IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs January 2016, National, UPSC

Archives

IASbaba’s Daily Current Affairs – 11th January, 2016

ECONOMICS

TOPIC:

- General studies 3: Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment; Effects of liberalization on the economy

- General studies 2: Important aspects of governance, transparency and accountability; Important International institutions, agencies and fora- their structure, mandate; Bilateral, regional and global groupings and agreements involving India and/or affecting India’s interests; Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

Illicit Financial Flows

Report by Global Financial Integrity (GFI) on Illicit Financial Flows (IFFs):

- $510 billion of black money flowed out of India from 2004 to 2013; that means an average annual outflow of $51 billion, or Rs. 3.3 lakh crore.

- But the estimate did not include or cover mis-invoicing of:

- Trade in services

- Trade of Goods- Accounted for 83.4 per cent of the $510 billion of IFFs from India

- Cash transactions

- Hawala transactions

Huge Mis-interpretations—

Of the mainstream discourse on

- Tax evasion (which is illegal)

- Tax avoidance (which is legal but could be equally abusive)

- Ignorance towards entities accounting for the lion’s share of illicit capital flight: Multinational Enterprises (MNEs)

- Organisation for Economic Cooperation and Development (OECD) estimates that more than 60 per cent of global trade occurs within MNEs — that is, between the subsidiaries of an MNE

Therefore, the numbers indicate a massive shifting of profits from jurisdictions with higher tax rates to those with zero or very low tax rates

Case of MNE:

- An integrated entity that coordinates the businesses of hundreds of subsidiaries spread across jurisdictions

- For tax purposes- These businesses are assumed to be separate economic activities

- Leads to a single group of companies with 500 subsidiaries assumed to consist of 500 independent taxable entities in diverse locations, thus, leaving plenty of scope for profit shifting and tax games

- Added to this, an evasion-friendly tax regime leads MNEs to enjoy an effective tax rate in the low single-digits

Finance Ministry’s Data:

Received: $392.2 billion in FDI in the 15 years from 2000 to 2015

Loss in illicit outflows: $512 billion in just the 10 years from 2004 to 2013

TJN Report: “The problem is that the assets of these countries are held by a small number of wealthy individuals while the debts are shouldered by the ordinary people of these countries through their governments”

So what should be the best way to make ordinary people shoulder the state’s debt burden?

Ans: Tax ‘consumption’ more heavily than wealth

(Goods & Services Tax comes into the picture as one would argue that it is the only way to make up the direct tax revenue that the state is either unable or unwilling to collect from treaty-shopping MNEs)

Transfer Pricing

Most popular mechanism for shifting profits

Mechanism of Transfer Pricing-

For IT giants such as Google or Microsoft (engaged in services), transfer pricing takes the form of:

- a licensing fee or

- a royalty payment or

- interest paid

..by a subsidiary to a parent company located offshore

Payments are then treated as a cost in the jurisdiction where revenues are being generated, thereby slashing profits (arbitrary and dictated, with no relation to cost and added value, diverge from the market forces)

Transfer Pricing Regulations (TPR)–

- Applicable to the all enterprises that enter into an ‘International Transaction’ with an ‘Associated Enterprise’ (all cross border transactions entered into between associated enterprises)

- Aim: To arrive at the comparable price as available to any unrelated party in open market conditions and this price is thus, known as the Arm’s Length Price (ALP)

- Arm’s Length Price: Price that would be charged in the transaction if it had been entered into by unrelated parties in similar conditions

Basically, transfer pricing channels a subsidiary’s profits through a cascade of companies incorporated in different jurisdictions, to eventual safety in a tax haven

Drawbacks:

- Loss of taxation revenue to Govt.

- Loss of foreign exchange

- Unethical corporate governance

Examples (illegal):

- Google has used Bermuda

- Amazon uses Luxembourg

- Microsoft uses Bermuda

This equals to a lethal combination of transfer pricing and tax havens thus, making it impossible to curb illicit capital flows

European Union: Estimated to be losing €1.1 trillion of income to tax-dodging every year

Bigger losers: Developing countries in Africa, Asia and Latin America

Consequences (India)—

- Country would be seen as possessing a combative tax administration

- Discourages overseas investors portraying the country as a troublesome investment destination

- Increase in tax litigation – causing valuable expenditure in (tareekh e tareekh)

Development of a Tax Regime:

- With global trade being dominated by MNEs, it was found necessary to put in place a tax regime that ensured revenue for every country while avoiding double taxation

- Two model tax treaties were developed:

- One by the United Nations—

- Favoured taxing income at the ‘source country’ that is, wherever the income-generating economic activity took place, regardless of the residence of the enterprise’s owners

- In favour: Of developing countries which, for years, had allowed their natural resources to be extracted by foreign capital, only to see the profits flow to offshore entities without doing much to enrich the local population

- Another by the OECD—

- Residents: Would be taxed on their worldwide income

- Predominant in tax treaties- Suits the MNEs

- Asked to pay little tax in their own residence jurisdiction, since the bulk of their revenue is generated overseas

- Non-residents: Would be taxed only on their domestic income

- MNEs make money here- and they end up avoiding paying the taxes owing to them being Non-residents and therefore, not eligible to pay taxes

- Occurrence of discrepancy of double tax avoidance

India’sDouble Taxation Avoidance Agreements have opted for a predominantly OECD model:

- FDI we seek will pay very little or no tax in India on the income it generates from India

- Place of Effective Management: Essentially a residence taxation concept

Is there any Alternative Arrangement that could have been opted for?

Yes; Linking taxation to sales and assets in India rather than the (putative) residence of ‘effective’ management

IASbaba’s Views

- We need to understand that curbing illicit capital flight is to be given a higher priority than courting foreign capital as what is rightfully ours should be brought back first (not a minimal amount- Which can be easily diverted towards creation of more social capital)

- India also needs to consider reducing the transfer pricing related litigations and enhance MNC’s confidence to invest in India. Shome Panel’s ‘retrospective cases formulation’ (recovery of dues only without additional penalty demand) seems to be a good way ahead for the same.

Connecting the Dots:

Write a short note on the following:

- GAAR

- Parthsarthi Shome Panel Recommendations

- UNCITRAL

NATIONAL

TOPIC: General studies 2:

- Functions and responsibilities of the Union and the States, issues and challenges pertaining to the federal structure, devolution of powers and finances up to local levels and challenges therein; Separation of powers between various organs dispute redressal mechanisms and institutions.

- Statutory, regulatory and various quasi-judicial bodies.

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

Making Commercial Courts work

- Recently the parliament in 2015 winter session passed Commercial Courts, Commercial Division and Commercial Appellate Division of High Courts Act, 2015.

- The law creates commercial courts at the district level to deal with commercial disputes.

- The success of the new commercial courts system that seeks to expedite settlement of commercial disputes and improve ease of doing business is critically dependent on how well the states respond to the need for setting up new courts and divisions.

- The financial threshold, which some litigants feel is too low for such cases, and a wide range of issues that are brought under their ambit could also pose challenges.

What the new law tries to do?

- The law creates commercial courts at the district level to deal with commercial disputes.

- These courts would be equivalent to the district courts and serve as the courts of original jurisdiction for all commercial disputes.

- For the high courts of Bombay, Delhi, Calcutta, Himachal and Madras, which are vested with original jurisdiction for commercial disputes over a certain value (rupees 50,000 before and now rupees 1 crore), the new law contemplates the setting up of a special commercial division to exercise such jurisdiction.

- This has the effect of streamlining the dispute resolution process as well as cutting down the time for which a dispute may be pending in the system.

Magnitude of the problem:

- The 253rd report of the Law Commission submitted in January last year lays down the magnitude of the task before the courts.

“Of the total of 32,656 civil suits pending in the five High Courts with original jurisdiction in India, we find that a little more than half (16,884) or 51.7 per cent of them are commercial disputes,” the report said, adding that this figure would have been far higher if not for the 35,072 suits that were transferred out of the Bombay High Court in 2012 when the pecuniary jurisdiction of the high court was raised to Rs 1 crore and above.

Multitude of cases in the High Courts:

- The commission observed that “the above data makes it evident that most high courts are still grappling with the issue of high pendency of cases on the original side, including writ petitions, arbitration cases etc, and have not been able to reduce the pendency in the last decade.

- Rather than increasing the burden of the courts, the focus should be on reducing the number of cases by increasing the pecuniary jurisdictional threshold of civil suits in such high courts.”

What the new law can do?

- The commercial courts Act has fixed a pecuniary threshold of Rs 1 crore.

- According to the Law Commission report, this limit, which was as low as Rs 50,000 earlier, alone would reduce the pendency in the five high courts of original jurisdiction namely Bombay, Delhi, Calcutta, Madras and Himachal Pradesh from around 17,000 cases to about 4,200 cases.

Implementation challenges:

- Implementation will remain a challenge, as right amount of infrastructure will be required to back up the intent and to ensure that the timelines as provided for are adhered to.

- This is paramount in making the law effective, and not letting it follow the patterns of other such failed attempts.

Where will the money come from?

- Though the statute itself does not provide for any specific financial allocation for setting up of these courts, it puts the onus on the state governments.

- The state government shall provide necessary infrastructure to facilitate the working of a commercial court or a commercial division of a high court.

- The state government may, in consultation with the high court, establish necessary facilities providing for training of Judges who may be appointed to the commercial court, commercial division or the commercial appellate division in a high court.

Improvements that has happened over the years:

- The Delhi High Court was the first off the blocks designating four of its benches as commercial division in March, based on the Law Commission recommendations in January 2015.

- It added two more benches to the division in November, soon after the Centre passed the commercial courts Ordinance in October.

- Lawyers feel that considering that 11 states have the same political party in power as the Centre, the passage of the law would be an opportunity for states to demonstrate their willingness to add to ease of doing business in the region.

- These states are likely to soon constitute such commercial courts in the region.

- The High Court of Bombay has also designated judges for the divisions.

- The other high courts with original jurisdiction such as, Madras-Chennai, Calcutta-Kolkata are also expected to follow soon.

- For other states, given the recent competition to attract business, constitution of commercial courts should be of high priority.

Other practical issues:

- One of the biggest problems could be the threshold Rs 1 crore. This is too small

- This limit could mean that there would still be too many cases for the commercial courts to handle.

- The number of cases could drop to around 1,600 if the threshold was raised to Rs 5 crore.

- Even this might take years to clear.

- If not Rs 50 crore, it should be at least Rs 20-25 crore so that the bigger cases get quicker decisions.

- The huge coverage area could be an issue

- The law lists some 20 areas ranging from carriage of goods to intellectual property rights that could produce ‘commercial disputes’ that come under the ambit of commercial courts besides adding a residual clause, which says “any other disputes so notified by the Central government.”

Way ahead:

- A key challenge is acceptance and adoption of the new regime and global practices introduced by all the stakeholders including the judiciary and lawyers.

- As there are new processes and cost regime being introduced, it is crucial that all stakeholders quickly understand and implement the law, in letter and spirit.

Connecting the dots:

- Critically examine the judicial reforms that is expected in India with special reference to the recently passed Commercial Courts, Commercial Division and Commercial Appellate Division of High Courts Act, 2015.

MUST READ

Widening the net beyond the income norm

Sri Lanka’s historic opportunity

Speaking of science- Controversies about Indian Science Congress point to a deeper problem in science administration

Pathankot attack: A terror strike, some hard truths- At Pathankot, lessons unlearnt from 26/11, and mistakes repeated, albeit on a smaller scale

Related Articles:

Save security from the establishment

Is a 2008-like financial crisis in the making?

Volatility in the financial markets shows fears over China are widespread

Not good economics or politics- Stalling the introduction of better emission standards is based on specious logic, especially in a country that has 13 of the world’s most polluted cities

MIND MAPS

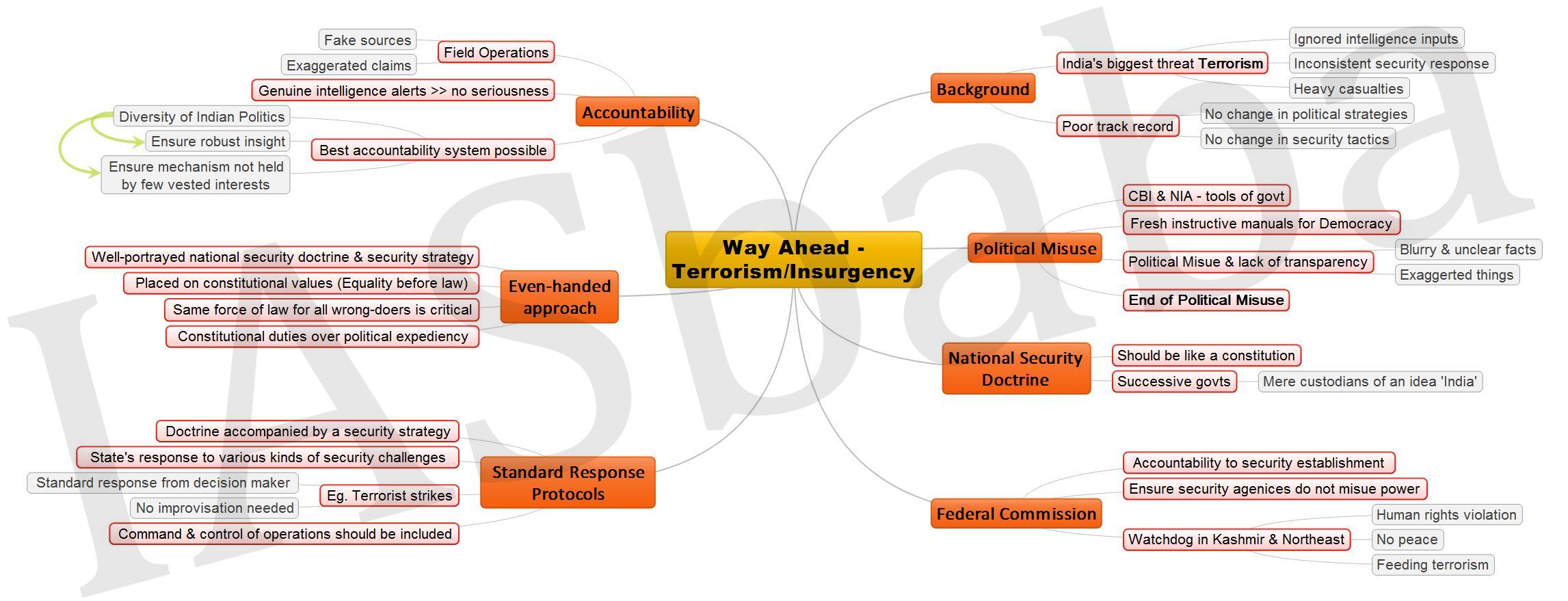

1. Way Ahead – Terrorism/Insurgency

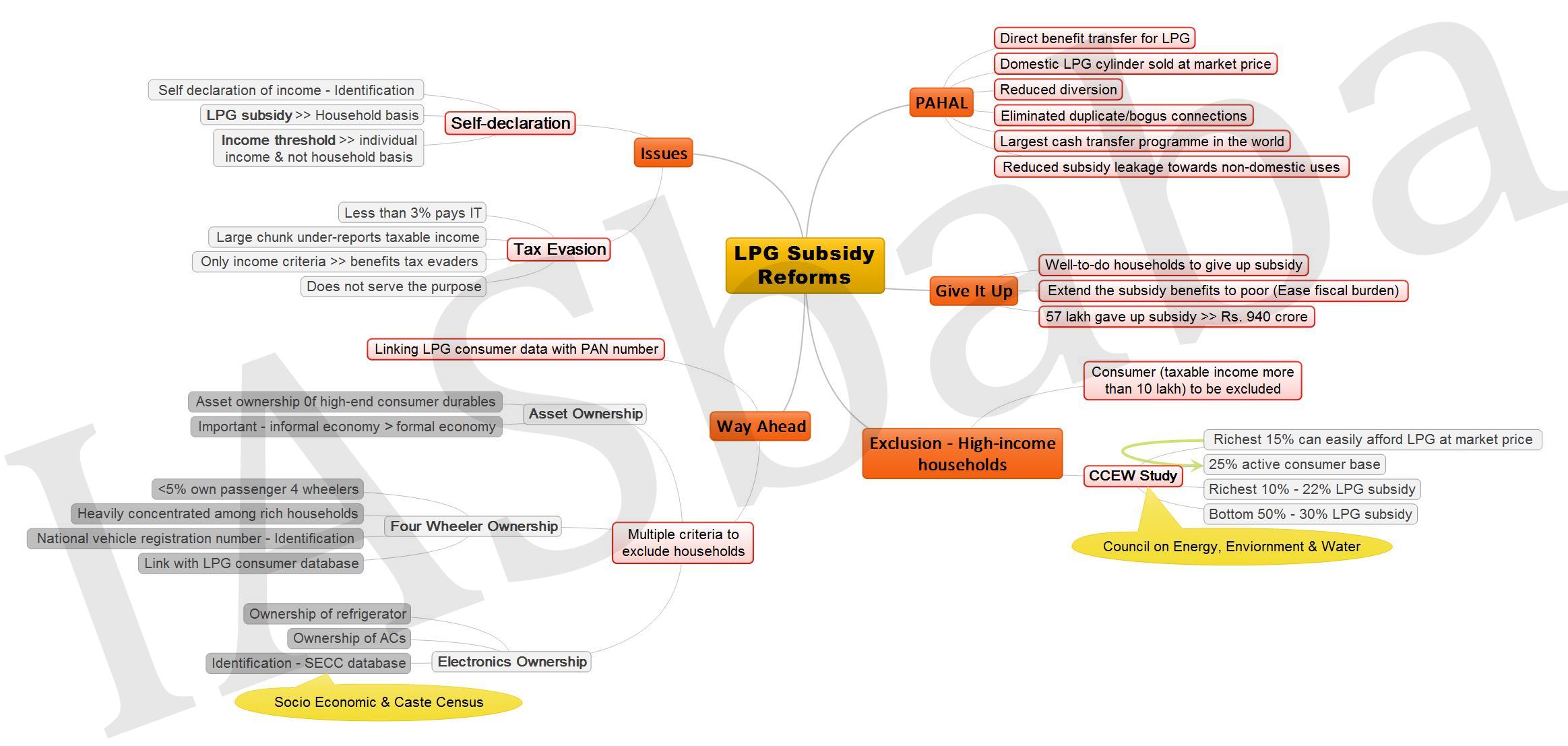

2. LPG Subsidy Reforms