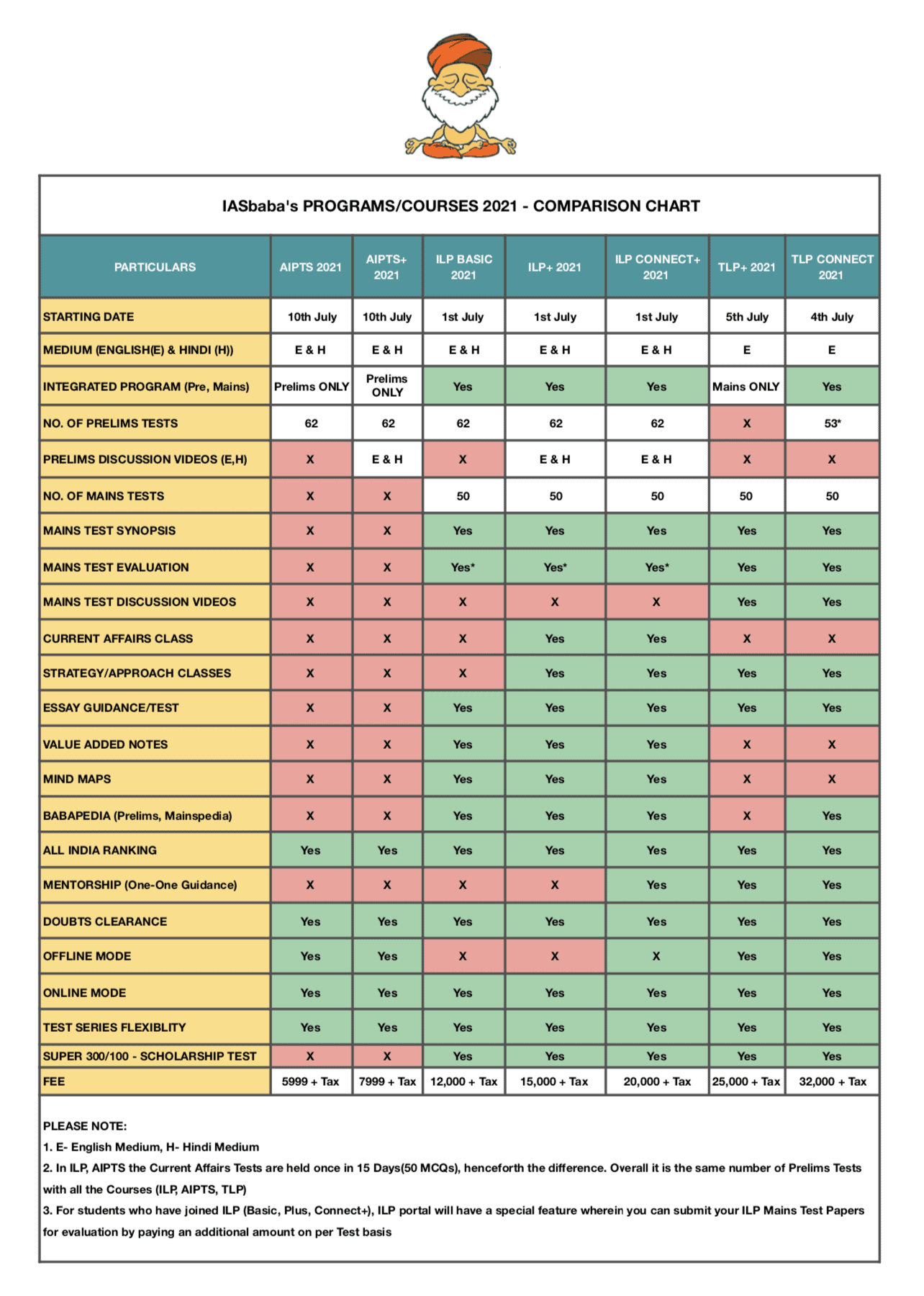

- ILP 2021 is the Most Comprehensive ONLINE Programme for UPSC aspirants. INTEGRATION OF PRELIMS, MAINS AND INTERVIEW PREPARATION. Smartness is to integrate your preparation in a common string of theme-based understanding of concepts. ILP has been designed minutely to meet this need. You will prepare for concepts in entirety keeping in mind the needs and orientation required for each stage of the examination.

- DAILY STUDY PLAN with DAILY TARGETS/PLANNING: Those who fail to plan, plan to fail. ILP does the planning for you in the most systematic and logical way. The plans are made to keep you on track as well on your toes. In the plan, you will get day-wise coverage of the syllabus, sources to refer and focus areas.

- The detailed plan covers the Prelims & Mains Syllabus which will take care of your overall preparation in the form of Daily Targets, Every 10th Day a Prelims and Mains Test, Sources to refer and the best Value-Added Notes (VAN) for every subject.

- This is the heart and soul of ILP-2021 that needs to be followed with utmost sincerity.

- Minimum Sources– The sources to be referred have been kept to the minimum. If you go through the plan, you will find that we have confined our sources to maximum of 2 per subject. It has been done to prevent a candidate from wasting their precious time in going through the repetitive and irrelevant sources available in the market.

- Revision- Due consideration has been given for Revision that will help to consolidate what you have learnt in a week’s time. Since the process is long and intensive, the lack of revision can be fatal. Therefore, we have given adequate room for revision and consolidation.

Please read -> IMPORTANT GUIDELINES FOR ILP 2021 on how this course is structured and how to use ILP Program effectively.

- Comprehensive Value Add Notes (VAN): With our value add notes (VAN), you will be able to declutter the complexity of UPSC syllabus. The VANs are high-quality specialised reading materials to give you an edge over your competitors. VANs have been designed intelligently to give separate prelims and mains focus pointers to make your understanding seamless and smooth. You need not look beyond sources other than the standard ones and our VAN.

For Example:

- For Ancient History and Art & Culture, you need to refer ONLY two sources – New NCERT – Themes in Indian History (Part 1) and IASbaba’s Value Add Notes (VAN – which covers OLD NCERT R.S Sharma, Ancient & Medieval India by Poonam Dalal (McGraw Hill), http://ccrtindia.gov.in/ (website))

- For Economics – ONLY IASbaba’s VAN along with Babapedia (Current Affairs).

- For Environment, Science & Technology – ONLY IASbaba’s VAN along with Babapedia (Current Affairs) will cover all your Prelims and Mains syllabus. You don’t have to refer to any other books!

We have simplified the VAN covering all important aspects so that it can be your ‘One Stop Source for UPSC Preparation’.

- BABAPEDIA – One-Stop Destination of Current Affairs Preparation (Prelims + Mains):

We understand that covering current affairs is going to be a real challenge for many aspirants. Given the huge sources to refer to, n’ number of materials flooded in the market, most of the times students are confused about which sources to refer to? what to read? what not to read? to what depth to read?

Here comes Babapedia to your rescue. Babapedia is divided into Prelimspedia and Mainspedia for both your prelims and mains preparation. It is one of its kind compendium of current affairs.

Prelimspedia gets updated on a daily basis. You will never be required to do the drudgery of note making for current affairs. The only thing required of you is to log into your ILP account every morning and go through the precise and crisp current affairs notes updated daily on Babapedia! Isn’t that awesome?

Mainspedia (Mains Datahub) – One of its kind platform (another Unique feature of ILP) for Mains Answer Writing Skills; best data organisation and usage for examination. This is updated on weekly basis. It is arranged and organized into various subtopics for all the contemporary aspects related to Paper 1, 2, 3 and 4. Under each topic, various subsections will be created and it will be updated regularly for you to have the best material/data at one place. You can keep making your own notes taking inputs from the data updated in Mainspedia on a regular basis. Mainspedia will have inputs from all possible contemporary issues and from all possible resources like Newspapers (The Hindu, Indian Express, Economics Times), PIB, PRS, RSTV, and important Government Websites. CLICK HERE TO SEE THE SAMPLE

Please Note: You will get unlimited complimentary access to Current Affairs content since the year 2016-2020. Babapedia is categorized Day-wise, Month-wise and Subject-wise, to make it very user-friendly and easily accessible!

- ALL INDIA PRELIMS TEST SERIES (AIPTS) TOTAL = 62 TESTS

52 GS (Paper -1) TESTS and 10 CSAT (Paper -2) TESTS

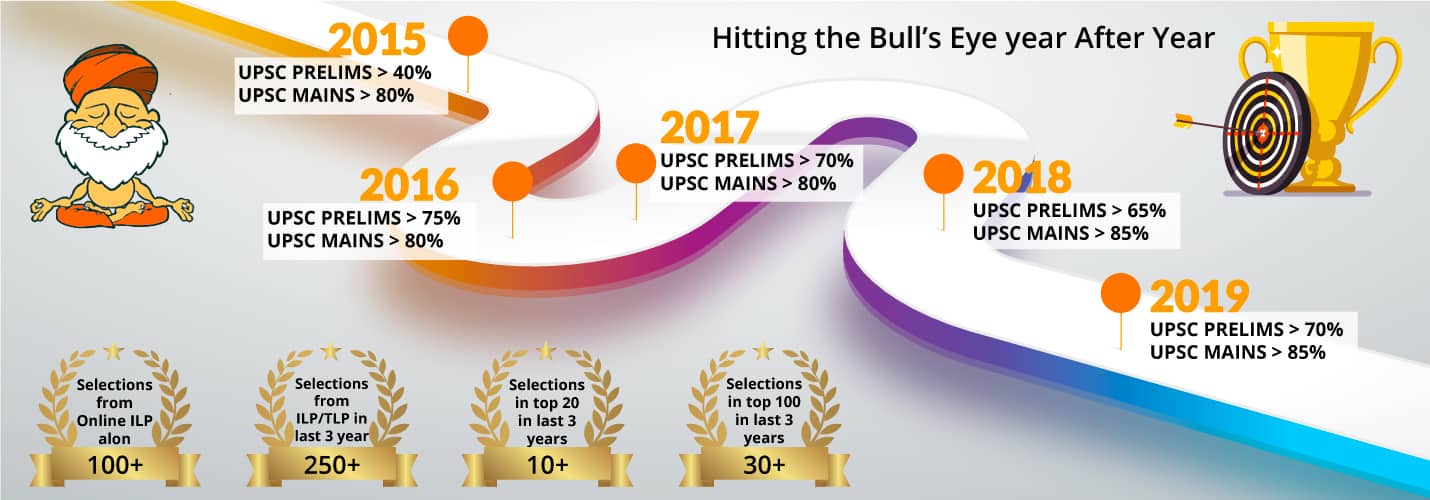

- IASbaba is known for its quality coverage and it is a testimony that we have been able to HIT the bull’s eye in Prelims and Mains both over the period of last 4 years. The closeness and exact repetition of Questions from our Tests needs no mention.

- High-quality tests with detailed solutions will help you keep a track on your preparation. You will also get the chance to compete with thousands of sincere aspirants from the ILP community.

- The Prelims Tests are designed carefully and with a lot of efforts to match the standards set by UPSC. Questions are graded. easy, moderate, difficult and very difficult. The overall level of the test is kept a notch higher than UPSC so that students of IASbaba can have an edge and can handle uncertainty much better than the rest.

- A few thought-provoking previous years questions of UPSC will also be covered as UPSC as a knack of picking up concepts covered in previous year question papers of exams conducted by UPSC.

- DETAILED SOLUTIONS will be provided after the tests. Detailed Solution Techniques to Decipher the Correct Answer (Elimination Technique).The solution document is made very exhaustive and revision friendly at the same time. The Detailed Solution itself will act as a Source of learning and Revision.

- With increasing IMPORTANCE OF CURRENT AFFAIRS (CA) in the exam, we have Current Affairs Test held every 15 days (50 MCQ’s). These 20 Separate CA Tests will help you in quick revision and consolidation.

- REVISION TESTS AND FULL MOCK TESTS- Tests intended to make the candidates revise the previously covered topics shall be posted on a regular basis along with detailed solutions, scores, and ranking (as per the given Plan).

- CSAT TESTS-10 FULL MOCKS – CSAT papers are designed on the standard’s, difficulty level and pattern followed by UPSC.

- DOUBTS RESOLUTION PAGE- We have a comment section for every question in a Test. So this gives you a scope to clear your doubts which are question-specific. All your doubts will be resolved by IASbaba’s team within 48 hours (maximum).

- ALL INDIA RANKING – the scores and ranks will be displayed after every test, one can clearly monitor his/her progress in a continuous manner. Since our subscriber base is huge, you will not only get to know the real competition but will also bring in seriousness and discipline in your preparation

- DETAILED ASSESSMENT of your Performance-based on Time-Analytics’ and Subject-wise Analytics’. This will help you gauge your efficiency per question (assist you in time-management) and to introspect your strength and weaknesses in a particular subject.

- There is no fixed time to take the tests. It’s flexible! But we would advise you to strictly follow the schedule as this will bring in discipline in your preparation and you will cover the syllabus on time.

- MAINS TESTS & SYNOPSIS– TOTAL = 50 TESTS

- 30 Micro MAINS TESTS & SYNOPSIS (Before Prelims)

- 20 FULL MOCK MAINS TESTS & SYNOPSIS (Post Prelims)

Mains Mock Tests with detailed Synopsis: What makes ILP even more special is the integration of mains mocks. This will help you to learn the art of answer writing from day one. With the VAN and mains mocks with a detailed synopsis, your mains preparation will always be on track.

In order for you to have a daily answer writing practice, a question will be posted every day on the ILP platform. You can write an answer on paper and upload its picture on the platform so that peer review can take place and you can improve. On the tenth day, the compiled question paper and detailed synopsis will be posted so that you can self-evaluate and learn.

Please Note: Mains Answers will NOT be evaluated. Only Synopsis/Model Answer will be provided. We have planned to keep Mains Evaluation in Package Format. You have to pay extra to get Mains Answers Evaluated. Its details will be announced once the programme start.

- MIND MAPS for GS MAINS: There are several mental techniques to enhance your learning experience. One such technique is mind map which has been proven very effective to revise and retain the topics. The main reasons for this are –

- It is pictographic.

- It helps you to visualize an image rather than the paragraphs. This way you will recall it much easier in the exam.

- It is crisp, so more information can be squeezed in a small space.

- You wouldn’t require bulky notes before the exam to revise.

- ESSAY GUIDANCE: Essay is an important part of one’s preparation of Civil Services exam. Since it is not a subject per se, you can’t read and learn it from the book. The more you’ll gain information on the GS subject, the more equipped you will become to tackle an essay. In ILP plan, once a sufficient portion of each subject is covered, we will start your essay preparation. Guidelines will be provided to you on how to write an essay, and then mock essays will be given for practice. UPSC asks for two types of topics – a static/ factual topic and a philosophical topic. Approach for both is different and will be provided to you as part of the Program.

- ABHIVYAKTI (The Social Media of ILP) for Doubt resolution and Discussions: Each year we have a vibrant and engaging ILP community. Abhivyakti gives the ILP members a platform to get their doubts/queries addressed by IASbaba and peers and also initiate discussions/debates on important issues. You can shift your attention away from the time-wasting online forums that take away the sheen from your preparation.

It also includes a Buddy-System’ wherein students having similar Optional-subjects, College or background can form groups and have discussions (peer-learning)! This will not only help you in forming a good peer-group/study-circle but also in motivating each other to achieve your goals. This is a boon! Especially for students who are studying at home, working professionals who are away from the UPSC-preparation hubs’ so that you can keep in touch with your friends, stay motivated, be informed and accountable at the same time.

UPSC Preparation is a long journey indeed, close to 2 years until your results are announced. And you will realise why we have introduced this buddy-system. It will have its own role to play by keeping your spirits high throughout this wonderful journey!

IMPORTANT NOTE:

- Mains Answers will NOT be evaluated. Only Synopsis/Model Answer will be provided in BOTH Prelims & Mains Phase after every Mains Mock Test. We have planned to keep Mains Evaluation in Package Format. You have to pay extra to get Mains Answers Evaluated. Its details will be announced once the programme start.

- The Schedule/Course Plan given below contains the details from July 2020 to next Prelims (2021). Post-Prelims Schedule/Course Plan for Mains 2021 will be provided once UPSC finalizes the Examination Dates. This plan will include Mains specific VAN’s and Mains Mock Tests & Synopsis.

It includes All the Features of ILP Basic. Additionally it consists of Video Classes.

We know there is no additional material required for one’s preparation after going through VAN and Babapedia. But still, many students often come to us asking how to study? How is studying for prelims different from studying for mains? How is studying history different from studying polity? And so on. We know these are common doubts that every student has.

In order to help such candidates, we are introducing ILP+. It is video-based programme which includes all features of ILP Basic and supplements them with the following video classes

The Video Classes include-

- 62 Discussion Videos (52 GS & 10 CSAT) – AIPTS (Prelims Test) DISCUSSION

- 30 Classes – Strategy Classes of Each Subject, Approach Classes for each Topic, Current Affairs Classes every Month.

- Polity

- Geography

- History

- Economics

- Science &Technology

- Environment

- Prelims Strategy Class – Do’s & Don’ts, Elimination Technique

- Art of Mains Answer Writing

- CA – 10 Classes (July 2020 to April 2021- 1 per month)

Features in detail:

Strategy Classes (5 Classes): One session for every subject wherein the general trends, previous year’s questions and approach to the subject shall be discussed. The aim of these classes is to make you aware of general mistakes you do and how you can overcome them in every subject. It sets the tone of preparation for the subject.

Approach Classes (15 Classes): Every module of ILP shall be accompanied by approach classes for the subjects in the module. The aim of these classes shall be to guide you on how to study each topic, important pointers from each topic, how to utilise VAN to supplement them. The glimpse of the topics in the module shall be given by the subject experts. These classes will also introduce you to the art of mains answer writing for the respective subjects.

Monthly Current Affairs (10 Classes): There shall be one Current Affairs session every month. This class is not to repeat the information which is already available in Babapedia and Daily Current Affairs (on the website) but to guide you on important topics/trends in news. The focus of these classes will be to help you develop curiosity in current affairs and improve analytical skills. These classes aim to effectively integrate Current Affairs into your prelims and mains preparation.

Test Discussion (62 Classes) : ILP has 52 GS tests and 10 CSAT tests. ILP+ provides you with discussion video for all these tests. These classes shall focus not only on the correct answer to the given question but also on other tricks and tactics (elimination techniques) that help you arrive at the correct answer.

Special Feature of this Program is ONLINE MENTORSHIP – A Dedicated Mentor to monitor your progress, give you feedback, motivate and guide you in the Right Path!

It includes all the features of-

- ILP Basic

- ILP+ (Video Classes)

- Mentorship

A Mentor is not just a teacher, he/she is your friend, philosopher and guide! He/She is a support system which guides you through the journey. Every student of ILP connect will be provided an mentor. The students will be able to contact the mentor periodically for any difficulties regarding preparation. This will keep an external check and will help in maintaining accountability throughout the preparation process.

So how does this Mentorship work?

You can talk to your mentor over a video call. There will be 20 Students who can connect at a time to your respective mentors. This will also act as a Buddy-System’, a small peer group to help and motivate each other for mutual learning.

You can connect with your mentors 3 times a month. Basically 10 days once, so that you can get feedback on your performance in the Test and also on what should be your approach in the future.

We will let you know about the application used for video call once the program starts.

Please Note: The Seats are limited for ILP Connect+. It is based on First-come-First Serve basis.

IMPORTANT NOTE:

- The Seats are limited for ILP Connect+. The intake for ILP Connect+ will be 800 students only. 500 students will be considered on first come First-come-First Serve basis & remaining from SUPER 300.

- ILP Program in HINDI will start from 16th July, 2020 (i.e, 15 days after ILP in ENGLISH).

(You have to enrol to ILP BASIC/ILP PLUS 2021 and then fill the form)

Last Date to Register 9th July, 2020

TO REGISTER FOR ‘SUPER 300’ -> CLICK HERE

- Based on the performance in the Test/Profile, FREE UPGRADATION will happen to ILP Connect+ for the TOP 300 Students.

- An OBJECTIVE TEST will be conducted on 10th July, 2020.

- Test will consists of 50 MCQ’s: 30 MCQ’s from Current Affairs and 20 MCQ’s from CSAT Syllabus (Aptitude and Logical Reasoning)

- Interested aspirants, kindly fill the above form. Selected candidates will be intimated through email. Please do not call us or mail us.

- Discretion lies with IASBaba on admission to this program.

- If you want to be part of ‘SUPER 300’, subscribe by 10th July 2020.

IMPORTANT NOTE:

- The Seats are limited for ILP Connect+. The intake for ILP Connect+ will be 800 students only. 500 students will be considered on first come First-come-First Serve basis & remaining from SUPER 300.

- ILP Program in HINDI will start from 30th July, 2020 (i.e, 15 days after ILP in ENGLISH).