Economics

In News: The Commerce Ministry has once again deferred the launch of its new foreign trade policy (FTP) as it felt the need to have wider consultation with industry.

- The current FTP (from 2015-20 but extended thereafter till March 2023) is a policy document that spells out the objectives and strategies to boost exports.

New foreign trade policy (FTP):

- The current trade policy was introduced in 2015 for a five-year term.

- During the COVID-19 pandemic, the government extended the Foreign Trade Policy 2015-20 for till 2022-23.

- The new policy will be a comprehensive and important document that interprets rules, regulations, and procedures in international trade transactions, which are critical in facilitating in export-import operations and making the export sector more competitive.

- India’s strategy is to cash in on a world seeking to become less dependent on China and to enable exporters (and importers) to plan their investments ahead.

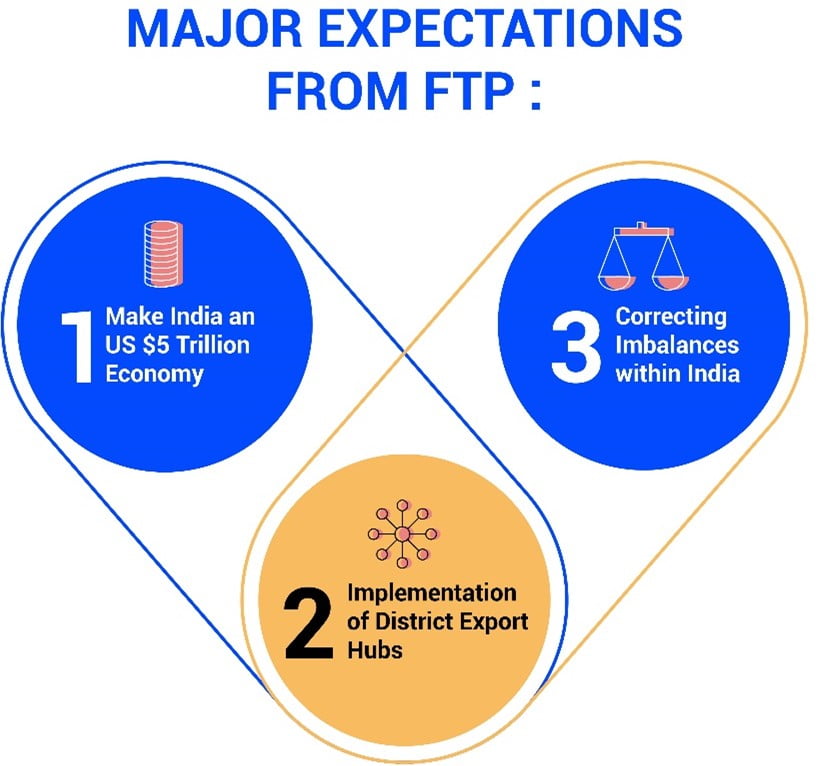

- The new policy will aim to provide a leg-up to exports and address some of industry’s key concerns, including a buffer against rising interest rates. It could include measures to help push up goods and services exports as well as rein in the runaway import bill.

- There is a need for new policy due to global growth slowdown and recession fears after the Ukraine-Russia war.

- The Indo-Pacific Economic Framework has led to assertions that the Government has ‘no bandwidth’ left for new free trade pact negotiations through more countries

Significance:

- Enhance trade facilitation measures

- Provide a simpler duty exemption scheme

- Reintroduce a services export promotion scheme

- Increase India’s share in global services exports

- Increase employment

- Boost domestic manufacturing

- Rope in India’s economic clout across the globe

- Leverage India’s potential in the services sector for greater export revenue

RoDTEP scheme & its issues:

- Remission of Duties and Taxes on Export Products (RoDTEP) scheme aims at neutralising the taxes at the State and local levels not otherwise refunded under any other mechanism.

- RoDTEP is a refund of duties and taxes (electricity duties, petroleum taxes, stamp duty etc.) which are embedded in manufactured products for exports. These taxes and duties are also applicable on excluded sectors and therefore need to be refunded to all sectors.

- However, this does not include “cess and levies,” which has emerged as a potent instrument in recent years, to collect funds for designated purposes.

- Not only this, the RoDTEP benefits are confined to limited sectors and a number of important sectors such as pharmaceuticals (chapter 30 of the FTP), chemicals (chapter 28 and 29) and steel (chapter 72 and 73) are out of its purview.

- Under the current policy, RoDTEP benefits are not available to advance authorisation holders and EOU’s.

- Exemption granted under the advance authorization/EPCG scheme/EOU is primarily from customs duties and IGST and not from embedded taxes like electricity duty, diesel/petrol taxes etc.

- Suggestion: The RoDTEP benefits needs to be extended to Advance Authorization holders and EOU’s on priority basis.

Other challenges:

- Pendencies:

- there is long list of pending cases of redemption with respect to Advance Authorization scheme due to pre-import conditions.

- This needs to be sorted out immediately by withdrawing the pre-import condition retrospectively.

- If this is not possible, examination of pre-import condition should be limited to the actual violation based on actual import with respect to export and should not be based on the licensing period.

Suggestions:

- Government should take into account the details of imports and against each authorisation on individual merits and help redeem such cases.

- To achieve the $1,000 billion exports target by 2030, it is important to resolve pending cases in a justified and time-bound manner.

- This will help exporters to focus on boosting exports rather than grappling with their existing cases.

- Manufacture and Other Operations in Customs Warehouse (MOOWR)

- Introduced in 2019 to facilitate duty free imports for exports under the Customs bonded warehouse.

- This scheme is akin to Export Oriented Units (EOU) of the FTP.

- Complicated methodology: Because the EOU scheme has dual monitoring, one by Development Commissioner and another by customs

- there are significant ambiguities on the scope of operations, depreciation provisions relating to capital goods etc., which need to be addressed for greater transparency

- Suggestions: it is better to bring about a simple methodology for conversion of existing units under EOU scheme into MOOWR scheme.

- Imports are subject to compliance with domestic laws as outlined in the FTP.

- It provides a generic guideline and actual regulations are multiple and not available at a single point.

- There is need to provide greater clarity and explanation of laws, rules, orders, regulations and technical specifications stipulated in Para 2.03 of the existing FTP.

- Suggestions: A separate appendix in the Handbook of Procedures covering all compliances under various domestic laws is required.

Way forward:

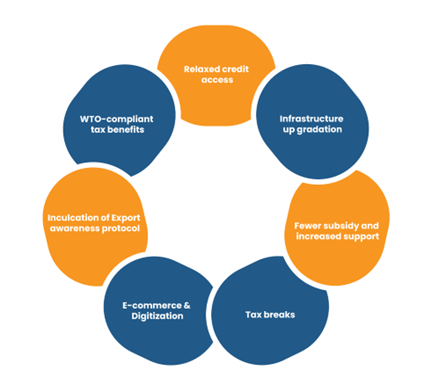

- The new FTP focusses more on addressing operational issues of EXIM operations as they reduce not only the cost of doing operations but also improves firm level export competitiveness.

- To enable a mechanism for integrated tax neutralisation through a single window.

- Lowering down logistics costs to make products competitive.

- Digitisation and e-commerce must integrate government policies such as one district one product and should complement each other.

- Free trade agreements between regional partners must be further explored for tapping trade opportunities with leading economies.

Source: The Hindu Businessline