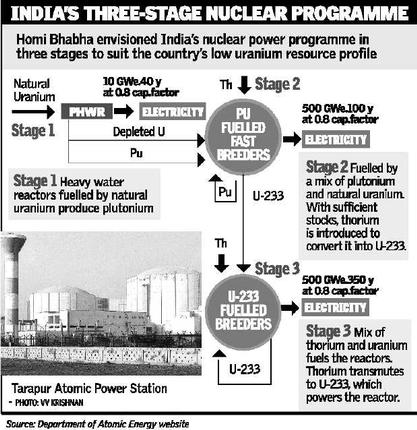

A 3 stage Indian nuclear power programme to suit the country’s resource profile:

- In the first stage, heavy water reactors fuelled by natural uranium would produce

plutonium;

plutonium; - The second stage would initially be fuelled by a mix of the plutonium from the first stage and natural uranium. This uranium would transmute into more plutonium and once sufficient stocks have been built up, thorium would be introduced into the fuel cycle to convert it into uranium 233 for the third stage.

- In the final stage, a mix of thorium and uranium fuels the reactors. The thorium transmutes to U-233 as in the second stage, which powers the reactor. Fresh thorium can replace the depleted thorium in the reactor core, making it essentially a thorium-fuelled reactor even though it is the U-233 that is undergoing fission to produce electricity.

However, experts estimate that it would take India at least another four decades before it has built up a sufficient fissile material inventory to launch the third stage. However, India cannot wait that long.

Procuring fissile material :

- The obvious solution to India’s shortage of fissile material is to procure it from the international market.

- As yet, there exists no commerce in plutonium though there is no law that expressly forbids it.

- In fact, most nuclear treaties such as the Convention on the Physical Protection of Nuclear Material address only U-235 and U-233, presumably because plutonium has so far not been considered a material suited for peaceful purposes.

- The Non-Proliferation Treaty (NPT) merely mandates that special fissionable material which includes plutonium if transferred, be done so under safeguards.

- Thus, the legal rubric for safeguarded sale of plutonium already exists.

- The physical and safety procedures for moving radioactive spent fuel and plutonium also already exists.

If India were to start purchasing plutonium and/or spent fuel, it would immediately alleviate the pressure on countries like Japan and the U.K. who are looking to reduce their stockpile of plutonium.

India is unlikely to remain the only customer for too long either. Thorium reactors have come to be of great interest to many countries in the last few years especially for the European countries.

Advantages of thorium over other nuclear fuel:

- Thorium reactors produce far less waste than present-day reactors.

- They have the ability to burn up most of the highly radioactive and long-lasting minor actinides that makes nuclear waste from Light Water Reactors a nuisance to deal with.

- The minuscule waste that is generated is toxic for only three or four hundred years rather than thousands of years.

- Thorium reactors are cheaper because they have higher burn up.

- Thorium reactors are significantly more proliferation-resistant than present reactors. This is because the U-233 produced by transmuting thorium also contains U-232, a strong source of gamma radiation that makes it difficult to work with. Its daughter product, thallium-208, is equally difficult to handle and easy to detect.

Way Forward :

- The mainstreaming of thorium reactors worldwide thus offers an enormous advantage to proliferation-resistance as well as the environment.

- Scientists predict that the impact of climate change will be worse on India.

- Advancing the deployment of thorium reactors by four to six decades via a plutonium market might be the most effective step towards curtailing carbon emissions.

Connecting the dots:

- Critically evaluate the nuclear power programme of India.

- Critically examine the advantages of thorium over other nuclear fuels.

- Between nuclear and renewable energy, which is the suitable energy for a sustainable energy scenario in India?

- Comment on the power crises in India.

ECONOMICS

TOPIC: General Studies 3

- Government Budgeting

- Indian Economy and issues relating to planning, mobilization of resources, growth, development

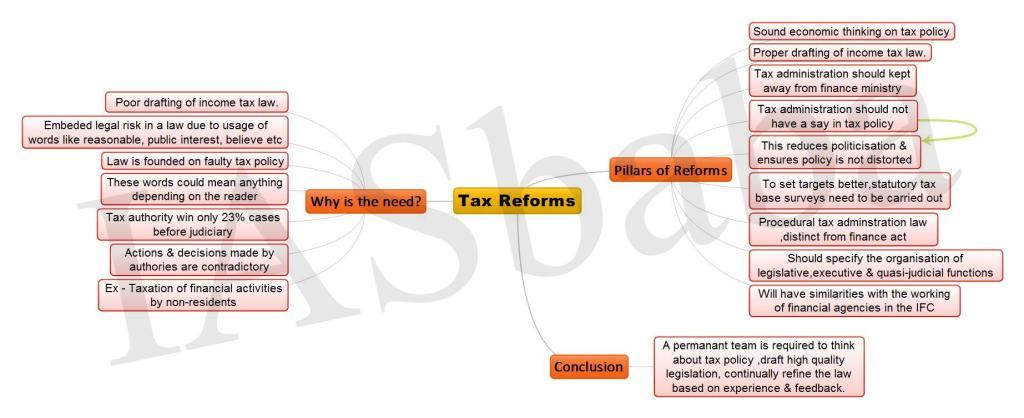

Tax Reform-Changing Paradigms

(Post the broader frameworks of the required tax-reforms, we’ve tried to reason out the recommendations by the Shome Panel (other panels are also there-Research and make a note of them for further revision) to bring in more clarity and an analytical perspective behind these recommendations– Hope this helps)

If we talk about the most important reforms that the country is waiting for, it’ll undoubtedly be in the ‘tax-maze’ of our country. But are reforms the only solution to the larger issues- while also considering, the prevailing fault-lines aligning it with the reasons that bring upon deeper troubles to the country’s economy?

Risks and Solutions

Legal Character:

- Re-defining the tax policy and working upon the strong foundations to enable a synergy between policies and the decisions being taken is extremely important

- Private sector needs to be made aware of the set policies well beforehand, to avoid bottlenecks later and taxation and exemptions need to be levied properly and be made known to the companies systematically to avoid complexity, unpredictability and legal risks (Transfer Pricing Issue)

- Awareness drives or appointment of a legal authority who is well-versed with the policies in the company can help bridge the gap and lessen the ‘tax-terrorism’ which has rendered the country unfriendly to business

Ideation:

- Drafting of the laws and usage of proper and to-the-point phrases are needed to avoid initiation of chronic battles.

- The drafting has to conform to high standards of legal language, should be proof-read properly and issues dealt with one-on-one basis and not be left for situations or ‘provisions’ subject to varied interpretations- tax changes are often done in a hurry with little or no analysis or impact assessment and that is why it is critical that the tax department acquires the specialisation to draft the law.

- A comprehensive ‘Impact Survey’ needs to be carried out before incorporating the changes and an assessment of costs or benefits needs to be done after the change is implemented– to make it more people-centric as evaluation of the impact on revenues vis-à-vis compliance costs to the taxpayer would help eliminate taxes that are no more required

Foundations:

- The organisational structures and the basis of public administration needs to be re-defined within the purviews of the strategy required by modern states to work upon also, on the proper devolution of duties

- Tax administration shouldn’t have a say in tax policy and this is done to evade growing politicization and tailor made choices of taxation by the administrators, for their own whims

- A procedural tax administration law is required to specify the organisation of legislative, executive and quasi-judicial functions in tax administration

- Also, statutory tax-base surveys should be made compulsory to be able to set and achieve targets in an effective manner and a holistic system-driven approach is a pre-requisite to drive the expansion in tax base.

Background:

The direction of tax-reform in developing countries includes:

- Scaling down of and possible elimination of trade taxes over time

- Reform of existing domestic indirect taxes to transform them into comprehensive consumption taxes on goods and services: this should cover both national and sub-national taxes

- A moderately progressive personal income tax

- A corporate income tax at a rate equivalent to the highest marginal rate of the personal income tax

Tax Administration Reform Commission: Shome Panel

Government, in 2014, had set up a Tax Administration Reform Commission comprising officials from public and private sector agencies

Objectives:

- To work on bringing in more transparency in the tax department and in the collection of taxes

- To counter the “distrust” that has emerged between the tax department and the tax payers

- Review the existing mechanism of dispute resolution covering time and compliance cost and recommend measures for strengthening them for both domestic and international taxation

- To enforce better tax compliance — by size, segment and nature of taxes and taxpayers, that should cover methods to encourage voluntary tax compliance

Major Recommendations:

Abolition of post of Revenue Secretary:

- They come from the Civil Services having little experience or familiarity with tax laws and administration and international practices. Thus, he tends to focus more on the administrative aspects and not on modernising the tax system.

- A governing council is thus suggested to work upon the policy formulation backed by proper analysis and years of experiences. Specialization of the officer (respective field) is required to augment the decisions with proper data

Unachievable set of targets:

- Tax projections need to be backed by analysis and therefore, there is a need to set up a knowledge, analysis and intelligence centre which can help in forecasting, data analytics and research

- Need to strengthen the database and inter-agency information sharing, not only between the Central Board of Direct Taxes and the Central Board of Excise and Customs but also with the banking and financial sector and other agencies such as Central Economic Intelligence Bureau (CEIB), Financial Intelligence Unit (FIU) and Enforcement Directorate to ensure better tax compliance through sharing of such data

IASbaba’s Views:

- Tax reform is an ongoing process, and with the fiscal imbalance in India looming large, reforms to improve long-run revenue productivity will have to continue with coordinated reforms being undertaken at the central, state, and local levels.

- Making the transition to information-based tax administration, online filing of tax returns and compiling and matching information has been the major drivers of tax administrative reform but both tax policy and tax administration cannot work in an isolated manner and requires much tandem between each other to steer the development of the economy.

- Components like Goods and Services Tax and Direct Tax Code may bring in a sigh of relief and thus needs to be aligned with the broader framework of reforms that can be workable for the country.

Connecting the Dots:

- Examine the ways in which tax reforms enhances the performance of labour utilisation, investment and productivity in a country?

- Enumerate the several effects of globalisation that needs to be taken into account while formulating a country’s tax policy

MUST READ

Misuse of sedition law

For detailed Analysis on ‘Sedition Law refer the below link-

http://iasbaba.com/2015/10/iasbabas-daily-current-affairs-14th-october-2015/

Portents of a religious autocracy- Cultural intolerance is a dominant element in the functioning of the present government, which wants to decide what we eat, wear, read, watch and who we love

A blast from the colonial past

Downstream concerns on the Brahmaputra

Over the barrel: The dilution of Brand India- Is India liberal, tolerant and democratic? Or is it conservative, atavistic and authoritarian? Investors want to know

The farm test- Government cannot afford to wait any longer to address the building agricultural distress

MIND MAPS

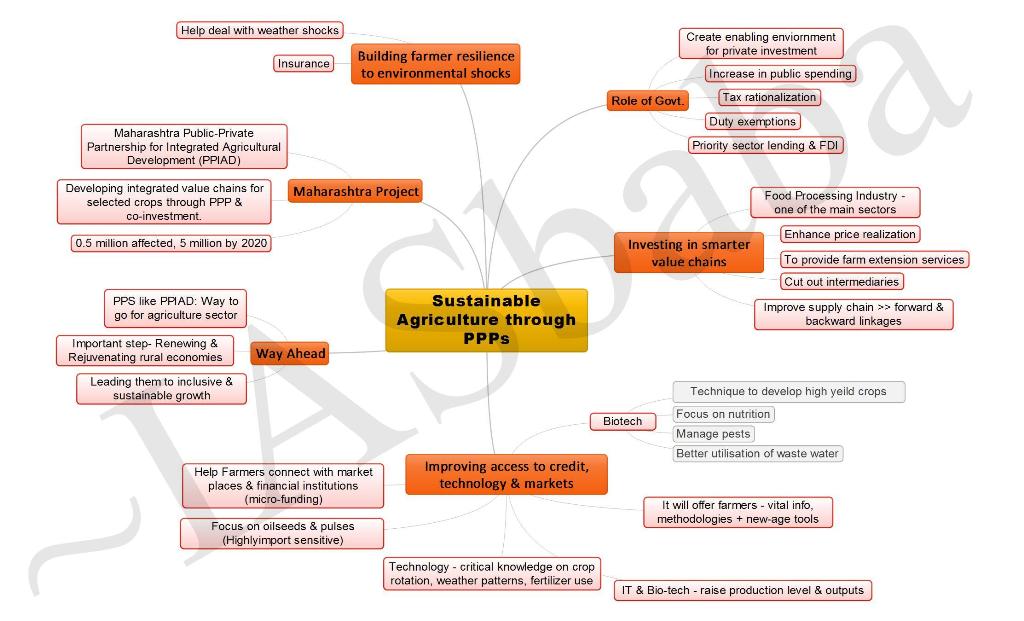

Agriculture through PPPs – Livemint

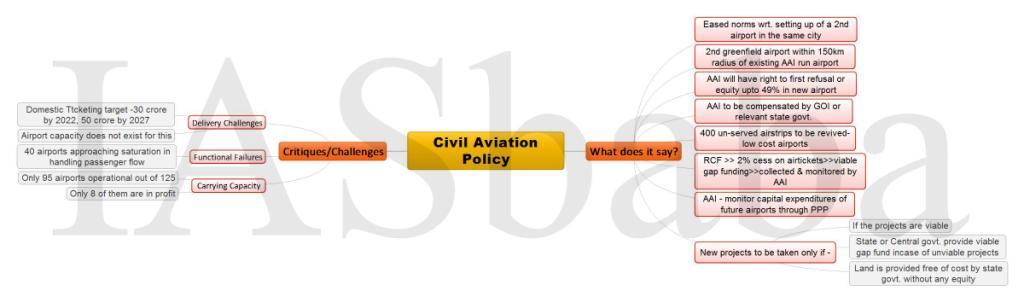

Civil Aviation Policy – Business Standard

India’s Nuclear Programme – The Hindu

Tax Reforms – Indian Express