Environment & Ecology

In News: Parliament passed the Energy Conservation (Amendment) Bill-2022 that enables the Union government to set up a carbon credit trading scheme and specify the minimum amount of non-fossil sources to be used by designated energy consumers.

Context:

- India had taken the lead when it came to energy transition.

- As per India’s commitments under the UNFCCC as given by the PM at COP-26 last year, the goal is to cut emission intensity by 45% and achieve 50% of the installed capacity of electricity generation from non-fossil fuel sources.

Energy Conservation (Amendment) Bill-2022

- The Bill amends the Energy Conservation Act-2001.

- The Central Electricity Regulatory Commission (CERC) would be the regulator and that the carbon price would be determined by the market.

- The Bill covers large buildings — those with connected load of 100 kilowatt and above — for compliance with energy conservation and sustainability codes.

- States had been empowered to lower the threshold to include a wider section of buildings.

- The Bill did not make a provision for those under the 100KW threshold who want to voluntarily submit to the energy conservation mechanism.

What is carbon trading:

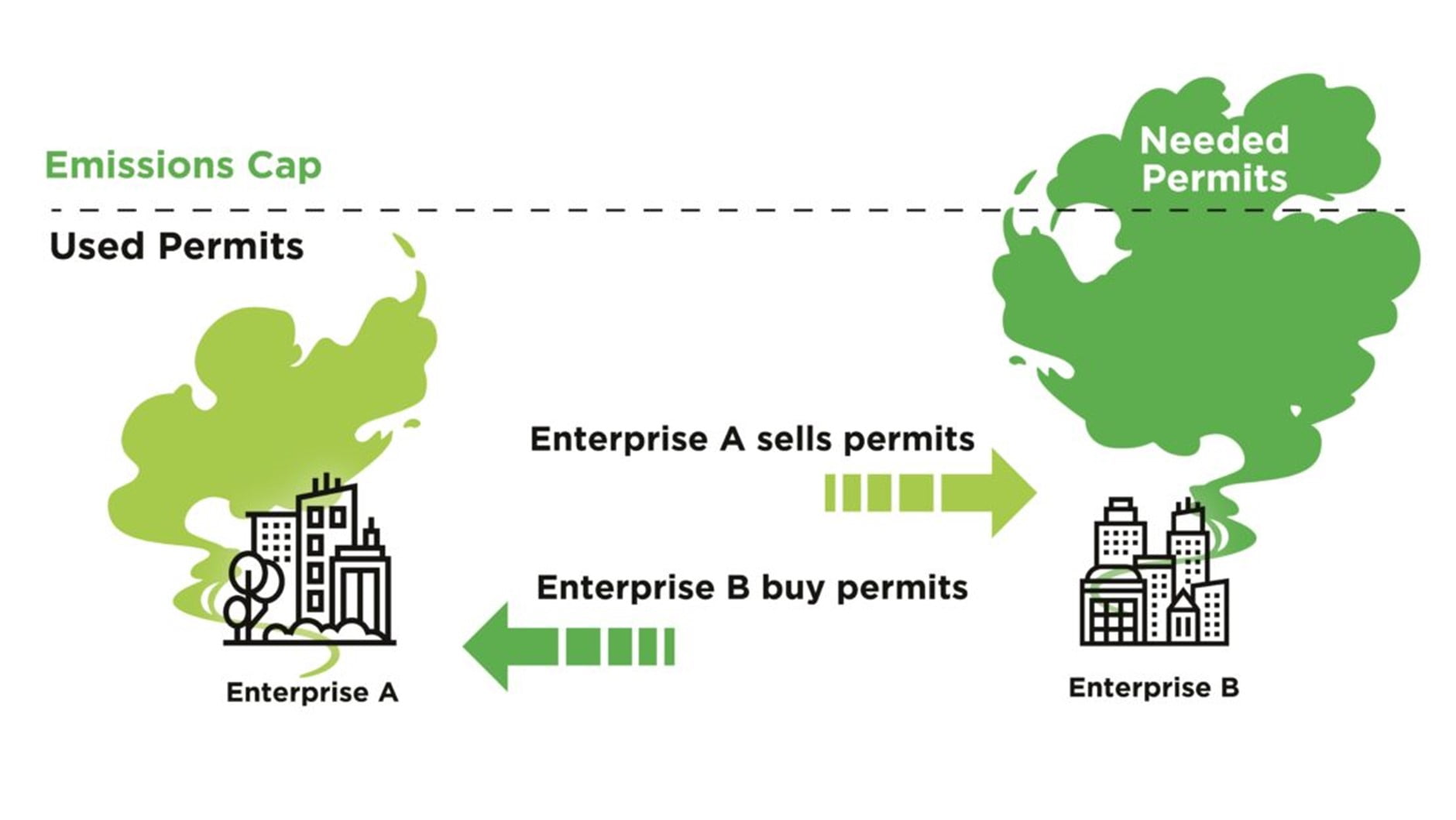

- Carbon trading is the process of buying and selling permits and credits that allow the permit holder to emit carbon dioxide.

- It is a market-based system aimed at reducing greenhouse gases that contribute to global warming, particularly carbon dioxide emitted by burning fossil fuels.

- An emissions trading scheme (cap-and-trade system) sets a regulatory ceiling or ‘cap’ on greenhouse gas emissions being regulated under the scheme.

- The right to emit a tonne of CO2 is often referred to as a carbon ‘credit’ or carbon ‘allowance’.

- There are broadly two types of carbon markets: compliance and voluntary.

- Examples – European Union’s Emissions Trading System(ETS)

- The Clean Development Mechanism (CDM), adopted under the Kyoto Protocol in 1997.

- Emission-reduction projects in developing countries have generated carbon credits used by industrialized countries to meet part of their emission reduction targets.

Significance:

- Help achieve current and future climate ambitions by tapping existing markets.

- Bring about development co-benefits: improve air quality and health outcomes and ensure energy security.

- g. trading in sulphur dioxide permits helping to limit acid rain in the US.

- Carbon trading is much easier to implement than expensive direct regulations, and unpopular carbon taxes.

- If regional cap and trade schemes can be joined up globally, with a strong carbon price, it could be a relatively pain-free and speedy method to help the worlds decarbonise.

- Boost competitive advantage of businesses by reducing risk of stranded assets.

- Open low carbon opportunities for MSMEs through

- Technology transfer

- Spur clean innovation

- Provide liquidity to Indian credits

- Unlock climate finance

Challenges:

- Creating a market in something with no intrinsic value such as carbon dioxide is difficult.

- Need to promote scarcity – and you have to strictly limit the right to emit so that it can be traded.

- In the world’s biggest carbon trading scheme, the EU ETS, political interference has created gluts of permits.

- On account of corruption, carbon credits have often been given away for free, which has led to a collapse in the price and no effective reductions in emissions.

- Another problem is that offset permits, gained from paying for pollution reductions in poorer countries, are allowed to be traded as well.

- The importance of these permits in reducing carbon emissions is questionable and the effectiveness of the overall cap and trade scheme is also reduced.

- Greenwashing – in which companies falsely market their green credentials, for example, misrepresentations of climate-neutral products or services

- Double-counting of GHG emission reductions

Suggestions:

- Carbon taxes – Taxes on energy content or production are in place in many European countries.

- Taxes exist in India, Japan and South Korea and they have been imposed then repealed in Australia.

- Direct regulations – Governments have tried to regulate their way to lower emissions.

- This approach is being tried in the US, where President Obama has imposed a Clean Power Plan on energy producers, designed to reduce emissions from this sector by 32% by 2030.

Way forward:

- As per latest IPCC report, developing countries will need up to US$6 trillion by 2030 to finance not even half of their climate action goals (as listed in their Nationally Determined Contributions, or NDCs).

- Carbon finance will be key for the implementation of the NDCs, and the Paris Agreement enables the use of such market mechanisms through Article 6.

- 83 percent of NDCs state the intent to make use of international market mechanisms to reduce greenhouse gas emissions.

MUST READ Greenwashing

Source : Indian Express