UPSC Articles

Three-rate GST structure

Part of: Prelims and GS-III – Economy

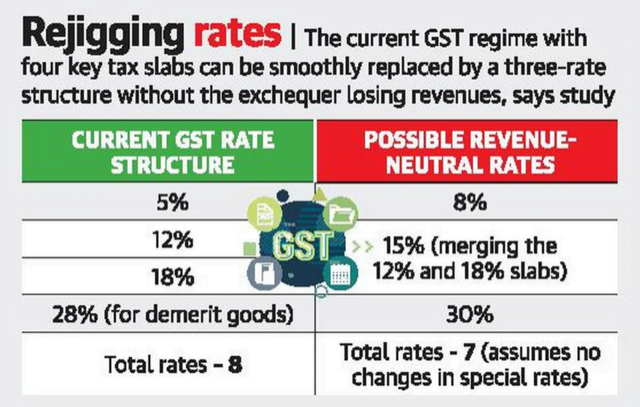

Context As per a National Institute of Public Finance and Policy (NIPFP) study, the Government can rationalise the GST rate structure without losing revenues by rearranging the four major GST rates (5%, 12%, 18% and 28%) with a three-rate framework of 8%, 15% and 30%.

- The NIPFP is an autonomous think tank backed by the Finance Ministry.

Significance of the study

- The GST Council has tasked a Group of Ministers, headed by Karnataka CM to propose a rationalisation of tax rates and a possible merger of different tax slabs by December to shore up revenues.

- The NIPFP paper also notes that raising rates on ‘high-value low volume goods’ like precious stones and jewellery ‘may encourage undisclosed transactions and revenue leakages.

Current rate structure

- GST is levied at four rates – 5%, 12%, 18% and 28%.

- The list of items that would fall under these multiple slabs are worked out by the GST council.

- Further, the tax on gold is kept at 3%. Rough precious and semi-precious stones are placed at 0.25% under GST.

What is the Goods and Services Tax (GST)?

- Value-added tax levied on most goods and services sold for domestic consumption.

- It was launched on 1st July 2017.

- It subsumed almost all domestic indirect taxes under one head.

- Paid by consumers, but it is remitted to the government by the businesses selling the goods and services.

- The GST to be levied by the Centre is called Central GST (CGST) and that to be levied by the States is called State GST (SGST).

- Integrated Goods & Services Tax (IGST): Inter-State Import of goods or services

- GST Council: Constitutional body (Article 279A) for making recommendations to the Union and State Government on issues related to GST.