IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS + MAINS FOCUS)

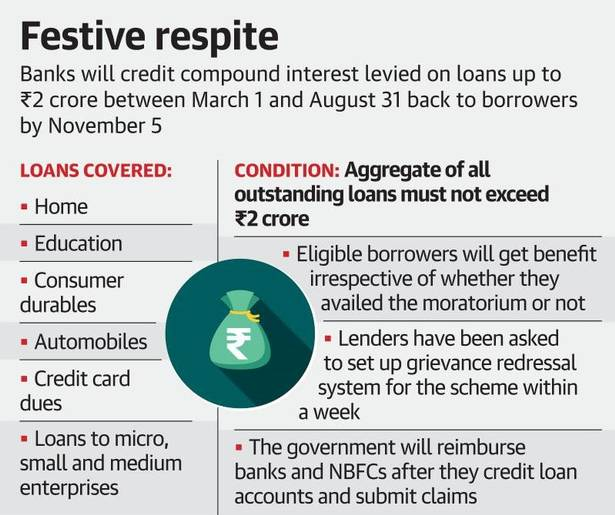

Government announces Compound Interest Waiver on Moratorium Loans

Part of: GS Prelims and GS-III – Economy

In news

- Recently, the Government of India has announced the scheme for the waiver of compound interest that was payable by the borrower who had opted for loan moratorium between 1st March 2020, and 31st August 2020.

Key takeaways

- The RBI had offered a three-month moratorium on loans in March 2020.

- This enabled borrowers to defer repayments on EMIs and other loans.

- This was later extended by another three months, till 31st August 2020.

- The loan moratorium, and waiver of compound interest, was aimed at providing borrowers relief amid the economic impact of the Covid-19 pandemic.

- Under this, the government will grant eligible borrowers ex-gratia payment of the difference between the compound interest and simple interest for the six-month moratorium period.

- The scheme shall be applicable for loans availed by Micro, Small and Medium Enterprises (MSMEs) and loans to retail customers for education, housing, consumer durables, automobiles, provided a borrower has an aggregate outstanding loan of Rs. 2 crore or less, from all such loans.

Do you know?

- Ex-gratia payment is the money which is paid due to moral obligation and not due to legal obligation.

- Simple interest is levied only on the principal amount of a loan or deposit.

- In contrast, compound interest is levied on the principal amount and the interest that accumulates on it in every period.

SOP amended for Adoption of Integrity Pact by CVC

Part of: GS Prelims and GS-II – Statutory bodies

In news

- Recently, the Central Vigilance Commission (CVC) has amended the Standard Operating Procedure (SOP) on adoption of “Integrity Pact” in government organisations for procurement activities.

- The CVC also restricted the maximum tenure of Integrity External Monitors (IEMs) to three years in an organisation.

Key takeaways

- Amended Provision of IEM: The choice of IEM should be restricted to officials from the government and Public Sector Undertakings (PSUs) who have retired from positions of the level of Secretary to the Central government or of equivalent pay scale.

- Earlier Provision: Under the 2017 order, the officials who had retired from positions of the level of Additional Secretary to the Central government and above, or equivalent pay scale, were eligible for the PSUs.

- Amended Provision for Appointment as IEM: For appointment as IEM, the Ministry, department or organisation concerned has to forward a panel of suitable persons to the CVC, of those persons who are in the panel maintained by the CVC.

- Earlier Provision: The panel could include those already in the panel maintained by the CVC, or they could propose names of other suitable persons.

- Amended Provision for Tenure:the IEM will be appointed for a period of three years in an organisation.

- Earlier Provision: The initial tenure of IEM would be three years which could be extended for another term of two years on a request received by the CVC from the organisation concerned.

Important value additions

Central Vigilance Commission (CVC)

- It is the apex vigilance institution.

- It is free of control from any executive authority.

- The Parliament enacted Central Vigilance Commission Act, 2003 (CVC Act) conferring statutory status on the CVC.

- It monitors all vigilance activity under the Central Government and advises various authorities in Central Government organizations in planning, executing, reviewing and reforming their vigilance work.

- It is an independent body.

- It is only responsible to the Parliament.

Do you know?

- Integrity Pact is a vigilance tool that envisages an agreement between the prospective vendors/bidders and the buyer, committing both the parties not to exercise any corrupt influence on any aspect of the contract.

- The pact also ensures transparency, equity and competitiveness in public procurement.

Draft Personal Data Protection Bill, 2019

Part of: GS Prelims and GS-II – Policies and interventions

In news

- Recently, Facebook India’s policy head appeared before the 30-member Joint Committee of Parliament which is examining the draft Personal Data Protection Bill, 2019.

- Amazon declined to appear on the ground of risky travel amidst the pandemic.

Key takeaways

- The committee has sought views from Amazon, Twitter, Facebook, Google and Paytm on data security and protection amid concerns that the privacy of users is being compromised for commercial interest.

- Amazon’s refusal amounts to a breach of parliamentary privilege.

- The panel is unanimous about taking coercive action if no one from the company appears on the next date.

Important value additions

Personal Data Protection Bill, 2019

- It is commonly referred to as the Privacy Bill.

- It intends to protect individual rights by regulating the collection, movement, and processing of data that is personal, or which can identify the individual.

- In December 2019, Parliament approved sending it to the joint committee.

- The Bill gives the government powers to authorise the transfer of certain types of personal data overseas.

- It has also given exceptions allowing government agencies to collect personal data of citizens.

- The Bill divides the data into three categories: (1) Personal Data: Data from which an individual can be identified like name, address, etc. (2) Sensitive Personal Data: Personal data like financial, health-related, sexual orientation, biometric, caste, religious belief, etc.; (3) Critical Personal Data: Anything that the government at any time can deem critical, such as military or national security data.

- It removes the requirement of data mirroring in case of personal data.

- Only individual consent for data transfer abroad is required.

- The Bill requires companies and social media intermediaries to enable users in India to voluntarily verify their accounts.

Indira Rasoi Yojana: Rajasthan

Part of: GS Prelims and GS-II – Policies and interventions

In news

- Recently, Indira Rasoi Yojana was in the news.

- Over 50 lakh people have benefited from the scheme in Rajasthan.

- The scheme was launched in August 2020.

Key takeaways

- Aim: To provide nutritious food to the poor and needy twice a day at concessional rates.

- Under the scheme, each plate serves 100 grams of pulses and vegetables each, 250 grams of chapati and pickles.

- Implementation: Local voluntary organisations

- Monitoring: A committee headed by the District Collector monitors the scheme.

- A special app has also been created for monitoring the food quality.

- Target: To serve 1.34 lakh people per day in the state.

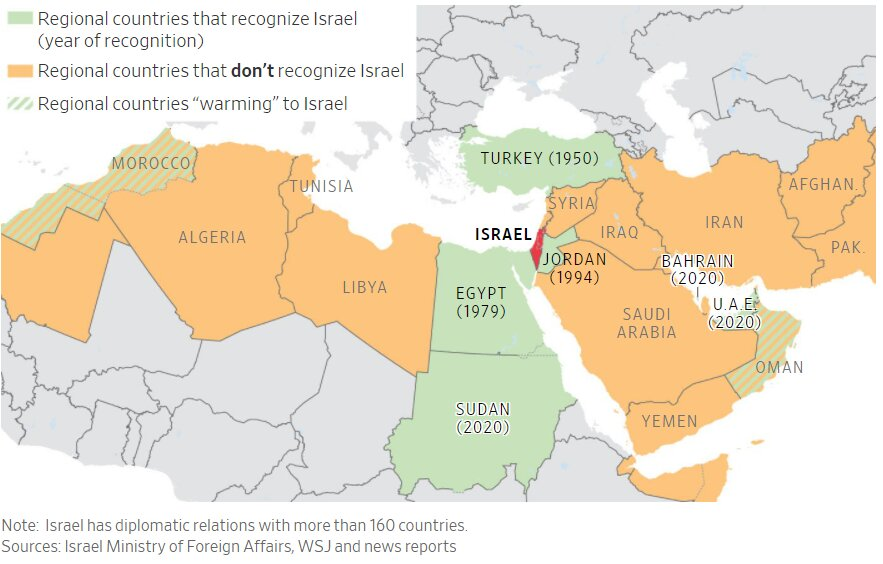

Sudan and Israel agree to Normalise Relations

Part of: GS Prelims and GS-II – International Relations

In news

- Recently, in a deal brokered by the USA, Sudan and Israel have agreed to normalise relations to end decades of hostility.

Key takeaways

- In the initial phase, there will be no exchange of ambassadors or a mutual establishment of embassies.

- With this agreement, Israel will complete the creation of a safety cordon in the Red Sea, which currently includes Egypt, Jordan, South Sudan and Saudi Arabia.

- Sudan has been at war with Israel since its foundation in 1948.

- It has now become the third country to forge diplomatic relations with Israel in recent times.

- The USA has also brokered diplomatic pacts between Israel and the UAE and Bahrain earlier to normalise their relations.

- The deal would deepen Sudan’s engagement with the West.

- USA has also agreed to remove Sudan from its blacklist of countries accused of sponsoring terrorism.

- The deal is also aimed at unifying Arab countries against their common rival Iran.

(MAINS FOCUS)

ECONOMY/ GOVERNANCE

Topic: General Studies 1,2:

- Indian Economy and issues relating to planning, mobilization, of resources, growth, development

- Infrastructure: Energy

India’s DisCom stress is more than the sum of its past

Context: The Indian government responded to COVID-19’s economic shock with a stimulus package of ₹20-lakh crore, out of which ₹90,000 crore was earmarked for DisComs (later upgraded to ₹1,25,000 crore).

DisComs are the utilities that typically buy power from generators and retail these to consumers.

Financial Issues with DisComs

- Not Exactly a Stimulus: While government’s package was called a stimulus, it is really a loan, meant to be used by DisComs to pay off generators. Stimulus loans are near market term and not soft loans.

- Threat from Renewable Energy: Increasing competition from Solar Powers whose tariff has come down to Rs 2.90 per unit (as compared to Rs 6 per unit average cost of electricity supply for distribution utilities) combined with existing long-term Power Purchase Agreements (PPAs) with mainly coal-based thermal power generating projects has led to financial rigidity & therefore financial loss for DisComs.

- Impact of COVID-19: The pandemic has completely shattered incoming cash flows to utilities. The lockdown disproportionately impacted revenues from commercial and industrial segments. But a large fraction of DisCom cost structures are locked in through PPAs that obligate capital cost payments.

- Underestimation of dues: The government’s PRAAPTI (or Payment Ratification And Analysis in Power procurement for bringing Transparency in Invoicing of generators) portal shows that DisCom dues to generators are in range of one lakh crore rupees. The portal is a voluntary compilation of dues, and is not comprehensive.

- Rise in Informal loans: Over the years, DisComs have delayed their payments upstream (not just to generators but others as well) — in essence, treating payables like an informal loan.

Why do DisComs not pay on time?

- Inefficiency of utilities leads to high losses, called Aggregate Technical and Commercial (AT&C) losses, a term that spans everything from theft to lack of collection from consumers. However, this is an incomplete explanation

- Challenge of payables to DisComs.

DisComs cash flow is disrupted due to dues that are payable to them.These dues are of three types.

- Improper Tariff fixation by regulators: Regulators themselves have failed to fix cost-reflective tariffs thus creating Regulatory Assets,which are to be recovered through future tariff hikes.

- Pending Subsidies: Second, about a seventh of DisCom cost structures is meant to be covered through explicit subsidies by State governments. Cumulative unpaid subsidies, with modest carrying costs, make DisComs poorer by over ₹70,000 crore just over the last 10 years.

- Consumer Bills pending: Third, consumers owed DisComs over ₹1.8 lakh crore in FY 2018-19, booked as trade receivables.

Way Ahead

- More Stimulus: There is a need a much larger liquidity infusion so that the entire electricity chain will not collapse

- Improving AT&C losses is important, but will not be sufficient. We need a complete overhaul of the regulation of electricity companies and their deliverables.

- Rationalisation of subsidies whereby doling out of free electricity can be eliminated to those who do not deserve such support.

- Proper Regulation: Regulators must allow cost-covering tariffs.

- Realigning PPAs in the wake of renewable energy: In the interim, it may be prudent for the discoms to sign only medium-term PPAs, if at all, as most of the power transactions move to the power exchanges.

Connecting the dots:

ECONOMY/ GOVERNANCE

Topic: General Studies 3:

- Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment

- Mechanisms, laws, institutions and Bodies constituted for the protection and betterment of these vulnerable sections

MFIs in India: Need social impact monitoring

Context: The microfinance industry in India witnessed unprecedented growth over the last couple of decades; from just a few players offering SHG loans to a matured market, the industry has come a long way.

What are MFIs?

- Micro finance Institutions, also known as MFIs, a microfinance institution is an organisation that offers financial services to low income populations.

- Usually, their area of operations of extending small loans are rural areas and among low-income people in urban areas.

- MFIs provide the much-needed aid to the economically underprivileged who would have otherwise been at the mercy of the local moneylender and high interest rates.

- The model had its genesis as a poverty alleviation tool, focused on economic and social upliftment of the marginalised sections through lending of small amounts of money without any collateral to women for income-generating activities.

- MFI loan portfolio has reached Rs 2.31 lakh crore at the end of FY2020, touching the lives of 5.89 crore customers.

- Some of the MFIs, that qualify certain criteria and are non-deposit taking entities, come under RBI wings for Non-Banking Financial Company (NBFC) Regulation and supervision. These “Last Mile Financiers” are known as NBFC MFI.

- The objective of covering them under RBI was to make these NBFC MFIs healthy and accountable.

Digitalisation and growth of MFI sector

- Over the years, the sector has incorporated several changes in its operating model, including digital interventions across the lending value chain.

- MFIs have adopted digital technologies in order to eliminate the redundancies, enable quick customer on-boarding, loan disbursals and even cashless collections.

- The use of digital technologies has enabled MFIs not only to reach a greater number of clients and thereby grow at a much faster pace, but also to do so in an efficient manner by streamlining processes and reducing turnaround times.

Challenges associated with MFI

- Social Objective Overlooked: In their quest for growth and profitability, the social objective of MFIs—to bring in improvement in the lives of the marginalised sections of the society—seems to have been gradually eroding.

- Impact of COVID-19: It has impacted the MFI sector, with collections having taken an initial hit and disbursals yet to observe any meaningful thrust.

- Inadequate Data: While overall loan accounts have been increasing the actual impact of these loans on the poverty-level of clients is sketchy as data on the relative poverty-level improvement of MFI clients is fragmented.

- Loans for Conspicuous Consumption: The proportion of loans utilised for non-income generating purposes could be much higher than what is stipulated by RBI. These loans are short tenured and given the economic profile of the customers it is likely that they soon find themselves in the vicious debt trap of having to take another loan to pay off the first

Way Ahead for MFIs

- Digital technologies should be utilised even beyond the lifecycle of the loan.

- MFIs should ensure that the ‘stated purpose of the loan’ that is often asked from customers at the loan-application stage is verified at the end of the tenure of the loan.

- This post-verification process will ascertain whether the loan amount has brought in any meaningful improvement in their lives; digital records of this should be maintained for further scrutiny and new loan sanctions.

- Create authenticated customer data

- In an industry that is dominated by cash, determining household income for loan eligibility purposes poses a serious challenge.

- Field officers should be prudent enough to include income from all sources as overestimating or incorrectly estimating would mean that genuinely deserving customers aren’t offered any.

- If captured and reported properly, this data could serve as critical underwriting inputs when these customers (having proved their credit worthiness in the microfinance industry) chose to avail financial services from commercial banks,

- Social Impact Scorecard

- RBI should encourage all institutions to monitor their impact on the society by means of a ‘social impact scorecard’

- This customer data in scorecard that is verified and captured digitally can be used to evaluate the impact of each loan in the lives of the clients, subsequent improvement in their earning capacity over the years, other direct/indirect benefits rendered from loan utilisation and finally how soon MFI customers are able to transition out of the MFI fold.

- This ‘social impact scorecard’ could also be leveraged when MFIs themselves seek funding to support their operations, which can serve as the crucial differentiating ‘intangible factor’ to enable commercial banks, development institutions and others in making lending decisions to MFIs.

Conclusion

MFIs need to focus on creating a sustainable and scalable microfinance model with a mandate that is unequivocal about both economic and social good.

Connecting the dots:

- Constitution’s 97th Amendment Act

- Farmer Producer organisations and its impact on agricultural sector

(TEST YOUR KNOWLEDGE)

Model questions: (You can now post your answers in comment section)

Note:

- Correct answers of today’s questions will be provided in next day’s DNA section. Kindly refer to it and update your answers.

- Comments Up-voted by IASbaba are also the “correct answers”.

Q.1 Consider the following statements regarding Central Vigilance Commission:

- It comes under the Ministry of Home Affairs.

- It is a non-statutory body.

Which of the above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Q.2 Draft Personal Data Protection Bill, 2019 divides the data into 3 categories. Consider the following statements regarding the same:

- Personal data refers to the details like name and address.

- Sensitive personal data refers to anything that the government can deem critical such as military or national security data.

- Critical personal data refers to details like sexual orientation, caste, religious belief.

Which of the above is/are correct?

- 1 only

- 1 and 2 only

- 2 and 3 only

- 1, 2 and 3

Q.3 Indira Rasoi Yojana is a scheme launched in August 2020 in which of the following state of India?

- Rajasthan

- Madhya Pradesh

- Uttar Pradesh

- Haryana

Q.4 Red Sea lies between which of the following?

- Africa and Asia

- Asia and Europe

- North America and South America

- Europe and North America

Must Read

About Centre’s farm bills:

About Chile’s referendum to bring Democratic Changes:

About GST and the complexity of political negotiations: