UPSC Articles

Non-Performing Asset: Gross NPAs may rise to 9.9% by next Sept., says RBI report

Part of: GS Prelims and GS-III Economy

Daily Current Affairs IAS | UPSC Prelims and Mains Exam – 28th December 2019

For Mains:

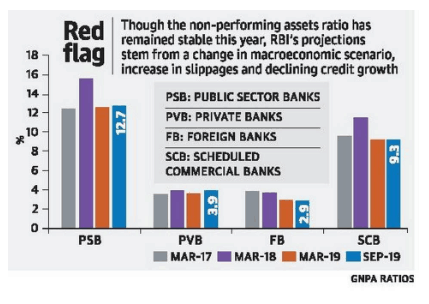

- The gross non-performing asset (GNPA) ratio of banks may increase to 9.9% by September 2020 from 9.3% in September 2019.

- due to change in macroeconomic scenario, marginal increase in slippages and the denominator effect of declining credit growth.

- The asset quality of agriculture and services sectors, as measured by their GNPA ratios, deteriorated to 10.1%

- Reviving the twin engines of consumption and investment remains the key challenge even while remaining vigilant about spillovers from global financial markets.

Value addition For Prelims:

- A non performing asset (NPA) is a loan or advance for which the principal or interest payment remained overdue for a period of 90 days.

NPAs classified further into Substandard, Doubtful and Loss assets.

- Substandard assets: Assets which has remained NPA for a period less than or equal to 12 months.

- Doubtful assets: An asset would be classified as doubtful if it has remained in the substandard category for a period of 12 months.

- Loss assets: As per RBI, “Loss asset is considered uncollectible and of such little value that its continuance as a bankable asset is not warranted, although there may be some salvage or recovery value.”