IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS + MAINS FOCUS)

UMANG app’s international version launched

Part of: GS Prelims and GS-II – Policies and interventions; E-governance

In news

- UMANG’s international version was recently launched to mark the occasion of its 3 years.

- It is launched in select countries that include USA, UK, Canada, Australia, UAE, Netherlands, Singapore, Australia and New Zealand.

- Primary Ministry: Ministry of IT

- Version launched in coordination with: Ministry of External Affairs

Key takeaways

- It will help Indian international students, NRIs and Indian tourists abroad, to avail Government of India services, anytime.

- It will also help in taking India to the world through ‘Indian Culture’ services available on UMANG and create interest amongst foreign tourists to visit India.

Important value additions

- The UMANG mobile app (Unified Mobile Application for New-age Governance) is a Government of India all-in-one single multi-lingual, multi-service Mobile App.

- It provides access to high impact services of various Government of India Departments and State Governments.

- Aim: To fast-track mobile governance in India.

- Developed by: National e-Governance Division (NeGD), Ministry of Electronics & IT.

- UMANG enables ‘Ease of Living’ for Citizens by providing easy access to a number of Indian government services such as Healthcare, Finance, Education, Housing, Energy, etc.

- Key partners of UMANG: Employee Provident Fund Organization, Direct Benefit Transfer scheme departments, Employee State Insurance Corporation, Ministries of Health, Education, Agriculture, Animal Husbandry and Staff Selection Commission (SSC).

- It is a ‘Digital India’ initiative.

- UMANG attained ‘Best m-Government service’ award at the 6th World Government Summit held at Dubai, UAE in February 2018.

China’s Chang’e-5 lunar mission

Part of: GS Prelims and GS-III – Space

In news

- China’s Chang’e-5 lunar mission recently became the first probe in over four decades to attempt to bring back samples of lunar rock from unexplored portion of the Moon.

- The spacecraft is set to return to Earth around December 15, 2020.

Key takeaways

- Chang’e-5 probe is the Chinese National Space Administration’s (CNSA) lunar sample return mission.

- Goal: To land in the Mons Rumker region of the moon, where it will operate for one lunar day, which is two weeks long and return a 2 kg sample of the lunar rock possibly by digging about 2 metres deep into the surface of the Moon.

- The mission comprises a lunar orbiter, a lander and an ascent probe that will lift the lunar samples back into orbit and return them back to Earth.

- The probe is named after the Chinese Moon goddess who is traditionally accompanied by a white or jade rabbit.

Do you know?

- Early in 2019, China’s Chang’e-4 probe successfully transmitted images from the far side of the Moon, also referred to as the dark side.

- This was the first probe to land in this portion of the Moon.

China sells Negative-Yield Bonds

Part of: GS Prelims and GS-II – International Relations & GS-III – Economy

In news

- Recently, China sold negative-yield debt for the first time, and this saw a high demand from investors across Europe.

- As yields in Europe are even lower, there was a huge demand for the 4-billion-euro bonds issued by China.

Important value additions

- Negative-yield bonds are debt instruments that offer to pay the investor a maturity amount lower than the purchase price of the bond.

- These are generally issued by central banks or governments, and investors pay interest to the borrower to keep their money with them.

- Negative-yield bonds attract investments during times of stress and uncertainty as investors look to protect their capital from significant erosion.

- At a time when the world is battling the Covid-19 pandemic and interest rates in developed markets across Europe are much lower, investors are looking for relatively better-yielding debt instruments to safeguard their interests.

Miscellaneous

Mount Vesuvius

- The Italian Culture Ministry announced the discovery of well-preserved remains of two men, who perished during the volcanic eruption of Mount Vesuvius in 79 AD.

- Vesuvius is located in southern Italy near the coastal city of Naples.

- It is the only active volcano in mainland Europe.

- Vesuvius has been classified as a complex volcano, one that consists of a complex of two or more vents.

- It is considered among the most dangerous volcanoes in the world due to its proximity to Naples and surrounding towns.

Katchal Island

- Recently, Katchal Island was in news.

- The Indian Coast Guard (ICG) towed a fuel tanker back to safe waters which was dangerously drifting towards the pristine Katchal Island in Nicobar due to power failure.

- Katchal Island was previously known as Tihanyu.

- It is inhabited by Nicobari Tribes and Migrated Tamilians (For Rubber plantation workers under Sastri-Srimao Bandaranayaka Pact of 1964).

Cyclone ‘Nivar’

- According to the meteorological department, Cyclone ‘Nivar’ may make a landfall on Wednesday in Tamil Nadu.

- The Bay of Bengal will see its second Severe Cyclone of 2020, after Super Cyclone Amphan formed in May.

- After cyclone Gaja in 2018, this will be the second cyclone to cross Tamil Nadu in the last two years.

- Its name ‘Nivar’ has been proposed by Iran.

(Mains Focus)

ECONOMY/ GOVERNANCE

Topic: General Studies 2,3:

- Indian Economy and issues relating to planning, mobilization, of resources, growth, development

Corporates as Banks

Context: Internal Working Group of RBI that was constituted to “review extant ownership guidelines and corporate structure for Indian private sector banks”, submitted its report.

A Brief History of Banking in India

- The banking system in any country is of critical importance for sustaining economic growth.

- India’s banking system has changed a lot since Independence when banks were owned by the private sector, resulting in a “large concentration of resources in the hands of a few business families”.

- To achieve “a wider spread of bank credit, prevent its misuse, direct a larger volume of credit flow to priority sectors and to make it an effective instrument of economic development”, the government resorted to the nationalisation of banks in 1969 (14 banks) and again in 1980 (6 banks).

- With economic liberalisation in the early 1990s, the economy’s credit needs grew and private banks re-entered the picture.

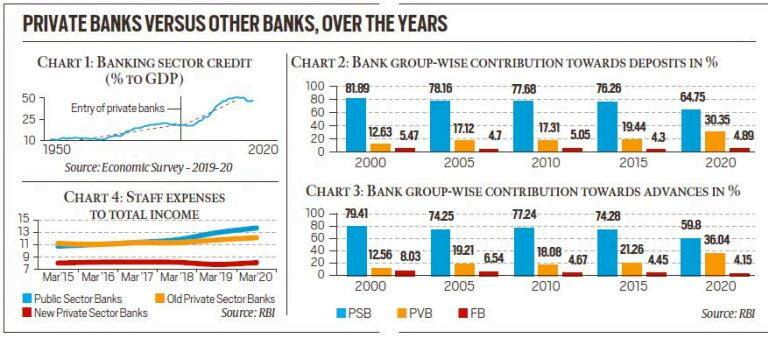

- As Chart 1 shows, the entry of Private sector post 1991 economic reforms had a salutary impact on credit growth.

Source: Indian Express

Why was the IWG constituted and what were its recommendations?

The below pointers provide the background in which the IWG was asked to suggest changes to boost private sector banking in India

- Low Balance Sheets of Banks: Even after three decades of rapid growth, “the total balance sheet of banks in India still constitutes less than 70 per cent of the GDP, which is much less compared to global peers” such as China, where this ratio is closer to 175%

- Inadequate Credit Flow to Private Sector: Moreover, domestic bank credit to the private sector is just 50% of GDP when in economies such as China, Japan, the US and Korea it is upwards of 150 per cent.

- Unable to meet Credit Demand of growing Economy: In other words, India’s banking system has been struggling to meet the credit demands of a growing economy.

- Need to bolster entire System: There is only one Indian bank in the top 100 banks globally by size. Further, Indian banks are also one of the least cost-efficient. Clearly, India needs to bolster its banking system if it wants to grow at a fast clip

- Merits of Private banks: Private banks are not only more efficient and profitable but also have more risk appetite. It is crucial to note that public sector banks have been steadily losing ground to private banks as Charts 2, 3 and 4 show.

Major Recommendation of IWG:

- Large corporate/industrial houses may be allowed as promoters of banks only after necessary amendments to the Banking Regulation Act, 1949 (to prevent connected lending and exposures between the banks and other financial and non-financial group entities); and strengthening of the supervisory mechanism for large conglomerates, including consolidated supervision.

- Well run large Non-banking Financial Companies (NBFCs), with an asset size of ₹50,000 crore and above, including those which are owned by a corporate house, may be considered for conversion into banks subject to completion of 10 years of operations and meeting due diligence criteria and compliance with additional conditions specified in this regard.

- For Payments Banks intending to convert to a Small Finance Bank, track record of 3 years of experience as Payments Bank may be considered as sufficient.

Why is the recommendation to allow large corporates to float their own banks being criticised?

- Historically, RBI has been of the view that the ideal ownership status of banks should promote a balance between efficiency, equity and financial stability.

- A predominantly government-owned banking system tends to be more financially stable because of the trust in government as an institution.

- Moreover, even in private bank ownership, past regulators have preferred it to be well-diversified — that is, no single owner has too much stake.

- More specifically, the main concern in allowing large corporates — that is, business houses having total assets of Rs 5,000 crore or more, where the non-financial business of the group accounts for more than 40% in terms of total assets or gross income — to open their own banks is a basic conflict of interest, or more technically, “connected lending”.

What is connected lending?

- Simply put, connected lending refers to a situation where the promoter of a bank is also a borrower and, as such, it is possible for a promoter to channel the depositors’ money into their own ventures.

- Connected lending has been happening for a long time and the RBI has been always behind the curve in spotting it.

- The recent episodes in ICICI Bank, Yes Bank, DHFL etc. were all examples of connected lending.

- The so-called ever-greening of loans (where one loan after another is extended to enable the borrower to pay back the previous one) is often the starting point of such lending.

- Therefore, it is prudent to keep the class of borrowers (big companies) apart from the class of lenders (banks).

- Past examples of such mingling — such as Japan’s Keiretsu and Korea’s Chaebol — came unstuck during the 1998 crisis with disastrous consequences for the broader economy.

Then why recommend it?

- The Indian economy, especially the private sector, needs money (credit) to grow. Far from being able to extend credit, the government-owned banks are struggling to contain their non-performing assets.

- Government finances were already strained before the Covid crisis. With growth faltering, revenues have plummeted and the government has limited ability to push for growth through the public sector banks.

- Large corporates, with deep pockets, are the ones with the financial resources to fund India’s future growth.

Conclusion

The dangers posed to overall financial stability by letting industrial houses have access to relatively inexpensive capital in the form of household savings through banks, howsoever legally regulated, are far too great to risk at the altar of liberalisation of ownership norms.

Connecting the dots:

- Twin Balance Sheet Problem

- Narasimham Committee Recommendations (1998)

GOVERNANCE/ FEDERALISM/ SECURITY

Topic: General Studies 2,3:

- Functions and responsibilities of the Union and the States, issues and challenges pertaining to the federal structure.

Dam Safety Bill, 2019

The Bill aims to deal with the risks of India’s ageing dams, with the help of a comprehensive federal institutional framework comprising committees and authorities for dam safety at national and state levels.

Do You Know?

- There are 5,344 large dams in India, of which around 293 are more than 100 years old and 1,041 are 50 to 100 years old.

- Nearly 92% of these dams are on inter-State rivers, and accidents at many of them have spurred concerns as to the frequency and efficiency of their maintenance.

Highlights of the Bill

- Objective: The Bill provides for the surveillance, inspection, operation, and maintenance of all specified dams across the country. These are dams with height more than 15 metres, or height between 10 metres to 15 metres with certain design and structural conditions.

- It constitutes two national bodies: The National Committee on Dam Safety, whose functions include evolving policies and recommending regulations regarding dam safety standards; and the National Dam Safety Authority, whose functions include implementing policies of the National Committee, providing technical assistance to State Dam Safety Organisations (SDSOs), and resolving matters between SDSOs of states or between a SDSO and any dam owner in that state.

- It also constitutes two state bodies: State Committee on Dam Safety, and SDSO. These bodies will be responsible for the surveillance, inspection, and monitoring the operation and maintenance of dams within their jurisdiction.

- Power of Union Government: Functions of the national bodies and the State Committees on Dam Safety have been provided in Schedules to the Bill. These Schedules can be amended by a government notification.

- Penal Provisions: An offence under the Bill can lead to imprisonment of up to two years, or a fine, or both.

Key Issues and Analysis of Dam Safety Bill

- Issue of Federalism:

- The Bill applies to all specified dams in the country. This includes dams built on both inter and intra state rivers.

- As per the Constitution, states can make laws on water including water storage and water power. However, Parliament may regulate and develop inter-state river valleys if it deems it necessary in public interest.

- The question is whether Parliament has the jurisdiction to regulate dams on rivers flowing entirely within a state.

- Since ‘water’ comes under the State list, the bill is criticised as being an unconstitutional move aimed at taking control of state’s dams.

- State’s see it as an attempt by the Centre to consolidate power in the guise of safety concerns

- Opposition by Tamil Nadu

- The State which has fours dams — the Mullaperiyar, Parambikulam, Thunakkadavu and Peruvaripallam — that are owned by it, but are situated in neighbouring Kerala.

- Currently, the rights on these dams are governed by pre-existing long-term agreements among the States.

- The provisions in the Bill implies that the dam-owning State would not have rights over the safety and maintenance of the dam located in another State.

- Thus, Tamil Nadu will lose the rights over the safety of above four dams which is violative of pre-existing agreement with Kerala State.

- Due Process

- The functions of the National Committee on Dam Safety, the National Dam Safety Authority, and the State Committee on Dam Safety are listed in Schedules to the Bill.

- These Schedules can be amended by the government through a notification.

- The question is whether core functions of authorities should be amended through a notification or whether such amendments should be passed by Parliament.

Conclusion

In the absence of a proper legal framework, safety and maintenance of these large number of dams are a cause of concern. Hence, the bill has to be passed by taking on board the concerns of States.

Connecting the dots:

- Inter State River Water Disputes

- Mullaperiyar Dam Issue

(TEST YOUR KNOWLEDGE)

Model questions: (You can now post your answers in comment section)

Note:

- Correct answers of today’s questions will be provided in next day’s DNA section. Kindly refer to it and update your answers.

- Comments Up-voted by IASbaba are also the “correct answers”.

Q.1 Umang app was developed under which of the following Ministry of Indian government?

- Ministry of Agriculture

- Ministry of Finance

- Ministry of External Affairs

- Ministry of Electronics and IT

Q.2 Consider the following statement regarding China Chang’E-5 lunar mission which was in news recently:

- It is the first proverb in 40 years which will attempt to bring back samples of Lunar rock from unexplored portion of the Moon.

- It will land in the Mons Romker region of the Moon.

Which of the above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Q.3 Negative-yield bonds are generally issued by which of the following?

- Central banks

- Central governments

- Both (a) and (b)

- Private companies only

ANSWERS FOR 24th November 2020 TEST YOUR KNOWLEDGE (TYK)

| 1 | B |

| 2 | A |

| 3 | D |

| 4 | D |

Must Read

About Protecting Article 32:

About Land Rights in Jammu & Kashmir:

On Nagrota Encounter: