IASbaba's Daily Current Affairs Analysis

IAS UPSC Prelims and Mains Exam – 7th February 2020

Archives

(PRELIMS + MAINS FOCUS)

Repo rate kept unchanged

Part of: GS Prelims and GS-III- Economy

In news:

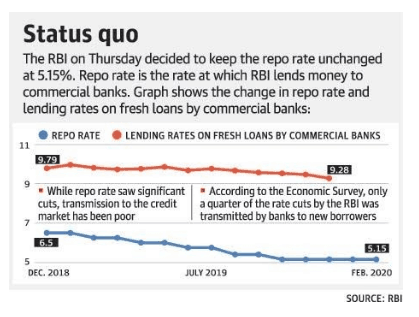

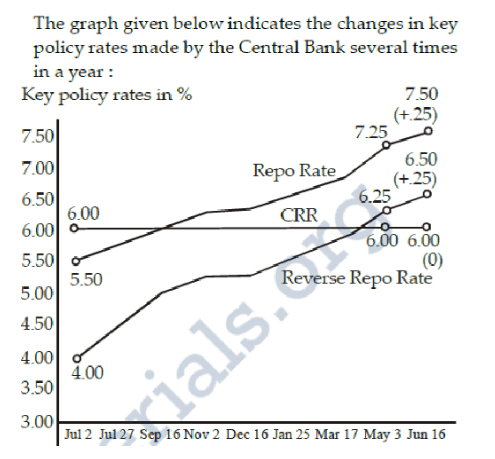

- The Monetary Policy Committee (MPC) decided to keep the interest rates unchanged in the wake of a rise in inflation.

Daily Current Affairs IAS | UPSC Prelims and Mains Exam – 7th February 2020

From Prelims Point of view:

Monetary Policy Committee (MPC):

- MPC is a six-member committee constituted by the Central Government

- Section 45ZB of the amended RBI Act, 1934

- Once in every six months, the Reserve Bank is required to publish a document called the Monetary Policy Report to explain: (1) the sources of inflation and(2) the forecast of inflation for 6-18 months ahead.

- The committee comprises six members – three officials of the Reserve Bank of India and three external members nominated by the Government of India.

- The Governor of Reserve Bank of India is the chairperson ex officio of the committee.

REPO Rate:

- REPO denotes Re Purchase Option – the rate by which RBI gives loans to other banks. In other words, it is the rate at which banks buy back the securities they keep with the RBI at a later period.

Lucknow Declaration Adopted at the 1st India-Africa Defence Ministers Conclave, 2020

Part of: GS Prelims and GS-II- Defence

In news:

- The first India-Africa Defence Ministers’ Conclave held in Lucknow

- adopted the Lucknow Declaration

Highlights :

- To deepen cooperation to combat the growing threat of terrorism

- Preserve maritime security by sharing information, intelligence and surveillance

From Prelims Point of view:

DEFEXPO

The DefExpo is biennial event organized by Ministry of Defence. The 11th edition of the event promises to bring in new technological solutions.

- Defence Exhibition Organisation is an autonomous organisation of the Indian Government established in 1981.

- The organisation was established to promote export potential of the Indian defence industry.

- The agency is responsible for organising international exhibitions such as DEFEXPO and Indian participation at overseas exhibitions.

India to work with Russia on copters

Part of: GS Prelims and GS-II- Defense , India’s Foreign relations

In news:

- Production Localisation of Ka-226T light utility helicopters

- (Defexpo 2020) Russian Helicopters (RH) signed a road map with IRHL for localisation of Ka-226T helicopter production in India.

- IRHL is a joint venture between Hindustan Aeronautics Limited (HAL) and Russian Helicopters (RH), which will assemble the Ka-226T helicopters in India.

From Prelims Point of view:

Ka-226T:

- The Ka-226T is a design of Russia’s famed Kamov design bureau. It is a light helicopter, with a maximum take-off weight of over 3.5 tonnes and can carry a payload of up to 1 ton.

Defence Acquisition Council (DAC):

- highest decision-making body in the Defence Ministry for deciding on new policies and capital acquisitions for the three services (Army, Navy and Air Force) and the Indian Coast Guard.

- The Minister of Defence is the Chairman of the Council.

- It was formed, after the Group of Ministers recommendations on ‘Reforming the National Security System’, in 2001, post Kargil War (1999)

Uniform Code of Pharmaceutical Marketing Practices

Part of: GS Prelims and GS-II- Health sector

In news:

- Department of Pharmaceuticals (DoP), which comes under the Ministry of Chemicals and Fertilizers, has yet again “requested companies to abide by UCPMP” Uniform Code of Pharmaceutical Marketing Practices

From Prelims Point of view:

Uniform Code of Pharmaceuticals Marketing Practices, (“UCPMP Code”)

- voluntary code issued by the Department Of Pharmaceuticals relating to marketing practices for Indian Pharmaceutical Companies and as well medical devices industry.

(MAINS FOCUS)

Indian Economy

Topic: General Studies 3

- Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

- Science & Technology

UPI- India’s Digital Payment Revolution

Context

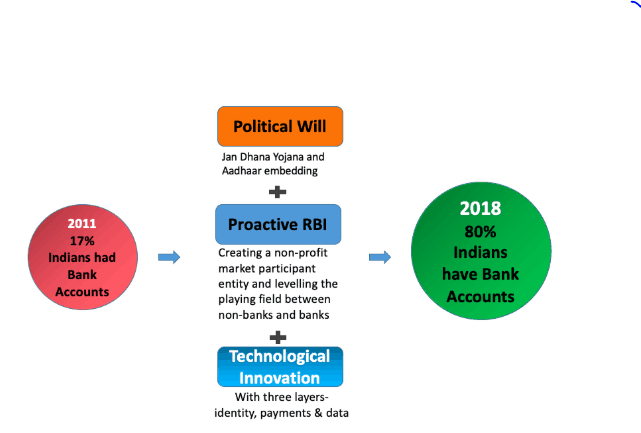

Google writing a letter to the US Federal Reserve two months ago asking them to learn from Indian digital payments

Also, digital payment transactions on the Universal Payment Interface (UPI) platform rose from 0.1 million in October 2016 to 1.3 billion in January 2020

Daily Current Affairs IAS | UPSC Prelims and Mains Exam – 7th February 2020

India’s payment revolution comes from

- A clear vision – shifting the system from low volume, high value, and high cost to high volume, low value, low cost

- A clear strategy -regulated and unregulated private players innovating on top of public infrastructure (UPI)

- Trade-offs balanced by design -regulation vs innovation, privacy vs personalisation, and ease-of-use vs fraud prevention

About UPI

- It is a common platform through which a person can transfer money from his bank account to any other bank account in the country instantly using nothing but his/her UPI ID.

- Launched in 2016 as Mobile First digital payments platform

- Immediate money transfer through mobile device round the clock 24*7 and 365 days based on the Immediate Payment Service (IMPS) platform.

- UPI is completely interoperable and as such, it is unique in the world, where you have an interoperable system on the ‘send’ and ‘receive’ side

- Developed by: National Payments Corporation of India (NPCI) under the guidance from RBI

Significance of UPI

- It created interoperability between all sources and recipients of funds (consumers, businesses, fintechs, wallets, 140 member banks),

- Settled instantly inside the central bank in fiat money – Convenience to consumers and merchants and

- Blunted data monopolies -big tech firms have strong autonomy but weak fiduciary responsibilities over customer data).

UPI offers the following policy lessons.

- First, the India stack — interconnected yet independent platforms or open APIs — are a public good that lowers costs, spurs innovation, and blunts the natural digital winner-takes-all..

- Second, collaboration can create ecosystems that overcome existing obstacles— the execution deficit of government, the trust deficit of private companies, and the scale deficit of nonprofits.

- Third, complementary policy interventions are important. Demonetisation and GST acted as a catalyst for the transition to digital payments .

- Fourth, human capital and diversity matter. This revolution needed career bureaucrats to partner with academics, tech entrepreneurs, venture capitalists, global giants and private firms.

However, more needs to be done

- The central government must deadline digitising all its payments.

- The RBI must implement the 100-plus action items (outlines in RBI’s Vision 2021 document) and the recommendations of Nandan Nilekani Committee for Deepening Digital Payments.

- RBI should make use of RuPay and UPI to tap the remittances market – which presently stands at 70billion USD and is largely in informal domain

- RBI must replicate the core design of UPI — fierce but sustainable private and public competition — in bank credit to increase our present 50% Credit-to -GDP ratio to atleast 100%(OECD level)

Conclusion

- This experience shows that India doesn’t need to be Western or Chinese to be modern. If our policymakers had copied Alipay or US banks, we wouldn’t have witnessed this digital payments revolution

- Replicating similar model in education, healthcare, and government services will help in achieving the socio-economic goals outlined in our Constitution

Connecting the Dots

- UPI 2.0 launched on August 2018

- Nandan Nilekani Committee for Deepening Digital Payments.

- More about NPCI

Governance

Topic: General Studies 2 –

- Mechanisms, laws, institutions and Bodies constituted for the protection and betterment of these vulnerable sections(women)

Abortion – Amendments to Medical Termination of Pregnancy(MTP) Act -Mixed bag

Context

Union Cabinet’s approval of the amended MTP Bill 2020 which included changes demanded by women’s groups and courts, including the Supreme Court.

Background

- Under the 1971 MTP Act, a pregnancy can be terminated until 20 weeks after conception if it will harm the mother, if the pregnancy was the result of rape, if the child will be born with serious physical or mental defects, or in case of contraceptive failure.

- If the pregnancy has gone over 20 weeks, then women has to seek legal course to terminate the pregnancy. The slow judicial process is thus pushing her to depend on illegal service providers for termination of unwanted pregnancies

- According to the ministry of health and family welfare, abortion deaths constitute 8% of all maternal deaths per year in India

The Bill seeks to extend the termination of pregnancy period from 20 months to 24 months, making it easier for women to safely and legally terminate an unwanted pregnancy.

The proposed amendments will definitely reduce the burden on the judiciary. The Court cases are broadly of two types. Let us critically analyse both these types

Type 1 –Pregnancies that extend beyond 20 weeks of gestation as a result of rape, incest or of minor women.

- The new Act rightly addresses these by extending prescribed period abortion to 24 weeks.

- However, such cases form a minuscule proportion of the total number.

- For such cases, even the 24-week cap can be done away with, provided the abortions can be safely done.

Type 2– Pregnancies that become unwanted after congenital foetal anomalies are found upon testing

- With advancement in prenatal foetal screening/diagnostic technologies –like Ultrasonography- more such cases are being filed in courts

- The extension to 24 weeks seems to give cover to these cases for abortion services, thus opening up the possibility for any congenital anomaly to be used as grounds for abortion.

- These foetal anomalies would involve some which are compatible with life and some which are incompatible with life.

- What constitutes an anomaly and whether it is life compatible or not depending on medical advancement and what is considered as socially desirable

- This raises concerns that raising children with disability can become “socially undesirable”

Conclusion

- With congenital anomalies as a ground for abortion, the eugenic mindset of having socially desirable children could push more women into risky late abortions.

- The approach of medical boards advising courts in cases of late abortions under this Act will be critical to balancing women’s right to choose with risk to the woman and the motives for abortion.

Other Salient feature of the bill are:

- Requirement of opinion of one registered medical practitioner (RMP) for termination of pregnancy up to 20 weeks of gestation – Earlier two RMP

- Requirement of opinion of two RMPs for termination of pregnancy of 20 to 24 week

- Raising the upper gestation limit from 20 to 24 weeks for special categories of women, including include rape survivors, victims of incest, differently-abled women and minors

- Name and other particulars of a woman whose pregnancy has been terminated shall not be revealed, except to a person authorised in any law

- Extend the contraceptive-failure clause for termination to include “any woman or her partner” from the present provision for “only married woman or her husband”.

Connecting the dots!

- Reproductive rights of a women vs Rights (if any) of an unborn child

(TEST YOUR KNOWLEDGE)

Model questions: (You can now post your answers in comment section)

Note:

- Featured Comments and comments Up-voted by IASbaba are the “correct answers”.

- IASbaba App users – Team IASbaba will provide correct answers in comment section. Kindly refer to it and update your answers.

Q 1. From which one of the following did India buy the Ka 226 T light helicopter?

- Israel

- France

- Russia

- USA

Q 2. What is “Luknow declaration “, sometimes seen in the news?

- An Israeli radar system collaboration with India

- India’s indigenous anti-missile Programme

- An American anti missile system

- A defence collaboration between India and Africa

Q 3. Which one of the following can be the most likely reason for the Central Bank for such an action?

Daily Current Affairs IAS | UPSC Prelims and Mains Exam – 7th February 2020

- Encouraging foreign investment

- Increasing the liquidity

- Encouraging both public and private savings

- Anti-inflationary stance

ANSWERS FOR 06 FEB 2020 TEST YOUR KNOWLEDGE (TYK)

| 1 | D |

| 2 | B |

Must Read

About India-Srilanka ties:

About Bodoland issue:

Analysis of Taxation reform mooted in Union Budget 2021-22:

About India’s electric Vehicle system: