Environment & Ecology

Context:

- The UN secretary general stated that the adaption finance needs of developing countries will gallop to $340 billion annually.

- While funding contours and future contributors remain unclear, least developed and vulnerable smaller island nations in need of assistance to tackle climate disasters are its likely beneficiaries.

- Not only must India continue pushing rich nations to contribute additional monies for past excesses, but also mobilize more private capital finance on its own by co-creating an auxiliary funding mechanism.

What is climate finance:

- It refers to the financial arrangements that are specific to the use for projects that are environmentally sustainable or projects that adopt the aspects of climate change.

- It includes

- Production of energy from renewable sources like solar, wind, biogas, etc.

- Clean transportation that involves lower greenhouse gas emission

- Energy efficient projects like green building

- Waste management that includes recycling, efficient disposal and conversion to energy, etc.

Current situation:

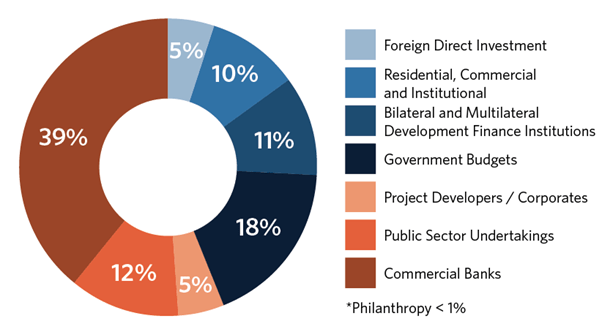

- A glance at the OECD’s climate finance trends report 2022 indicates that of the targeted $100 billion aggregate climate funding, about $83 billion was mobilized from developed nations via global agencies through 2020.

- Of this, bilateral and multilateral public climate finance from the developed West stood at $68 billion, comprising concessional and non-concessional loans (71%), grants (26%) and equity (2%), while private climate finance and export credit extended via agencies comprised just $15 billion.

- Experience suggests that depending solely on timely Western public funds, per current or post-2025 quantified agreements, will be unwise in times of geo-strategic competition and recessionary fears.

- Monies from rich countries are unpredictable, yet the allocation thereof by global agencies is predictably done among least developed and developing nations across Asia (42% of the 2020 total), Africa (26%) and Latin America (17%).

Challenges in India:

- High borrowing costs due to asymmetric information, higher risk perception and governance issues.

- Green-washing or false claims of environmental compliance

- Plurality of green loan definitions

- Maturity mismatches between long-term green investment and relatively short-term interests of investors.

- Lack of adequate market infrastructure and policy framework

- Public sector orientation – Climate finance funds on concessional terms will largely be earmarked for select public sector projects or renewable energy mitigation and low-carbon transport systems planned under India’s long-term Low Emissions Development Strategy (LEDS) for climate action.

- Presently, adaptation and mitigation financing for compact businesses, SMEs and local communities is not in focus.

- Fiscal incentives like production-linked incentive (PLI) schemes may work in drawing manufacturing mitigation investments for utility-scale solar or wind, however the same are not resilient and sustainable.

Suggestions:

- New financial instruments such as green bonds, carbon market instruments (e.g. carbon tax) and new financial institutions (e.g. green banks and green funds).

- A banking framework wherein Indian banks are nudged to lock in long-tenure, low-cost private climate capital from alternative sources, like overseas investor institutions, global pledge organizations, private philanthropy, CSR budgets, etc, and are incentivized to on-lend cheaper loans to diverse businesses.

- Arming banks with risk weight and priority sector incentives can help extend concessional low-coupon, shorter tenor sustainability financing to clients.

- This may also deepen funding liquidity for lower-rung entities and improve global forex inflows at a time of weak exports.

- Delineated projects of larger companies or well-rated special purpose vehicles(SPVs) that meet pre-set mitigation specifications should continue to be encouraged to raise funds through domestic financial institutions (DFIs), project financiers and private and sovereign green bonds.

- Impact funds, blended finance instruments and venture capitalists betting on new climate technologies need to be nurtured for the purpose.

- Fintech start-ups and digitization can play a big supporting role in connecting small clients with banks.

- Regulators and financiers need to evaluate various use-case scenarios before implementation.

- Decentralised approach – For instance, block-level wholesalers/transport operators or fertilizer and tractor sellers can be incentivized to arrange machinery for mulching crop stubble into farm fields or recycling waste for biofuels, with the objective of lowering husk-fire emissions and air pollution across the Indo-Gangetic plains.

- DFI funds and direct fiscal transfers by the government may only work partially.

- Low coupon sustainability-linked bank loans or overdraft facilities at the entity level would be a more practical adaptation solution for many across the rural and urban divide.

Way forward:

- As India lays out a G20 agenda, the government should set the direction for augmenting our private climate finance framework, too.

- As the country marches forward in its quest towards net-zero emissions powered by a people’s movement as much as low-cost climate finance.

- Inclusive growth with relentless and resilient development (“Sahit Vikas, Satat Viksan”) should be our mantra.

Source: Livemint