Baba’s Explainer, Economics, Security Issues

Baba’s Explainer – Foreign Contribution Regulation Act (FCRA)

Syllabus

- GS-2: Government policies and interventions for development in various sectors and issues arising out of their design and implementation

- GS-2: Rights

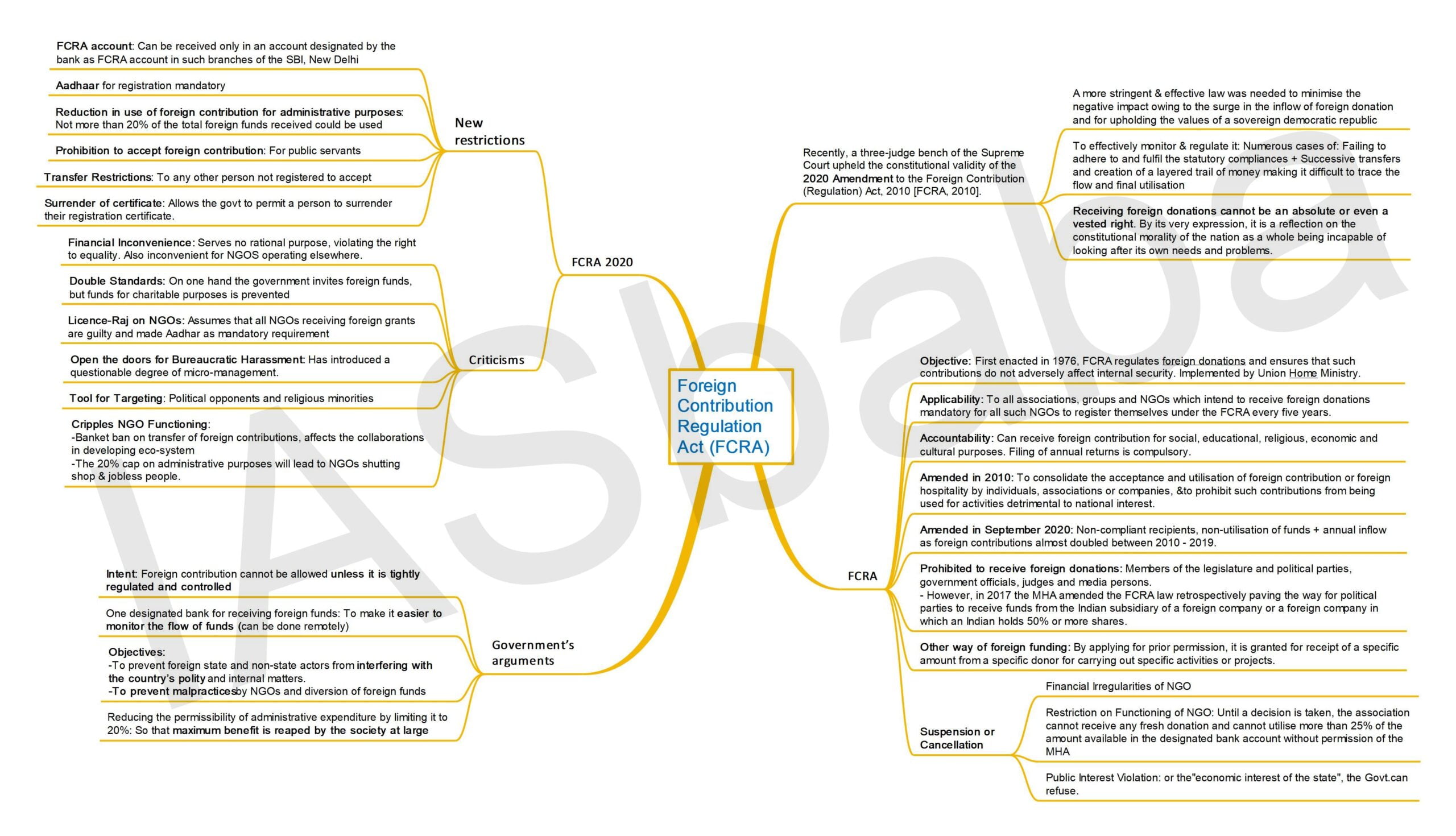

Why in News: Recently, a three-judge bench of the Supreme Court upheld the constitutional validity of the 2020 Amendment to the Foreign Contribution (Regulation) Act, 2010 [FCRA, 2010].

What is the FCRA?

- Objective: First enacted in 1976 FCRA regulates foreign donations and ensures that such contributions do not adversely affect internal security.

- The Act ensures that the recipients of foreign contributions adhere to the stated purpose for which such contribution has been obtained.

- It is implemented by Union Home Ministry.

- Applicability: The FCRA is applicable to all associations, groups and NGOs which intend to receive foreign donations. It is mandatory for all such NGOs to register themselves under the FCRA every five years.

- Accountability: Registered associations can receive foreign contribution for social, educational, religious, economic and cultural purposes. Filing of annual returns, on the lines of Income Tax, is compulsory.

- The act was subsequently amended in 2010 that sought to consolidate the acceptance and utilisation of foreign contribution or foreign hospitality by individuals, associations or companies, and to prohibit such contributions from being used for activities detrimental to national interest.

- The FCRA was amended in September 2020 to introduce some new restrictions. The Government says it did so because

- It found that many recipients were wanting in compliance with provisions relating to filing of annual returns and maintenance of accounts.

- Many did not utilise the funds received for the intended objectives.

- It claimed that the annual inflow as foreign contributions almost doubled between 2010 and 2019.

Who cannot receive foreign donations?

- Members of the legislature and political parties, government officials, judges and media persons are prohibited from receiving any foreign contribution.

- However, in 2017 the MHA, through the Finance Bill route, amended the FCRA law retrospectively paving the way for political parties to receive funds from the Indian subsidiary of a foreign company or a foreign company in which an Indian holds 50% or more shares.

How else can one receive foreign funding?

- The other way to receive foreign contributions is by applying for prior permission.

- It is granted for receipt of a specific amount from a specific donor for carrying out specific activities or projects.

- But the association should be registered under statutes such as the Societies Registration Act, 1860, the Indian Trusts Act, 1882, or Section 25 of the Companies Act, 1956.

- A letter of commitment from the foreign donor specifying the amount and purpose is also required.

When is a registration suspended or cancelled?

- Financial Irregularities of NGO: The MHA on inspection of accounts and on receiving any adverse input against the functioning of an association can suspend the FCRA registration initially for 180 days.

- Restriction on Functioning of NGO: Until a decision is taken, the association cannot receive any fresh donation and cannot utilise more than 25% of the amount available in the designated bank account without permission of the MHA

- Public Interest Violation: The government can refuse permission if it believes that the donation to the NGO will adversely affect “public interest” or the “economic interest of the state”.

- Recent Example: In 2017, the MHA suspended the FCRA of the Public Health Foundation of India (PHFI), one of India’s largest public health advocacy groups, on grounds of using “foreign funds” to lobby with parliamentarians on tobacco control activities.

- After several representations by the PHFI to the government, it was placed in the ‘prior permission’ category

- According to MHA data, since 2011, the registration of 20,664 associations was cancelled for violations such as misutilisation of foreign contribution, non-submission of mandatory annual returns and diversion of foreign funds for other purposes.

- As on September 11,2020 there are 49,843 FCRA-registered associations.

What has been the criticism of FCRA?

- Democratic Functioning: NGOs perform vital role of interest aggregation and interest articulation in Democratic process. Disproportionately restricting their functioning will hamper Democracy in long run.

- Affects Fundamental Rights: The FCRA restrictions have serious consequences on both the rights to free speech and freedom of association under Articles 19(1)(a) and 19(1)(c) of the Constitution respectively.

- Liable to misuse due to Vagueness in law: The Act gave the government the power to frame rules whereby an organisation can be declared to have political objectives — without defining what a ‘political objective’ is.

What were the new restrictions introduced by Foreign Contribution (Regulation) Amendment Act, 2020?

- FCRA account: Foreign contribution must be received only in an account designated by the bank as FCRA account in such branches of the State Bank of India, New Delhi.

- All foreign funds should be received only in this account and none other.

- However, the recipients are allowed to open another FCRA bank account in any scheduled bank to which they could transfer the received funds for utilisation.

- The designated bank will inform authorities about any foreign remittance with details about its source and the manner in which it was received.

- Aadhaar for registration: The Act makes Aadhaar number mandatory for all office bearers, directors or key functionaries of a person receiving foreign contribution, as an identification document.

- Reduction in use of foreign contribution for administrative purposes: Not more than 20% of the total foreign funds received could be used for administrative expenses. In FCRA 2010 the limit was 50%.

- Prohibition to accept foreign contribution: The Act bars public servants from receiving foreign contributions.

- Transfer Restrictions: The Act prohibits the transfer of foreign contribution to any other person not registered to accept foreign contributions

- Surrender of certificate: The Act allows the central government to permit a person to surrender their registration certificate.

What are the criticisms of the FCRA, 2020?

- Financial Inconvenience: Blanket requirement to open an account at the SBI Main Branch, New Delhi, is considered manifestly arbitrary serving no rational purpose, violating the right to equality. It is also inconvenient as the NGOS might be operating elsewhere.

- Lawyers have argued that there is no rational link between designating a particular branch of a bank with the objective of preserving national interest.

- Lawyers have also cited the recent Supreme Court judgment on the alleged use of Pegasus spyware to argue that ‘national security’ cannot be cited as a reason without adequate justification.

- Cripples NGO Functioning: NGOs questioning the law consider the prohibition on transfer arbitrary and too heavy a restriction. One of its consequences is that recipients cannot fund other organisations

- When foreign help is received as material, it becomes impossible to share the aid if the recipient NGO does not have the means to distribute on its own.

- It is a blanket ban on transfer of foreign contributions, thus affecting the collaborations in developing eco-systems, especially for smaller and less visible grassroots organisations that may not meet the criteria or be able to submit detailed proposals to get access to grants from foreign countries.

- Also, due to the 20% cap on administrative purposes, many NGOs will shut shop and many people will become jobless.

- Double Standards: On one hand the government invites foreign funds, but when such funds come for educational and charitable purposes, it is prevented.

- Licence-Raj on NGOs: The Bill assumes that all NGOs receiving foreign grants are guilty and thus makes Aadhar of office bearers as mandatory requirement.

- Open the doors for Bureaucratic Harassment: There is a thin line between enforcing transparency and using rules to allow official interference and harassment in the sector. Much of the present bill crosses that line and introduces a questionable degree of micro-management.

- Tool for Targeting: The legislation may be used to target political opponents and religious minorities.

What are the government’s arguments in introducing amendments in 2020?

- The Union of India argued that the legislative intent behind the enactment of the 2010 Act was that foreign contribution cannot be allowed unless it is tightly regulated and controlled.

- The Government has contended that the amendments were necessary to prevent foreign state and non-state actors from interfering with the country’s polity and internal matters.

- Foreign contributions have increased from Rs 10,282 crores in 2009-2010 to Rs 16,343 crores in 2018-2019, which is a significant contribution through foreign funds.

- The changes are also needed to prevent malpractices by NGOs and diversion of foreign funds. Preventing possible diversion of funds is also the reason cited for reducing the administrative expense component, as some organisations tended to inflate the actual expenditure incurred.

- The provision of having one designated bank for receiving foreign funds is aimed at making it easier to monitor the flow of funds. The Government clarified that there was no need for anyone to come to Delhi to open the account as it can be done remotely.

- The wisdom of the Parliament was also in favour of reducing the permissibility of administrative expenditure by limiting it to 20 per cent, so that maximum benefit is reaped by the society at large due to its utilisation for permissible activities of the NGO.

- Section 12A had been inserted requiring furnishing of Aadhaar card details in lieu of identification document. Centre has stated that the Supreme Court’s judgment in K.S. Puttaswamy (2018) does not completely rule out the possibility of intrusion into the privacy of a person, which is backed by a just law.

- The challenge to the amendments made on the touchstone of Article 19(1)(c) (freedom of association) and Article 21 (Right to life) needs to be considered in light of the object of the Principal Act. It is an Act to protect the ‘sovereignty and integrity of India’ and ‘public order’. The government is therefore empowered to impose reasonable restrictions to achieve these objectives.

What observations were made by the Supreme Court while it upheld the Constitutional validity of 2020 amendments?

- The experience gained after implementation of the 1976 Act revealed that a more stringent & effective law was needed to minimise the negative impact owing to the surge in the inflow of foreign donation and for upholding the values of a sovereign democratic republic.

- “Philosophically, foreign contribution (donation) is akin to a gratifying intoxicant replete with medicinal properties and may work like a nectar. However, it serves as a medicine so long as it is consumed (utilised) moderately and discreetly, for serving the larger cause of humanity.”

- Many recipients had failed to adhere to and fulfil the statutory compliances – which resulted in cancellation of as many as 19,000 certificates of concerned persons/organisations. Also, there had been cases of successive transfers and creation of a layered trail of money making it difficult to trace the flow and final utilisation. Thus, stringent law was required to effectively monitor & regulate it.

- Receiving foreign donations cannot be an absolute or even a vested right. By its very expression, it is a reflection on the constitutional morality of the nation as a whole being incapable of looking after its own needs and problems.

Mains Practice Question – Imposing restrictions on foreign funding is a necessity. Analyse the statement in the context of the criticisms meted against the 2020 amendments to Foreign Contribution Regulation Act, 2010.

Note: Write answers to this question in the comment section.

Mind Map

DOWNLOAD MIND MAP – CLICK HERE

For a dedicated peer group, Motivation & Quick updates, Join our official telegram channel – https://t.me/IASbabaOfficialAccount

Subscribe to our YouTube Channel HERE to watch Explainer Videos, Strategy Sessions, Toppers Talks & many more…