UPSC Articles

ECONOMY

TOPIC: General Studies 3:

- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment

Economic crisis: economy in bad shape

Context:

- Growth in the quarter from July to September had slipped to 4.5%.(lowest level recorded in six years)

- 6.1% nominal GDP growth (real growth plus inflation) the slowest in a decade.

- Fixed investment slumped to 1%, private consumption growth halved year on year, and manufacturing activity contracted by 1%.

Evidences for Slowdown:

- The 12.2% decline in electricity generation( it is a good barometer of demand generated by all economic activity, not just industrial production.)

- Metrics one would usually look at to assess economic activity and consumption such as Imports, merchandise exports, automobile sales, bank credit…, are indicating warning

- Bank credit growth is expected to hit a 58-year low in 2019-2020.

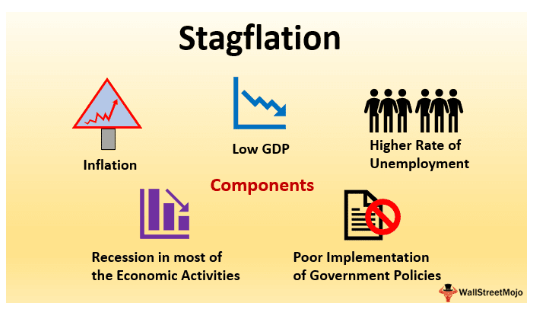

Stagflation:

- With retail inflation hitting a 40-month high of 5.54% in November and Food inflation hit 10%, vegetables (onions) and pulses.

- This has led to worries about India entering a phase of stagflation, (persistent high inflation combined with high unemployment and stagnant demand in a country’s economy)

Daily Current Affairs IAS | UPSC Prelims and Mains Exam – 30th December 2019

Concerns:

- The current slowdown is closer in nature to what was faced as far back as 1991 — the year India liberalised.

- India’s current crisis is driven by both cyclical and structural factors

- Problems in finance have exacerbated the slowdown.

- The World Bank has said this cyclical slowdown is severe.

- Demand collapsing due to reasons ranging from poor rural income growth,

- The ghosts of demonetisation and a hastily implemented Goods and Services Tax (GST).

Point to be noted:

- India’s growth recovered after global financial crisis 2008 without fixing the problems

- Series of fortuitous developments such as lower oil prices and a boom in credit from non-banking financial companies (NBFCs) which may be partly driven by demonetisation sending more cash into the formal financial system.

- With the collapse of IL&FS in late 2018,this support also ended .

- Now the twin balance sheet crisis (of stressed banks and corporates with infrastructure bets) raised

Way forward:

- Reserve Bank of India must cut interest rates for spurring growth out of the equation.

- Increase public expenditure by investing in agriculture

- raise funds for the Mahatma Gandhi National Rural Employment Guarantee Act

- Investment in Skill , Education and Health

Conclusion:

- This is a cyclical phenomenon and will pass like the circle of life… what goes up, must come down, but govt must also address the concerns of economy

Connecting the dots:

- Do you think economy seems headed for the intensive care unit?

- Do you think Demonetisation is responsible for the current slowdown?