IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS + MAINS FOCUS)

World Cities Culture Forum

Part of: GS Prelims and GS – II – International

- The World Cities Culture Forum is a network of local governments and cultural sector leaders from 40 world cities.

- The World Cities Culture Forum was established in London in 2012 with eight cities (London, New York City, Tokyo, Shanghai, Paris, Istanbul, Sydney and Johannesburg) convened by the Mayor of London.

- The WCCF enables the policy makers of member cities to share research and intelligence, while exploring the vital role of culture in prosperity. Forum members collaborate via a program of events including themed symposia, regional summits and workshops.

- The World Cities Culture report is published by the forum every three years, with data and details on innovative projects from cities across the world.

HSN Code

Part of: GS Prelims and GS – III- Economy

News: The ministry of finance has announced that businesses with turnover of Rs 5 crore and above will have to furnish six-digit HSN or tariff code on the invoices issued for supplies of taxable goods and services

About

- HSN stands for Harmonised System of Nomenclature code. It is mandatory for both B2B and B2C tax invoices on the supplies of Goods and Services.

- This was introduced in 1988 by the World Customs Organization (WCO).

- This was introduced for a systematic classification of goods both national and international.

- This is a 6-digit code that classifies various products.

- India has been using HSN codes since 1986 to classify commodities for Customs and Central Excise. HSN codes apply to Customs and GST.

- The codes prescribed in the Customs tariff are used for the GST purposes too. HSN is used all over the world.

- There are different HSN codes for various commodities. HSN codes remove the need to upload details about the goods which makes filing of GST returns easier.

- The HSN code contains 21 sections. These are divided into 99 chapters which are divided into 1244 sections. This system helps in making GST simpler and globally accepted. HSN codes for goods at 6 digits are universally common. Common HSN codes apply to Customs and GST. Codes prescribed in the Customs tariff are used for the GST purposes. In Customs Tariff, HS code is prescribed as heading (4 digits HS), sub-heading (6 digits HS) and tariff items (8 digits).

SAC HSN code

- SAC code stands for Services Accounting.

- This is issued by Central Board of Indirect Taxes and Customs (CBIC) to classify each service under GST.

- Each service has a unique SAC.

- These SAC codes can be used in invoices created by you for the services you delivered. HSN and SAC codes are used to classify goods and services under GST regime.

National Policy for Rare Diseases, 2021 released

Part of: GS Prelims and GS – II – Health

In news

- “National Policy for Rare Diseases 2021” was recently approved

- Ministry: Ministry of Health

Key takeaways

- Aim: (1) To lower the high cost of treatment for rare diseases with increased focus on indigenous research; (2) To strengthen tertiary health care facilities for prevention and treatment of rare diseases through designating 8 health facilities as Centre of Excellence (CoEs) .

- National Consortium shall be set up to provide the required help

- Department of Health Research, Ministry of Health & Family Welfare will be its convenor.

- Vision: Creation of a national hospital based registry of rare diseases so that adequate data about rare diseases is available.

- Focus: Early screening and prevention through primary and secondary health care infrastructure such as Health and Wellness Centres and District Early Intervention Centres (DEICs) and through counselling for the high-risk patients.

- Screening will also be supported by Nidan Kendras set up by Department of Biotechnology.

- CoEs will also be provided one-time financial support of up to Rs 5 crores for upgradation of diagnostics facilities.

- A provision for financial support up to Rs. 20 lakhs under the Umbrella Scheme of Rashtriya Arogya Nidhi is proposed for treatment of those rare diseases that require a one-time treatment (diseases listed under Group 1 in the rare disease policy).

Do you know?

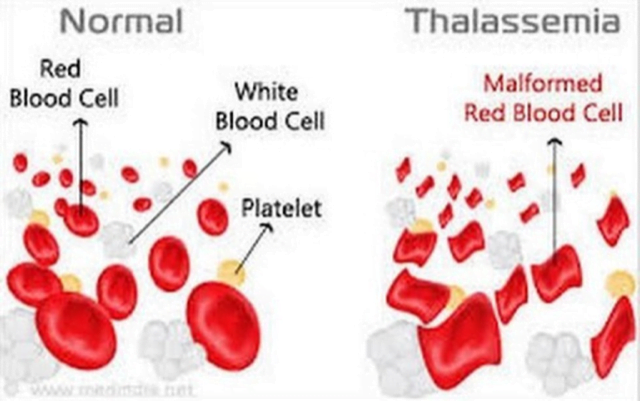

- In India, Haemophilia, Thalassemia, Sickle cell anaemia and Primary Immuno Deficiency in children, auto-immune diseases, Lysosomal storage disorders such as Pompe disease and Gaucher’s disease are in the rare diseases list.

H-1B Visa Rule to expire

Part of: GS Prelims and GS – II – International Relations

In news

- USA President Joe Biden has allowed the H-1B visa rule to expire.

Key takeaways

- In June 2020, former USA President Donald Trump halted the issuance of non-immigrant work visas of several types, including the skilled worker visa, or H-1B.

- It was valid until March 31, 2021.

- Its expiry order shall bring relief to a large number of Indian nationals, especially IT workers.

Do you know?

- Until now, the U.S. issued 85,000 H-1B visas annually, of which 20,000 went to graduate students and 65,000 to private sector applicants, and Indian nationals would garner approximately 70% of these.

(Mains Focus)

ECONOMY/ GOVERNANCE

Topic:

- GS-3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

- GS-3: Monetary Policy

Government on Inflation Targets

Context: On the last day of the financial year 2020-21, the Finance Ministry announced that the inflation target for the five years between April 2021 and March 2026 will remain unchanged at 4%, with an upper tolerance level of 6% and a lower tolerance level of 2%

This is the retail inflation target that will drive the country’s monetary policy framework and influence its decision to raise, hold or lower interest rates.

Why is this important?

- India had switched to an inflation target-based monetary policy framework in 2015, with the 4% target kicking in from 2016-17.

- Many developed countries had adopted an inflation-rate focus as an anchor for policy formulation for interest rates rather than past fixations with metrics like the currency exchange rate or controlling money supply growth. Emerging economies have also been gradually adopting this approach.

- In adopting a target for a period of five years, the central bank has the visibility and the time to smoothly alter and adjust its policies in order to attain the targeted inflation levels over the medium term, rather than seek to achieve it every month.

Analysis of Government’s targets

- Worrying Trend: Volatile food prices and rising oil prices had already driven India’s consumer price index (CPI)-based inflation past the 6% tolerance threshold several times in 2020. Retail inflation has remained below 6% since December 2020. However, it accelerated from 4.1% in January 2021 to 5% in February 2021. Core CPI inflation also increased to a 78-month high of 6.1% in February 2021.

- Pressure of Oil Prices: With oil prices staying high inflation headwinds remain.

- Growth Vs Inflation: There was some speculation that the Central government, whose topmost priority now is to revive growth in the COVID-19 pandemic-battered economy, may ease up on the inflation target by a percentage point or two. This would have given RBI more room to cut interest rates even if inflation was a tad higher.

- Welcome Step: That the government has desisted from doing this and left the inflation target untouched has been welcomed by economists who believe that the new framework has worked reasonably well in keeping inflation in check over the last five years. They attribute the few recent instances when the upper target was breached to the exceptional nature of the COVID-19 shock.

What is the RBI’s position on this?

- The RBI had, in recent months, sought a continuance of the 4% target with the flexible tolerance limits of 2%.

- The 6% upper limit, it argued, is consistent with global experience in countries that have a large share of food items in their consumer price inflation indices.

- Accepting inflation levels beyond 6% would hurt the country’s growth prospects, the central bank had asserted.

How are consumers impacted by this?

- Suppose the inflation target were to be raised to 5% with a 2% tolerance band above and below it, for consumers, that would have meant that the central bank’s monetary policy and the government’s fiscal stance may not have necessarily reacted to arrest inflation pressures even if retail price rise trends would shoot past 6%.

- For instance, the central bank has been perhaps the only major national institution to have made a pitch for both the Centre and the States to cut the high taxes they levy on fuels that have led to pump prices for petrol crossing ₹100 a litre in some districts.

- As high oil prices spur retail inflation higher, the central bank is unhappy as its own credibility comes under a cloud if the target is breached.

- If the upper threshold for the inflation target were raised to 7%, the central bank may not have felt the need to seek tax cuts (yet).

- Thus, the inflation target makes the central bank a perennial champion for consumers vis-à-vis fiscal policies that, directly or indirectly, drive retail prices up.

Connecting the dots:

ECONOMY/ INTERNATIONAL/ SCIENCE & TECH

Topic:

- GS-2: Effect of policies and politics of developed and developing countries on India’s interests

- GS-3: Science and Technology- developments and their applications and effects in everyday life.

China’s Digital Currency

Context: China in February 2021 launched the latest round of pilot trials of its new digital currency, with reported plans of a major roll-out by the end of the year and ahead of the Winter Olympics in Beijing in February 2022.

While several countries have been experimenting with digital currencies, China’s recent trials in several cities have placed it ahead of the curve and offered a look into how a central bank-issued digital tender may impact the world of digital payments.

About China’s Digital Currency

- Officially titled the Digital Currency Electronic Payment (DCEP), the digital RMB (or Renminbi, China’s currency) is, as its name suggests, a digital version of China’s currency.

- It can be downloaded and exchanged via an application authorised by the People’s Bank of China (PBOC), China’s central bank.

- China is among a small group of countries that have begun pilot trials; others include Sweden, South Korea and Thailand.

How is it different from an e-wallet?

- Unlike an e-wallet such as Paytm in India, or Alipay or WeChat Pay in China, the Digital RMB does not involve a third party.

- For users, the experience may broadly feel the same. But from a legal perspective, the digital currency is different. This is legal tender guaranteed by the central bank, not a payment guaranteed by a third-party operator.

- There is no third-party transaction, and hence, no transaction fee.

- Unlike e-wallets, the digital currency does not require Internet connectivity. The payment is made through Near-field Communication (NFC) technology.

- Also, unlike non-bank payment platforms that require users to link bank accounts, this can be opened with a personal identification number, which means “China’s unbanked population could potentially benefit”.

How widely is it being used in China?

- Following trials launched last year shortly after the COVID-19 pandemic struck, 4 million transactions worth $300 million had used the Digital RMB, the PBOC said in November.

- In the latest round of trials in February to coincide with the Chinese New Year holiday, Beijing distributed around $1.5 million of the currency to residents via a lottery, with “virtual red envelopes” worth 200 RMB each (around $30) sent to each resident.

- Shenzhen and Suzhou were other cities that distributed currency as part of pilot trials, which the Ministry of Commerce said will be expanded in coming months, with a wider roll-out expected before the Winter Olympics.

What are the reasons behind the push?

- Tame Private dominating Digital Payment Market: While digital payment platforms have helped to facilitate commerce in China, they have placed much of the country’s money into the hands of a few technology companies.

- By 2019, Alibaba (which is behind Alipay) controlled 55.1% of the market for mobile payments in China. Tencent (which owns WeChat Pay) controlled another 38.9%.

- The trials by Chinese authorities coincided with moves by Chinese regulators to tame some of its Internet giants, like Alibaba and Tencent.

- Financial Stability: A key objective of China’s sovereign digital currency was “to maintain financial stability should ‘something happen’ to Alipay and WeChat Pay.

- Counter rise of Cryptocurrencies: Chinese regulators have also warily viewed the rise of cryptocurrencies. The central bank-issued digital RMB will turn the logic of decentralised cryptocurrencies on its head, without the privacy and anonymity they offer, by giving regulators complete control over transactions.

- Global motivations: Beyond China’s borders, DCEP could help facilitate the internationalisation of the renminbi.

Connecting the dots:

- Blockchain Technology

(TEST YOUR KNOWLEDGE)

Model questions: (You can now post your answers in comment section)

Note:

- Correct answers of today’s questions will be provided in next day’s DNA section. Kindly refer to it and update your answers.

- Comments Up-voted by IASbaba are also the “correct answers”.

Q.1 Which of the following is the currency of China?

- Ringgit

- Renminbi

- Yen

- Dong

Q.2 Consider the following statements regarding digital currency:

- It is a legal tender guaranteed by the central bank.

- It involves transaction fee.

Which of the above is or are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Q.3 H-1B visa is associated with which of the following type of people?

- Student

- Migrants travelling permanently to USA

- Skilled workers

- Temporary workers travelling on behalf of US government

Q.4 Which of the following is listed under Rare diseases List?

- Sickle cell anaemia

- Hypothyroidism

- Diabetes

- Blood cancer

ANSWERS FOR 3rd April 2021 TEST YOUR KNOWLEDGE (TYK)

| 1 | D |

| 2 | C |

Must Read

On rare diseases and government support for treatment:

On missing science pillar in the COVID response:

About GST on fuel: