Agriculture

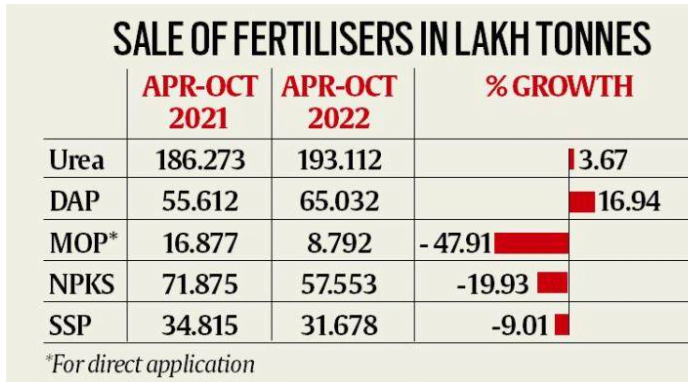

In News: Data from the Department of Fertilisers shows a 3.7 per cent increase in the sale of urea during April-October 2022 over the corresponding seven months of the previous year. Even higher, at 16.9 per cent, has been the growth in DAP sales.

Context:

- For a long time, India’s fertiliser sector has been riddled with distortions from excessive use of urea.

- Now, there’s a second fertiliser — di-ammonium phosphate or DAP — that is seeing a similar phenomenon of over-application due to under-pricing.

- Hence, there is a need for balanced use of fertilizer in conjunction with bio fertilisers and organic fertilizers

Fertilizer sector:

- There are 3 basic types of fertiliser used—urea, Diammonium Phosphate (DAP), and Muriate of Potash (MOP).

- Urea is the most produced (86 per cent), most consumed (74 per cent share), and the most imported (52 per cent)

- It is the most physically controlled fertiliser and receives the largest subsidies (nearly 70 per cent of total fertilisers subsidy)

- DAP and MOP producers and importers receive a Nutrient Based Subsidy (NBS) based on a formula of N, P and K in 4:2:1 ratio.

- India is the second biggest consumer of fertilizer in the world next only to China.

- The India Fertilizers Market stood at 28.56 billion USD in 2022 and is projected to register a CAGR of 6.25% to reach 41.08 billion USD in 2028.

- Sale of Urea and DAP is rising while that of other fertilizers is falling.

Challenges of the sector:

- High government subsidies such as on Urea and DAP

- About 0.73 lakh crore or 5 percent of GDP, the second-highest after food

- Companies are obliged to sell at MRP, with their higher cost of production or imports being reimbursed as subsidy by the Centre.

- Small Farmer Inability to derive full benefits: Only 17,500 crores or 35 per cent of total fertiliser subsides reaches small farmers.

- Heavy Import dependence:

- Entire potash requirement, about 90 per cent of phosphatic requirement, and 20 per cent urea requirement is met through imports.

- The use of nitrogen (N), phosphorous (P) and potassium (K) in the country has over the last few years sharply deviated from the ideal NPK use ratio of 4:2:1.

- This causes worsening of soil quality

- Imbalance in application: MOP, which contains 60% K, has a high MRP so farmers have no incentive today to apply the same.

- Environmental concerns: nutrient imbalance owing to their use — disproportionate to other, more expensive fertilisers — could have implications for soil health, ultimately affecting crop yields.

- The India Fertilizers Market is fragmented, with the top five companies occupying 28.93%.

- Black market & corruption:

- Urea is highly regulated and is only subsidised for agriculture

- This creates a black market that burdens small farmers disproportionately; incentivises production inefficiency, leads to over-use, depleting soil quality and damaging human health.

Suggestions:

- Reducing urea imports and increase in domestic availability via less restrictive imports and to respond flexibly and quickly to changes in demand.

- Direct benefit transfer based on biometric identification with physical offtake using JAM trinity.

- Encouraging Indian firms to locate plants in countries such as Iran following the example of the Fertiliser Ministry’s joint venture in Oman, which allowed India to import fertiliser at prices almost 50 per cent cheaper than the world price.

- Self-reliance to escape the vagaries of high volatility in international prices.

- five urea plants at Gorakhpur, Sindri, Barauni, Talcher and Ramagundam are being revived in the public sector.

- Extend the NBS model to urea and allow for price rationalisation of urea compared to non-nitrogenous fertilizers and prices of crops.

- Develop alternative sources of nutrition for plant such as use of waste biomass crop and enhancing the value of livestock by-products.

- Improving fertilizer efficiency through need-based use rather than broadcasting fertilizer in the field.

- Liquid Nano urea by IFFCO, fertigation, etc.

Way forward:

- Fertiliser subsidies are very costly, accounting for about 0.8 per cent of GDP

- They encourage urea overuse, which damages the soil, undermining rural incomes, agricultural productivity, and thereby economic growth.

- Reform of the fertiliser sector would not only help farmers and improve efficiency

in the sector. It would also show that India is prepared to address exit constraints that bedevil reform in other sectors.

MUST READ Nano Urea

Source: Indian express