IASbaba's Daily Current Affairs Analysis

IASbaba’s Daily Current Affairs (Prelims + Mains Focus)- 30th June 2018

Archives

(PRELIMS+MAINS FOCUS)

Regional Integrated Multi-Hazard Early Warning System (RIMES)

Part of: GS Prelims and Mains – Environment and Ecology; Disaster Management

In news:

- Odisha government entered into a collaboration with the RIMES

Important Value Additions

About RIMES

- It is an intergovernmental body registered under United Nations.

- It is a body of 48 members and collaborating countries in Asia Pacific and Africa Region, aimed at automating risk management, advisory generation and dissemination.

- RIMES evolved from the efforts of countries in Africa and Asia, in the aftermath of the 2004 Indian Ocean tsunami, to establish a regional early warning system within a multi-hazard framework for the generation and communication of early warning information, and capacity building for preparedness and response to trans-boundary hazards.

- RIMES was established on 30 April 2009, and was registered with the United Nations on 1 July 2009.

- RIMES operates from its regional early warning center located at the campus of the Asian Institute of Technology in Pathumthani, Thailand.

Do you know?

- RIMES is already working with the Tamil Nadu State Disaster Management Authority.

Online Continuous Emission Monitoring Systems (OCEMS)

Part of: GS Prelims and Mains – Environment and Ecology; Pollution

In news:

- Central Pollution Control Board (CPCB) has directed State Pollution Control Boards (SPCB) to close down industrial units that haven’t installed Online Continuous Emission Monitoring Systems (OCEMS).

- It is mandatory for a new industrial unit to install an OCEM to commence operations.

- The CPCB has since 2015 made it mandatory for industries to install OCEMS.

- Industries, particularly so-called Grossly Polluting Industries, are mandated to report their emissions to pollution control boards.

- The industries that require OCEMS include distilleries (including fermentation industry), sugar, fertiliser, pulp & paper (paper manufacturing with or without pulping), pharmaceuticals, dyes and dye-intermediates, pesticides, tanneries, thermal power plants, iron and steel, zinc, copper and aluminium smelters.

Increased MSP to Farmers

Part of: GS Prelims and Mains II and III – Government policies and schemes; Social Reforms; Farmer issue

About:

- Yesterday we read that farmers’ groups have started agitating on the lack of announcement on MSP rates.

- Government had decided to offer a minimum support price (MSP) of at least 1.5 times the expenses borne by farmers for all crops.

- Niti Aayog, in consultation with Central and State Governments, had to put in place a fool-proof mechanism so that farmers will get adequate price for their produce.

Three options which NITI Aayog proposed

- The first proposal would make States responsible for procurement, storage and disposal of crops with partial financial support from the Centre;

- the second would pay farmers the price difference between market rates and MSP without any crop procurement, and

- the third would involve procurement by private agencies and traders at MSP rates.

It is alleged that the above NITI Aayog proposals could shift some of the burden of enforcing MSPs to the States and even private agencies.

FATF has laid out a 10-point action plan to Pakistan

Part of: GS Prelims and Mains II – International issue; Security

In news:

- The Financial Action Task Force (FATF) that monitors countries on action taken against terror-financing and money-laundering has decided to place Pakistan back on its watch list, or “greylist”.

- The decision is both appropriate and overdue, given Pakistan’s blatant violation of its obligations to crack down on groups banned by the Security Council 1267 sanctions committee. Their leaders like Hafiz Saeed and Masood Azhar continue to hold public rallies and freely garner support and donations.

- Under the 1267 sanctions ruling, banned entities can get no funds, yet Lakhvi received the bail amount, and the authorities have since lost track of him.

- Financial Action Task Force (FATF) has laid out a 10-point action plan to Pakistan for compliance with its guidelines.

Pic: https://d39gegkjaqduz9.cloudfront.net/TH/2018/06/30/DEL/Delhi/TH/5_09/e3bb40ab_2210182_101_mr.jpg

Important Value Additions:

About FATF

- It is an inter‐governmental policy making body

- It aims to establish international standards for combating money laundering and terrorist financing.

- It was established in 1989 during the G7 Summit in Paris (France) to combat the growing problem of money laundering.

- It comprises over 39 countries.

- India is a member

- FATF Secretariat is housed at the headquarters of the OECD in Paris.

- Initially it was only dealing with developing policies to combat money laundering. But in 2001 its purpose was expanded to act against terrorism financing.

(MAINS FOCUS)

GOVERNMENT POLICY/ECONOMY

TOPIC:

General Studies 2:

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

General Studies 3:

- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

1 Year of GST: Assessment

Introduction:

- Today marks one year of the launch of the goods and services tax (GST)

- So what has the GST achieved?

- According to the article – it is important not to expect instant results as there will be many short comings when a complex reform is rolled out. However, it is important to assess – Whether the economy is heading in the right direction?

Arguments in favour of the GST

We have read from many articles that –

- GST would lead to ease of doing business

- make markets efficient;

- eliminate cascading effect;

- yield higher tax collections; and

- lead to lower prices.

With higher tax collection, the government would be able to deliver better services. Thus, the GST was presented as a win-win situation for everyone.

Performance so far:

- Businesses have not yet experienced ‘ease of doing business’ though some have adjusted to it.

- Industry could not fix GST prices well in time and difficulties grew right from day one.

- The IT functioning of the Goods and Service Tax Network (GSTN) has been unsatisfactory due to problems or inordinate delays in access because of the volume of traffic.

- Complexity of the tax filing system. Even though it was computerised, accounting was difficult.

- So, even though 17 taxes were replaced by one tax made up of many parts, simplification did not follow.

- The small businesses operating under the Composition Scheme (turnover between ₹20 lakh and ₹75 lakh; later the limit was raised to ₹1.5 crore) could not give input tax credit (ITC) and if anyone bought from them, then the buyer had to pay the tax that the small business should have paid. This was the reverse charge mechanism (RCM).

- Both big and small businesses faced severe difficulties.

- Small businesses were not permitted to make inter-State sales so their market became limited in case they were at the border of the State.

GST Council comes for rescue

Taking cognisance of these, the government made rapid changes during the year through the GST Council (the body set up to govern GST).

- But this only added to the confusion.

- Some components of the GST which were considered essential to its design were suspended or altered permanently.

- For example, the e-way bill (to track goods being transported) was postponed to April 2018. The RCM was suspended and may resume now.

- The tax rate for businesses under the Composition Scheme was brought down.

- Restaurants were brought under the Composition Scheme with a 5% tax rate but no ITC.

Crux:

For a year now, there have been reports every day of new problems cropping up and clarifications being sought from the authorities. In some cases, court cases are being filed.

- Prices have not fallen. GST has contributed to inflation because services are now taxed higher — the rate has risen to 18% from 15%.

- Restaurants misused the ITC and it was replaced by a different scheme. It also prompted government to legislate the anti-profiteering clause. But it is proving hard to implement; industry is resisting it.

- Even though essential goods are exempt under the GST, as basic goods and services prices rise, all prices increase. For instance, if diesel or truck prices rise, transport costs increase. All prices rise even if they are exempt under the GST, examples being the cost of cereals and vegetables.

- The tax rate structure (0%, 5%, 12%, 18% and 28%) is also so complex. There are different rates for gold and jewellery. Some petro-goods and alcohol (human consumption) are not a part of the GST. Electricity and real estate are also out of the GST.

Aspirants also faced problems in this year Prelims paper – Egg boiled (but with shell) is not under GST, Boiled egg without shell is under GST 😀 (Babaji is still confused who serves or sells boiled eggs with shell)

- The multiplicity of tax rates and exemptions means that the cascading effect continues.

Conclusion:

India does not have a full GST which is applicable from raw material to the final good/service. The chain is broken in many places. Partial GST may not meet the objectives effectively.

The GST is not bigger than the policy changes introduced in 1991 and hence not the biggest reform.

It is not yielding more revenue to enable governments to spend more on services for the poor.

Further, by damaging the unorganised sectors, it has set back output and employment in the economy rather than leading to a higher growth rate.

These problems emanate from introducing a very complex tax in a complex economy. In brief, while there are a few gains, the economy is not headed in the right direction because of the faulty design of the GST.

GOVERNMENT POLICY/SCHEME

TOPIC: General Studies 2:

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

- Welfare schemes for vulnerable sections of the population by the Centre and States and the performance of these schemes; mechanisms, laws, institutions and bodies constituted for the protection and betterment of these vulnerable sections

- Issues relating to development and management of Social Sector/Services relating to Health, Education, Human Resources.

Draft law on revamping higher education governance: UGC to HECI

Introduction

- From previous articles, we know that – Government has planned to replace UGC with HECI (HECI Bill 2018 seeks to repeal UGC Act,1951)

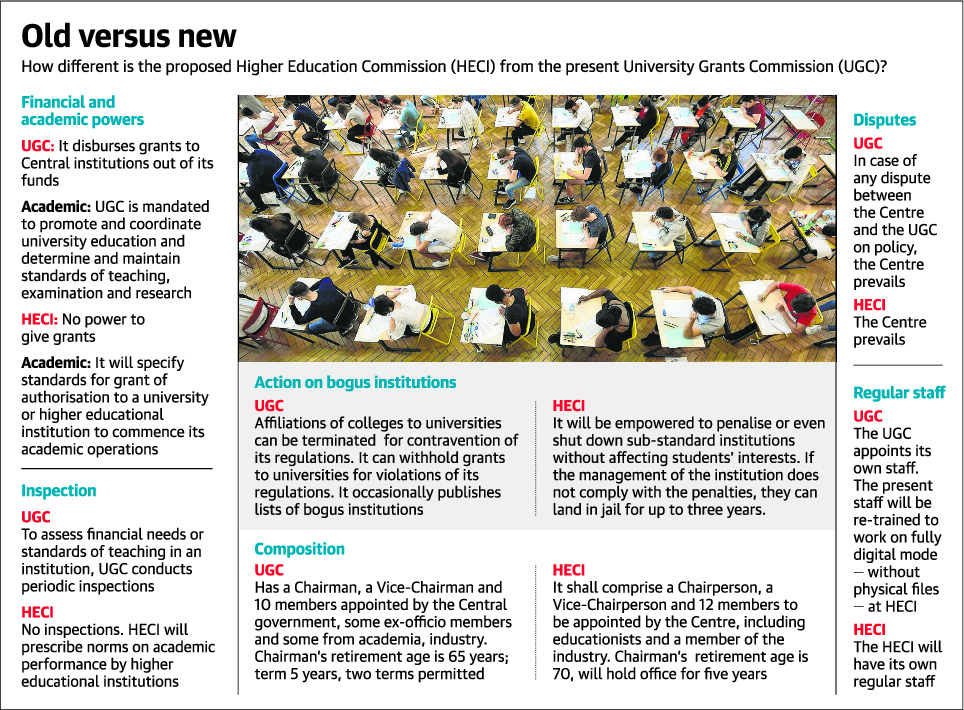

- We learnt about HECI and how it is different from old UGC (details provided below)

- In today’s article we shall assess whether India’s higher education sector is in desperate need of reform.

- Are the proposed provisions and regulator good?

Why India’s higher education sector needs desperate reforms?

- consistently poor performance of Indian universities at the World University Rankings

- Inspite of boasting of rich demographic dividend, rarely do 1 or 2 IITs figure in the top 100 institutes of the world.

- institutional shortcomings like the lack of quality research, less room for cross specialization, very less or non existent industry exposure and so on.

- But clearly the genesis of all such issues can be somehow linked to our existing policy set up.

All these testify to the fact that the country’s higher education regulator, the University Grants Commission (UGC), has not lived up to its mandate of “maintaining standards of teaching, examination and research in universities”.

Hence, government has proposed a new draft law, the Higher Education Commission of India Bill, to revamp the governance of higher education in India.

About Higher Education Commission of India (HECI)

- HECI to focus on improving academic standards and the quality of Higher Education.

- Unlike UGC, HECI will not have grant functions and would focus only on academic matters.

- HECI will also be backed with penal powers to order closure of institutes that violate set norms, imposition of fines where necessary and provisions for imprisonment up to three years where necessary.

How HECI is different from UGC?

Pic link: https://d39gegkjaqduz9.cloudfront.net/TH/2018/06/29/CNI/Chennai/TH/5_13/02a39acb_ec29b1bc_101_mr.jpg

The transformation of the regulatory set up is guided by the following principles:

- Less Government and more Governance:

- Downsizing the scope of the Regulator. No more interference in the management issues of the educational institutions.

- Separation of grant functions:

- The grant functions would be carried out by the HRD Ministry, and the HECI would focus only on academic matters.

- End of Inspection Raj:

- Regulation is done through transparent public disclosures, merit-based decision making on matters regarding standards and quality in higher education.

- Focus on academic quality:

- HECI is tasked with the mandate of improving academic standards with specific focus on learning outcomes, evaluation of academic performance by institutions, mentoring of institutions, training of teachers, promote use of educational technology etc. It will develop norms for setting standards for opening and closure of institutions, provide for greater flexibility and autonomy to institutions, lay standards for appointments to critical leadership positions at the institutional level irrespective of University started under any Law (including State Law).

- Powers to enforce :

- The Regulator will have powers to enforce compliance to the academic quality standards and will have the power to order closure of sub-standard and bogus institutions. Non-compliance could result in fines or jail sentence.

Highlights of the Higher Education Commission of India (Repeal of University Grants Commission Act) Bill 2018

- The focus of the Commission will be on improving academic standards and quality of higher education, specifying norms for learning outcomes, lay down standards of teaching/research etc.

- It will provide a roadmap for mentoring of institutions found failing in maintaining the required academic standards.

- It shall have the power to enforce its decisions through legal provisions in the Act,

- The Commission shall have the power to grant authorization for starting of academic operations on the basis of their compliance with norms of academic quality.

- It will also have the powers to revoke authorization granting to a higher education institution where there is a case of wilful or continuous default in compliance with the norms / regulations.

- It will also have the power to recommend closure of institutions which fail to adhere to minimum standards without affecting students’ interest.

- The Commission will encourage higher education institutions to formulate a Code of

- Good Practices covering promotion of research, teaching and learning.

- The constitution of the Commission is strengthened by the cooption of Chairpersons of regulatory bodies in higher education, namely the AICTE and the NCTE. Moreover the Chairpersons/Vice-Chairpersons and members will be scholars of eminence and standing in the field of academics and research, possessing leadership qualities, proven capacities for institution building and deep understanding of issues of higher education policy and practice.

- The Bill also provides for the penal provisions, which albeit graded in nature, will cover withdrawal of power to grant degrees/ diplomas or direction to cease academic operations and in cases of wilful non-compliance, may result in prosecution sanction as per the Criminal Procedure Code with a punishment of imprisonment for a term which may extend up to 3 years.

- There will be an Advisory Council to render advice to the Commission on matters concerning coordination and determination of standards in the country. This will be represented by the Chairpersons / Vice-Chairpersons of State Councils for Higher Education and chaired by the Union Minister for HRD.

- The Commission will also specify norms and processes for fixing of fee chargeable by higher education institutions and advice the Central Government or the State Governments, as the case may be, regarding steps to be taken for making education affordable to all.

- The Commission will monitor, through a national data base, all matters covering the development of emerging fields of knowledge and balanced growth of higher education institutions in all spheres and specially in promotion of academic quality in higher education.

In crux:

- HECI will not have grant functions and would focus only on academic matters. The ministry will deal with the grant functions.

- The separation between the regulator and the funder is in tune with the first principles of regulatory governance.

- The professed goal of the draft law is “autonomy for universities.” However, making the HRD ministry the fund dispersal agency strikes against this objective.

- It is true that academic institutions in the country have never been completely free from government interference. But with the HRD ministry controlling university funding directly, the dangers of political interference in the running of these institutions increase manifold.

- The proposed law also empowers the Centre to remove the HECI’s chairman and vice-chairman for reasons that include “moral turpitude” — the UGC act did not have such a provision — will raise questions about the government’s sincerity on giving autonomy to universities.

Connecting the dots:

- Higher education in India is faced with challenges that range from lack of institutional autonomy to heavy bureaucratization of policy making. In light of the given statement and the recent ‘Occupy UGC’ protest, examine the need of having a new regulator Higher Education Commission of India (HECI) replacing UGC.

- With only few institutes of excellence amidst an ecosystem of mediocrity, the higher education system in India is in dire need of reforms. Do you agree. Comment.

- Why doesn’t India have globally competitive institutions of education? Examine. What would it take to transform higher education in India? Analyse.

(TEST YOUR KNOWLEDGE)

Model questions: (You can now post your answers in comment section)

Q.1) Which of the following statements are correct regarding Regional Integrated Multi-Hazard Early Warning System (RIMES)

- It is an intergovernmental body registered under United Nations.

- RIMES evolved from the efforts of countries in Asia and Pacific.

- It was established aftermath of the 2004 Indian Ocean tsunami.

Select the code from following:

- 1 and 2

- 1 and 3

- 2 and 3

- 1, 2 and 3

Q.2) Which of the following industries require Online Continuous Emission Monitoring Systems (OCEMS)?

- pulp & paper

- sugar

- fertilizer

- copper and aluminium smelters

- dyes

Select correct answer:

- 1, 2, 3 and 4 only

- 2, 3, 4 and 5 only

- 3, 4 and 5 only

- 1, 2, 3, 4 and 5

Q.3) Given below are the statements regarding Financial Action Task Force (FATF), select the INCORRECT statements among them.

- It is a body governed by UN which is involved in setting standards for anti-money laundering and combating financing of terrorism.

- India is a member party to FATF.

Select the code from following:

- 1 only

- 2 only

- Both 1 and 2

- None of the above

Q.4) Consider the following statements about Financial Action Task Force (FATF):

- It is a Parisbased multidisciplinary and intergovernmental body whose purpose is the development and promotion of national and international policies to combat money laundering and terrorist financing.

- It was founded at the 1989 OECD Economic Summit.

Select the correct code:

- Only 1

- Only 2

- Both 1 and 2

- Neither 1 nor 2

MUST READ

Reform 101: On higher education

In the city of refugees: Rohingya camps in Bangladesh’s Cox’s Bazar

From 1975 to 44

In the grey zone

India is middle income now: Raise the poverty line

In 2018, the 1992 test