IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs January 2016, International, UPSC

Archives

IASbaba’s Daily Current Affairs – 9th January, 2016

DEFENCE/SECURITY

TOPIC:

General studies 2:

- Functions and responsibilities of the Union and the States, issues and challenges pertaining to the federal structure, devolution of powers and finances up to local levels and challenges therein.

General studies 3:

- Role of external state and non-state actors in creating challenges to internal security.

- Challenges to internal security through communication networks, role of media and social networking sites in internal security challenges, basics of cyber security; money-laundering and its prevention.

- Security challenges and their management in border areas; linkages of organized crime with terrorism.

- Various Security forces and agencies and their mandate.

Save security from the establishment

The recent Pathankot incident has again highlighted the security lapses that is prevalent in the country.

Practical mistakes India committed while tackling Pathankot incident:

- No coordination between the foreign office, the defence forces and the internal security establishment. There is no regular interaction and exchange of messages between the above said three main pillars of any defence establishment.

- There was no sign of a “single command and control” :

- The Defence Security Corps re-employs retired jawans who are not much better than armed gatekeepers.

- The Guard Force is a defensive arm of the air force to protect air force assets.

- The NSG is a target-specific counter-terrorist force, not a battlefield unit.

- Yet, these were the units that were called in as the first responders.

- The one trained battle-ready counter-terrorist force, the army’s Special Forces, was nearby but not deployed to secure the sprawling base or the perimeter.

In short it can be said most terror attacks in India are characterised by three critical missteps: ignored intelligence inputs, inconsistent security response, and heavy casualties.

Reshaping India’s security posture:

- Though India’s wars with neighbouring countries have played the most important role in impacting its security posture, terrorism has, in fact, been the biggest threat faced by the country on almost all major counts — the number of soldiers killed, duration of engagement with armed movements or the spread of the menace.

- However, terrorism hasn’t had a commensurate impact on reshaping India’s security posture and tactics, as well as political strategies.

Support for National Counter Terrorism Centre(NCTC)

- TheNational Counter Terrorism Centre (NCTC) is a proposed federal anti-terror agency to be created in India, modelled on the National Counter Terrorism Centre of the USA.

- The proposal arose after the2008 Mumbai attacks aka 26/11 attacks where several intelligence and operational failures revealed the need for a federal agency with real time intelligence inputs of actionable value specifically to counter terrorist acts against India.

- The proposal has however met with much criticism from the Chief Ministers of various states who see this as a means of weakening India’s federalism.

- However with the recent pathankot incident the arguments favouring the establishment of NCTC has been strengthened.

Why states are opposing NCTC?

- Unlike the American NCTC which deals only with strategic planning and integration of intelligence without any operational involvement or the Joint Terrorism Analysis Centre, which too plays a purely coordinating role, the Indian agency will have not only intelligence functions but also powers to conduct operations.

- It is this concentration of powers that has had the states objecting to the NCTC, arguing that such sweeping powers vested in a Central agency will violate the autonomy of state governments, given that law and order is a state subject according to the Constitution.

- It has also been argued that given the establishment of the National Investigating Agency in the aftermath of the 26/11 attacks, the establishment of an NCTC would only add to the bureaucratic tangle in intelligence sharing and counter terrorist action.

A case of strengthening NATGRID:

- TheNational Intelligence Grid or NATGRID is the integrated intelligence grid connecting databases of core security agencies of the Government of India to collect comprehensive patterns of intelligence that can be readily accessed by intelligence agencies.

- It was first proposed in the aftermath of theterrorist attacks on Mumbai in 2008.

What NATGRID can do?

- NATGRID will serve as a valuable platform to trace suspicious cross-border movements of individuals like David Headley, who had made several trips to India before the Mumbai attacks.

- It will become a centralized database with sensitive information on individuals collected from 21 sources, which include data on immigration, banks and the telecom sector, in addition to data from intelligence agencies.

- NATGRID will help to collate scattered information into a transparent, accessible, integrated grid and do away with the inefficiencies associated with information asymmetries that hitherto delayed counter-terror operations.

Need revamping of NATGRID:

- In its present form, NATGRID suffers from many inadequacies, some due to bureaucratic red tape and others due to fundamental flaws in the system like consolidating data from a huge population, lack of compatibility with data sets in regional languages, risk of spies ratting out vital information to outside sourcesetc.

- If government takes enough measures to ensure that information does not fall through the firewalls that guard it, NATGRID has the potential to become India’s go-to grid for a 360-degree perspective to prevent and contain crises.

Need for a documented security doctrine

- It is time to finally accept the reality and move forward on a broad sweep of reforms in the security establishment.

- This could be done at three levels — parliamentary oversight, a well-defined national security doctrine and a national security strategy to implement the doctrine, and, finally, an independent federal commission of accountability on security matters.

- Parliamentary oversight:

- There have been several discussions about improving the accountability of intelligence agencies and other federal organisations responsible for the security of the country.

- Many experts are apprehensive of an adverse effect of parliamentarians being given oversight of intelligence agencies.

- However, the fact is that there is no better accountability system possible.

- The diversity of Indian politics will ensure there is robust oversight, and that the mechanism is not held hostage by a few vested interests in Parliament.

- A well-defined national security doctrine:

- As many experts recommend, it is time for India to have a documented national security doctrine, like the Constitution, so that successive governments do not forget the fact that they are mere custodians of an idea called India, and not revolutionaries mandated with recreating the nation-state.

- National security strategy:

- The doctrine should be accompanied by a security strategy that should spell out the state response to various kinds of security challenges.

- If it is a terrorist strike, then the decision-makers must know the responses expected of them, and not try to improvise based on their limited awareness.

- Command and control for such operations should also be spelt out in the document.

Finally, and most importantly, India must constitute a very credible, and permanent, federal commission of accountability on security matters.

- This is important not just to bring in accountability to the security establishment, but also to ensure that the many insurgencies and terrorist challenges do not result in the intelligence and security apparatus getting a free hand to misuse their powers.

- Such a commission can also be a watchdog in places like Kashmir and the Northeast, where repeated allegations of human rights violations are haunting political efforts to find peace, and feeding terrorism.

Way ahead:

- India, and its security forces, can’t any more trust the wisdom of a few wise men to tackle terror threats, secure our assets and safeguard national interests.

- The first step is to write down what the rulers of the day should do when a terror threat occurs.

Connecting the dots:

- Critically examine the growing need for national counter terrorism centre with special reference to security lapses in the recent Pathankot attack.

- Explain the various intelligence agencies in India along with their mandate.

- Even though India has an extensive intelligence infrastructure, attacks like 26/11, Pathankot etc make us doubt our intelligence systems. At this backdrop explain the various drawbacks in our intelligence system. Suggest measures to revamp the same.

INTERNATIONAL

TOPIC:

- General studies 2:

- Bilateral, regional and global groupings and agreements involving India and/or affecting India’s interests

- Effect of policies and politics of developed and developing countries on India’s interests

Devaluation of Yuan

- China’s has surprisingly moved to peg the yuan at its lowest value against the U.S. dollar since 2011 and this move has, as a result triggered a selloff in global markets, bringing alive the fears of competitive devaluation among emerging economies

- Since 2005, China’s currency has appreciated 33% against the US dollar and the first devaluation on August 11 marked the largest single drop in 20 years

- The depreciation of the yuan is par for the course as it becomes increasingly market-linked (to move towards a more market-oriented economy-allowing the market to have a more instrumental role in determining the yuan’s value) following its induction as a reserve currency by the IMF

Implies—

- Attempt to stimulate China’s sluggish economy—How?

- Keep exports from falling further

- Shifting it away from a model of debt-fuelled infrastructure

- Low-cost exports towards lower but more sustainable growth,

- Being driven by domestic consumption and services

- Beginning of a currency war that could lead to increasing trade tensions

Global Impact—

Indices:

- Trading in the Chinese equity market was suspended as soon as the benchmark index breached the 7 per cent circuit limits, leading to the leading Asian indices losing ground

- Hong Kong’s Hang Seng Index declined more than 3 per cent

- Japan’s Nikkei and Singapore’s Straits Times lost in the range of 1-2 per cent

- S. stock markets, including the Dow Jones Industrial Average (DJIA), S&P 500 and Nasdaq, as well as European and Latin American markets fell

Prices:

- Brent crude oil also fell to its lowest level since April 2004 at $33 a barrel in intra-day trading

- Adverse impact on Commodity prices, China being the biggest consumer of many commodities (including base metals)

- S: Mortgage rates can stay lower for longer

- Commodity:

- China will start trading with cheaper yuan and this might lead to lower demand for commodities

- Eg: Oil dropped 4 percent and copper dropped 8; but less-valuable Chinese currency is not good for exporters who want to sell manufactured goods that include copper, for example, as impact on their costs will cut into any benefit they get from selling their goods more cheaply to dollar-using buyers

Note: Drop in Oil— Proved to be a silver lining for India as it is a net importer

Lead other countries to devalue their currencies— Competitive Devaluation

- Currencies of Australia, Malaysia and South Korea fell in tandem after China’s move

- What is it: An abrupt national currency devaluation by one nation is matched by a currency devaluation of another

- Why: To not let its exports lose the competitive value in international markets (as High prices may pave way for fewer sales)

- More likely: Countries that have managed exchange-rate regime

- Major threat to the stability of the global economy

Theory of Devaluation—

Devaluation is a deliberate downward adjustment to the value of a country’s currency, relative to another currency, group of currencies or standard

Causes—

- Country’s exports to become less expensive

- As price of the country’s product in international market falls

- And products become more competitive in the global market.

- As price of the country’s product in international market falls

- Imports become more expensive, making domestic consumers less likely to purchase them

Negative consequences of Devaluation—

- By making imports more expensive, it protects domestic industries who may then become less efficient without the pressure of competition

- Higher exports relative to imports can also increase aggregate demand, which can lead to inflation

Devaluation & Yuan

- Reserve Currency by IMF- following its induction in the SDR Portfolio

- Flexibility in settling all its international obligations with its own currency

- Other countries can diversify their forex reserve portfolios to include yuan

- IMF wants China to be willing to progress towards a “freely floating exchange rate”

- 2010- Rejected ‘yuan’ to be a part of the official reserves by IMF on the basis that it was not “freely usable”

Special Drawing Rights (SDR)-

- International Reserve Asset

- Created by- IMF in 1969

- Why: To supplement its member countries official reserves (restricted to members)

- IMF re-evaluates the currency composition of its SDR basket every five years (last time being-2010)

- Basis of Value: Basket of 4 key international currencies (Euro, Japanese Yen, Pound Sterling, U.S. Dollar)

- SDRs can be exchanged for freely usable currencies

India& Yuan Devaluation—

Indian stock indices:

- Fell sharply and the rupee hit a three-week intraday low of 66.93 a dollar as foreign funds continued their exodus from emerging markets.

- The 30-share Sensex flirted with a 19-month nadir during the day, before closing 554.50 points lower at 24,851.83.

India’s inherent resilience put to test—

India is firmly on the path of economic revival and has emerged as one of the fastest growing economies in the world but it could face the following issues—

- Currency Volatility can be aggravated due to the fact that the volume of exports has remained the same in many sectors

- Sharp increase in cheap imports (reasons below) hurting Indian Industries

- Cheaper goods of China

- Excess capacity of China might lead it to dump its goods in other countries

- Could affect India’s exports making it expensive

- Expansion in the country’s deficit with China

- Hurt ‘Make in India’ plan – Indian manufacturers already suffer significant cost disadvantages and their competitiveness will now diminish further against imports from China

IASbaba’s Views:

- India should take the following broad steps to contain the differences that suddenly arises out of this arrangement—

- Consider proposals to protect steel manufacturers from cheap steel imports from China(India had increased the import duty on certain steel products by 2.5 per cent in August, 2015)

- Decision should be taken on a case-to-case basis based on ground facts for a case of anti-dumping duty or any other policy to be put into effect

- Focus on global trade and policy related efforts in boosting competitiveness

- There is also an urgent need to develop global safety nets to protect nations from negative spill-overs of the devaluation and ‘competitive devaluation’.

Connecting the Dots:

- With ‘Yuan Devaluation’ effectively spooking the world financial markets, make a case for the importance of strong domestic institutions in the country

MUST READ

Tashkent syndrome- Unable to apply transformative pressures, subjected to strong external pressures ourselves, we reverted to the status quo ante

Simply put: What needs to be done to upgrade from BS-IV : Four years from now, the government wants to leap directly to BS-VI auto emission norms from the existing BS-IV, skipping BS-V. But the challenges, before both oil companies and automakers, are enormous

Insider Trading: New rules confound India Inc- There has been a virtual freeze in communication when it comes to price-sensitive information under the changed rules

Isn’t liberalisation meant to be liberal?- The new AIF rules lay down the red carpet for foreign investors to make a grand front-door entry into the booming Indian start-up space

MIND MAPS

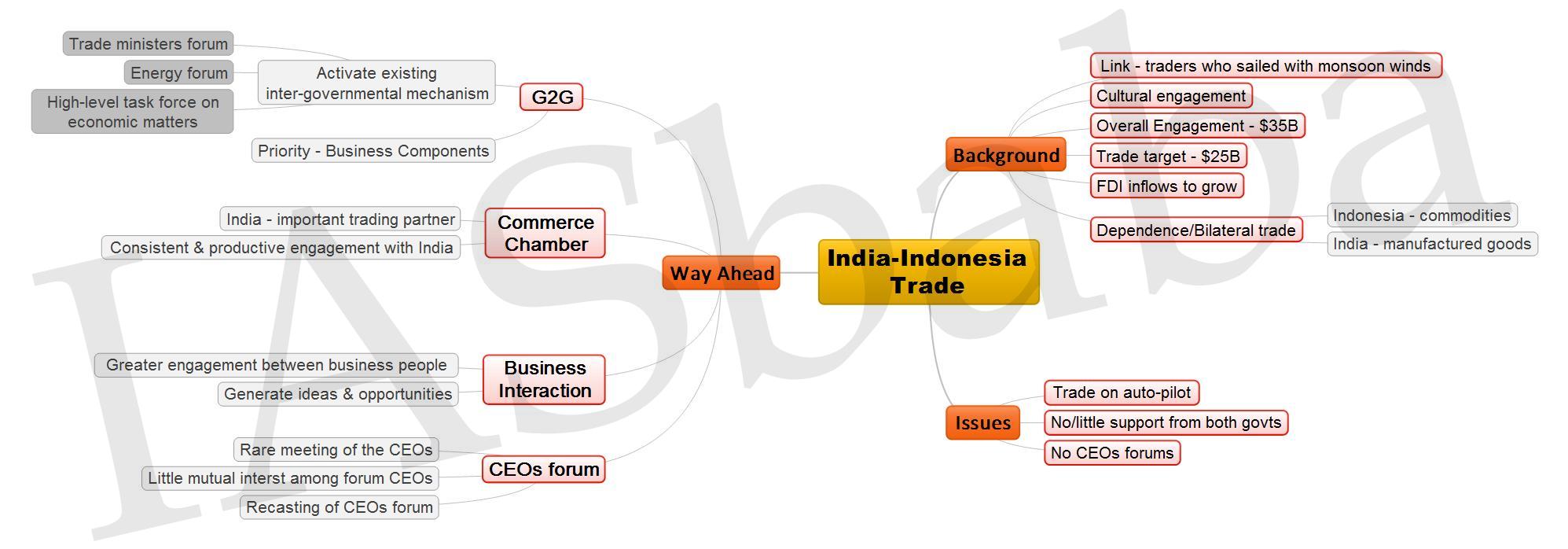

1. India- Indonesia

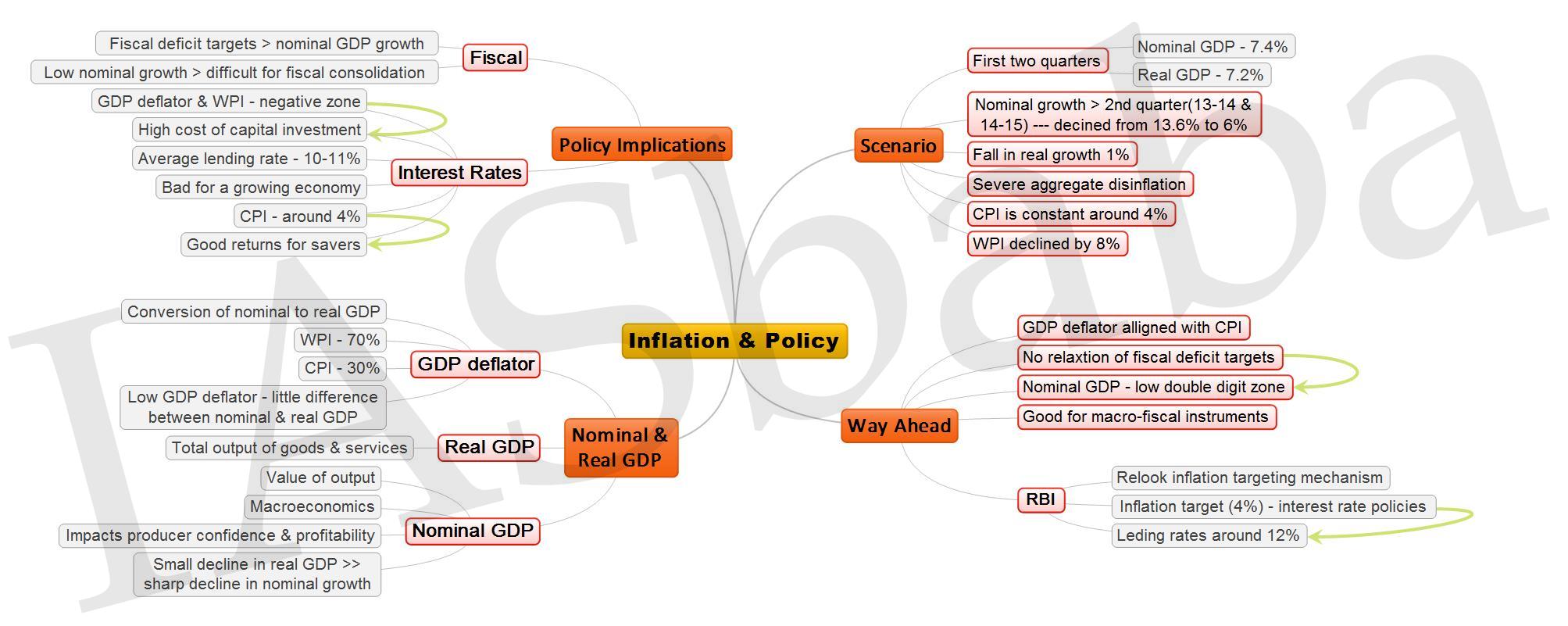

2. Inflation Policy