IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS & MAINS Focus)

Syllabus

- Prelims – Art and Culture

Context: Recently A 61-year-old French tourist died inside the Fatehpur Sikri fort after she fell from a nine-feet-high platform following the collapse of a wooden railing.

About Fatehpur Sikri:

- Location: It is a city predominantly in red sandstone, situated at a distance of 37 km from Agra, Uttar Pradesh.

- Founder: Mughal emperor Akbar in 1569.

- Designated a UNESCO World Heritage site in 1986.

- The structures has combined elements of Persian, Indian, and Central Asian styles.

- It served as the Mughal Empire’s capital from 1571 to 1585.

- When Akbar returned from his Gujarat campaign victorious in 1573, the city was renamed Fatehpur Sikri, or the City of Victory, to commemorate the victory.

The Fatehpur Sikri complex include:

- Jama Masjid: It is home to the Jama Masjid, one of the largest mosques in India.

- It is known for its imposing structure, graceful arches, and intricately designed prayer hall.

- Buland Darwaza: This colossal gateway, also known as the “Gate of Magnificence,” is an iconic monument of Fatehpur Sikri.

- It was built to commemorate Akbar’s victorious campaign in Gujarat and is a grand example of Mughal architecture.

- Diwan-i-Khas and Diwan-i-Aam: These are two prominent buildings within the complex.

- The Diwan-i-Khas (Hall of Private Audience) was where Akbar held private meetings, while the Diwan-i-Aam (Hall of Public Audience) was for conducting public affairs.

- Panch Mahal: This five-storied palace is a unique structure with open pavilions on each level.

- It served as a place for relaxation and entertainment.

Source: Hindustan Times

Syllabus

- Prelims – Economy

Context: The RBI recently introduced norms on the Basel III capital framework for All India Financial Institutions (AIFIs), which will come into effect from 2024.

About Basel III:

- Basel III is an internationally agreed set of measures developed by the Basel Committee on Banking Supervision in response to the financial crisis of 2007-09 in order to strengthen the regulation, supervision and risk management of banks.

- Basel III standards are minimum requirements which apply to internationally active banks.

- Objective: The guidelines aim to promote a more resilient banking system by focusing on four vital banking parameters viz. capital, leverage, funding and liquidity.

- Capital: The capital adequacy ratio is to be maintained at 12.9%.

- The minimum Tier 1 capital ratio and the minimum Tier 2 capital ratio have to be maintained at 10.5% and 2% of risk-weighted assets respectively.

- Leverage: The leverage rate has to be at least 3 %. The leverage rate is the ratio of a bank’s tier-1 capital to average total consolidated assets.

- Funding and Liquidity: Basel-III created two liquidity ratios: LCR and NSFR.

- The liquidity coverage ratio (LCR) will require banks to hold a buffer of high-quality liquid assets sufficient to deal with the cash outflows encountered in an acute short term stress scenario as specified by supervisors.

- This is to prevent situations like “Bank Run”.

- The goal is to ensure that banks have enough liquidity for a 30-days stress scenario if it were to happen.

- The Net Stable Funds Rate (NSFR) requires banks to maintain a stable funding profile in relation to their off-balance-sheet assets and activities.

- NSFR requires banks to fund their activities with stable sources of finance (reliable over the one-year horizon).

- The minimum NSFR requirement is 100%.

- Therefore, LCR measures short-term (30 days) resilience, and NSFR measures medium-term (1 year) resilience.

- Capital: The capital adequacy ratio is to be maintained at 12.9%.

- Deadline for India to adopt: March 2019 but it was postponed to March 2020 in light of the coronavirus pandemic.

About AIFIs:

- AIFI is a group composed of financial regulatory bodies that play a pivotal role in the financial markets by assisting the proper allocation of resources, sourcing from businesses that have a surplus and distributing to others who have deficits.

- They act as an intermediary between borrowers and final lenders, providing safety and liquidity.

- India has five AIFIs regulated by the central bank:

- National Bank for Financing Infrastructure and Development (NaBFID)

- National Housing Bank (NHB)

- Small Industries Development Bank of India (SIDBI)

- Export-Import Bank of India (EXIM Bank)

- National Bank for Agriculture and Rural Development (NABARD)

Source: The Hindu

Syllabus

- Prelims – Environment and Ecology

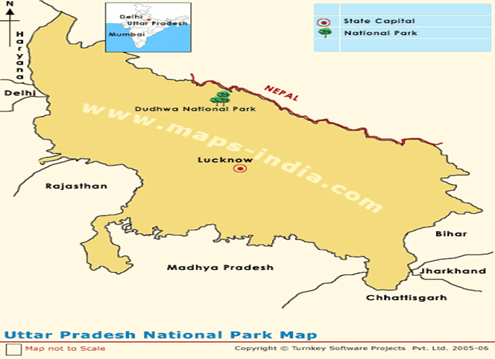

Context: The endangered Indian Skimmer was recently spotted near Zalim Nagar Bridge along the Ghaghra River at Dudhwa Tiger Reserve, Uttar Pradesh (UP).

About the Indian Skimmer:

- It is an unusual-looking bird with a striking red, orange beak where the lower bill is longer than the upper bill.

- Distribution: Globally found in the coastal estuaries of western and eastern India, and Bangladesh.

- Food: fish, larvae, insects, and shrimps.

- Habitat: It favours slow-moving rivers with sandbar habitats formed seasonally during summers, around lakes and adjacent marshes, estuaries, and coasts.

- Breeding: Between February to June and raise one to three chicks per clutch.

- Conservation Status:

- IUCN: Endangered (EN)

- Wildlife Protection Act, 1972 : Schedule I

About Dudhwa Tiger Reserve:

- Location: Spread across the Lakhimpur Kheri and Bahraich districts of Uttar Pradesh.

- Rivers: The Sharda River flows by the Kishanpur WL Sanctuary, the Geruwa River flows through the Katerniaghat WL Sanctuary and the Suheli and Mohana streams flow in the Dudhwa National Park, all of which are tributaries of the mighty Ghagra River.

- It was considered as a tiger reserve in 1987.

- Vegetation: The vegetation is of the North Indian Moist Deciduous type, containing some of the finest examples of Sal forests (Shorea robusta) in India.

- Flora: The flora is predominantly Sal forest along with its associate tree species like Terminalia alata (Asna), Lagerstroemia parviflora (Asidha), Adina cordifolia (Haldu), Mitragyna parviflora (Faldu), Gmelina arborea (Gahmhar), Holoptelea intgrifolia (Kanju) etc.

- Fauna: Guldar, Tiger, Fishing cat, Monkey, Langur, Mongoose, Small Indian Mongoose, small Indian civet, Jackal etc.

- Birds include Dabchick, spotbilled pelican, Large cornorant, Little cormorant, Grey Heron, White stork, Black storck, White Ibis etc.

- Reptiles include Mugger, Ghariyal, Python, Sandboa, Banded krait, Russel’s viper, Rat snake etc.

Source: India Times

Syllabus

- Prelims – International Relations

Context: Recently US ambassador to Canada has claimed that “shared intelligence among Five Eyes partners” had informed Prime Minister of the possible involvement of Indian agents in the killing of Khalistan separatist.

About Five Eyes Alliance:

- Est: Post-World War II

- Members states: Australia, Canada, New Zealand, the United Kingdom, and the United States.

- The term “Five Eyes” refers to the five countries’ collective efforts to gather and share signals intelligence (SIGINT) to address common security threats and challenges.

- Objectives:

- Intelligence Sharing: The alliance members collaborate to share signals intelligence, which includes intercepted communications and electronic data, to enhance their collective understanding of global security threats.

- Counterterrorism and National Security: The Five Eyes network focuses on countering terrorism and addressing other national security concerns by exchanging vital intelligence and cooperating on joint operations.

- Cybersecurity and Cyber Threats: Given the growing significance of cyber threats, the alliance works together to monitor and address cyber activities from adversarial nations and non-state actors.

- Information and Technology Sharing: The Five Eyes partners share expertise and technological advancements in the field of intelligence gathering, analysis, and cryptography.

Source: Indian Express

Syllabus

- Prelims – Governance

Context: The Department of Fisheries is installing artificial reef units for coastal states as a sub-activity under ‘Integrated Modern Coastal Fishing Villages’ of Pradhan Mantri Matsya Sampada Yojana (PMMSY).

About Artificial Reefs:

- An artificial reef is a human-made underwater structure that substitutes as a natural reef to form a habitat for marine life.

- They are placed in areas where there is little bottom topography or near coral reefs to attract marine populations.

- They serve to protect coral reefs from human-induced damages as well as supporting biodiversity and healthy ecosystems.

About Pradhan Mantri Matsya Sampada Yojana (PMMSY):

- It is a flagship scheme for focused and sustainable development of the fisheries sector to be implemented from 2020-21 to 2024-25

- Ministry: Fisheries, Animal Husbandry and Dairying

- Objectives:

- To bring about a blue revolution through sustainable and responsible development of the fisheries sector in India.

- To double the incomes of fishers and fish farmers, reducing post-harvest losses from 20-25% to about 10% and the generation of employment opportunities in the sector.

- Implementation: It is implemented as an umbrella scheme with two separate components Central Sector Scheme and Centrally Sponsored Scheme.

- North Eastern & Himalayan States: 90% Central share and 10% State share.

- Other States: 60% Central share and 40% State share.

- Achievements:

- As of 2023, under PMMSY, projects worth Rs 14,654.67 crore have been approved from 2020-21 to 2022-23.

- The fish production reached an all-time high of 25 MMT during FY 2021-22 with marine exports touching Rs. 57,586 Crores.

Source: PIB

Syllabus

- Prelims – Governance

Context: Every year Sign Language Day is being celebrated by the Indian Sign Language Research and Training Centre (ISLRTC) on 23rd September.

About International Day of Sign Languages:

- The UN General Assembly proclaimed 23 September as the International Day of Sign Languages.

- The choice commemorates the date that the World Federation of the Deaf (WFD) was established in 1951.

- WFD is an international non-profit and non-governmental organization of deaf associations from 133 countries.

- Established: 23 September,1951

- HQ: Helsinki, Finland

- Objective: It promotes the human rights of deaf people in accordance with the principles and objectives of the United Nations Charter, Universal Declaration of Human Rights, UN Convention on the Rights of Persons with Disabilities (CRPD), 2030 Agenda and Sustainable Development Goals (SDGs), and other Human Rights Treaties.

- Theme for 2023: A World where Deaf People Everywhere can Sign Anywhere!

Source: PIB

Syllabus

- Mains – GS 2 (Economy)

Context: Researchers with the National Dairy Research Institute (NDRI), under the Indian Council of Agricultural Research (ICAR), describe how COVID-19 put the brakes on India’s artificial insemination programme.

State of the Dairy sector in India:

- India is the largest producer of milk.

- India’s success story in milk production was scripted by Dr Verghese Kurien, known as the “Father of the White Revolution” in India.

- Small and marginal farmers own 33 percent of land and about 60 percent of female cattle and buffaloes.

- Some 75 percent of rural households own, on average, two to four animals.

- The top 5 milk-producing states are:

- Uttar Pradesh (16.3%, 30.52 MMT), Rajasthan (12.6%, 23.69 MMT), Madhya Pradesh (8.5%, 15.91 MMT), Andhra Pradesh (8%, 15.04 MMT) and Gujarat (7.7%, 14.49 MMT).

- UAE remains the biggest market for Indian dairy products, accounting for US$ 35.43 million worth of dairy products followed by Bangladesh, the US , Bhutan, and Singapore.

- Stakeholders in the sector:

- Notably, 228 dairy cooperatives reach out to 17 million farmers, many of whom are likely to be assured of their milk being procured at the right time and at a fair price.

Significance of Dairy Sector:

- Reduces Imports: Operation Flood (also called as White Revolution) converted India from a milk importer to the world’s largest producer.

- Secure Livelihood: It is a source of income to small and landless agri houses. 70 per cent of those earning their livelihood from milk are women.

- Dairying provides a source of regular income, whereas income from agriculture is seasonal.

- This regular source of income has a huge impact on minimizing risks to income.

- Women Empowerment: 69 per cent are female workers.

- They are dependent on the sector for their livelihood.

- Labour-Intensive Sector: Dairy and livestock workers account for 70 million of the farm-dependent population, which includes cultivators and agricultural laborers.

- Helping Farmers During Natural Calamities: Milk production increases during crop failures caused by natural disasters because farmers place a greater emphasis on animal husbandry at that time.

Challenges Faced by the Sector

- Productivity: Indian cattle and buffaloes have among the lowest productivity. Improving productivity of farm animals is one of the major challenges.

- Crossbreeding of indigenous species with exotic stocks to enhance genetic potential of different species has been successful only to a limited extent.

- The sector also witnesses adulteration practices and overuse of antibiotics to boost production.

- Need of Investment: There is a shortage of organized dairy farms and there is a need for a high degree of investment to take the dairy industry to global standards.

- Fragmented Supply Chain: The fundamental challenge in dairy is maintaining quality and quantity within a diversified supply base.

- Due to its perishable nature, dairy requires more complex supply chain operations and logistics to ensure freshness and safety.

- Lumpy skin disease: Lumpy skin disease has, by all accounts, wreaked havoc. The official death count of 1.9 lakh cattle could be an underestimate.

- Price Sensitivity: Milk producers are highly susceptible to even minor shocks. For instance, small changes in the employment and income of consumers can leave a significant impact on milk demand.

- Lack of Budgetary Allocation: Despite the importance of the dairy sector in overall GDP, it receives less government budgeting than the agriculture sector.

- Impact of Emerging Market: The sector will also come under significant adjustment pressure to the emerging market forces.

- Though globalization will create avenues for increased participation in international trade, stringent food safety and quality norms would be required.

- Informal Dairy Economy: The majority of cattle raisers are unorganised unlike sugarcane, wheat, and rice-producing farmers.

- This nature further inhibits the creation of political clout to advocate for their rights.

- Only 18-20% is channelized via the organized sector.

- Need of Modern Technology: Lack of access to markets may act as a disincentive to farmers to adopt improved technologies and quality inputs.

Government’s Initiatives Related to the Dairy Sector

- Dairy Sahakar scheme: Union Minister of Home Affairs and Corporation launched the Dairy Sahakar scheme which will be implemented by NCDC under the Ministry of Cooperation to realize the vision, “from cooperation to prosperity”.

- Lumpi-ProVacInd: It is jointly developed by ICAR’s National Research Centre on Equines (NRCE) and the Indian Veterinary Research Institute (IVRI).

- It is a live attenuated vaccine, similar to those used against tuberculosis, measles, mumps and rubella.

- Rashtriya Gokul Mission: Launched in 2014, this scheme aims to promote indigenous breeds of cattle and enhance their productivity through breed improvement, nutrition, and health management.

- National Animal Disease Control Programme (NADCP): It is a flagship scheme launched in September 2019 for control of Foot and Mouth Disease and Brucellosis by vaccinating 100%.

- Dairy Entrepreneurship Development Scheme (DEDS): The department of Animal Husbandry, dairying and fisheries is implementing DEDS for generating self-employment opportunities in the dairy sector.

- e-GOPALA: The web version of the e-GOPALA application developed by the National Dairy Development Board (NDDB) has been launched to aid dairy farmers.

- Launching of Dairy mark: The NDDB and Bureau of Indian Standards (BIS) together developed a dedicated ‘Dairy Mark’ logo as a unified quality mark across India to boost the confidence of consumers in milk and milk products.

- A unified Conformity Assessment Scheme has been chalked out by BIS with the help of NDDB after extensive stakeholder consultations.

Way Forward:

Though India emerged as the largest milk-producing nation in the world, and if it has to capture overseas markets for its surplus milk, then the country must be export-competitive. Government should take robust steps in order to make dairy farming more lucrative for the small and marginalized farmers. It is the responsibility of all of us to develop the dairy industry by adopting environment-friendly and climate-smart technologies, keeping animal welfare in mind.

Source: DTE

Syllabus

- Mains – GS 3 (Environment)

Context: As we move from UN Climate Week to CoP-28, we need to stop ‘greenwishing’ and ‘greenwashing’ and start thinking about the instruments that will enable the private sector to channel more capital toward climate resilience and sustainable development.

About “The Three Greens”: Greenwashing, Greenwishing, and Greenhushing

- Greenwashing: Greenwashing refers to the deceptive practice of making false or exaggerated claims about the environmental friendliness of a company’s products, services, or practices.

- Example: Starbucks introduces straw-less lid citing it will help reduce environmental footprint.

- However, it contained more plastic than the old lid and straw combined together.

- Greenwishing: It refers to organisations expressing a desire to be more environmentally responsible without taking concrete actions to achieve those goals.

- It’s like making a wish for sustainability without any tangible actions directed in the required direction.

- Greenhushing: It implies a situation where an organisation intentionally downplays their positive environmental achievements.

- It might involve not publicising sustainable practices for various reasons, such as modesty, fear of criticism, or reducing external communication.

About Climate Finance and its significance:

- Climate finance refers to local, national or transnational financing—drawn from public, private and alternative sources of financing—that seeks to support mitigation and adaptation actions that will address climate change.

- The Convention, the Kyoto Protocol and the Paris Agreement call for financial assistance from Parties with more financial resources to those that are less endowed and more vulnerable.

- It is critical to addressing climate change because large-scale investments are required to significantly reduce emissions, notably in sectors that emit large quantities of greenhouse gases.

Need for practical and accessible investment solutions to fight climate change:

- Climate change affects all living beings: It is impacting both poor and rich countries, creating an urgent need for broad-based resilience and adaptation strategies.

- Potential of private sector resources: Scalable solutions require substantial commitments from the private sector, with many current climate-centric investments being illiquid and tightly wound up in private-equity funds.

- Inclusion of ordinary investors: Many current climate investments are inaccessible to ordinary investors and savers who are the most exposed to climate-driven food, water, and energy insecurity.

- Requirement of diversified solutions: Diversified, liquid, and profitable investment solutions like ETFs in climate-resilient sectors can mobilize capital effectively and are essential for inclusivity, including the unbanked global population.

Challenges associated with the climate finance:

- Unachieved goals: The UNFCCC Standing Committee on Finance (SCF) released a report on the progress made by developed countries towards achieving the goal of mobilising $100 billion per year.

- According to the report, it is widely accepted that:

- The $100 billion goal has not been achieved in 2020, and an earlier effort to mobilise private finance by the developed countries has met with comprehensive failure.

- Demands of developing countries: Developing countries have for a long time insisted that a significant portion of climate finance should come from public funds as private finance will not address their needs and priorities especially related to adaptation.

- Climate finance already remains skewed towards mitigation and flows towards bankable projects with clear revenue streams.

- Private climate finance: The OECD 2020 data shows that the mobilisation of private climate finance has underperformed against the expectations of developed countries.

- Many investors associate climate-centric investments with ‘social impact’ and reduced profitability.

- Contradictory claims: Many developed countries and multilateral development banks have emphasised the importance of private finance mobilised in their climate finance strategies, including by de-risking and creating enabling environments.

- According to the reports, these efforts have not yielded results at the scale required to tap into the significant potential for investments by the private sector and deliver on developed countries’ climate ambition.

- According to the report, it is widely accepted that:

Way Forward: Suggestive measures

- Need of significant private-sector resources: While the public sector has an important role to play in climate financing, scalable solutions require significant commitments of private-sector resources.

- CoP-28 offers an opportunity to rethink how we deliver such market solutions, and how we can harness digital innovation to scale up promising models.

- Mobilising capital: The solution is to create climate investments that are profitable, liquid and accessible to all.

- To mobilize capital at scale, we must draw on the global savings of individual investors as well as institutions such as pension funds, insurers, and sovereign funds.

- Seeking for reliable returns: Carefully selected Real Estate Investment Trusts (REITs) and exposure to greenfield developments through ETFs are two ways to secure reliable returns from climate-adaptation efforts.

- Green commodities: An orderly transition to a more resilient future requires massive investments not only in energy, food and water assets, but also in the metals and critical minerals used in renewable energy and electric vehicles (EVs).

- These include commodities such as soy, wheat, copper, rare-earth elements, cobalt, lithium, and so forth.

- Climate-aligned portfolio: A climate-aligned portfolio should include assets that provide a hedge against inflation and geo-economic risks, such as short-term and inflation-indexed sovereign bonds and gold.

- Greater investments in inflation-proof sovereign assets will allow governments to do more to finance the green transition.

Source: LM

Practice MCQs

Q.1) The Dudhwa Tiger Reserve is located in which of the following states?

- Uttar Pradesh

- Madhya Pradesh

- Karnataka

- Rajasthan

Q.2) Consider the following countries:

- Australia

- Canada, New

- China

- the United States

How many of the countries given above are part of Five Eyes Alliance group?

- One only

- Two only

- Three only

- All the four

Q.3) Consider the following paragraph and identify the historical monument:

It is a city predominantly in red sandstone, situated at a distance of 37 km from Agra, Uttar Pradesh. It was founded by the Mughal emperor Akbar in 1569. It is designated a UNESCO World Heritage site in 1986. When Akbar returned from his Gujarat campaign victorious in 1573, it was renamed to commemorate the victory. The structures has combined elements of Persian, Indian, and Central Asian styles.

Select the correct answer using the code given below:

- Fatehpur Sikri

- Qutb Minar complex

- I’timād-ud-Daulah

- None of the above

Mains Practice Questions

Q.1) Over the past few years, the Dairy sector has emerged as the most important sector of the rural economy in India. However, it has become one of the most vulnerable sectors of the rural economy too. Critically examine. (250 Words)

Q.2) Define the concepts related to climate change: Greenwashing, Greenwishing, and Greenhushing along with relevant examples (150 words)

Comment the answers to the above questions in the comment section below!!

ANSWERS FOR ’ 25th September 2023 – Daily Practice MCQs’ will be updated along with tomorrow’s Daily Current Affairs.st

ANSWERS FOR 23rd September – Daily Practice MCQs

Q.1) – a

Q.2) – c

Q.3) – d