IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS & MAINS Focus)

Syllabus

- Prelims –Science and Technology

Context: As per recent reports, the Laser Interferometer Gravitational-Wave Observatory project (LIGO)-India, is the next focus of Indian scientists after the Chandrayaan and Aditya missions.

Background:-

- Laser Interferometer Gravitational-Wave Observatory project (LIGO) observatory.

About Laser Interferometer Gravitational-Wave Observatory project (LIGO)-India:-

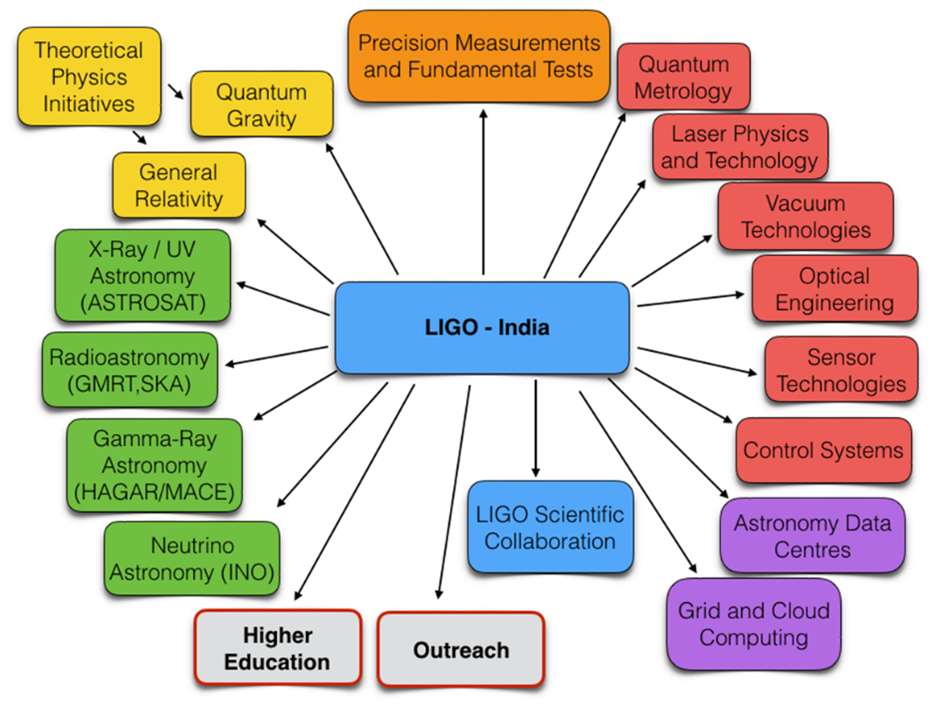

IMAGE SOURCE: LIGO-INDIA

- Location: Hingoli district of Maharashtra, India.

- Built by: the Department of Atomic Energy and the Department of Science and Technology with an MoU with the U.S. National Science Foundation.

- The LIGO-India Project aims to detect gravitational waves from the universe.

- Gravitational waves: They were first postulated (1916) in Albert Einstein’s General Theory of Relativity.

- These waves are produced by the movement of massive celestial bodies, such as black holes or neutron stars

- They are the ripples in spacetime that propagate outward.

- Four comparable detectors will be operating simultaneously around the globe to localize a source of gravitational waves anywhere in the sky. (International Space Station (ISS))

- LIGO-India will be the third of its kind in the world. (Space Economy of India)

- It is made to the exact specifications of the twin LIGO, in Louisiana (first) and Washington (second) in the U.S.

- The fourth detector will be in Kagra, Japan.

- LIGO: an international network of laboratories that detect gravitational waves.

- The LIGO in the US first detected gravitational waves in 2015, which led to a Nobel Prize in Physics in 2017.

Significance:-

- It will bring India into a prestigious international scientific experiment.

- It will bring advances in astronomy, astrophysics, and cutting-edge technology.

MUST READ: SpaceTech Innovation Network (SpIN)

SOURCE: THE INDIAN EXPRESS

PREVIOUS YEAR QUESTIONS

Q.1) Which one of the following countries has its own Satellite Navigation System? (2023)

- Australia

- Canada

- Israel

- Japan

Q.2) Recently, scientists observed the merger of giant ‘black holes’ billions of light-years away from the Earth. What is the significance of this observation? (2019)

- ‘Higgs boson particles’ were detected.

- ‘Gravitational waves’ were detected.

- Possibility of intergalactic space travel through a ‘wormhole’ was confirmed.

- It enabled the scientists to understand ‘singularity’.

Syllabus

- Prelims –Art and Culture

Context: Various classical dances of Kerala were performed during Onam celebrations held recently.

Background:-

- This year, Onam festivities began on 20th August 2023 and Thiruvonam fell on August 31 as the 10-day harvest festival was observed across the South Indian state of Kerala.

- It marks the beginning of the Malayalam year, called Kolla Varsham, and commemorates the return of the mythical King Mahabali with great enthusiasm and cultural fervor.

About Classical dances of Kerala:-

- Kerala is known for its rich cultural heritage. (Karakattam dance)

- It includes various classical dance forms, some of these performed during Onam 2023 celebrations include:-

Kathakali:-

- It originated in Kerala over 300 years ago. (Kathakali dance)

- It is one of the most famous classical dance forms of the state.

- It is One of the eight classical dances of India.

- It is a highly stylized and dramatic art form combining the elements of dance, music, acting, devotion, drama, costumes, and make-up.

- Kathakali performances retell the great stories of the past, mostly from Indian epics, or depict episodes from the Mahabali legend or other mythological stories associated with the festival, using hand and facial gestures and expressions.

Mohiniyattam:–

- It is a graceful and lyrical dance form. (Mohiniyattam)

- It is performed in honor of the Hindu god Vishnu in his incarnation as the enchantress Mohini.

- It is One of the eight classical dances of India.

- It is performed exclusively by women.

- It is characterized by gentle, flowing movements and expressive storytelling, narrating the stories related to King Mahabali during the Onam festival.

Koodiyattam:-

- It is recognized as a UNESCO Intangible Cultural Heritage.

- It is one of the oldest classical theater forms in the world.

- It involves elaborate and ritualistic performances with traditional costumes and makeup.

- It depicts stories from Hindu epics and Puranas that are sometimes staged during Onam.

Thiruvathirakali:-

- It is a traditional group dance.

- It involves graceful circular movements by the women and clapping of their hands to the rhythm of the music.

- This group dance is often performed by women.

- It is considered a celebration of womanhood.

- It is mostly performed in the evening under the moonlight.

Chakyar Koothu:-

- It is a traditional solo performance.

- It has the artist narrating episodes from epics like the Ramayana and the Mahabharata in a humorous and dramatic manner on Onam.

- It is not a dance form per se.

It is an integral part of Kerala’s performing arts tradition.

Ottamthullal:-

- The dance form was created by the renowned Malayalam poet Kunchan Nambiar.

- It involves a single performer narrating stories with dance and song in a satirical and humorous style.

- The performance is accompanied by a mridangam (barrel-shaped drum).

MUST READ: National Tribal Dance Festival 2022

SOURCE: HIDUSTAN TIMES

PREVIOUS YEAR QUESTIONS

Q.1) With reference to Manipuri Sankirtana, consider the following statements: (2017)

- It is a song and dance performance

- Cymbals are the only musical instruments used in the performance

- It is performed to narrate the life and deeds of Lord Krishna

Which of the statements given above is/are correct?

- 1, 2 and 3

- 1 and 3 only

- 2 and 3 only

- 1 only

Q.2) With reference to the famous Sattriya dance, consider the following statements: (2014)

- Sattriya is a combination of music, dance and drama

- It is a centuries-old living tradition of Vaishnavites of Assam

- It is based on classical Ragas and Talas of devotional songs composed by Tulsidas, Kabir and Mirabai

Which of the statements given above is/are correct?

- 1 only

- 1 and 2 only

- 2 and 3 only

- 1, 2 and 3

Syllabus

- Prelims – Government Initiatives

Context: The Lieutenant Governor of Delhi, Shri Vinai Kumar Saxena, distributed Honey Bee-Boxes and Toolkits under the ‘Gramodyog Vikas Yojna’ recently.

Background:-

- The Lieutenant Governor of Delhi, Shri Vinai Kumar Saxena, distributed Honey Bee-Boxes and Toolkits to 130 beneficiaries.

- The program was organized under the Khadi and Village Industries Commission (KVIC), Ministry of Micro, Small and Medium Enterprises, State Office Delhi, Government of India.

- Addressing the occasion, Shri Vinai Kumar Saxena emphasized the vital role played by the Khadi and Village Industries Commission in generating employment opportunities in rural India.

About Gramodyog Vikas Yojna:-

- Launched: March 2020.

- Ministry: Ministry of Micro, Small and Medium Enterprises (MSME)

- Objective: assisting and developing of agarbatti industry and its artisans.

- The programme aims to enhance the production of ‘Agarbatti’ in the country.

- It aims to create sustainable employment for the traditional Artisans, by providing them with regular employment and an increase in their wages.

- Components of the Yojana:-

- Research & Development and Product Innovation: R&D support would be given to the institutions that intend to carry out product development, new innovations, design development, product diversification processes, etc.

- Capacity Building: exclusive capacity building of staff, as well as the artisans, would be adequately addressed through the existing Multidisciplinary Training Centers (MDTCs) and institutions of excellence.

- Marketing & Publicity: The institutions will be provided market support. (Effects of globalization on the rural population of India)

About Khadi and Village Industries Commission (KVIC):-

- Establishment: 1957.

- Ministry: Ministry of Micro, Small and Medium Enterprises

- It is a statutory body established under the Khadi and Village Industries Commission Act, of 1956.

Objectives of KVIC:-

- To boost employment in the country. (Project Re-Hab)

- To promote the promotion and sale of Khadi articles.

Function:-

- It is charged with the planning, promotion, organization, and implementation of programmes for the development of Khadi and other village industries in rural areas.

- It coordinates with other agencies engaged in rural development wherever necessary.

MUST READ: Rural Manufacturing

SOURCE: PIB

PREVIOUS YEAR QUESTIONS

Q.1) Which of the following organisms perform the waggle dance for others of their kin to indicate the direction and the

distance to a source of their food? (2023)

- Butterflies

- Dragonflies

- Honeybees

- Wasps

Q.2) Which of the following statements is/are correct regarding the Maternity Benefit Amendment Act, 2017? (2019)

- Pregnant women are entitled to three months of pre-delivery and three months of post-delivery paid leave.

- Enterprises with creches must allow the mother a minimum of six creche visits daily.

- Women with two children get reduced entitlements.

Select the correct answer using the code given below.

- 1 and 2 only

- 2 only

- 3 only

- 1, 2 and 3

Syllabus

- Prelims –POLITY

Context: Kalahandi Gram Sabhas wrote to the National Commission for Schedule Tribes (NCST), invoking an atrocities act against the Jharkhand Divisional Forest Officer (DFO), recently.

Background of the issue:-

- DFO illegally seized a consignment of kendu leaves being transported from Odisha to West Bengal, a federation of Gram Sabhas alleges.

- The Kasturapadar and Khasiguda Gram Sabhas of the federation had issued transit permits to a company, Green India, for carrying kendu leaves (also known as tendu), which are used to roll beedi, from Kalahandi to Dhulian in West Bengal in May this year.

- On May 31, the company’s truck, along with 400 sacks of kendu, was seized during transit by the DFO of Simdega forest division in Jharkhand.

- The Mahasangh has alleged that the seizure is in violation of the Scheduled Tribes and Other Traditional Forest Dwellers (Recognition of Forest Rights) Act, 2006 (FRA) and the Scheduled Castes and the Scheduled Tribes (Prevention of Atrocities) Act, 1989.

- Scheduled Castes and the Scheduled Tribes (Prevention of Atrocities) Act, 1989: It is an Act to prevent the commission of offenses of atrocities against the members of the Scheduled Castes and the Scheduled Tribes.

- It provides for Special Courts for the trial of such offenses for the relief and rehabilitation of the victims of such offenses and for matters connected therewith or incidental thereto.

- The letter dated June 19, 2023, appealed NSCT to take legal action against the Simdega DFO for “illegal interference with the enjoyment of forest rights of Schedule Tribes and Other Traditional Forest Dwellers”.

About the National Commission for Schedule Tribes (NCST):-

- Establishment:

- Ministry: Ministry of Tribal Affairs.

- HQ: New Delhi.

- It was established by amending Article 338 and inserting a new Article 338A.

- It was done through the Constitution through the Constitution (89th Amendment) Act, 2003.

- By this amendment, the erstwhile National Commission for Scheduled Castes and Scheduled Tribes was replaced by two separate Commissions namely:-

- National Commission for Scheduled Castes (NCSC), and

- National Commission for Scheduled Tribes (NCST)

- The commission submits its report to the President annually.

- It gives data on the working of safeguards and measures required for the effective implementation of Programmers/ Schemes relating to the welfare and socio-economic development of STs.

Structure:-

- Term of office of Chairperson, Vice-Chairperson, and each member: three years from the date of assumption of charge.

- Chairperson has been given the rank of Union Cabinet Minister.

- Vice-Chairperson that of a Minister of State

- Other Members have the ranks of a Secretary to the Government of India.

Powers:-

- NCST is empowered to investigate and monitor matters relating to safeguards provided for STs under the Constitution under other laws or under Govt. order.

- It is also authorized to inquire into specific complaints relating to the rights and safeguards of STs and to participate.

- It can advise in the Planning Process relating to the socio-economic development of STs and evaluate the progress of their development under the Union and States.

MUST READ: Addition of Tribes in ST List

SOURCE: DOWN TO EARTH

PREVIOUS YEAR QUESTIONS

Q.1) If a particular area is brought under the Fifth Schedule of the Constitution of India, which one of the following statements best reflects the consequence of it? (2022)

- This would prevent the transfer of land from tribal people to non-tribal people.

- This would create a local self-governing body in that area.

- This would convert that area into a Union Territory.

- The State having such areas would be declared a Special Category State.

Q.2) With reference to India, the terms ‘Halbi, Ho, and Kui’ pertain to (2021)

- dance forms of Northwest India

- musical instruments

- pre-historic cave paintings

- tribal languages

Syllabus

- Prelims – International Relations

Context: Recently, Africa Climate Summit 2023 was inaugurated.

Background:-

- Despite having a small carbon footprint, Africa disproportionately bears the human toll of climate change.

- Thus, highlighting the urgent need for regional and global action, President William Ruto reminded us while inaugurating the Africa Climate Summit, 2023 (ACW23) on September 4, 2023, in Nairobi, Kenya.

About Africa Climate Summit 2023:-

- Date: 4th to 6th September 2023.

- Venue: Nairobi, Kenya. (Africa)

- The summit aims to address the increasing exposure to climate change and its associated costs, both globally and particularly in Africa.

- At the Africa Climate Summit, leaders will be called upon to make ambitious pledges and commitments.

- A comprehensive “Pledging and Commitment Framework” will be developed to guide these actions.

- The outcomes of the summit are critical for the African continent to arrive at a consensus and mobilize action in the lead-up to the upcoming 28th Conference of Parties (COP28) to the United Nations Framework Convention on Climate Change to be hosted in Dubai, United Arab Emirates.

Theme & Focus Areas:-

- Climate Action Financing.

- Green Growth Agenda for Africa.

- Climate Action and Economic Development.

- Global Capital optimization.

MUST READ: 27th COP of UNFCCC

SOURCE: DOWN TO EARTH

PREVIOUS YEAR QUESTIONS

Q.1) Consider the following statements : (2023)

- In India, the Biodiversity Management Committees are key to the realization of the objectives

- of the Nagoya Protocol.

- The Biodiversity Management Committees have important functions in determining access and benefit sharing, including the power to levy collection fees on the access of biological resources within its jurisdiction.

Which of the statements given above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Q.2) Climate Action Tracker” which monitors the emission reduction pledges of different countries is a : (2022)

- Database created by a coalition of research organizations

- Wing of “International Panel of Climate Change”

- Committee under “United Nations Framework Convention on Climate Change”

- Agency promoted and financed by the United Nations Environment Programme and World Bank

Syllabus

- Prelims –Defense

Context: As per recent reports, the Indian Army’s new Thal Sena Bhawan will conform with GRIHA-IV (Green Rating for Integrated Habitat Assessment) norms.

Background:-

- The Indian Army’s new Thal Sena Bhawan (TSB), coming up on a sprawling 39-acre site with a built-up area of 143,450 sq. m.

- The building will be ready by May-June 2025.

About Thal Sena Bhawan:-

- Area:143,450 sq. m.

- It has been designed to be earthquake-resistant.

- The complex is designed to cater to the needs of 5,600 personnel.

- It will bring together the Indian Army Headquarters currently split into eight pockets across Delhi, including South Block, Sena Bhawan, Hutments Area, R. K. Puram, and Shankar Vihar.

- Thal Sena Bhawan adheres to GRIHA-IV specifications and criteria.

- For instance, the topsoil of the entire site will be preserved, and its fertility will be maintained during the construction phase.

- This preserved soil will then be used for landscaping the area after construction.

- GRIHA: It is the national rating system that evaluates the environmental performance of a building holistically over its entire life cycle.

- It evaluates the environmental performance of a building holistically over its entire life cycle, thereby providing a definitive standard for what constitutes a ‘green building’.

- These buildings consume resources from municipal wastes or indirectly from emissions of electricity generation.

- The rating system, based on accepted energy and environmental principles, will seek to strike a balance between the established practices and emerging concepts, both national and international.

- It is under the Ministry of New and Renewable Energy.

- The ‘Thal Sena Bhawan’ is conceptualized as a multi-story green building. ( Green Buildings Need & Benefits)

- It will house offices, a residential area for security personnel, and basic amenities.

Significance:-

- The new structure will bring together various pockets of the Army headquarters spread across Delhi under one roof.

- It will improve working efficiency while reducing the carbon footprint and logistics requirements.

- It would also allow more family time for all personnel at peace posting in Delhi.

- The newly created Department of Military Affairs (DMA) headed by the Chief of Defence Staff (CDS) will work from here. This will help in jointness.

MUST READ: 12th GRIHA (Green Rating for Integrated Habitat Assessment) Summit

SOURCE: THE HINDU

PREVIOUS YEAR QUESTIONS

Q.1) With reference to Home Guards, consider the following statements: (2023)

- Home Guards are raised under the Home Guards Act and Rules of the Central Government.

- The role of the Home Guards is to serve as an auxiliary force to the police in the maintenance of internal security.

- To prevent infiltration on the international border/ coastal areas, the Border Wing Home Guards Battalions have been raised in some states.

How many of the above statements are correct?

- Only one

- Only two

- All three

- None

Q.2) Consider the following statements (2023)

- Ballistic missiles are jet-propelled at subsonic speeds throughout their flights, while cruise missiles are rocket-powered only in the initial phase of flight.

- Agni-V is a medium-range supersonic cruise missile, while BrahMos is a solid-fuelled intercontinental ballistic missile.

Which of the statements given above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Syllabus

- Prelims –Defense

Context: Recently, AG-365S of Marut Drones became the first DGCA-certified drone for dual usage.

Background:-

- Marut Drones has secured type certification approvals from the Director General of Civil Aviation (DGCA) for its AG-365S kisan drone for use in agriculture and also for drone pilot training given by the remote pilot training organization (RPTO).

- This certification allows the drone to be used in agriculture as well as for drone pilot training.

About AG-365S Drone:-

- Developed by: Marut Drones.

- Marut Drones: an Indian drone technology company based in Hyderabad.

- It is the first multi-utility agriculture small-category drone in India to receive the DGCA-approved type certificate.

- DGCA (Director General of Civil Aviation): The regulatory body responsible for overseeing civil aviation operations in India, including the certification and regulation of drones.

- It is a ‘Made-in-India’ kisan drone.

- It has been developed to help farmers reduce crop losses, lower the use of agrochemicals, and improve yields as well as profits.

- It aims to enhance crop yields, reduce agrochemical usage, and minimize crop losses.

- It is a multi-utility agricultural drone in the small category (less than 25kg).

- It has a flight endurance of 22 minutes.

- It is equipped with high-end sensors for smooth operations.

- It has undergone extensive testing to ensure the highest quality.

- It is a small-category drone developed by the Hyderabad-based Indian company.

- It has advanced features, including obstacle and terrain sensors.

- It has the capacity for multiple agricultural tasks.

- It is equipped with multiple payloads.

- One AG-365S can be used for spraying pesticides, and granular spreaders.

MUST READ: MQ-9B Predator Drone

SOURCE: THE HINDU

PREVIOUS YEAR QUESTIONS

Q.1) Recently, India signed a deal known as ‘Action Plan for Prioritization and Implementation of Cooperation Areas in the Nuclear Field’ with which of the following countries? (2019)

- Japan

- Russia

- The United Kingdom

- The United States of America

Q.2) The experiment will employ a trio of spacecraft flying in formation in the shape of an equilateral triangle that has sides one million kilometres long, with lasers shining between the craft.” The experiment in question refers to (2020)

- Voyager-2

- New Horizons

- LISA Pathfinder

- Evolved LISA

Should Agriculture Income be Taxed?

Syllabus

- Mains – GS 2 (Governance) and GS 3 (Economy)

Context: Recently, the debates were floated around exemptions and non-taxation of agricultural income in India.

- Agriculture employs about 50% of the population contributing approximately 17% to the GDP of the country.

- According to Indian Constitution, agriculture and the taxation of agricultural incomes has been a state subject.

- Accordingly, section 10(1) of the Income Tax Act, 1961, exempts agricultural income from taxation by the central government.

- This has led to rich farmers and landlords immune from the tax net.

History of Taxing Agriculture income:

- The issue of taxing agricultural income (and wealth) goes back to the 1960s.

- Seventh Schedule, entry 82 in the Union List mentions taxes other than agricultural income, while Entry 46 in the State List mentions taxes on agricultural income.

- Therefore, arguing that this is in the State List is valid.

- Income Tax Act of 1860 (which introduced income tax in India) it taxed agricultural income till 1886.

- Income tax act 1961 had provisions for taxing agricultural income.

- Agricultural Income Tax Acts are present in Bihar, Assam, Bengal, Orissa, Uttar Pradesh, Hyderabad, Travancore and Cochin and Madras and Old Mysore State.

- Therefore, states tax some kinds of agricultural income, such as plantations.

Significance of not taxing agricultural income:

- No revenue potential: Around 95% of the total assets are owned by small and marginal farmers which means only 5% of the farmers will be liable to pay the tax.

- Therefore, it will not have major revenue potential. So, the tax income would be very limited and it is not worth consideration.

- Burden on the poor: The income of small and marginal farmers is very low; they can hardly earn a living and thus are left with either no savings or a very small amount.

- The average per month income of a farm household in India in 2012-13 as per the National Sample Survey Office was just Rs. 6,491.

- The income-expenditure gap for a majority of farmers is in the negative.

- Lack of documentation and records: The small farmers are usually illiterate and uninformed and thus they are unaware of the procedure to make proper documentation of their land.

- Reduction in credits: If agricultural tax is imposed on farmers, it will reduce their chances of getting significant credits and it will lead to credit flowing only to rich farmers, as they’ll have a higher income to show.

- May lead to suicides: With so many farmers committing suicide because of pending debts, low productivity and small income, imposing agriculture tax may even increase the suicide rate.

- Fluctuating incomes and profit margins: There is a large fluctuation in the annual income of farmers. Harvests are unpredictable as they are affected by weather, disease and pests.

Various challenges:

- Political will: Many states may have been reluctant to tax agriculture incomes as they do not wish to lose vote bank of farmers.

- Moreover, India’s state legislatures have typically been populated by land owners who have been blocking efforts to impose a tax on themselves.

- Cash transactions: In India in particular, agriculture is harder to tax as it is based largely on cash transactions which are hard to track and trace.

- Cash transactions not routed through the banking system are difficult to verify and be used for assessment of agricultural incomes.

- Burden small farmers: In a country where 83% of the farming community comprises small and marginal farmers.

- Many farmers do not hold land and work on contract. Rich farmers would pass on the burden of tax on these farmers.

- Fraud “farmer” certificates: There is also a significant lack of credibility about the way states issue “farmer” certificates.

Way Forward

- A bold and dynamic approach is needed in India whereby all the stakeholders to organize a conclave to debate and discuss the issues concerning taxation of agricultural income in India.

- Agricultural income taxation must be integrated with non-agricultural income taxation.

- Land revenue tax hasn’t quite worked and must be replaced.

- If implemented this would be an indirect tax on commodities, like an excise or sales tax, which will get subsumed under GST.

- The income of the farmer will still be outside the ambit of income tax.

- The underlying argument in the current discussion is to bring more people under the tax net to expand the tax base and also curb tax evasion.

Source:LM

Syllabus

- Mains – GS 2 (Governance) and GS3 (Security)

Context: The Minister of State for Defence recently released the Maritime Infrastructure Perspective Plan (MIPP), 2023-37 at the second edition of the biennial Naval Commanders Conference.

About Maritime Infrastructure Perspective Plan (MIPP):

- It aims to synchronise and enmesh the infrastructure requirements of the Navy, over the next 15 years, through a comprehensive perspective plan model.

- It is aligned with the government’s vision on creation of sustainable infrastructure, and encompasses salient for compliance with broader policy directives on PM Gati Shakti project, disaster resilience, transition to net zero, among others.

- The Navy received a revised set of “IRS Rules and Regulations Handbook for Construction and Classification of Naval Combatants” to accommodate technological advancements and promote self-reliance in naval shipbuilding.

- This rule book represents the self-reliance of the naval shipbuilding industry and aims to keep pace with modern technology.

- Two new initiatives: the “Family Logbook for Defence Civilian Personnel of the Indian Navy” for personal records and the “Electronic Service Document Project” to enhance HR records within the Navy.

Significance of Maritime security for India:

- India as a maritime nation: With 12 major and 200+ non-major ports situated along its 7500 km long coastline and a vast network of navigable waterways.

- Trade: The country’s maritime sector plays a crucial role in its overall trade and growth, with 95% of the country’s trade volume and 65% of the trade value being undertaken through maritime transport.

- Blue economy: Marine fisheries sector is one major contributor to the economy and livelihood of the fishing community.

- There are almost three lakh fishing vessels.

- India’s foreign relations: Maritime security is a prominent feature of India’s relations with Indian Ocean littoral states.

- The Indian Ocean, which has been an “ocean of peace”, is now witness to rivalries and competitions.

Challenges associated maritime sector in India:

- Inadequate infrastructure: India’s maritime infrastructure, including ports and inland waterways, is inadequate and requires significant investment and development.

- Poor connectivity: The lack of connectivity between ports, as well as ports and hinterland, leads to inefficiencies and increased costs.

- Skill gaps: There is a shortage of skilled manpower in the maritime sector, including seafarers, engineers, and other professionals.

- Environmental concerns: The maritime sector can have a significant impact on the environment, and there are concerns around issues such as oil spills, pollution, and the impact of climate change.

- Security challenges: Terrorism(26/11 attack), arms smuggling, piracy, drug trafficking, illegal migration and natural disasters became the major challenges in the maritime domain.

- China factor: With the growing Chinese belligerence, efforts to further strengthen maritime security and surveillance of India’s coastline needs to be undertaken.

India’s Initiatives for Maritime Security:

- Security and Growth for All (SAGAR) Policy: India’s SAGAR policy is an integrated regional framework, unveiled by the Indian Prime Minister during a visit to Mauritius in March 2015.

- SAGAR is a maritime initiative which gives priority to the Indian Ocean region (IOR) for ensuring peace, stability and prosperity of India in the Indian Ocean region.

- Abiding by the International Law: India has time and again reiterated its commitment to respecting the rights of all nations as per the UN Convention on Law of Sea (UNCLOS)

- UNCLOS 1982, also known as Law of the Sea divides marine areas into five main zones namely: Internal Waters, Territorial Sea, Contiguous Zone, Exclusive Economic Zone (EEZ), and the High Seas.

- Data Sharing: Sharing data on threats to commercial shipping is an important component of enhancing maritime security.

- India established an International Fusion Centre (IFC) for the Indian Ocean region in Gurugram in 2018.

Source: The Hindu

MUST READ: India’s blue economy

Practice MCQs

Q1) Consider the following pairs:

| Classical Dance | State |

| 1.Sattriya | Mizoram |

| 2.Kuchipudi | Andhra Pradesh |

| 3.Bharatnatyam | Kerala |

How many of the above pairs are correctly matched?

- Only one

- Only two

- All three

- None

Q2) Consider the following statements

Statement-I:

AG-365S Drone is a ‘Made-in-India’ Kisan drone.

Statement-II:

It does not have the capacity to operate multiple agricultural tasks at a time

Which one of the following is correct in respect of the above statements?

- Both Statement-I and Statement-II are correct and Statement-II is the correct explanation for Statement-I

- Both Statement-I and Statement-II are correct and Statement-II is not the correct explanation for Statement-I

- Statement-I is correct but Statement II is incorrect

- Statement-I is incorrect but Statement II is correct

Q3) With reference to the National Commission for Schedule Tribes (NCST), consider the following statements:

- It is a statutory body.

- It was established in 1988.

- It submits its report to the President annually.

How many of the statements given above are correct?

- Only one

- Only two

- All three

- None

Main Practice Questions

Q.1) Analyse the significance of exempting agriculture from taxation in India? What are the constitutional provisions directing exemption? Discuss the challenges of exempting agriculture from taxation. (250 words)

Comment the answers to the above questions in the comment section below!!

ANSWERS FOR ’ 6th September 2023 – Daily Practice MCQs’ will be updated along with tomorrow’s Daily Current Affairs.st

ANSWERS FOR 5th September – Daily Practice MCQs

Q.1) – b

Q.2) – c

Q.3) – c