UPSC Articles

Indian Economy

Topic: General Studies 3

- Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

- Science & Technology

UPI- India’s Digital Payment Revolution

Context

Google writing a letter to the US Federal Reserve two months ago asking them to learn from Indian digital payments

Also, digital payment transactions on the Universal Payment Interface (UPI) platform rose from 0.1 million in October 2016 to 1.3 billion in January 2020

Daily Current Affairs IAS | UPSC Prelims and Mains Exam – 7th February 2020

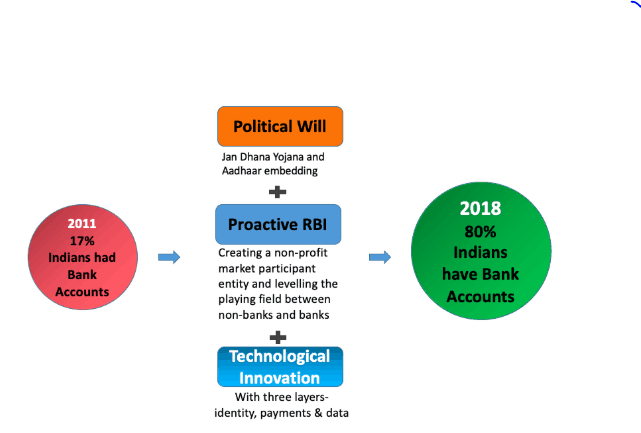

India’s payment revolution comes from

- A clear vision – shifting the system from low volume, high value, and high cost to high volume, low value, low cost

- A clear strategy -regulated and unregulated private players innovating on top of public infrastructure (UPI)

- Trade-offs balanced by design -regulation vs innovation, privacy vs personalisation, and ease-of-use vs fraud prevention

About UPI

- It is a common platform through which a person can transfer money from his bank account to any other bank account in the country instantly using nothing but his/her UPI ID.

- Launched in 2016 as Mobile First digital payments platform

- Immediate money transfer through mobile device round the clock 24*7 and 365 days based on the Immediate Payment Service (IMPS) platform.

- UPI is completely interoperable and as such, it is unique in the world, where you have an interoperable system on the ‘send’ and ‘receive’ side

- Developed by: National Payments Corporation of India (NPCI) under the guidance from RBI

Significance of UPI

- It created interoperability between all sources and recipients of funds (consumers, businesses, fintechs, wallets, 140 member banks),

- Settled instantly inside the central bank in fiat money – Convenience to consumers and merchants and

- Blunted data monopolies -big tech firms have strong autonomy but weak fiduciary responsibilities over customer data).

UPI offers the following policy lessons.

- First, the India stack — interconnected yet independent platforms or open APIs — are a public good that lowers costs, spurs innovation, and blunts the natural digital winner-takes-all..

- Second, collaboration can create ecosystems that overcome existing obstacles— the execution deficit of government, the trust deficit of private companies, and the scale deficit of nonprofits.

- Third, complementary policy interventions are important. Demonetisation and GST acted as a catalyst for the transition to digital payments .

- Fourth, human capital and diversity matter. This revolution needed career bureaucrats to partner with academics, tech entrepreneurs, venture capitalists, global giants and private firms.

However, more needs to be done

- The central government must deadline digitising all its payments.

- The RBI must implement the 100-plus action items (outlines in RBI’s Vision 2021 document) and the recommendations of Nandan Nilekani Committee for Deepening Digital Payments.

- RBI should make use of RuPay and UPI to tap the remittances market – which presently stands at 70billion USD and is largely in informal domain

- RBI must replicate the core design of UPI — fierce but sustainable private and public competition — in bank credit to increase our present 50% Credit-to -GDP ratio to atleast 100%(OECD level)

Conclusion

- This experience shows that India doesn’t need to be Western or Chinese to be modern. If our policymakers had copied Alipay or US banks, we wouldn’t have witnessed this digital payments revolution

- Replicating similar model in education, healthcare, and government services will help in achieving the socio-economic goals outlined in our Constitution

Connecting the Dots

- UPI 2.0 launched on August 2018

- Nandan Nilekani Committee for Deepening Digital Payments.

- More about NPCI