IASbaba's Daily Current Affairs Analysis

IAS UPSC Prelims and Mains Exam – 9th April 2020

Archives

(PRELIMS + MAINS FOCUS)

Food Corporation of India directed to provide grains to NGOs

Part of: GS Prelims and GS – II – Role of NGOs; GS-III – Marketing of agricultural produce

In News:

- The Government has directed Food Corporation of India to provide wheat and rice to NGOs.

- The food grains will be provided at the Open Market Sale Scheme (OMSS) rates without going through the e-auction process.

Key takeaways:

- FCI has network of more than 2000 godowns in the country.

- Large network of godowns will ensure smooth supply of food grains to these organisations in this hour of crisis posed by COVID-19.

- It will help relief camps in their philanthropic work of feeding poor and migrant workers.

Important value additions:

The Food Corporation of India (FCI)

- It was setup under the Food Corporation’s Act 1964.

- The objectives are:

-

- Effective price support operations to safeguard the interests of the farmers.

- Distributing foodgrains throughout the country for Public Distribution system.

- Maintaining satisfactory level of buffer stocks to ensure National Food Security.

- Since its inception, FCI has played a significant role in maintaining food security in the country.

Open Market Sale Scheme (OMSS)

- It refers to selling of foodgrains by Government/Government agencies at predetermined (decided in advance) prices in the open market from time to time.

States asked to invoke Essential Commodities Act, 1955

Part of: GS Prelims and GS-II – Polity & Governance

In News:

- States are asked to invoke Essential Commodities (EC) Act, 1955 by the Ministry of Home Affairs to maintaining smooth supply of essential items at fair prices in the country.

- The measures include fixing of stock limits, capping of prices, enhancing production, etc.

Key takeaways:

- States can now notify orders under the EC Act, 1955 without prior agreement from the Central Government up to June 30, 2020.

- Offences under EC Act are criminal offences and may result in imprisonment of 7 years or fine or both.

- Offenders can also be booked under the Prevention of Black-marketing and Maintenance of Supplies of Essential Commodities Act, 1980.

Important value additions:

Essential Commodities (EC) Act, 1955

- It is an act of Parliament of India.

- It was established to prevent hoarding of the essential commodities and to ensure their timely delivery so that the normal life does not get affected.

- This includes foodstuff, drugs, fuel (petroleum products) etc.

Funding for developing nasal passage gel approved

Part of: GS Prelims and GS-II – Health; GS – III – Science and Technology

In News:

- Department of Science and Technology (DST) has approved funding for Department of Biosciences and Bioengineering, IIT Bombay.

- The team from the department shall develop a gel that can be applied to nasal passage.

- It will capture and inactivate novel corona virus, the causative agent of COVID-19.

- This solution will ensure the safety of health workers.

- It can lead to reduction in community transmission of COVID-19.

Biofortified carrot variety benefits local farmers

Part of: GS Prelims and GS – III – Science and Technology

In News:

- Madhuban Gajar, a biofortified carrot variety, developed by a farmer scientist has benefited hundreds of farmers in Gujarat.

- The carrot has high β-carotene (beta-carotene) and iron content.

Key takeaways:

- The variety is being cultivated in Gujarat, Maharashtra, Rajasthan, West Bengal, Uttar Pradesh since the last three years.

- The Madhuvan Gajar is used for various value-added products.

- It was developed by Shri Vallabhhai Vasrambhai Marvaniyawas.

- He has received a National Award (2017) and a Padma Shri (2019) for his extraordinary work.

Important value additions:

Biofortification

- It means breeding crops to increase their nutritional value.

- This can be done either through conventional selective breeding, or through genetic engineering.

Image source: http://nif.org.in/Innovationofday/madhuvan-gajar-a-high-nutritious-carrot-vareity/6

(MAINS FOCUS)

POLITY/WELFARE

Topic: General Studies 2:

- Separation of powers between various organs

- Good Governance

- Welfare/Developmental issues

MPLADS: Members of Parliament Local Area Development Scheme

Context: The Union Cabinet approved a 30% cut in the salaries of all Members of Parliament and a two-year suspension of MPLAD scheme so that the amount saved can go to the Consolidated Fund of India (CFI) to fight COVID-19.

What is MPLADS Scheme or Sansad Nidhi Yojana?

- It is a central sector scheme for MPs to recommend works of developmental nature in their constituencies

- It was launched in December, 1993

- The emphasis is on creating durable community assets based on locally felt needs.

- Parent Body: Ministry of Statistics and Programme Implementation (MOSPI)

- The funds – Rs. 5 crore/annum/MP – under the scheme are non-lapsable.

- Funds are released in the form of grants in-aid directly to the district authorities.

- MPs have only recommendatory role and the district authority is empowered to examine the eligibility of works, select the implementing agencies and monitor it.

Criticism of the scheme

- Against the separation of powers: It allows individual legislators to encroach on executive role of planning & implementation works

- Promotes Patronage Politics: MPLADS gives scope for MPs to utilise the funds as a source of patronage that they can dispense at will.

- Inefficiency: Gap between recommendation made by MPs and implementation by the district administration

- Unused Funds: Some members do not utilise their full entitlement

- Weak monitoring of the scheme has led to allegations of misuse & corruption

Views about the scheme

- Judiciary: The Supreme Court has upheld the scheme but called for a robust accountability regime

- Second ARC: It recommended its abrogation altogether, highlighting the problems of the legislator stepping into the shoes of the executive

Why MPLADS was suspended for two years?

- It frees up financial resources of about ₹7,900 crore

- It will boost the funding available for the COVID-19 fight

- The funds can be spent on boosting the health infrastructure needed to combat the pandemic.

- Judicious usage of Funds: Money will now go into CFI and will be spent based on an assessment of the varying needs in different regions of India.

Challenges ahead due the suspension of scheme

- Political discontent: Funding under the scheme was source of much goodwill for elected representatives.

- Centralising tendency: The step undermines the decentralised manner of funding local area development

- There are dangers that allocations of freed up funds can be discriminatory.

Connecting the dots:

- Parliamentary System – Merits and Challenges

- Other instances where there is breach of Separation of Power

ECONOMY

Topic: General Studies 3:

- Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Financing the Pandemic rescue package

When COVID-19 cases began to increase, the Government of India (GoI) announced a 21-day national lockdown and a ₹1.7-lakh crore rescue package.

Challenges

- There are expectations of further such packages (aimed at businesses & middle class) and the challenges of financing these relief measures.

- Also, the financing strategy should be to raise long-term funds at cost effective rates, with flexible repayment terms.

How can government fund its relief packages?

- Utilizing the availability of unused resources in the state disaster relief fund to the tune of ₹60,000 crore

- Issuing of GDP-linked bonds

- Indian rupee denominated 25-year GDP-linked bonds that are callable from, say, the fifth year

- The interest on a GDP-linked bond is correlated to the GDP growth rate and is subject to a cap

- The issuer, the GoI, is liable to pay a lower coupon during years of slower growth and vice-versa.

- Precedence: Costa Rica, Bulgaria and Bosnia-Herzegovina issued such GDP-linked bonds in the 1990s, from whose experience India could learn

- Prerequisite: Publishing reliable and timely GDP data

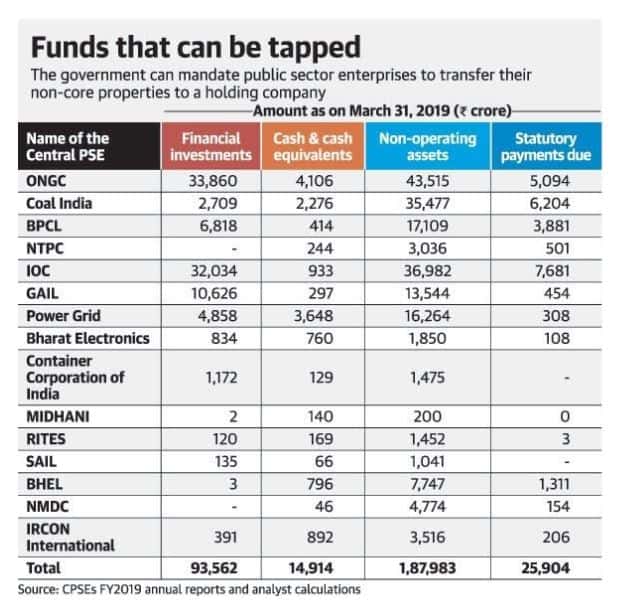

- Utilizing the resources of Public Sector Enterprises(PSEs)

-

- Paying dues to GoI: The 15 largest non-financial central PSEs (CPSEs) owe the government ₹25,904 crore as of end-March 2019

- Using cash and bank deposits of these 15 CPSEs (₹64,253 crore) that is in excess of their operating requirements, to increase dividend to government

- Monetization of non-core assets of these CPSEs as they generally yield 200 basis points lower than the returns on their core businesses.

- Forming Public sector bank holding company (‘Holdco’) along the lines of Singapore’s Temasek Holdings to enable PSEs to monetise their non-core assets at remunerative prices

- Securitization of ₹30,168 crore loans that CPSEs have extended to employees, vendors and associates – to ensure that associated businesses remain liquid

Pic Source: The Hindu

Should government also tap the RBI resources?

- RBI has allocated ₹1 lakh crore to carry out long-term repo operations and has reduced the repo rates by 75 basis points to 4.4% to help banks augment their liquidity in the wake of pandemic

- Government already enjoys handsome dividends pay-outs by RBI

- During the five years ending on June 30, 2019, the RBI paid the GoI 100% of its net disposable income

- In FY2019 dividends from RBI more than trebled to ₹1.76 lakh crore from ₹50,000 crore in FY2018.

- The Bimal Jalan panel constituted in 2019 to review the RBI’s economic capital framework opined that:

- The RBI may pay interim dividends only under exceptional circumstances

- The unrealised gains in the valuation of RBI’s assets ought to be used as risk buffers against market risks and may not be paid as dividends

- Therefore, it is in India’s self-interest to allow a robust and independent RBI to defend the financial sector’s stability

Conclusion

The GoI may finance the COVID-19 rescue package by issuing GDP-linked bonds, tapping PSEs’ excess liquidity and monetising non-core assets

Connecting the dots:

- Different types of Investment Models

- Impact on the disinvestment plans of GoI

(TEST YOUR KNOWLEDGE)

Model questions: (You can now post your answers in comment section)

Note:

- Correct answers of today’s questions will be provided in next day’s DNA section. Kindly refer to it and update your answers.

- Comments Up-voted by IASbaba are also the “correct answers”.

Q.1 Consider the following statements:

- Essential Commodities (EC) Act was established to prevent hoarding of the essential commodities.

- Recently the states are being asked by the Government of India to invoke EC Act amidst COVID-19 pandemic.

Which of the above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Q.2 Consider the following statements regarding Food Corporation of India:

- It will provide major food grains to NGOs at the Open Market Sale Scheme (OMSS) rates.

- It plays major role in ensuring food security in India.

Which of the above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Q.3 The nasal passage gel is being developed by which of the following?

- IIT Bombay

- Department of Science and Technology

- Indian Council of Medical Research

- Ministry of Health and welfare

Q.4 Consider the following statements:

- Madhuban gajar is a biofortified tomato variety.

- It is high in beta-carotene.

Which of the above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

ANSWERS FOR 8th April 2020 TEST YOUR KNOWLEDGE (TYK)

| 1 | C |

| 2 | A |

| 3 | A |

| 4 | B |

Must Read

About impact of lockdown on domestic violence:

About COVID-19 lockdown and religious congregations:

About need for decentralization of powers to fight COVID-19: