UPSC Articles

Government announces Compound Interest Waiver on Moratorium Loans

Part of: GS Prelims and GS-III – Economy

In news

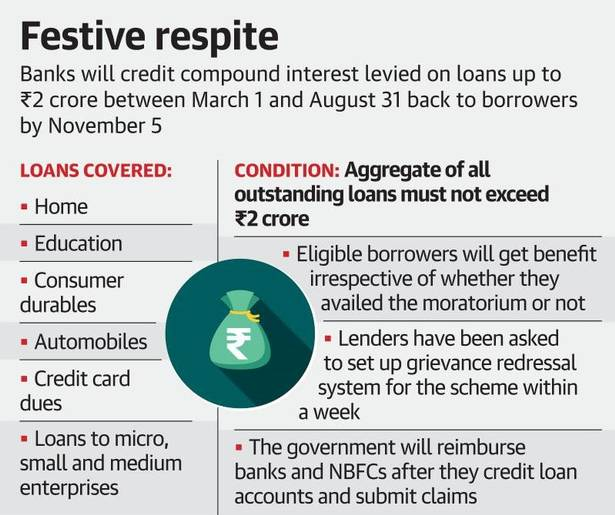

- Recently, the Government of India has announced the scheme for the waiver of compound interest that was payable by the borrower who had opted for loan moratorium between 1st March 2020, and 31st August 2020.

Key takeaways

- The RBI had offered a three-month moratorium on loans in March 2020.

- This enabled borrowers to defer repayments on EMIs and other loans.

- This was later extended by another three months, till 31st August 2020.

- The loan moratorium, and waiver of compound interest, was aimed at providing borrowers relief amid the economic impact of the Covid-19 pandemic.

- Under this, the government will grant eligible borrowers ex-gratia payment of the difference between the compound interest and simple interest for the six-month moratorium period.

- The scheme shall be applicable for loans availed by Micro, Small and Medium Enterprises (MSMEs) and loans to retail customers for education, housing, consumer durables, automobiles, provided a borrower has an aggregate outstanding loan of Rs. 2 crore or less, from all such loans.

Do you know?

- Ex-gratia payment is the money which is paid due to moral obligation and not due to legal obligation.

- Simple interest is levied only on the principal amount of a loan or deposit.

- In contrast, compound interest is levied on the principal amount and the interest that accumulates on it in every period.