All India Radio

NPAs of Public Sector Banks

Search 12th June 2017 http://www.newsonair.com/Main_Audio_Bulletins_Search.aspx

TOPIC: General Studies 2

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

- Structure, organization and functioning of the Executive

Background

For years, Indian lenders, especially state-run banks, were engaged in volume game to balloon their balance sheets and appease their promoter (the government). That has been so ever since nationalisation of these banks happened in two stages (beginning 1969). Governments often treated these banks as their extended arms and used them for populist measures.

There was a time from 2011-13 when every bank rushed to give money to corporations, no matter what the credit perception was as everyone expected a miraculous pick-up in the economy.

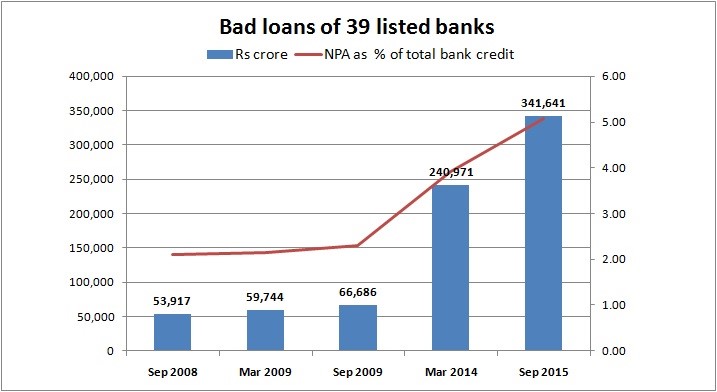

Picture credit: http://s1.firstpost.in/wp-content/uploads/2016/02/bad-loans-of-39-banks.jpg

Today, the total values of NPAs in India is 6 lakh crore.

What is NPA?

NPA in terms of RBI regulations result out of non-payment of interest for a period of 90 days or non-payment of principle amount for 90 days or more. So beyond that point, it is called Non-Performing Asset. The loan is taken by the company on its assets from the bank. When the asset is not performing because they become doubtful and NPAs from doubtful become bad loans.

Can’t collateral be used to write off loans?

When the banks give loans, they take something from the entity taking it as collateral for that loan. Lot of people give collaterals but in case of large projects, it is not possible to give collaterals. In such cases, the land purchase, the building purchase, the plant machines, the debtors and inventory are mortgaged to the bank.

These assets are available but if they are able to produce enough to really repay to the bank remains doubtful.

The question than arises what should the banks do with those assets. Suppose a car is a collateral, it can be sold to anybody but a petrochemical complex or steel complex cannot be sold to anybody.

The banks have the right to sell the assets. But selling is not the question. When these assets are sold in distress, there is chance that against Rs. 50000 crore loan, the banks get only Rs. 20000 crores.

Out of 6 lakh crores, 80-90% of them large borrowers. Now the government doesn’t want to kill these companies, create employment problems and take people’s job. Huge areas such as steel, cements, energy industries are country’s development backbone. Such companies cannot be shut down and hence there bad loans are continued to be carried forward.

How NPAs arose?

After 2008, there was international financial crisis. The prices have fallen significantly in the international market. In last two years the commodity market is very bad for example, the Sugar industry and steel industry. Power sector was not operating properly. Halfway through the plants being operational, the banks stopped giving them money due to policy paralysis.

People had extended their business beyond their means and higher interest was creating more problems

Had the financial planning and financial management not compromised while giving the loans, the issue wouldn’t have been this grave. In certain cases, the money has been diverted by entrepreneurs, they did not bring in promoters, did over invoicing of expenditure and took out money from that. So all kinds of speculations are there which led to increase in NPAs.

Challenges to payback policies

The rate of interest is so high that at times the people are unable to pay it back. There are policy errors when the government policy change and the enabling environment is not there.

Solution

- Government will have to do mix and match of various things. No single solution for all the problems. The solution has to be derived on case to case basis.

- The government is thinking of setting up committees for this purpose. There can be learned people appointed in each and every case who know their industry very well.

- Whether government should run the business is also a big issue. It makes sense for the government to convert part of the loan into equity and take majority ownership possible.

- The banks will be able to take over the management and revive the company. It is important to do the financial restructuring.

- There are many who get repeated in the defaulters list. So some long term solution is required. They can’t be allowed to benefit on their own fault. There should be certain benchmark on the performance. If they are not able to perform, then entire debt can be converted into equity or part of the debt can be waived and bring in other promoters.

Many banks, especially PSBs do a lot of work. They do PSL, they give educational loans and housing loans. Because of bad loans, the entire system of PSBs, their priorities are compromised and entire structure gets vulnerable. However, it doesn’t mean private sector banks have suffered less due to NPAs.

Conclusion

Start up, initial capital, turn business into amateur industry. They should take the risk as far as possible. Whatever money they take as loan is for repayment. People who pay the banks in time keep on growing and prospering.

Unfortunately, a tendency has come to a section of borrowers that this money of bank is like a free money. This kind of feeling is a major reason for the disaster. Lot of people don’t have enough capital on their own. Only those succeed who plan with due care. Contingency is important. When going for larger projects, there should be more concentration on equity and borrowing kept on minimum. The capital inflow is not much in India. So the government has to plan regarding the same.

Capital can be channelized into equity and people can expand business.

Another idea is to create a bad bank which would be a centralised agency that would take over the largest and most difficult stressed loans from public sector banks in order to help clean their balance sheets, and would take politically tough decisions to reduce debt, providing an impetus to further lending to spur economic activity.

NPAs will cause pain to banks by those who have not paid back the loan. But some part of the money have to come back to the system as it is common man’s money.

Connecting the dots:

- Issue of NPAs have been reaching to unexpected levels. What is the reason for such high levels and suggest possible measures to tackle them.