IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS & MAINS Focus)

Syllabus

- Prelims – Polity

- Mains – GS 2 (Polity & Governance); GS 3 (Money Laundering)

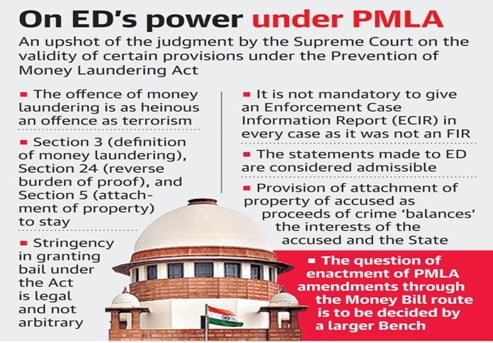

In News: The Supreme Court upheld the core amendments made to the Prevention of Money Laundering Act (PMLA)

- The act gives the government and the Enforcement Directorate (ED) powers of summons, arrest, and raids, and makes bail nearly impossible while shifting the burden of proof of innocence on to the accused rather than the prosecution.

- The apex court called the PMLA a law against the “scourge of money laundering” and not a hatchet wielded against rival politicians and dissenters.

- The verdict came on an extensive challenge raised against the amendments introduced to the 2002 Act by way of Finance Acts.

- The three-judge Bench said the method of introduction of the amendments through Money Bills would be separately examined by a larger Bench of the apex court.

Contended Provisions

- Over 240 petitions were filed against the amendments which the challengers claimed to violate personal liberty, procedures of law and the constitutional mandate.

Summoning

- Petitioners’ argument: The accused are summarily summoned by the ED and made to sign statements on the pain of threat of arrest and ED assumed the powers of a civil court.

- SC: The court said statements were recorded as part of an “inquiry” into the relevant facts in connection with the proceeds of crime. It cannot be equated to an investigation for prosecution.

- A person cannot claim protection under Article 20(3) (fundamental right against self-incrimination) of the Constitution

Arrest

- Petitioners’ argument: The ED could arrest a person even without informing him of the charges.

- This power was violative of the right to ‘due process’ enshrined in Article 21 of the Constitution.

- Besides, Article 22 mandated that no person can be arrested without informing him or her of the grounds of the arrest, they had contended.

- SC: The court rejected the notion that the ED has been given blanket powers of arrest, search of person and property and seizure.

- The court said there were “in-built safeguards” within the Act, including the recording of reasons in writing while effecting arrest.

- The court also noted that the Special Court could verify using its own discretion if the accused need to be further detained or not.

- The court said that supply of a copy of ECIR in every case to the person concerned is not mandatory and “it is enough if ED at the time of arrest, discloses the grounds of such arrest

Bail

- Petitioners’ argument: The “twin conditions” of bail under the PMLA rendered the hope of freedom non-existent for the accused.

- The two conditions are that there should be “reasonable grounds for believing that he is not guilty of such offence” and the accused “is not likely to commit any offence while on bail”.

SC: The court said that money laundering was no ordinary offence. It was an “aggravated form of crime the world over”.

- The court said that there is a need for “creating a deterrent effect” through a stringent law.

- Even a plea for anticipatory bail would have to undergo the rigours of the twin conditions under PMLA.

- However, the court said undertrials could seek bail under Section 436A of the Code of Criminal Procedure if they had already spent one half of the term of punishment in jail for the offence prescribed in law.

Burden of Proof

- Petitioner’ argument: Burden of proof resting heavily on the shoulders of the accused

- SC: The provision did not suffer from the “vice of arbitrariness or unreasonableness”.

- Once the issue of admissibility of materials supporting the factum of grave suspicion about the involvement of the person in the commission of crime under the 2002 Act is accepted, in law, the burden must shift on the person concerned to dispel that suspicion.

Attaching a property

- Petitioners’ argument: They objected the powers bestowed on the ED to attach a property as proceeds of crime.

- They had contended that even properties which were not proceeds of crime could be attached by the agency.

- SC: The court said Section 5 of the PMLA, which concerns with the provisional attachment of property, cannot be used by the agency “mechanically”.

- Authorities under the 2002 Act cannot resort to action against any person for money-laundering on an assumption that the property recovered by them must be proceeds of crime and that a scheduled offence has been committed, unless the same is registered with the jurisdictional police or pending inquiry by way of complaint before the competent forum.

- The court said the provision provided a “balancing arrangement” between the interests of the accused and that of the State.

- Further, if the accused was eventually absolved of the crime, no further action could be taken against the attached property suspected to have been linked to the crime.

Must Read: Prevention of Money Laundering Act (PMLA), 2002

Source: The Hindu

Previous Year Question

Q.1) With reference to the ‘Prohibition of Benami Property Transactions Act, 1988 (PBPT Act), consider the following statements: (2017)

- A property transaction is not treated as a benami transaction if the owner of the property is not aware of the transaction.

- Properties held benami are liable for confiscation by the Government.

- The Act provides for three authorities for investigations but does not provide for any appellate mechanism.

Which of the statements given above is/are correct?

- 1 only

- 2 only

- 1 and 3 only

- 2 and 3 only

Syllabus

- Prelims – Polity – Important Acts

- Mains – GS 1 (Society); GS 2 (Governance)

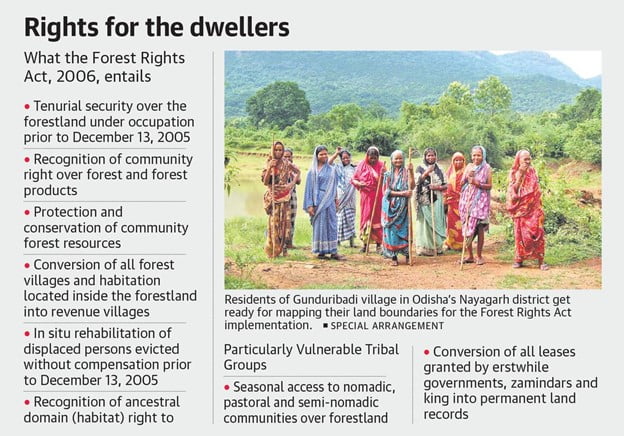

In News: While many States are nowhere near completing implementation of the historic Act, Odisha is aiming for a full rollout by 2024.

- It is the first State in the country to make budgetary provision for implementation of the Central Act – ₹8 crore for 168 FRA cells in 2021-22.

- Till last year, forest rights committees were functioning in Tribal Sub Plan areas. Now, they have been extended to the entire State.

- The State is not only ensuring tenurial security and entitlement over land but also addressing livelihood and food security under the Act.

- Odisha’s ST and SC Development Department is about to launch Mission 2024 for FRA by granting all kinds of forest rights whether it is for the individual, community or habitat.

- The mission, currently under Finance Department and Planning and Convergence Department scrutiny, aims at granting the tribal people their rightful ownership.

Forest Rights Act, 2006

- FRA enacted in 2006 recognises the rights of forest-dwelling tribal communities (FDST) and other traditional forest dwellers (OTFD) to forest resources on which these communities were dependent for a variety of needs, including livelihood, habitation and other sociocultural needs.

- It recognizes and vest the forest rights and occupation FDST and OTFD who have been residing in such forests for generations.

- It strengthens the conservation regime of the forests while ensuring livelihood and food security of the FDST and OTFD.

- The Gram Sabha is the authority to initiate the process for determining the nature and extent of Individual Forest Rights (IFR) or Community Forest Rights (CFR) or both that may be given to FDST and OTFD.

Rights Under the Forest Rights Act:

Title rights:

- It gives FDST and OTFD the right to ownership to land farmed by tribals or forest dwellers subject to a maximum of 4 hectares.

- Ownership is only for land that is actually being cultivated by the concerned family and no new lands will be granted.

Use rights:

- The rights of the dwellers extend to extracting Minor Forest Produce, grazing areas

Relief and development rights

- To rehabilitate in case of illegal eviction or forced displacement and to basic amenities, subject to restrictions for forest protection.

Forest management rights:

- It includes the right to protect, regenerate or conserve or manage any community forest resource which they have been traditionally protecting and conserving for sustainable use.

Source: The Hindu

Previous Year Question

Q.1) Consider the following statements: (2019)

- As per recent amendment to the Indian Forest Act, 1927, forest dwellers have the right to fell the bamboos grown on forest areas.

- As per the Scheduled Tribes and Other Traditional Forest Dwellers (Recognition of Forest Rights) Act, 2006, bamboo is a minor forest produce.

- The Scheduled Tribes and Other Traditional Forest Dwellers (Recognition of Forest Rights) Act, 2006 allows ownership of minor forest produce to forest dwellers.

Which of the statements given above is/are correct?

- 1 and 2 only

- 2 and 3 only

- 3 only

- 1, 2 and 3

Q.2) Consider the following statements about Particularly Vulnerable Tribal Groups (PVTGs) in India: (2019)

- PVTGs reside in 18 States and one Union Territory.

- A stagnant or declining population is one of the criteria for determining PVTG status.

- There are 95 PVTGs officially notified in the country so far.

- Irular and Konda Reddi tribes are included in the list of PVTGs.

Which of the statements given above are correct?

- 1, 2 and 3

- 2, 3 and 4

- 1, 2 and 4

- 1, 3 and 4

Syllabus

- Prelims – Geography

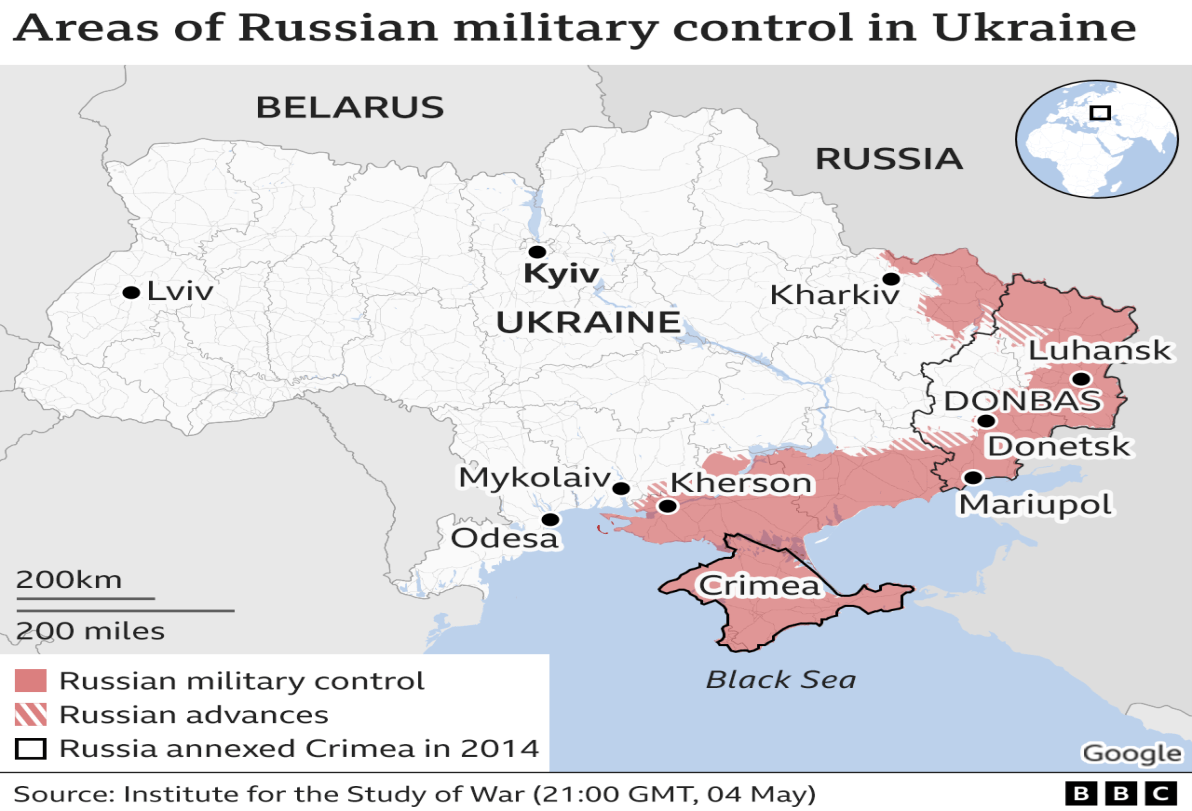

Kherson

In News: Ukraine strikes key bridge in Russian-held Kherson

- Ukrainian artillery on Wednesday struck a key bridge in Moscow-controlled territory in south Ukraine, damaging an important supply route as Kyiv’s forces look to wrest back the Kherson region.

- The strike on the Antonivskiy bridge over the Dnipro river came hours ahead of the opening in Istanbul of a joint observation centre to monitor Ukrainian grain exports that have been blocked by the Kremlin’s warships.

- Ukrainian forces in recent weeks have been clawing back territory in the Kherson region, which fell to Russian forces easily and early after their invasion launched on February 24

- Their counter-offensive supported by Western-supplied long-range artillery has seen its forces push closer to Kherson city, which had a pre-war population of under 300,000 people.

Dnieper River

- The Dnieper or Dnipro is one of the major rivers of Europe, rising in the Valdai Hills near Smolensk, Russia, before flowing through Belarus and Ukraine to the Black Sea.

- It is the longest river of Ukraine and Belarus and the fourth-longest river in Europe, after the Volga, Danube, and Ural rivers.

Source: The Hindu

Previous Year Question

Q.1) Consider the following pairs: (2022)

Country: Important reason for being in the news recently

- Chad: Setting up a permanent military base by China

- Guinea: Suspension of Constitution and Government by military

- Lebanon: Severe and prolonged economic depression

- Tunisia: Suspension of Parliament by President

How many pairs given above are correctly matched?

- Only one pair

- Only two pairs

- Only three pairs

- All four pairs

Syllabus

- Prelims – Polity

In News: In a show of solidarity with the four suspended members Opposition members in the Lok Sabha demanded the revocation of their suspension.

Suspension

- On what grounds and rules – Refer – Suspension of MPs

What is the procedure for revocation of a Member’s suspension?

- While the Speaker is empowered to place a Member under suspension, the authority for revocation of this order is not vested in her.

- It is for the House, if it so desires, to resolve on a motion to revoke the suspension.

In Rajya Sabha

- The House by motion terminates the suspension.

Source: Indian Express

Syllabus

- Prelims – Current Affairs

High Ambition Coalition for Nature and People

- It is an intergovernmental group championing a global deal for nature and people that can halt the accelerating loss of species, and protect vital ecosystems that are the source of our economic security.

- It was launched in 2019 by Costa Rica, France and Britain.

Aim:

- To promote an international agreement to protect at least 30% of the world’s land and ocean by 2030 (Global 30×30 target).

- To manage the planet sustainably with no net loss of natural habitats, supported by a circular economy, and strives for the sustainable and equitable sharing of benefits from nature.

Members:

- It has more than 70 countries which are a mix of countries in the global north and south, European, Latin American, Africa and Asia countries are among the members.

- India became a member in October 2021.

Source: Indian Express

Previous Year Question

Q.1) With reference to the ‘New York Declaration on Forests’ Which of the following statements are correct? (2021)

- It was first endorsed at the United Nations Climate Summit in 2014.

- It endorses a global timeline to end the loss of forests.

- It is a legally binding international declaration.

- It is endorsed by governments, big companies and indigenous communities.

- India was one of the signatories at its inception.

Select the Correct answer using the code given below.

- 1, 2 and 4

- 1, 3 and 5

- 3 and 4

- 2 and 5

Syllabus

- Mains – GS 2 ( Polity)

Context: The concerns of the founding fathers — addressing socio-economic inequities — are being forgotten in today’s fiscal policy.

- In his last speech, in 1949, to the Constituent Assembly, R. Ambedkar sounded a note of caution about the Indian republic entering a life of contradictions.

“In politics we will have equality and in social and economic life we will have inequality. These conflicts demanded attention: fail to do so, and those denied will blow up the structure of political democracy”.

- Initially a degree of centralisation in fiscal power was required to address the concerns of socio-economic and regional disparities.

- But this asymmetric federalism, inherent to the Constitution, is recently accelerated and mutually reinforced with political centralisation making the Union Government extractive rather than enabling.

What’s happening?

A politicised institution

- The concerns of the founding fathers — addressing socio-economic inequities — were forgotten in the process of ushering in an era of political centralisation and cultural nationalism that drive today’s fiscal policy.

- Historically, India’s fiscal transfer worked through two pillars, i.e., the Planning Commission and the Finance Commission.

- But the waning of planning since the 1990s, and its abolition in 2014, led to the Finance Commission becoming a major means of fiscal transfer as the commission itself broadened its scope of sharing all taxes since 2000 from its original design of just two taxes — income tax and Union excise duties.

- Today, the Finance Commission became a politicised institution with arbitrariness and inherent bias towards the Union government.

Hollowing out fiscal capacity

Stagnant Revenue

- The ability of States to finance current expenditures from their own revenues has declined from 69% in 1955-56 to less than 38% in 2019-20.

- While the expenditure of the States has been shooting up, their revenues did not

- States cannot raise tax revenue because of curtailed indirect tax rights — subsumed in GST, except for petroleum products, electricity and alcohol — the revenue has been stagnant at 6% of GDP.

Devolution

- Even the increased share of devolution, mooted by the 14th FC, from 32% to 42%, was subverted by raising non-divisive cess and surcharges that go directly into the Union kitty.

- This non-divisive pool in the Centre’s gross tax revenues shot up to 15.7% in 2020 from 9.43% in 2012, shrinking the divisible pool of resources for transfers to States.

- In addition, the recent drastic cut in corporate tax, with its adverse impact on the divisible pool, and ending GST compensation to States have had huge consequences.

Differential Interest

- The States are forced to pay differential interest — about 10% against 7% — by the Union for market borrowings.

- It is not just that States are also losing due to gross fiscal mismanagement — increased surplus cash in balance of States that is money borrowed at higher interest rates — the Reserve Bank of India, when there is a surplus in the treasury, typically invests it in short treasury bills issued by the Union at lower interest rate.

- In sum, the Union gains at the expense of States by exploiting these interest rate differentials.

Centrally sponsored schemes

- There are 131 centrally sponsored schemes, with a few dozen of them accounting for 90% of the allocation, and States required to share a part of the cost.

- They spend about 25% to 40% as matching grants at the expense of their priorities.

- These schemes, driven by the one-size-fits-all approach, are given precedence over State schemes, undermining the electorally mandated democratic politics of States.

- Driven by democratic impulses, States have been successful in innovating schemes that were adopted at the national level, for example, employment guarantee in Maharashtra, the noon meals in Tamil Nadu, local governance in Karnataka and Kerala, and school education in Himachal Pradesh.

Deepening inequality

This political centralisation has only deepened inequality.

Stats

- The World Inequality Report estimates ‘that the ratio of private wealth to national income increased from 290% in 1980 to 555% in 2020, one of the fastest such increases in the world.

- The poorest half of the population has less than 6% of the wealth while the top 10% nearly grab two-third of it.

- India has a poor record on taxing its rich.

- Its tax-GDP ratio has been one of the lowest in the world — 17% of which is well below the average ratios of emerging market economies and OECD countries’ about 21% and 34%, respectively.

Problems

- Hollowing out of fiscal capacity continued for decades after Independence, resulting in one of the lowest tax bases built on a regressive indirect taxation system in the world.

- India has simply failed to tax its property classes.

- If taxing on agriculture income was resisted in the 1970s when the sector prospered.

- India does not have wealth tax either.

- Its income tax base has been very narrow.

- Indirect tax still accounts for about 56% of total taxes.

- Instead of strengthening direct taxation, the Union government slashed corporate tax from 35% to 25% in 2019 and went on to monetise its public sector assets to finance infrastructure.

Way Forward

India’s Fiscal Federalism needs to be restructured in order to eliminate the above mentioned inadequacies.

- Finance Commission: The role of finance should be redefined. Commission should frame a devolution framework by considering the concerns of all the stakeholders.

- NITI Aayog should strive to remove regional and subregional disparities among states by reducing development imbalances.

- Decentralization can serve as the third pillar of the new fiscal federalism by strengthening local finances and state finance commission.

- Goods and Services Tax should be simplified in its structure by ensuring Single Rate GST and Transparency.

- A Reformed Approach toward States – the Centre could strive to be more conciliatory towards States’ concerns and fiscal dilemmas.

Source: The Hindu

Baba’s Explainer – State of DISCOMs

Syllabus

- GS-3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development

- GS-3: Infrastructure: Energy

Context: On July 13, the Tamil Nadu state DisCom filed a power tariff revision petition with the Tamil Nadu Electricity Regulatory Commission proposing to hike power tariffs by 10% to 35%. If the proposal comes into effect, expected in September, the hike will be after a gap of eight years.

Read Complete Details on State of DISCOMs

Daily Practice MCQs

Q.1) Consider the following statements

- N-Treat technology is a five-stage process for waste treatment.

- The technology is developed by IIT-Madras and National Institute of Urban Affairs.

- It involves in-situ or on-site method of treatment and does not require additional space.

Choose the correct statements:

- 1 only

- 1, 2 and 3

- 3 only

- 2 and 3

Q.2) Which of the below given pairs is/are not correctly matched?

| Wetland | State |

| Sakhya Sagar | Madhya Pradesh |

| Pala Wetland | Mizoram |

| Karikili Bird Sanctuary | Tamil Nadu |

Choose the correct code:

- 1 only

- 3 only

- 2 and 3

- None

Q.3) Consider the following statements about Forest Rights Act, 2006

- The Gram Sabha is the authority to initiate the process for determining the nature and extent of Individual Forest Rights under the act.

- It gives forest-dwelling tribal communities (FDST) the right to ownership to land farmed by tribals subject to a maximum of 6 hectares.

Choose the correct statements:

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Comment the answers to the above questions in the comment section below!!

ANSWERS FOR ’28th JULY 2022 – Daily Practice MCQs’ will be updated along with tomorrow’s Daily Current Affairs.

ANSWERS FOR 27th JULY 2022 – Daily Practice MCQs

Q.1) – b

Q.2) – c

Q.3) – b