IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS + MAINS FOCUS)

Apophis expected to hit Earth in 2068

Part of: GS Prelims and GS-III – Space

In news

- Asteroid Apophis may hit the Earth in 2068 due to a phenomenon called Yarkovsky effect.

- This effect has eventually accelerated the asteroid’s flow and also changed its path.

- As per the new calculations by astronomers at the University of Hawaii at Manoa, asteroid Apophis, which will also be extremely close to Earth on April 13, 2029, is deviating from its actual orbit and may crash into Earth in 2068.

Important value additions

- According to a recent report, the sun can heat an asteroid in a non-uniform way, causing the space rock to radiate heat energy asymmetrically.

- This can cause a thrust or a tiny push in a certain direction, sometimes changing the path of the asteroid.

- This effect is called the Yarkovsky acceleration.

- Before the discovery of Yarkovsky effect, the possibility of the collision was impossible.

- The detection of this effect acting on Apophis means that the 2068 impact scenario is still a possibility.

Do you know?

- The asteroid was discovered in 2004.

- It is named after the Greek God of Chaos.

- It is a 340-meter-wide asteroid. That’s about the size of three-and-a-half football fields.

Air quality in Delhi continues to remain in ‘severe’ category

Part of: GS Prelims and GS-III – Pollution

In news

- The air quality in Delhi continues to remain in ‘severe’ category.

- The System of Air Quality and Weather Forecasting and Research, SAFAR has advised people to avoid all physical activity outdoors.

Important value additions

System of Air Quality and Weather Forecasting and Research (SAFAR)

- Indigenously developed by: Indian Institute of Tropical Meteorology, Pune

- Run by: India Meteorological Department (IMD).

- Objective: (1) To provide Real-time air quality index on 24×7 basis with colour coding along with 72-hour advance weather forecast; (2) To issue Health advisory to prepare citizens well in advance.

- Parameters monitored: Pollutants: PM1, PM2.5, PM10, Ozone, CO, NOx (NO, NO2), SO2, BC, Methane (CH4), Non-methane hydrocarbons (NMHC), Black Carbon, VOC’s, Benzene and Mercury.

- Meteorological Parameters: UV Radiation, Rainfall, Temperature, Humidity, Wind speed, Wind direction, solar radiation.

The Scheme For Financial Support To PPPs in Infrastructure to be revamped and continued

Part of: GS Prelims and GS-II – Policies and interventions

In news

- The Cabinet Committee on Economic Affairs has approved Continuation and Revamping of the Scheme for Financial Support to Public Private Partnerships (PPPs) in Infrastructure Viability Gap Funding (VGF) Scheme till 2024-25 with a total outlay of Rs. 8,100 crore.

Key takeaways

- The Department of Economic Affairs, Ministry of Finance introduced “the Scheme for Financial Support to PPPs in Infrastructure” (Viability Gap Funding Scheme) in 2006.

- The revamped Scheme is mainly related to introduction of following two sub-schemes for mainstreaming private participation in social infrastructure:

Sub scheme–1

- This would cater to Social Sectors such as Waste Water Treatment, Water Supply, Solid Waste Management, Health and Education sectors etc.

- The projects eligible under this category should have at least 100% Operational Cost recovery.

- The Central Government will provide maximum of 30% of Total Project Cost (TPC) of the project as VGF and State Government/Sponsoring Central Ministry/Statutory Entity may provide additional support up to 30% of TPC.

Sub scheme–2

- This Sub scheme will support demonstration/pilot social sectors projects.

- The projects may be from Health and Education sectors where there is at least 50% Operational Cost recovery.

- In such projects, the Central Government and the State Governments together will provide up to 80% of capital expenditure and upto 50% of Operation & Maintenance (O&M) costs for the first five years.

Inter-Ministerial Committee set up To Strengthen The Capital Goods Sector

Part of: GS Prelims and GS-III – Economy

In news

- The government has set up a 22-member inter-ministerial committee in strengthening the Capital Goods (CG) Sector to make this sector globally competitive and to become the manufacturing hub for the world.

Key takeaways

- The Committee will look into issues pertaining to the Capital Goods Sector including technology development, mother technology development, global value chains, skill training, global standards, custom duties, etc.

- Chairmanship: Secretary of Department Heavy Industries

- The committee shall meet quarterly

Operation Greens – Top To Total Scheme

Part of: GS Prelims and GS-III – Economy

In news

- Under Operation Greens Scheme TOP to TOTAL, 50% transportation subsidy is now made available for air transportation for 41 notified fruits and vegetables from North-Eastern and Himalayan States to any place in India.

Key takeaways

- Airlines will provide the transport subsidy directly to the supplier by way of charging only 50% of the actual contracted freight charges and will claim the balance 50% from MoFPI as subsidy.

- The scheme was approved and the amended Scheme Guidelines were notified in November 2020.

- All consignment of notified fruits and vegetables irrespective of quantity and price would be eligible for 50% freight subsidy.

- Eligible airports: All the airports in Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim (Bagdogra), and Tripura from North-East, and Himachal Pradesh, Uttarakhand, and Union Territories of Jammu & Kashmir and Ladakh among the Hilly States.

Do you know?

- The transportation subsidy was earlier extended under Operation Greens Scheme for Kisan Rail Scheme in December.

- Railways charge only 50% of freight charges on the notified fruits and vegetables.

Miscellaneous

Jingtang Port

-

Jingtang port was in news recently.

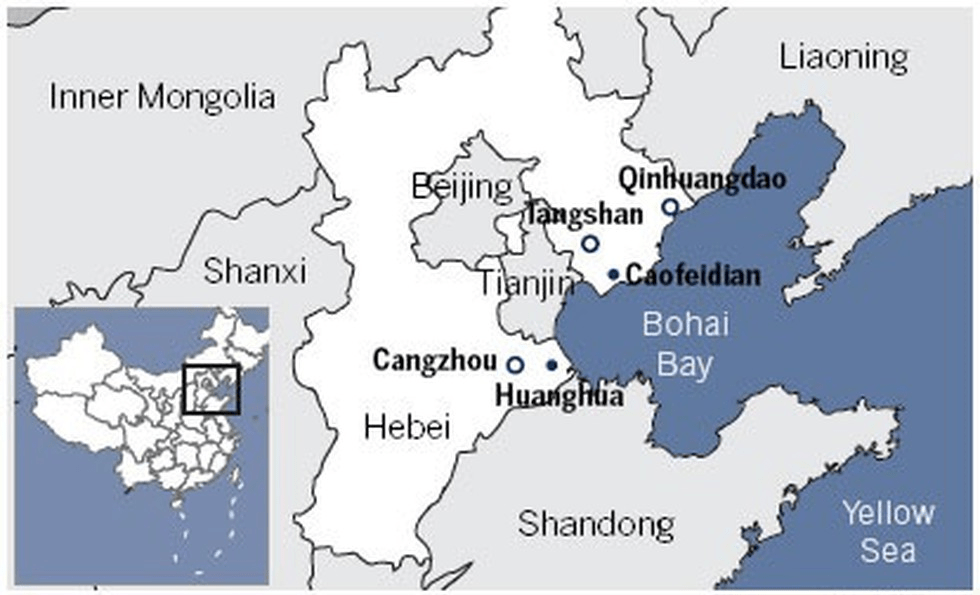

- The ship named Jag Anand been awaiting anchorage at the Chinese port Jingtang near Tangshan in China’s Hebei province since June this year.

- China has cited COVID-19 regulations for denying departure to the ship

- The Port of Jingtang is an artificial deep-water international seaport on the coast of Tangshan Municipality, Hebei, in Northern China.

- Jingtang port is located in Bohai bay (Bohai sea) close to the port of Tianjin.

(MAINS FOCUS)

ECONOMY/ FEDERALISM

Topic: General Studies 2,3:

- Functions and responsibilities of the Union and the States, issues and challenges pertaining to the federal structure

- Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

GST compensation: how some states are borrowing

Context: After Puducherry, Congress-ruled Rajasthan last week became the latest Opposition-ruled state to opt for a special borrowing window for meeting its compensation shortfall under Goods and Services Tax (GST)

Other dissenting states — Kerala, Punjab, West Bengal, Chhattisgarh, Jharkhand — are yet to join any of the borrowing options floated by the central governmen

About GST Compensation

- Before GST, States had the power to levy some indirect taxes on economic activity. Therefore, after GST regime was introduced (in 2017), the Centre promised guaranteed compensation to the States for the first five years, for the revenues they lost after the shift from the earlier system.

- The compensation is calculated at a growth rate of 14% keeping 2015-16 as the base year and by levying a Compensation Cess on Sin and luxury goods.

Background of the Issue

- The total GST revenue shortfall for the current fiscal (2020-21) was estimated at Rs 3 lakh crore. Compensation cess collection for this fiscal is estimated at Rs 65,000 crore, thus leaving a compensation deficit/shortfall of Rs 2.35 lakh crore.

- The Centre distinguished the GST shortfall into two types:

- (1) Due to GST implementation itself;

- (2) due to the impact of Covid-19 – which was termed as Act of God

- The GST Compensation Act, 2017 had not envisaged Act of God events like COVID-19 and thus did not have any mechanism to deal with shortfall arising out of such crisis.

- Thus, the Centre had earlier refused to compensate GST shortfall arising due to covid-19 to the states.

- However, States argued that Centre cannot absolve of its responsibility to make up for GST revenue shortfall and thus demanded full compensation amount.

How did Centre try to solve the issue of compensation deficit?

- Of the Rs 2.35 lakh crore compensation shortfall, Rs 1.1 lakh crore has been estimated as shortfall on account of GST implementation, while the rest (1.25 lakh crores) is being estimated as the impact of the pandemic (Act of God).

- In August after GST Council meet, the Centre gave two options to the states

-

- Borrow Rs 1.10 lakh crores (revised figures) from a special window facilitated by the RBI at a reasonable G-Sec-linked interest rate. The amount can be repaid after five years ending 2022 from cess collections (on luxury goods).

- Borrow entire Compensation Cess (2.35 Lakh Crores) from the market facilitated by the Centre and RBI. In this case, the burden of repayment is on States and the Union government will provide relaxation of 0.5% in states’ borrowing limit under the FRBM Act.

- States will have to bear the cost of borrowing in two cases, albeit at a reasonable interest rate. States had specifically asked the Centre to borrow and pay the compensation cess shortfall to them

What is the Central government’s new special window for borrowing?

- The Centre would borrow from the market and then act as an intermediary to arrange back-to-back loans to pay the GST compensation shortfall of Rs 1.1 lakh crore to state governments.

- Also, States have been hence given additional unconditional borrowing freedom of 0.5% of the gross state domestic product (G-SDP) in FY21.

- The states opting for this window are also eligible to carry forward their unutilised borrowing space to the next financial year.

- This arrangement will not reflect in the fiscal deficit of the Centre, and will appear as capital receipts for state governments.

- Kerala, Punjab and Chhattisgarh have insisted on further clarification and inclusion of the balance compensation deficit amount beyond the proposed borrowing of Rs 1.10 lakh crore, too, under the ambit of the back-to-back loan mechanism.

What are the merits of Centre enabled borrowing?

- The earlier proposal was for a special window to be facilitated by the RBI and the Centre, but states would have had to tap the window separately.

- One of the primary concerns for earlier mechanism was that it leads to differential rates with a wide variance in interest rates between the states with more debt and those with less debt.

- Also, the yields for state development loans (SDLs), which is the tool for market borrowing by states, are generally at a premium, higher than the yield on the central government’s G-Secs.

- So, it would have been costlier for states to borrow rather than the Centre borrowing at a uniform rate and then passing it on to them as a back-to-back loan.

- Also, Centre did not go for any immediate hikes in the tax rate as it would have overburdened consumers, especially during the ongoing economic slowdown.

How has the scheme progressed so far?

- Under the special window, the Centre has already borrowed Rs 12,000 crore in two equal instalments and passed it on to 21 states and three Union Territories on October 23 and November 2.

- The second round of borrowing was done at an interest of 4.42%, and the first round at 5.19%, lower than the cost of borrowing for states.

What is the way forward for the rest?

- The Finance Ministry is now engaged in dialogue with the opposing states to join the scheme.

- Economists say the borrowing issue has only been resolved for the compensation shortfall for this fiscal.

- It remains to be seen how this issue will be resolved for the next fiscal, given that tax revenues are expected to grow at a lower rate than the 14% growth guaranteed to states under the compensation mechanism of GST.

Conclusion

Rather than waiting for the last moment and doing back and forth, the GST Council should have come out with a detailed resolution plan.

Connecting the dots:

INTERNATIONAL/ ECONOMY/ GOVERNANCE

Topic: General Studies 2,3:

- Effect of policies and politics of developed and developing countries on India’s interests.

- Awareness in the fields of IT

- Economy and issues relating to planning, mobilization, of resources, growth, development

Gig Economy and Proposition-22

Context: Gig-economy giants in the US such as Uber, Lyft and DoorDash celebrated a major win last week as voters in California green-signalled Proposition 22

What was the issue all about? Contractors Vs Employees

- When companies such as Uber and Lyft first started in California in the 2010s, they did not hire drivers as employees, and instead classified them as independent contractors.

- For drivers, the gig work was supposed to bring greater flexibility than traditional employment.

- The industries argued that they were technology companies, and said that they should not be burdened with the legal requirements applicable to transportation companies.

- Under California’s labour law, this business model was controversial from the beginning, since the companies did not provide drivers and other workers unemployment insurance, health care, sick leaves or guaranteed pay– the binding responsibilities of an employer.

- The gig business model came under attack in 2018, when the California Supreme Court in its landmark ‘Dynamex’ ruling held workers were to be treated as employees in every case, except if they were: free from the control and direction of the hirer; performed work outside the usual course of the hirer’s business; and were engaged in their own independent business

- The California legislature saw the Dynamex judgment as a welcome move which could rein in the burgeoning gig industry, and in 2019 enshrined it in a state law called Assembly Bill 5 (AB5), that extended employee protections to gig workers.

The battle for Prop 22

- Gig Companies argued that with AB5 law, drivers would be forced to become full-time or leave the platform, and prices would increase.

- The app-based companies came together to draft a ballot proposal– a legal measure available in several US states by which citizens can suggest propositions to be put to popular referendum in the state, bypassing the legislature.

- Named Proposition 22, the ballot proposal aims to exempt ride-sharing and food delivery firms from AB5 law.

- Prop 22 also brings some advantages for gig workers. They would be able to work independently, but with new benefits such as minimum pay, vehicle insurance and some health care options.

- The gig industries poured money into their ‘Yes on Prop. 22’ campaign, raising over $200 million — the most in California’s history on a proposition campaign — to get voters on their side

- Those opposed to the proposition, such as labour unions, argued that drivers should get full employee protections, and criticised the companies for trying to write their own labour laws.

What the passing of Proposition 22 means?

- The popular approval of Proposition 22 on November 3 is seen as a major achievement for app-based companies, as it brings stability to their contract-based business model, especially since many of them, such as Uber and Lyft, are yet to turn a profit.

- Enthused, the gig industry has already announced that it would seek to replicate the measure in other states

Criticisms of the Proposition 22

- Against Labour Protections: Critics accuse the ballot measure of undoing the achievements of the labour movement of over a century.

- Wrong Precedent: With the success of Prop 22, experts worry that traditional businesses in the US would follow the same path as app-based companies to reduce costs – only choosing to hire gig workers and not offer full employment

- Questions on Democratic Process: Prop 22 is also criticised for undermining the democratic process. Because of a provision contained in the ballot measure, the California legislature would now require a seven-eighths majority– an unusually high bar– to make any legal amendments affecting gig workers.

Connecting the dots:

- Should India also adopt Ballot Proposal tools to get citizen’s feedback on legislations?

(TEST YOUR KNOWLEDGE)

Model questions: (You can now post your answers in comment section)

Note:

- Correct answers of today’s questions will be provided in next day’s DNA section. Kindly refer to it and update your answers.

- Comments Up-voted by IASbaba are also the “correct answers”.

Q.1 Yarkovsky effect is associated with which of the following?

- Asteroid

- Meteor

- Earthquake

- Saturn RIngs

Q.2 Consider the following statements regarding System of Air Quality and Weather Forecasting and Research (SAFAR):

- It is developed by ISRO.

- It monitors parameters of pollutants only

Which of the above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

ANSWERS FOR 11th November 2020 TEST YOUR KNOWLEDGE (TYK)

| 1 | D |

| 2 | A |

| 3 | D |

Must Read

About Pfizer’s COVID-19 vaccine development:

About flawed regulations by NPCI on UPI transactions for third-party apps:

About ECI’s success in conducting Bihar assembly elections: