IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs Oct 2016, National, UPSC

Archives

IASbaba’s Daily Current Affairs – 28th October, 2016

ECONOMY

TOPIC: General Studies 3

- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

Banking – Non Performing Assets

What are Non Performing Assets?

As per Reserve Bank of India (RBI), an asset, including a leased asset, becomes non-performing when it ceases to generate income for the bank. A ‘Non-Performing Asset’ (NPA) was defined as a credit facility in respect of which the interest and/ or instalment of principal has remained ‘past due’ for a specified period of time. NPAs are further categorized depending upon the time periods for which the payments have been overdue.

Reasons for Non Performance

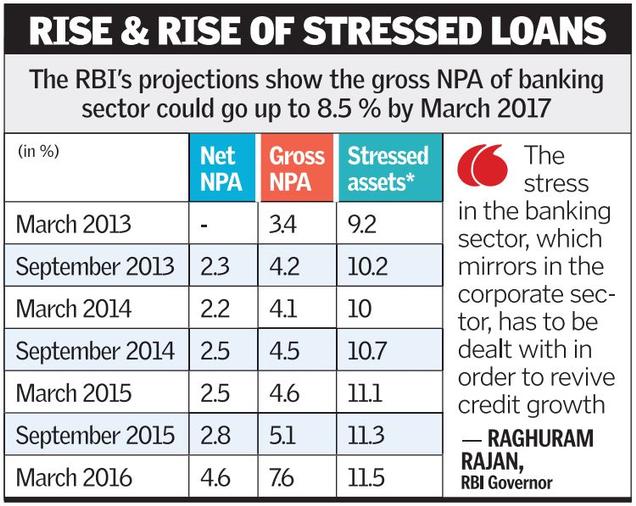

Gross bad loans at commercial banks could increase to 8.5 per cent of total advances by March 2017, from 7.6 per cent in March 2016, according to projections by the RBI in its Financial Stability Report released earlier this year during the tenure of Dr. Raghuram Rajan.

Picture Credit: http://www.thehindu.com/multimedia/dynamic/02912/28-biz_lead_2912232f.jpg

A few important reasons for the constant increase of NPA are as follows:

- Global economic slowdown leading to a reduced demand

- Reckless lending by banks during periods of boom

- Lack of digitisation of banks and poor data management

- Poor quality of due diligence conducted by banks thus leading to poor loan appraisals

- Delay in implementation of infrastructure projects due to environment or regulatory hurdles

- Wilful defaults and frauds

Recent remedies and their impact

RBI has recently released the following guidelines to ease the pressure on the banking sector:

- Limit the lending by banks to corporate borrowers

- Restrict the overall lending to large borrowers gradually to Rs. 10,000 Crores by April 1, 2019.

- Corporates requiring loans in excess of specified limits will have to reach out directly to the market.

- Increased risk weights have been allocated for excessive lending and borrowing.

However, the above guidelines are not being viewed very positively due to the following concerns:

- Guidelines, such as allocation of increased risk weights, have added additional pressure on the lender and the borrower.

- Borrowing from the market can be tough for those companies suffering credibility issues and low investment ratings leading to slowdown of infrastructure development.

- The banks are moving towards alternative areas of credit expansion which have other limitations and constraints such as risk.

Alternatives investment avenues and limitations

- Retail Sector: Lending to the retail sector might not prove to be very fruitful due to low margins leading to higher risk and poor quality.

- Agricultural Sector: Banks are not very enthusiastic in lending to the farmers due to constant loan waivers given by the government.

- Investing beyond the Statutory Liquidity Limits (SLR): This will lead to increase in the fiscal deficit of the government.

- Bond Markets: Investment in bond markets are also restricted due to higher risk involved and limits imposed by RBI guidelines.

Way Forward

- Discipline in case of consortium lending and involvement of executives with sufficient and relevant expertise.

- Monitoring and strict scrutiny of utilisation of funds without solely relying on external auditors.

- Quality and on the field inspection of projects being implemented by expert branch officials.

- Steps should be taken to ensure both responsibility and accountability of lending banks who have taken to outsourcing.

- The role of credit committees sanctioning loans need to be revisited, in terms of increased accountability, especially in this age of digitisation where loan processing has become centralised. There are hardly ways to hold them accountable for their work.

- Online application procedures do increase the transparency, but they reduce the significance attached to the branch officials’ role. Critical processes such as background analysis, risk potential of borrowers are ignored.

- The short period of one month or 90 days, used for classifying NPAs, is inadequate to analyse the reasons for default and assess the genuine requirements of the borrower.

- Strict action against wilful defaulters.

Conclusion

There is a need to avoid hasty provisioning and write-offs, for merely reducing NPAs at enormous cost to the entire system. The regulatory authorities have to play a more proactive role in prevention with more supervisory oversight on credit management in banks. Lastly, a huge importance needs to be given to training and skilling the bank executives with relevant skill set.

Connecting the dots

- What are Non Performing Assets? Is limiting the lending and borrowing capacity the most appropriate solution for tackling the problem of NPAs? If not suggest a strategy for overcoming this problem plaguing the Indian economy.

NATIONAL

TOPIC: General Studies 2

- Structure, organization and functioning of the Executive and the Judiciary

Judging the Judges: Is it needed?

In news: Recently, the law department in Gujarat, on the recommendation of the Gujarat High Court, cracked the whip on 17 judges from various cadres in lower courts, ordering their retirement for unsatisfactory performance.

Background:

- The 17 judges, who were ordered to take retirement, were issued notices in past to improve their performance but their failure to heed to these warnings led to the government taking this drastic step.

- As per official of HC secretariat, the state government and the high court’s administration are spending Rs. 2-3 lakh per month on the functioning of a court and if the performance of a judge is not up to the mark, they are bound to take action against them.

- This action of the state suggests that holding judges to performance standards is gaining momentum.

- However, the existing system of performance evaluation for the lower judiciary is plagued with various problems.

- What is more worrying is that higher judiciary in India is not subject to any sort of evaluation.

Assessing the judges- India and abroad

India

- Lower court judges in India are evaluated through a system of Annual Confidential Reports (ACRs), which are completed by the senior-most judges of the lower court, and reviewed by the State High Court.

- But ACRs are neither filled up regularly nor is the evaluation process transparent.

- Concerns about this lack of due process have even reached the Supreme Court, which recently has summoned the Registrar General of the Delhi High Court to explain why a lower court judge was marked as ‘integrity doubtful’ without material basis.

- In 2013, the idea for amending and improving existing methods for evaluating judges’ performance was floated, when the Law Ministry acknowledged the need for a more scientific method of performance appraisal of judges.

- The Ministry also admitted that there was a lack of uniformity of judicial performance appraisal across States.

- However, there has been no significant changes since these observations were made.

- A research institute recently surveyed the legal community for its views on judicial performance evaluation where it found that almost all the surveyed individuals were of the opinion of a system of performance appraisal of judges, particularly of the higher judiciary.

- Most survey respondents believed that such appraisal would lead to greater accountability, transparency and better and efficient functioning of judges.

- Hence, this is an opportune moment to revise existing mechanisms and deliberate on the performance evaluation of judges at all levels of the judiciary.

Abroad

USA

- The system of periodic assessment of judicial performance, formally called as ‘Judicial Performance Evaluation’ (JPE), originated in USA.

- Here, the sitting judges were evaluated to inform voters about a judge’s performance record for ‘retention elections’. The retention elections allowed the public to vote for or against the continuing tenure of judges.

- Thus, JPEs became institutionalised over time, and are now regularly followed across the USA, with most States incorporating provisions for evaluating judges in their constitutions.

- Studies of JPE programmes suggest that parameters for evaluating judicial performance may be qualitative as well as quantitative. These include the rate of disposal of cases by a judge, the quality of judgments and legal reasoning, knowledge of the law, behaviour towards lawyers in court proceedings, independence and transparency.

- JPE programmes initially tend to use objective criteria to evaluate judges, eventually moving towards more qualitative criteria when systems have evolved sufficiently to reduce likelihood of bias and subjectivity in assessment processes.

EU

- Here, the European Commission for the Efficiency of Justice conducts a periodic performance review of court systems of different member states.

- This country-wise study collects data on various parameters, including the efficiency of courts in justice disposal, the costs per case, and the budget of courts.

- The outcome of this exercise is called the ‘EU Justice Scoreboard’ which is published annually and rates the working of justice systems across member states.

JPE in India?

- Judges in India are nominated or appointed through examination processes and not elected as in the USA.

- Therefore, JPE programmes here would not work the same way as in the US, where they were formulated to give voters information on judges before retention elections.

- However, studies of JPEs show that besides providing information to voters, these programmes also serve the purpose of increased transparency and accountability of the judiciary.

- A regular review of judicial performance ensures that once appointed, judges are mindful of their accountability to the institution of the judiciary.

Conclusion

- A delicate balance needs to be struck even while measuring judicial performance. Scholars have expressed reservations that performance evaluations could compromise the independence of the judiciary.

- Thus, to avoid this, a JPE programme should be devised by the judiciary itself, instead of government.

- The Madras High Court, for the first time, has come out with qualitative as well as quantitative performance assessment of its judges in 2016.

- As it is was for first time, it was met with mixed reactions from lawyers, some of whom felt that this could unduly pressurise judges to dispose of cases and encourage indiscriminate disposal rather than delivering justice.

- However, this is precisely the sort of performance evaluation courts should start conversations about despite the opposition from a section of lawyers.

- For this, the first step towards such evaluation should be the objectives of such evaluation, such as improving quality of justice, pendency rates, and so on.

- A joint consultation could be held with stakeholders, including judges, lawyers, academics and members of civil society to understand how best to initiate such a system in India.

- Any codified system that emerges from these discussions, like in the form of guidelines or regulations, must be reviewed to ensure minimum bias and maximum transparency.

- All these steps would help India work towards higher standards and greater accountability in judicial functioning.

Connecting the dots:

- Judges in India have a comparatively opaque way of functioning than in western countries? Do you agree? Examine.

- How can judiciary in India be made more transparent and accountable? Discuss.

MUST READ

Situating law in the land

Shy of fighting causes

Swachh biology – swasth biology

When an icon falls

A Story Of Two Bills

Multiple ways to equality

Unhealthy delay

SC ruling on equal pay for equal work difficult to implement: Experts

Ensure pay parity for the armed forces

Arrest this drift in ties with Bangladesh

Centre to modify model APMC law to address States’ concerns