IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS & MAINS Focus)

Syllabus

- Prelims –ECONOMY

Context: Recently, REC Limited issued the first Japanese Yen green bonds worth JPY 61.1 billion.

Background:-

- REC Limited, a Maharatna Central Public Sector Enterprise (CPSE) under the Ministry of Power, has achieved a significant milestone by issuing its inaugural Japanese Yen (JPY) 61.1 billion (approximately Rs 3,500 crore) green bonds.

About Yen green bonds:-

- It is REC Limited’s eleventh venture into the international bond market and inaugural Yen Bond issuance, which is also the first Yen Green Bond issuance by any Indian PSU.

- These bonds, part of the $ 10 billion global medium-term notes programme, span 5-year, 5.25-year, and 10-year tenures.

- Proceeds from the bond issuance will be dedicated to financing eligible green projects, adhering to REC Limited’s green finance framework, Reserve Bank of India’s (RBI) external commercial borrowings guidelines, and relevant approvals.

- It is the first Yen Green Bond issuance by any Indian PSU.

- It is the largest ever Euro-Yen issuance in South and South East Asia.

- It is the largest Yen-denominated issuance from India.

- It is the largest non-sovereign Yen-denominated issuance ever from South and South East Asia.

About green bonds:-

- Green bonds are financial instruments designed to raise capital specifically for projects that have positive environmental and/or climate benefits.

- Green bonds function similarly to regular bonds, offering fixed or variable interest rates to investors. However, the key difference lies in the use of proceeds.

- They offer investors a platform to engage in good practices, influencing the business strategy of bond issuers.

Benefits:-

- Positive Impact on Environment

- Attracts Investment

- Alternative to Bank Loan: Green bonds are also an effective tool in driving down the cost of capital and reducing asset-liability mismatches.

MUST READ: Sovereign Green Bonds (SGB)

SOURCE: BUSINESS STANDARD

PREVIOUS YEAR QUESTIONS

Q.1) Which one of the following best describes the term “greenwashing”? (2022)

- Conveying a false impression that a company’s products are eco-friendly and environmentally sound

- Non-inclusion of ecological/ environmental costs in the Annual Financial Statements of a country

- Ignoring the consequences of disastrous ecological while infrastructure development undertaking

- Making mandatory provisions for environmental costs in a government project/programme

Q.2) With reference to the India economy, what are the advantages of “Inflation-Indexed Bonds (IIBs)”? (2022)

- Government can reduce the coupon rates on its borrowing by way of IIBs.

- IIGs provide protection to the investors from uncertainty regarding inflation.

- The interest received as well as capital gains on IIBs are not taxable.

Which of the statements given above are correct?

- 1 and 2 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Syllabus

- Prelims –GOVERNMENT SCHEMES

Context: Recently, the Central Board of Secondary Education (CBSE) issued instructions for Residential Private Schools interested in joining the Scheme for Residential Education for Meritorious Scheduled Caste (SC) Students (SHRESHTA).

Background:-

- According to the official notification, eligible schools must be private residential institutions affiliated with CBSE up to class 12, operational for at least 5 years, and boasting a pass percentage of 75 or more in class 10 and 12 over the last 3 years.

About SHRESHTA Scheme:-

- Launched: December, 2021.

- Ministry: Ministry of Social Justice and Empowerment.

- Objective: for the purpose of providing seats for the meritorious SC boys and girls in the best private residential schools in the country.

Salient Features:-

- This scheme was launched for Scheduled Castes, as they have faced historical injustices in a hierarchical society and education is the most powerful tool to empower them as a community.

- The scheme will provide a level playing field to the poor and meritorious SC students.

- It aims to enhance the reach of development Intervention of the Government and to fill the gap in service-deficient SCs dominant areas, in the sector of education through the efforts of grant-in-aid institutions (run by NGOs) and residential high schools offering high-quality education and provide the environment for socio-economic upliftment and overall development of the Scheduled Castes (SCs). (New National Education Policy)

Modes of implementation:-

The scheme is being implemented in two Modes:-

SHRESHTA schools:-

- Under this, each year a specified number of meritorious SC students in States/UTs will be selected through the National Entrance Test for SHRESHTA (NETS) to be conducted by the National Testing Agency (NTA).

- These would be admitted to the best private residential schools affiliated by the CBSE/State Board in classes 9th and 11th for completion of education till 12th standard.

- Selection of schools: Best performing CBSE-based private residential schools, having more than 75% pass percentage for classes 10 and 12 for the last three years are selected by a Committee for admission of selected students.

- Eligibility/Selection of students: Approx 3000 (1500 for 9th class and 1500 for class 11th tentative) SC students, whose parent’s annual income is up to 2.5 lakh, are selected every year under the Scheme through a national-level test conducted by the National Testing Agency (NTA).

- The choices of schools shall be offered to the students in accordance with their merit. (Education & Nation Building)

NGO/VO-operated Schools/Hostels:

- These include EXISTING COMPONENT, Guidelines hereinafter applicable only for Mode 2 of the Scheme, Schools/Hostels.

- These are run by VOs/NGOs and other organizations having higher classes (up to class 12) and who have been receiving Grant-in-aid will be continued, subject to satisfactory performance.

MUST READ: Gender gap in education

SOURCE: FREE PRESS JOURNAL

PREVIOUS YEAR QUESTIONS

Q.1) Which of the following is/are the aim/aims of the “Digital India” Plan of the Government of India? (2018)

- Formation of India’s own Internet companies like China did.

- Establish a policy framework to encourage overseas multinational corporations that collect Big Data to build their large data centers within our national geographical boundaries.

- Connect many of our villages to the Internet and bring Wi-Fi to many of our schools, public places, and major tourist centres.

Select the correct answer using the code given below:

- 1 and 2 only

- 3 only

- 2 and 3 only

- 1, 2 and 3

Q.2) What is the aim of the programme ‘Unnat Bharat Abhiyan’? (2017)

- Achieving 100% literacy by promoting collaboration between voluntary organizations the government’s education system and local communities.

- Connecting institutions of higher education with local communities to address development challenges through appropriate technologies.

- Strengthening India’s scientific research institutions in order to make India a scientific and technological power.

- Developing human capital by allocating special funds for health care and education of rural and urban poor, and organizing skill development programmes and vocational training for them.

Syllabus

- Prelims –ECONOMY

Context: Recently, the Government of India slashed the windfall tax on petroleum crude to Rs 1,700 a tonne from 2,300 rupees a tonne.

Background:-

- The cut will be effective from Jan. 16, the order said.

About Windfall Tax:-

- Windfall taxes are designed to tax the profits a company derives from an external, sometimes unprecedented event.

- The term “windfall” refers to an unexpected rise in profits.

- These are profits that cannot be attributed to something the firm actively did, like an investment strategy or an expansion of business.

- Example: The most common industries that fall target to windfall gains tax include oil, gas, and mining.

- Typically, it’s levied as a one-off tax retrospectively over and above the normal rates of tax.

- It can be used to fund social welfare schemes, and as a supplementary revenue stream for the government.

Need for Windfall Tax:-

- To narrow the country’s widened trade deficit on account of rising prices of oil, gas, and coal.

- To redistribute the unexpected gains when high prices benefit producers at the expense of consumers.

- To fund social welfare scheme.

- As a supplementary revenue stream for the government.

MUST READ: Fuel Tax

SOURCE: ECONOMIC TIMES

PREVIOUS YEAR QUESTIONS

Q.1) What is/are the most likely advantages of implementing ‘Goods and Services Tax (GST)’? (2017)

- It will replace multiple taxes collected by multiple authorities and will thus create a single market in India.

- It will drastically reduce the ‘Current Account Deficit’ of India and will enable it to increase its foreign exchange reserves.

- It will enormously increase the growth and size of the economy of India and will enable it to overtake China in the near future.

Select the correct answer using the code given below:

- 1 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Q.2) With reference to India’s decision to levy an equalization tax of 6% on online advertisement services offered by non-resident entities, which of the following statements is/are correct? (2018)

- It is introduced as a part of the Income Tax Act.

- Non-resident entities that offer advertisement services in India can claim a tax credit in their home country under the “Double Taxation Avoidance Agreements”.

Select the correct answer using the code given below:

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Syllabus

- Prelims –HISTORY

Context: Recently, Guru Gobind Singh Jayanti, or the Prakash Parv of the tenth Sikh Guru, was celebrated.

Background:-

- Guru Gobind Singh Jayanti, also known as Prakash Utsav, is a significant Sikh festival commemorating the birth anniversary of Guru Gobind Singh Ji, the tenth and last Sikh Guru.

- It was celebrated on January 17 this year.

About Guru Gobind Singh:-

IMAGE SOURCE: blogspot.com

- Birth: January 5, 1671.

- Death: 21 October, 1708.

- He was the tenth and last of the Gurus of Sikhism.

- He became Guru at the age of nine, in 1676, following the martyrdom of his father, the ninth Guru, Guru Tegh Bahadur Ji (killed by Aurangzeb).

- He is variously revered as Sarbans Dani (the merciful donor, who sacrificed his all), Mard Agamra (man without any parallels), Shah-e-Shahenshah (emperor of emperors), Bar do Alam Shah (ruler of both worlds), amongst others.

- He founded the Khalsa Panth in 1699, a community of baptized Sikhs dedicated to living a life of courage, sacrifice, and service.

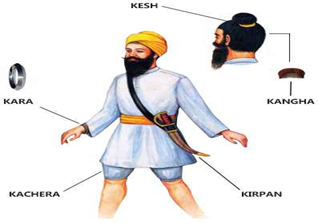

- The Five Ks: He introduced the five Ks – Kesh (uncut hair), Kangha (comb), Kirpan (sword), Kaccha (undergarment), and Kara (steel bracelet), symbolizing the ideals of the Khalsa.

- He was a divine messenger, a warrior, a poet, and a philosopher

- He completed the Guru Granth Sahib Ji, in the final form that we find today.

- Guru Gobind Singh Ji created the revered khalsa Vani “Waheguru Ji Ka Khalsa, Waheguru Ji Ki Fateh”.

MUST READ: Sri Guru Teg Bahadur Ji

SOURCE: TIMES OF INDIA

PREVIOUS YEAR QUESTIONS

Q.1) The world’s second tallest statue in sitting pose of Ramanuja was inaugurated by the Prime Minister of India at Hyderabad recently. Which one of the following statements correctly represents the teachings of Ramanuja? (2022)

- The best means of salvation was devotion.

- Vedas are eternal, self-existent and wholly authoritative.

- Logical arguments were meant for the highest bliss.

- Salvation was to be obtained through meditation.

Q.2 ) Consider the following Bhakti Saints: (2013)

- Dadu Dayal

- Guru Nanak

- Tyagaraja

Who among the above was/were preaching when the Lodi dynasty fell and Babur took over?

- 1 and 3

- 2 only

- 2 and 3

- 1 and 2

Syllabus

- Prelims –ENVIRONMENT AND ECOLOGY

Context: Recently, the Commission for Air Quality Management (CAQM) presented an action plan January 2, 2024 to the NGT.

Background:-

- It is aimed at improving the air quality in the National Capital Region (NCR) and its surrounding areas.

- CAQM’s proposed plan is multi-sectoral, detailing specific timelines and identifying responsible nodal agencies.

- Key aspects of the plan include reducing industrial pollution, curtailing air pollution from diesel generators (DG) sets and tackling emissions from thermal power plants (TPP).

About Commission for Air Quality Management (CAQM):-

- Establishment: 2020.

- It was formed by an ordinance in October 2020.

- HQ: Delhi. (CAQM)

- The commission replaces the Environment Pollution (Prevention and Control) Authority (EPCA).

-

- EPCA: it is a Supreme Court-mandated body tasked with taking various measures to tackle air pollution in the National Capital Region.

- It was notified in 1998 by Environment Ministry under Environment Protection Act, 1986.

Objectives of CAQM:-

- For Air Quality Management in National Capital Region and Adjoining Areas. ( Delhi and Air Pollution)

- For better co-ordination, research, identification and resolution of problems surrounding the air quality index and

- For matters connected therewith or incidental thereto.

Powers of the CAQM:-

- The rulings by the Commission on air pollution will override anything contained in any other law.

- The powers of the Commission will also supersede that of any other body in matters of air pollution..

- The Commission will have the power to take measures, issue directions and entertain complaints “for the purpose of protecting and improving the quality of air in the National Capital Region”.

- It will also coordinate action taken by states on air pollution and will lay down parameters for air quality and emission or discharge of environmental pollutants.

- It will also have powers to restrict industries in any area, carry out random inspections of any premises including factories and be able to close down an industry or cut its power and water supply in case of non-compliance.

- It will also be monitoring the measures taken by the States to prevent stubble burning.

Merits of CAQM:-

- Effective Mechanism to tackle Pollution: The permanent Commission envisages a multi-sectoral, public participatory, multi-state dynamic body for combating pollution on a war footing.

- More Teeth: It will now be binding on state governments to follow the directions of the Commission regarding air quality management.

- Consolidated Approach: The commission will have the power to coordinate with relevant state and central governments on the multi-sector plan including industry, power plants, agriculture, transport, residential and construction.

- Penal Powers: The penalty for non-compliance shall be imprisonment of up to five years or a fine up to Rs 1 crore, or both.

- Relieves Supreme Court: The Centre seeks to relieve the Supreme Court from having to constantly monitor pollution levels through various pollution-related cases.

- Participatory Democracy: the Commission would function under the oversight of the elected representatives with regular reports to the Parliament.

MUST READ: Initiatives and Measures for Prevention of Air Pollution

SOURCE: DOWN TO EARTH

PREVIOUS YEAR QUESTIONS

Q.1) Consider the following: (2023)

- Aerosols

- Foam agents

- Fire retardants

- Lubricants

In the making of how many of the above are hydrofluorocarbons used?

- Only one

- Only two

- Only three

- All four

Q.2) In the context of WHO Air Quality Guidelines, consider the following statements: (2022)

- The 24-hour mean of PM2.5 should not exceed 15 ug/m3 and annual mean of PM2.5 should not exceed 5 ug/m3.

- In a year, the highest levels of ozone pollution occur during periods of inclement weather.

- PM10 can penetrate the lung barrier and enter the bloodstream.

- Excessive ozone in the air can trigger asthma.

Which of the statements given above is correct?

- 1, 3 and 4

- 1 and 4 only

- 2, 3 and 4

- 1 and 2 only

Syllabus

- Prelims –GEOGRAPHY

Context: Recently, Nayagarh Kanteimundi Brinjal received a GI Tag.

About Nayagarh Kanteimundi Brinjal:-

- Location: Odisha.

- Nayagarh Kanteimundi Brinjal is known for its prickly thorns on the stems and the whole plant.

- The green and round fruits contain more seeds as compared to other genotypes.

- It is famous for its unique taste and relatively short quick cooking time.

- The plants are resistant to major insects.

- They can be grown with minimal pesticide.

- It is being widely cultivated in Nayagarh district of the state.

- The growers are getting a yield of up to 200 quintals per hectare and selling at around Rs 60 per kg.

- Historical records also suggest that the locals got the brinjal from the hilly areas.

- They collected seeds from it and started raising seedlings nearly 100 years ago.

MUST READ: GI Tag for Mithila Makhana

SOURCE: THE INDIAN EXPRESS

PREVIOUS YEAR QUESTIONS

Q.1) With reference to the “Tea Board” in India, consider the following statements: (2022)

- The Tea Board is a statutory body.

- It is a regulatory body attached to the Ministry of Agriculture and Farmers Welfare.

- The Tea Board’s Head Office is situated in Bengaluru.

- The Board has overseas offices in Dubai and Moscow.

Which of the statements given above is correct?

- 1 and 3

- 2 and 4

- 3 and 4

- 1 and 4

Q.2) With reference to the ‘Changpa’ Community of India, consider the following statements: (2014)

- They live mainly in the state of Uttarakhand

- They rear the Pashmina goats that yield fine wool

- They are kept in the category of Scheduled Tribes

Which of the given statements is/are correct?

- 1 only

- 2 and 3 only

- 3 only

- 1, 2 and 3

Practice MCQs

Q1) Consider the following pairs:

| SCHEME | MINISTRY |

| Atal Beemit Vyakti Kalyan Yojna | Ministry of Labor & Employment |

| MPLADS (Members of Parliament Local Area Development Scheme) | Ministry of Finance |

| One District One Product Scheme | Ministry of Commerce & Industry |

How many of the above pairs are correctly matched?

- Only one

- Only two

- All three

- None

Q2) Consider the following statements

Statement-I :

SHRESHTA Scheme is under the Ministry of Education.

Statement-II :

It is for the purpose of providing seats for the meritorious SC boys and girls in the best private residential schools in the country.

Which one of the following is correct in respect of the above statements?

- Both Statement-I and Statement-II are correct and Statement-II is the correct explanation for Statement-I

- Both Statement-I and Statement-II are correct and Statement-II is not the correct explanation for Statement-I

- Statement-I is correct but Statement II is incorrect

- Statement-I is incorrect but Statement II is correct

Q3) With reference to the Nayagarh Kanteimundi Brinjal, consider the following statements:

- The green and round fruits contain more seeds as compared to other genotypes.

- It takes a long cooking time.

- They need a large amount of pesticide.

How many of the statements given above is/are correct?

- 2 only

- 1, 2 and 3 only

- 1 and 3 only

- 1 only

Comment the answers to the above questions in the comment section below!!

ANSWERS FOR ’ 19th January 2024 – Daily Practice MCQs’ will be updated along with tomorrow’s Daily Current Affairs.st

ANSWERS FOR 18th January – Daily Practice MCQs

Q.1) – a

Q.2) – c

Q.3) – a