IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS + MAINS FOCUS)

Financial Stability Report for July 2021 released by RBI

Part of: GS Prelims and GS -III – Economy

In news

- RBI has recently released the Financial Stability Report, July 2021.

- It is a bi-annual report that reflects risks to financial stability and the resilience of financial system.

Key highlights of the report

- The gross non-performing assets (GNPAs) ratio of banks may rise from 7.48% in March 2021 to 9.8% by March 2022.

- MSMEs face huge stress in meeting their payment obligations.

- At the end of March 2021, 15.9% of loans of less than Rs. 25 crore to the MSEME Sector had turned bad.

- Capital to risk weighted assets ratio (CRAR) of Scheduled commercial Banks (SCBs) increased to 16.0 3% in March 2021.

- It is the ratio of a Bank’s capital in relation to its risk weighted Assets and current liabilities.

- Provision coverage ratio stood at 68.86% in March 2021.

- A high PCR ratio means most asset quality issues have been taken care of and the bank is not vulnerable.

- Demand for consumer credit across banks and non banking financial companies (NBFCs) has decreased amidst the second wave of Covid-19.

- Banks remain relatively unaffected by distractions caused due to the pandemic and are well protected by regulatory, monetary and fiscal Policies.

Six Years of Digital India Programme

Part of: GS Prelims and GS -II – Policies and interventions

In news

- Recently, the Indian Prime Minister of India addressed a virtual event to mark the completion of six years of Digital India programme.

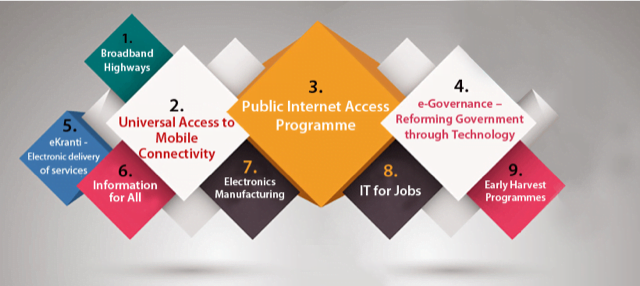

About Digital India Programme

- It was launched in 2015.

- The programme has been enabled for several important Government schemes, such as BharatNet, Make in India, Startup India, industrial corridors, etc.

- Vision Areas:

- Digital infrastructure as Utility to Every Citizen.

- Governance and services on demand.

- Digital empowerment of citizens.

- Objectives:

- To prepare India for a knowledge future.

- To realize IT (Indian Talent) + IT (Information Technology) = IT (India Tomorrow).

- Making technology central to enabling change.

Significant Achievements

- The introduction of Unified Payments Interface (UPI)

- Introduction of the e-KYC, DigiLocker and eSign were introduced to help businesses

- Introduction of JAM Trinity – Jan Dhan, Aadhar and Mobile to weed out leakages in the system

- India’s rise in UN eGovernance Index

- SWAYAM free online courses

Challenges faced:

- Regulatory roadblock due to taxation and other regulatory guidelines

- Digital divide due to lack of internet connectivity

- Lack of coordination among various departments

Pic courtesy: Digital India

Zydus Cadila seeks emergency use authorisation (EUA) for ZyCov-D vaccine

Part of: GS Prelims and GS-II – Health and GS-III – Biotechnology

In news

- Zydus Cadila has applied to the Central Drugs Standard Control Organisation (CDSCO), the national drugs regulator, seeking emergency use authorisation (EUA) for ZyCov-D, its Covid-19 vaccine.

- If approved, ZyCov-D will be the world’s first DNA vaccine against infection with SARS-CoV-2.

About ZyCov-D

- It is a “plasmid DNA” vaccine.

- It is a vaccine that uses a genetically engineered, non-replicating version of a type of DNA molecule known as a ‘plasmid’.

- A plasmid is a small, often circular DNA molecule found in bacteria and other cells. They generally carry only a small number of genes, notably some associated with antibiotic resistance.

- The plasmids in this case are coded with the instructions to make the spike protein of SARS-CoV-2

- Vaccination gives the code to cells in the recipient’s body, so they can begin making the spiky outer layer of the virus.

- The immune system is expected to recognize this as a threat and develop antibodies in response.

- The other unique thing about the vaccine is the way it is given. No needle is used — instead, a spring-powered device delivers the shot as a narrow, precise stream of fluid that penetrates the skin.

- ZyCov-D has been developed with the support of Department of Biotechnology and the Indian Council of Medical Research (ICMR).

Difference between conventional and gene-based vaccines

- In contrast to vaccines that employ recombinant bacteria or viruses, genetic vaccines consist only of DNA (as plasmids) or RNA (as mRNA), which is taken up by cells and translated into protein.

- Gene based vaccines use part of virus’ own genes to stimulate an immune response.

Advantages of gene based vaccines

- Relatively inexpensive

- Easy to manufacture and use

- Safe and non-infectious

- Generates stronger type of immunity

LEAF Coalition announced

Part of: GS Prelims and GS -III – Conservation

In news

- LEAF (Lowering Emissions by Accelerating Forest Finance) Coalition was announced at the Leaders Summit on Climate, 2021.

- It will be one of the largest ever public-private efforts to protect tropical forests

- It intends to mobilize at least USD 1 billion in financing to countries committed to protecting their tropical forests.

About LEAF Coalition

- It is a collective of the governments of the USA, UK and Norway.

- A country willing to participate would need to fulfil certain predetermined conditions laid down by the Coalition.

- The results-based financing model will be used in LEAF.

Significance

- The goal of net zero emissions cannot be reached without bold leadership from the private sector

- Tropical forests are massive carbon sinks and by investing in their protection will help in achieving Nationally Determined Contributions (NDCs)

- It is a step towards achieving the aims and objectives of the Reducing Emissions from Deforestation and Forest Degradation (REDD+) mechanism.

- Solve Development versus Ecological Commitment

Reducing Emissions from Deforestation and Forest Degradation

- REDD+ aims to achieve climate change mitigation by incentivizing forest conservation.

- It monetises the value of carbon locked up in the tropical forests of most developing countries, thereby propelling these countries to help mitigate climate change.

- REDD+ was created by the United Nations Framework Convention on Climate Change (UNFCCC).

Tropical Forest

- Tropical forests are closed canopy forests growing within 28 degrees north or south of the equator.

- They receive more than 200 cm rainfall per year, either seasonally or throughout the year.

- Temperatures are uniformly high – between 20°C and 35°C.

- Such forests are found in Asia, Australia, Africa, South America, Central America, Mexico and on many of the Pacific Islands.

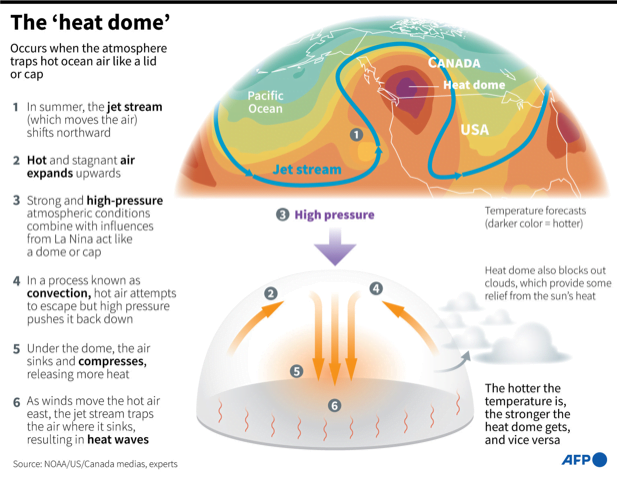

Historic heat wave in Canada caused due to Heat Dome

Part of: GS Prelims and GS I – Geography

In news

- Recently, the Pacific Northwest and some parts of Canada recorded temperatures around 47 degrees, causing a “historic” heat wave.

- This is a result of a phenomenon referred to as a “heat dome”.

- The western Pacific ocean’s temperatures have increased in the past few decades and are relatively more than the temperature in the eastern Pacific.

Phenomenon of heat dome

- A heat dome is an area of high pressure that parks over a region like a lid on a pot, trapping heat.

- The phenomenon begins when there is a strong change in ocean temperatures.

- The gradient causes more warm air, heated by the ocean surface, to rise over the ocean surface (Convection).

- As prevailing winds move the hot air east, the northern shifts of the jet stream trap the air and move it toward land, where it sinks, resulting in heat waves.

- This strong change in ocean temperature from the west to the east causes heat dome (HD).

- HD also prevents clouds from forming, causing more Sun’s radiation to reach the Earth’s surface.

- They are more likely to form during La Niña years like 2021, when waters are cool in the eastern Pacific and warm in the western Pacific.

Effects of Heat Dome

- The temperatures of homes rise unbearably high, leading to sudden fatalities, if such homes do not have AC.

- Damage crops, dry out vegetation and droughts.

- Rise in energy demand, especially electricity, leading to pushing up rates.

- Fuel to wildfires, which destroys a lot of land area in the US every year.

What are Jet streams?

- Jet streams are relatively narrow bands of strong wind in the upper levels of the atmosphere.

- The winds blow from west to east in jet streams but the flow often shifts to the north and south.

Pic courtesy: Barrons

Miscellaneous

First Movable Freshwater Tunnel Aquarium: Indian Railways

-

Recently, Indian Railway (IR) has opened the first movable freshwater tunnel aquarium of India at Bengaluru Railway Station.

- It has been opened by the Indian Railway Stations Development Corporation Limited (IRSDC) in collaboration with the HNi Aquatic Kingdom.

- The aquarium is a one-of-its-kind aquatic park based on the Amazon River (of South America) concept.

- It is home to various aquatic animals such as alligator gar ranging, stingrays, sharks, lobsters, snails and shrimps.

- Aim:

- Enhancing the passenger experience at the station.

- Improving revenue earning for IR.

(Mains Focus)

ECONOMY/ GOVERNANCE

Topic:

- GS-3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

- GS-2: Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

Insolvency & Bankruptcy: Issues & Way forward

About Insolvency & Bankruptcy

- Insolvency is the situation where the debtor is not in a position to pay back the creditor.

- For a corporate firm, the signs of this could be a slow-down in sales, missing of payment deadlines etc.

- Bankruptcy is the legal declaration of Insolvency.

Salient features of the Insolvency and Bankruptcy Code:

- IBC was enacted in 2016 for reorganization and insolvency resolution of corporate persons, partnership firms and individuals in a time bound manner for maximization of the value of assets of such persons

- IBC Code 2016 covers all individuals, companies, Limited Liability Partnerships (LLPs) and partnership firms.

- The adjudicating authority is National Company Law Tribunal (NCLT) for companies and LLPs and Debt Recovery Tribunal (DRT) for individuals and partnership firms.

- Insolvency Professionals: A specialised cadre of licensed professionals is proposed to be created. These professionals will administer the resolution process, manage the assets of the debtor, and provide information for creditors to assist them in decision making.

- Insolvency and Bankruptcy Board: The Board will regulate insolvency professionals, insolvency professional agencies and information utilities set up under the Code. The Board will consist of representatives of Reserve Bank of India, and the Ministries of Finance, Corporate Affairs and Law.

Has IBC worked well?

- Reduced Time for resolution: Today, on average, one can see maybe about three years [for recoveries and resolutions] as compared to an earlier timeline of five years, six years or more

- Promotes fiscal discipline & Reduces wilful default: The fear of losing the company under Section 49A will push the promoters to find a resolution.

Issues

- Infrastructure issues: There is shortage of NCLT member, lot of vacancies & delays in appointments all of which has a bearing on IBC working efficiency

- Legacy Issues: A lot of IBC cases are very old cases related to the stock of NPAs [Non-Performing Assets]. So, once this round is over, in future, perhaps, there will be fewer cases and IBC will be able to perform better than before.

- Procedural Delays: There are delays in implementation, whether it’s in terms of approvals, having an application admitted itself.

- Lack of Buyers: In India there are not many strategic investors. An asset will have interest or value only if there are more people who are ready to buy. Better asset value realization will lead to faster resolution of stressed companies (happy creditors)

Way Forward

- Increasing the predictability of IBC process so as to attract more & diverse range of strategic buyers who are willing to bid for assets, and submit resolution plans under the code

- Flexibility for Promoters: MSMEs have flexibility in terms of promoters being able to submit resolution plans for such companies. Similar type of relaxation can be extended to large companies with necessary safeguards built into it.

- Establishing National ARC(“Bad Bank”) will give the time to the banks to resolve these cases over a period of time. Government should make sure that it is adequately staffed & well-functioning.

- Capacity building in terms of NCLT: IBC cases are not the only mandate of the NCLT. They also consider various cases under the Companies Act (Ex: mergers or oppression). To improve IBC efficiency, NCLT strength has to be enhanced.

- Alternate Resolution: IBC is not the only solution for resolving stress. Other mechanisms pre-IBC mechanisms, one-time settlements, restructuring packages needs to be promoted as well.

Connecting the dots:

- Ease of Doing Business

- Twin Balance Sheet Problem faced by economy

ECONOMY/ GOVERNANCE

Topic:

- GS-3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

- GS-2: Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

New RBI Guidelines on Microfinance

Definition: Microfinance is a type of banking service provided to low-income individuals or groups who otherwise would have no other access to financial services. The goal is to give impoverished people an opportunity to become self-sufficient.

Merits

- Low interest rate prevents people from taking loans from private money lenders who charge very high interest rate. As a result, they are saved from debt trap.

- Promotes Self-employment opportunities thus reducing burden on govt. to provide jobs.

- Regionally balanced development, thus reduces rural to urban migration

- Enhanced financial literacy

New RBI Guidelines for Microfinance

- Standard definition of what is microfinance

Collateral free loans repayable in instalments for households with annual incomes of Rs 1.25 lakh for rural households and Rs two lakh for urban households will be considered microfinance loans

- Bringing all institutions giving microfinance loans under one regulatory umbrella

-

- Banks, Small Finance Banks and NBFC-MFI were all undertaking microfinance activities.

-

- Earlier MFI regulation was only focused on NBFC-MFI which accounts for only 30% of outstanding microfinance loans.

-

- RBI is now proposing a single uniform set of regulations to govern microfinance irrespective of who delivers it, thus creating a level playing field.

- EMI must not exceed 50 per cent of household income

-

- This is done to prevent reckless lending by micro finance institutions to single borrowers, which can lead to defaults in long terms.

- Market forces to determine the cost (interest rate) of microfinance

-

- The existing complicated formula on cost is done away with and the pricing of loans will henceforth be determined by the market, as is the case with lending rates adopted by banks.

Connecting the dots:

(TEST YOUR KNOWLEDGE)

Model questions: (You can now post your answers in comment section)

Note:

- Correct answers of today’s questions will be provided in next day’s DNA section. Kindly refer to it and update your answers.

- Comments Up-voted by IASbaba are also the “correct answers”.

Q.1 Which of the following is not a pillar of Digital India Programme

- Broadband highways

- IT for jobs

- Public internet access programme

- Digital electrification of Rural roads

Q.2 Consider the following statements about LEAF Coalition:

- It will be one of the largest ever public-private efforts to protect tropical forests

- It is a collective of the governments of the USA, UK and Norway.

Which of the above is or are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

ANSWERS FOR 2nd July 2021 TEST YOUR KNOWLEDGE (TYK)

| 1 | A |

| 2 | B |

| 3 | C |

Must Read

On Globalisation and Security:

On role of India’s North East in regional Cooperation: