IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS & MAINS Focus)

Syllabus

- Prelims –Environment and Ecology

Context: Recent reports suggest, that the Congo rainforest continues to vanish with half a million hectares lost in 2022.

Key findings of the study:-

- The Congo rainforest lost half a million hectares (mha) of forest last year.

- The Democratic Republic of Congo (DRC) lost over 500,000 hectares in 2022.

- It noted that 4.1 mha of primary tropical forest were lost worldwide last year

- Of this, Brazil accounted for 43 per cent of the total tropical primary forest loss, followed by DRC (12.1 per cent) and Bolivia.

- This destruction in natural forests generated 2.7 billion tonnes of CO2.

- The total area of humid primary forest in DRC decreased by 6.1 per cent during this period.

- Primary forests: forests of native tree species, where there are no clearly visible indications of human activities.

- Most of the primary forest loss consists of small clearings near cyclical agricultural areas, according to the report.

- Cyclical agricultural areas: land that is cleared (using slash-and-burn techniques) for the short-term cultivation of crops and left fallow for forests and soil nutrients to regenerate.

- Economic factors may be driving deforestation.

- Most Congolese rely on forests to meet their food and energy needs and thus reducing primary forest loss in the region remains a challenge.

- The drivers of forest loss across DRC are slash-and-burn agriculture, uncontrolled bushfires, charcoal production for local and regional markets, cattle ranching, and illegal (artisanal) logging

- Charcoal is the dominant form of energy in the region, which is generated by cutting and burning timber.

About Congo rainforest:-

IMAGE SOURCE: adlance22.blogspot.com

- The Congo is the world’s second-largest rainforest. (UPSC MAINS: India’s stakes in Africa)

- World’s largest rainforest is the

- Bordering countries: The Congo Rainforest encompasses six African countries:–

Cameroon, Central African Republic, the Republic of Congo, the Democratic Republic of Congo (DRC), Equatorial Guinea, and Gabon.

- Climate: it has a tropical climate year-round, with heavy precipitation and high humidity and temperatures.

- Plants: It houses approximately 10,000 tropical plants, 30% unique to the region.

- Wildlife: There are also 400 species of mammals, over 600 tree species, 10,000 animal species, 1,000 bird species, and 700 fish species.

- This includes endangered wildlife such as forest elephants, chimpanzees, and bonobos.

- Economic Significance: the Congo Basin provides food, medicine, water, materials and shelter for over 75 million people.

- Human inhabitants: More than 150 ethnic groups have lived in the Congo rainforest area for over 50,000 years.

- Among these ethnic groups, the Ba’Aka, BaKa, BaMbuti, Efe and other related groups are often referred to as

- Pygmy: a member of any human group whose adult males grow to less than 59 inches (150 cm) in average height.

- They rely on hunting and gathering for survival in the rainforest.

MUST READ: India-Africa: Challenges & Way Ahead

SOURCE: DOWN TO EARTH

PREVIOUS YEAR QUESTIONS

Q.1) Consider the following trees: (2023)

- Jackfruit (Artoca7pus heterophyllus)

- Mahua (Madhuca indica)

- Teak (Tectona grandis)

How many of the above are deciduous trees?

- Only one

- Only two

- All three

- None

Q.2) Which one of the following is a part of the Congo Basin? (2023)

- Cameroon

- Nigeria

- South Sudan

- Uganda

Syllabus

- Prelims –Economy

Context: Recently, the Employees’ Provident Fund Organisation (EPFO) has extended the deadline for members and pensioners to apply for higher Provident Fund (PF).

About Provident Fund (PF):-

- Provident fund (PF) is a fixed amount of money that is contributed by employees from their salary until retirement.

- It is used to provide a lump sum or monthly payments to salaried employees when they retire.

- Regulator: the government regulates provident funds and in India through the Employees’ Provident Fund Organization (EPFO).

Benefits of PF:-

- The provident fund provides good investment opportunities to individuals upon retirement.

- The one-time inflow of money can aid them in changing homes, opening new businesses, educating dependents, medical emergencies or just investing in mutual funds.

Type of Provident funds

- There are various types of provident funds: some are exclusive to government employees while others are meant for private employees.

Employees Provident Fund (EPF)

- It is the most popular type of PF in India.

- Applicability: All businesses or corporations with more than 20 employees must offer retirement benefits to the employees and contribute to the PF.

- It also covers certain other establishments which may be notified by the Central Government even if they employ less than 20 persons each.

Implementation:–

- The employee has to pay a certain contribution towards the provident fund (PF) and the employer on a monthly basis pays the same amount.

- At the end of retirement or during the service (under some circumstances), the employee gets the lump sum amount including the interest on the PF contributed.

- Benefits: It offers higher interest rates.

- The amount that the employee pays is matched by the employer.

- A major part of the sum is handed out at the time of retirement.

- The rest is paid in instalments as a

- Partial withdrawals for education, marriage, illness and house construction is allowed.

- Maturity: the EPF matures only on retirement.

- Taxation: The amount received is tax-free as long as the employee has been working with the company for more than 5 years.

Public Provident Fund (PPF)

- The Public Provident Fund is a saving scheme.

- It is available to everyone in India.

- It can be opened by both permanently employed or self-employed individuals.

- Eligibility: PPF can be opened by any resident of India.

- Amount deposited: The minimum amount to be deposited is ₹500, and the maximum is ₹1.5 lacs in a financial year.

- The amount is paid after 15 years at pre-decided rates.These rates are fixed by the central government every quarter.

- Taxation: PPF amounts received on maturity are tax-free.

- PPF Vs EPF: PPF is mainly a savings scheme, while EPF also offers pensionary benefits.

General Provident Fund (GPF)

- General Provident Fund is also known as the Statutory Provident Fund.

- Eligibility: It is only available for government servants.

- These include permanent employees, re-employed pensioners, or temporary employees with at least one year of service.

- Amount contributed: 6 per cent of the monthly salary has to be contributed to the GPF account.

- Interest: The interest rate is adjusted by the government and ranges between 7-8 per cent.

EPFO

- Establishment: 1952.

- Ministry: Ministry of Labour & Employment.

- HQ: New Delhi.

- Function: It is a government organization that manages the provident fund (PF) and pension accounts of member employees.

- It implements the Employees’ Provident Fund and Miscellaneous Provisions Act, of 1952.

MUST READ: National Pension System (NPS)

SOURCE: THE HINDU

PREVIOUS YEAR QUESTIONS

Q.1) Consider the following statements : (2023)

Statement-I: Interest income from the deposits in Infrastructure Investment Trusts (InviTs) distributed to their investors is exempted from tax, but the dividend is taxable.

Statement-II: InviTs are recognized as borrowers under the ‘Securitization and Reconstruction of Financial Assets and·Enforcement of the Security Interest Act, 2002’.

Which one of the following is correct in respect of the above statements?

- Both Statement-I and Statement-II are correct and Statement-11 is the correct explanation for Statement-I

- Both Statement-I and Statement-II are correct and Statement-II is not the correct explanation forStatement-I

- Statement-I is correct but Statement-II is incorrect

- Statement-I is incorrect but Statement-II is correct

Q.2) Consider the following statements: (2022)

- In India, credit rating agencies are regulated by the Reserve Bank of India.

- The rating agency popularly known as ICRA is a public limited company.

- Brickwork Ratings is an Indian credit rating agency.

Which of the statements given above is correct?

- 1 and 2 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Syllabus

- Prelims – Science and Technology

Context: An Indian-origin British satellite industry expert was appointed as the director of the United Nations Office for Outer Space Affairs (UNOOSA).

Background:-

- Aarti Holla-Maini, has been appointed as the director of the United Nations Office for Outer Space Affairs (UNOOSA).

- She is an Indian-origin British satellite industry expert.

- The United Nations secretary general appointed her.

- She holds a bachelor’s degree in law with German law from King’s College London and a master’s degree in business administration from French business school HEC Paris.

- She spent over 18 years as the secretary-general of the Global Satellite Operators Association.

- She has 25 years of experience in the aerospace industry.

- She has recently held the role of executive vice-president, of sustainability, policy and impact at NorthStar Earth & Space.

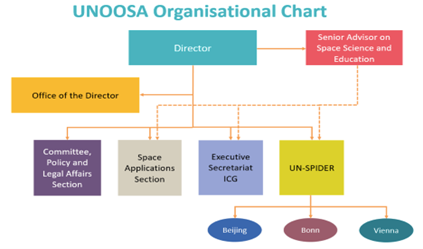

About United Nations Office for Outer Space Affairs (UNOOSA):-

IMAGE SOURCE: UNOOSA.ORG

- Established: 1958

- HQ: Vienna, Austria.

- Objective: to help all countries, especially developing countries, access and leverage the benefits of space to accelerate sustainable development.

Structure of UNOOSA:-

- The Office is headed by a Director and has five sections:-

- Office of the Director (OD)

- OD oversees and coordinates the strategic direction and operational priorities of UNOOSA.

- Committee, Policy and Legal Affairs Section (CPLA)

- CPLA provides substantive, secretariat, organisational and administrative support.

- Space Applications Section (SAS)

- SAS plans and implements the United Nations Programme on Space Applications.

- United Nations Platform for Space-Based Information for Disaster Management and Emergency Response (UN-SPIDER)

- UN-SPIDER is a programme of UNOOSA to leverage space data and applications for disaster risk reduction.

- Executive Secretariat of the International Committee on GNSS (ICG)

- The ICG brings together all global navigation satellite system (GNSS) providers.

Functions of UNOOSA:-

- It helps countries build their capacity to develop and make the most out of the space sector.

- It helps countries use space data and technologies, such as satellite imagery, to prevent and manage disasters. (UPSC MAINS: Can outer space be considered a resource)

- It helps countries understand the fundamentals of international space law and increase their capacity to draft or revise national space law and policy.

- It supports transparency in space activities.

- It helps to promote sustainable development through space.

- It works with space agencies and space leaders around the world to devise solutions to challenges that require an international response.

MUST READ: IN–SPACe (Indian National Space Promotion and Authorisation Centre)

SOURCE: TIMES NOW

PREVIOUS YEAR QUESTIONS

Q.1) Consider the following statements (2023)

- Carbon fibers are used in the manufacture of components used in automobiles and aircraft.

- Carbon fibers once used cannot be recycled.

Which of the statements given above is correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Q.2) Consider the following pairs: (2023)

Objects in space Description

- Cepheids Giant clouds of dust and gas in space

- Nebulae Stars which brighten and dim periodically

- Pulsars Neutron stars are formed when massive stars run out of fuel and collapse

How many of the above pairs are correctly matched?

- Only one

- Only two

- All three

- None

Syllabus

- Prelims –Important Institutions

Context: Recently, the Digital Publisher Content Grievances Council (DPCGC) recommended punitive action for the OTT platform ULLU over allegedly obscene content.

About Digital Publisher Content Grievances Council (DPCGC):-

IMAGE SOURCE: The Dominion Post

- It is an officially recognized, independent self-regulatory body for online-curated content providers (OCCPs).

- OCC Platforms: companies that carry on the business, which curates and present a wide variety of content by means of online video-on-demand platforms.

- OOC Platforms operating in India: Amazon Prime, Netflix, Hot star, Zee5, etc.

- Establishment: 2021.

- It has been set up under the aegis of the Internet and Mobile Association of India (IAMAI).

- IAMAI: a not-for-profit industry body representing the interests of the online and mobile value-added services industry.

- Objective: to usher in a redressal mechanism which will ensure a balance between addressing viewer complaints and showcasing content in a free-speech environment without ad-hoc interventions

- Ministry: Ministry of Information & Broadcasting

- Current Head: A K Sikri, retired Supreme Court Judge.

Functions of GRB:-

- It will oversee and ensure the alignment and adherence to the Code of Ethics by the OCCP Council members.

- Provide guidance to entities on the Code of Ethics. (UPSC CSE: Digital India programme)

- Address grievances that have not been resolved by the publisher within 15 days.

- Hear grievances/appeals filed by complainants.

MUST READ: Grievance Appellate Committees

SOURCE: THE INDIAN EXPRESS

PREVIOUS YEAR QUESTIONS

Q.1) Consider the following actions : (2023)

- Detection of car crashes/collisions which results in the deployment of airbags almost instantaneously.

- Detection of accidental free fall of a laptop towards the ground which results in the immediate turning off of the hard drive.

- Detection of the tilt of the smartphone which results in the rotation of the display between portrait and landscape mode.

In how many of the above actions is the function of the accelerometer required?

- Only one

- Only two

- All three

- None

Q.2) Which one of the following countries has its own Satellite Navigation System? (2023)

- Australia

- Canada

- Israel

- Japan

Syllabus

- Prelims –Environment and Ecology

Context: New drones have been provided for the Tadoba-Andhari Tiger Reserve recently.

Background:-

- Global end-to-end supply chain solution provider DP World has provided thermal drones for the Tadoba-Andhari Tiger Reserve in Maharashtra.

- These drones are to help detect forest fires and intensify surveillance.

- The forest field staff to receive on-site training for operating the drones for a year

About Tadoba-Andhari Tiger Reserve:-

IMAGE SOURCE: ResearchGate

- Location: Chandrapur district in (UPSC CSE: Tadoba-Andhari Tiger Reserve)

- Established: in 1993-94.

- It is Maharashtra’s oldest and largest national park.

- It is one of India’s 50 “Project Tiger”.

- The reserve is the second Tiger Reserve in Maharashtra.

- The first Tiger Reserve established in the State is Melghat Tiger Reserve (1973-74).

Fauna:-

- Mammals: Wolf, Jackal, Wild dogs, Fox, Hyenas, Spotted Deer, Wild Boars, Barking deer.

- Birds: Honey Buzzard, Shy Jungle Fowl, Grey-headed Fishing Eagle.

Flora:–

- Vegetation: tropical dry deciduous forest with dense woodlands.

- It comprises about eighty-seven per cent of the protected area.

- Teak is the predominant tree species.

- Others: Bamboo, Ain, Bija, Dhaudab, Haldu, Salai, Semal, Shisham, Sisoo, Surya, Sirus.

MUST READ: Global Conservation Assured|Tiger Standards (CA|TS)

SOURCE: BUSINESS LINE

PREVIOUS YEAR QUESTIONS

Q.1) Consider the following statements : (2023)

- In India, the Biodiversity Management Committees are key to the realization of the objectives of the Nagoya Protocol.

- The Biodiversity Management Committees have important functions in determining access and benefit sharing, including the power to levy collection fees on the access of biological resources within its jurisdiction.

Which of the statements given above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Q.2) Which one of the following protected areas is well-known for the conservation of a sub-species of the Indian swamp deer (Barasingha) that thrives well on hard ground and is exclusively graminivorous? (2020)

- Kanha National Park

- Manas National Park

- Mudumalai Wildlife Sanctuary

- Tal Chhapar Wildlife Sanctuary

Syllabus

- Prelims –Economy

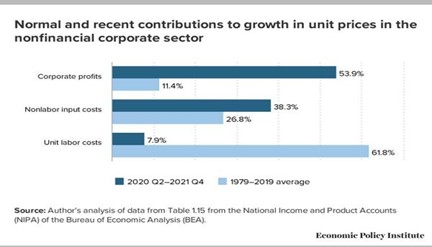

Background:-

- There is a growing consensus across the world that corporate greed is spiking inflation even as workers are doubly penalized by low wage increases and higher interest rates.

About Greedflation:-

IMAGE SOURCE: THE INDIAN EXPRESS

- Greedflation simply means (corporate) greed is fuelling inflation. (UPSC CSE: INFLATION)

- It is the phenomenon where corporate greed becomes a significant factor in fueling inflation.

- It implies that companies exploited the inflation that people were experiencing by putting up their prices way beyond just covering their increased costs.

- This was then used to maximize their profit margins.

Disadvantage:-

- The increased prices may further contribute to inflationary pressures in the economy.

- It disrupts the traditional understanding of the wage-price spiral and emphasizes the influence of corporate behavior on inflation dynamics.

- Excessive price hikes by companies contribute to an inflationary cycle, exacerbating the overall inflation levels.

Effects of Greedflation:-

- Greedflation in non-essential products: the consumers can simply opt to go without that particular item or service because it is not a necessity.

- Greedflation on a wide scale: its impact will be similar to traditional inflation.

- Consumers may not be able to avoid the higher prices because they genuinely need the affected products or services.

Greedflation and India:-

- The Indian corporate sector has generated superlative profits in the post-pandemic period.

- Profits during recent times have been nearly thrice the profits corporates earned earlier.

- The Higher profits than can come from:-

- Higher sales (with the same profit margins).

- Higher profit margins (with the same level of sales).

- Or a combination of higher sales and higher profit margins.

MUST READ: Inflation Targeting as Monetary Policy

SOURCE: THE INDIAN EXPRESS

PREVIOUS YEAR QUESTIONS

Q.1) In India, which one of the following is responsible for maintaining price stability by controlling inflation? (2022)

- Department of Consumer Affairs

- Expenditure Management Commission

- Financial Stability and Development Council

- Reserve Bank of India

Q.2) In India, which one of the following compiles information on industrial disputes, closures, retrenchments and lay-offs in factories employing workers? (2022)

- Central Statistics Office

- Department for Promotion of Industry and Internal Trade

- Labour Bureau

- National Technical Manpower Information System

A grand revival: on India-Egypt Ties

Syllabus

- Mains – GS 2 (International Relations)

Context: Recently, the Indian Prime Minister (PM) has visited Egypt for the first time since 1997 to discuss bilateral relations between India and Egypt.

About India-Egypt Ties:

Historical Background:

- India-Egypt relations can be traced back to 2750 BCE when the Pharaoh Sahure sent ships to the “Land of Punt,” believed to be peninsular India.

- The exchange continued, with Egyptian mummies wrapped in Indian indigo-dyed muslin in the second millennium BCE.

Friendship Treaty and bilateral relations:

- The two nations became even closer in the 1950s and concluded a historic Friendship Treaty in 1955.

- During the last couple of years, the traditionally strong bilateral relations enjoyed by the two countries have received an impetus with regular exchange of high-level meetings and contacts between the two sides.

Economic Relations:

- Since March 1978, the India-Egypt Bilateral Trade Agreement has been in effect, operating under the Most Favoured Nation clause.

- In the fiscal year 2018-19, the bilateral trade reached a value of US$ 4.55 billion.

- Despite the challenges posed by the pandemic, the volume of trade only experienced a slight decline to US$ 4.5 billion in 2019-20 and further decreased to US$ 4.15 billion in 2020-21.

- Notably, the bilateral trade between India and Egypt reached a record high of US$ 7.26 billion in the fiscal year 2021-22.

- Major Egyptian exports to India include: Raw cotton, raw and manufactured fertilizers, oil and oil products, organic and non-organic chemicals, leather and iron products.

- Major imports into Egypt from India are: Cotton yarn, sesame, coffee, herbs, tobacco and lentils.

- Mineral fuel; vehicle parts; Ship, boat and floating structure; cuts of boneless bovine frozen meat; and Electrical machinery and parts are also exported from India.

Defense Cooperation:

- The two Air Forces collaborated on the development of fighter aircraft in the 1960s, and Indian pilots trained their Egyptian counterparts from the 1960s until the mid-1980s.

- Both the Indian Air Force (IAF) and Egyptian air force fly the French Rafale fighter jets.

- In 2022, a pact was signed between the two countries that have decided to also participate in exercises and cooperate in training.

- The first joint special forces exercise between the Indian Army and the Egyptian Army, “Exercise Cyclone-I” was completed in January 2023 in Jaisalmer, Rajasthan.

Science and Technology:

- ‘Science and Technology’ cooperation is implemented through biennial Executive Programmes and Scientific Cooperation Programme between CSIR (India) and NRC (Egypt).

- The 2nd ISRO-NARSS JWG was held in Cairo in 2017.

- The India-Egypt Workshops on Agriculture-Biotechnology and Nanotechnology were held in Shillong in 2018 and in Mumbai in 2019 respectively.

- An IT Centre in Al Azhar University, CEIT, is also operational since February 2019.

Cultural Links:

- The Maulana Azad Centre for Indian Culture (MACIC) was set up in Cairo in 1992.

- It aims to promote cultural cooperation between the two countries, through the implementation of the Cultural Exchange Programme (CEP).

- The Centre, in addition to popularizing Indian culture through Hindi, Urdu and Yoga classes and the screening of movies, also organizes cultural festivals.

- ‘India by the Nile’ festival:

- It is a cultural festival celebrated annually in Egypt.

- It brings the essence of India through classical, contemporary, performing and visual arts, food and popular culture in a language that amalgamates diverse cultural and artistic strands.

- The festival is produced by Delhi-based M/S Teamwork Arts and supported by ICCR and the Egyptian Ministry of Culture.

Challenges of India Egypt Relations:

- Political differences: There have been differences on key international issues. For instance, Egypt has not always shared India’s position on the United Nations Security Council (UNSC) reforms.

- Regional instability: Egypt’s geographical location in North Africa places it in proximity to several unstable regions and conflict zones, including Libya and Sudan.

- This instability can indirectly impact India-Egypt relations by creating uncertainties in areas of mutual interest such as regional security and economic investment.

- Navigating regional politics: Both India and Egypt have complex regional relationships to navigate.

- Balancing these relationships, particularly as they pertain to issues such as Kashmir for India or the Israeli-Palestinian conflict for Egypt, could pose challenges.

- China’s growing influence: China’s growing economic presence in Africa, including Egypt, is another significant challenge.

- China’s Belt and Road Initiative has been making significant inroads in Africa and this has increased China’s influence in the region.

- Balancing relations with China while trying to increase India’s economic engagement in Egypt and the broader African region could be a tricky diplomatic challenge for India.

Way Forward:

Bolstered by historical ties, and buffeted by present-day geopolitical turmoil, it is clear that India and Egypt are now essaying a closer relationship, one that looks both at future economies and autonomous foreign policies.

Source: The Hindu

Syllabus

- Mains – GS 2 (Governance) and GS 3 (Economy)

Context: Andhra Pradesh Police have filed seven FIRs against Margadarsi Chit Fund Private Limited (MCFPL), which is owned by the Eenadu Group.

About Chit Fund:

- Chit fund means transaction in which a person enters into an agreement with a specified number of persons that everyone shall subscribe a certain sum of money by way of periodical instalments over a definite period.

- Each such subscriber in his turn, as determined by lot or by auction or by tender be entitled to the prize amount.

Advantages of Chit Funds

- Access to Funds: A chit-fund scheme can be an excellent way of gaining access to funds that may not be available otherwise.

- They can provide financial assistance to households and help with debt payments, among other things.

- No Need for Collateral: If one wish to invest in a chit-fund scheme, there is no requirement for collateral.

- Savings and Credit: Chit funds are a hybrid of savings and credit plans.

- Members can save money while simultaneously having credit available when needed.

- Potential Returns: Members can receive returns on their donations by investing in chit funds.

- The bid amount and the number of fund members determine the amount of return.

- Financial Discipline: A chit fund can be a great means of inculcating financial discipline in your life.

- It helps promote financial stability and discipline by encouraging you to save a fixed amount regularly.

Concerns:

- Chit funds have known to be vulnerable to scams. g. Saradha Chit Fund Scam, Rose Valley Chit Fund Scam.

- The biggest risk involving a chit fund is the misuse of the pooled funds by the foreman.

- Sometimes members stop paying the dues and have already taken the first bid.

- Lack of financial literacy results in people getting duped as they are promised huge returns on their investment which has no substantial basis to fulfill.

- Despite the presence of staunch rules against scams by chit funds, a lot of these funds run Ponzi schemes and make away with a lot of people’s money.

Existing Regulations for Chit Funds:

- At present chit funds are governed by Chit Funds Act of 1962, Reserve Bank of India (RBI) Act of 1934, and Securities & Exchange Bond of India (SEBI) Act of 1992 etc.

- Under the Chit Fund Act of 1962, businesses can be registered and regulated only by the respective State Governments.

- Regulator of chit funds is the Registrar of Chits appointed by respective state governments under Section 61 of Chit Funds Act.

- Functionally, Chit funds are included in the definition of Non-Banking Financial Companies (NBFCs) by RBI under the sub-head Miscellaneous Non-Banking Company (MNBC).

- RBI, however, has not laid out any separate regulatory framework for them.

Way Forward:

Participating in chit funds is riskier than participating in state-run funds or public-sector enterprises. Chit fund proponents argue that these funds are a vital financial tool. However, a scandal such as the Saradha scam, which is accused of defrauding customers under the cover of a chit fund, has generated severe concerns about the business.

Source: Indian Express

Practice MCQs

Q1) Consider the following statements

Statement-I:

Greedflation can fuel deflation.

Statement-II:

Greedflation can increase existing inflation.

Which one of the following is correct in respect of the above statements?

- Both Statement-I and Statement-II are correct and Statement-11 is the correct explanation for Statement-I

- Both Statement-I and Statement-II are correct and Statement-II is not the correct explanation for Statement-I

- Statement-I is correct but Statement-II is incorrect

- Statement-I is incorrect but Statement-II is correct

Q2) Consider the following statements

Statement-I:

United Nations Office for Outer Space Affairs’ (UNOOSA) headquarters is in Australia.

Statement-II:

United Nations Office for Outer Space Affairs (UNOOSA) was established in 1958.

Which one of the following is correct in respect of the above statements?

- Both Statement-I and Statement-II are correct and Statement-11 is the correct explanation for Statement-I

- Both Statement-I and Statement-II are correct and Statement-II is not the correct explanation for Statement-I

- Statement-I is correct but Statement-II is incorrect

- Statement-I is incorrect but Statement-II is correct

Q3) Consider the following statements

Statement-I:

Tadoba-Andhari Tiger Reserve is in Maharashtra.

Statement-II:

Tadoba-Andhari Tiger Reserve was established in 2017.

Which one of the following is correct in respect of the above statements?

- Both Statement-I and Statement-II are correct and Statement-11 is the correct explanation for Statement-I

- Both Statement-I and Statement-II are correct and Statement-II is not the correct explanation for Statement-I

- Statement-I is correct but Statement-II is incorrect

- Statement-I is incorrect but Statement-II is correct

Comment the answers to the above questions in the comment section below!!

ANSWERS FOR ’ 27th June 2023 – Daily Practice MCQs’ will be updated along with tomorrow’s Daily Current Affairs.st

ANSWERS FOR 9th June – Daily Practice MCQs

Q.1) – d

Q.2) – c

Q.3) -d