IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS + MAINS FOCUS)

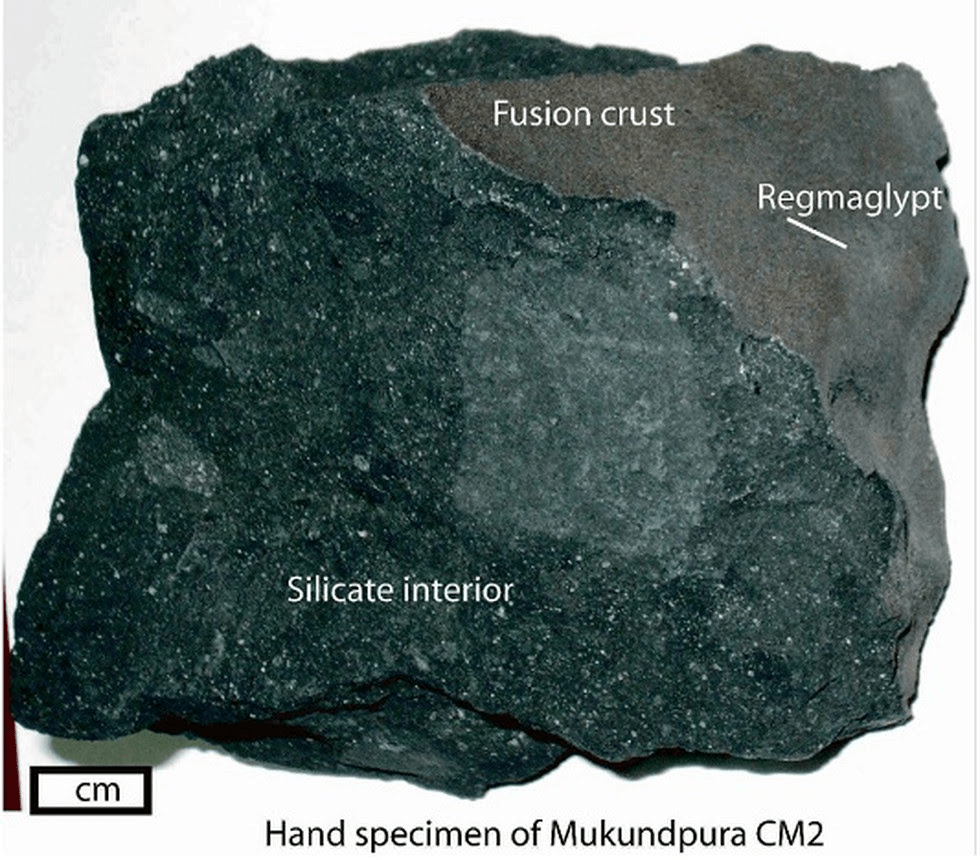

Mukundpura CM2

Part of: GS Prelims and GS-III – Sci & Tech

In news

- A new study by Geological Survey of India, Kolkata has shed light on the mineralogy of the meteorite which fell in 2017 in Mukundpura village near Jaipur.

Key takeaways

- The meteorite named Mukundpura CM2 was classified to be a carbonaceous chondrite.

- The composition of carbonaceous chondrites is also similar to the Sun.

- This is a type of stony meteorite, considered the most primitive meteorite and a remnant of the first solid bodies to accumulate in the solar system.

- Meteorites are broadly classified into three groups – stony (silicate-rich), iron (Fe–Ni alloy), and stony-iron (mixed silicate–iron alloy).

- Chondrites are silicate-droplet-bearing meteorites, and this Mukundpura chondrite is the fifth carbonaceous meteorite known to fall in India.

- The results of the Mukundpura CM2 study are relevant to the surface composition of near-Earth asteroids Ryugu and Bennu.

Kalaripayattu to be taught at Kerala Tourism’s Vellar Crafts Village

Part of: GS Prelims and GS-I – Culture

In news

- Kalaripayattu is set to see a surge in popularity with the establishment of an academy in the Kerala capital.

Key takeaways

- Lessons in Kalaripayattu will now be taught at Kerala Tourism’s Vellar Crafts Village en route to Kovalam.

- The 3,500 Sq. Ft. academy in the village is scheduled to be completed in two months.

- Kerala Chief Minister released the syllabus of the Kalaripayattu Academy recently during the inauguration of the renovated Crafts Village.

Important value additions

Kalaripayattu

- It is also known as Kalari.

- It is an Indian martial art and fighting style that originated in Kerala.

- It is considered to be among the oldest martial arts still in existence, with its origin dating back to at least the 3rd century BC.

- It includes strikes, kicks, grappling, preset forms, weaponry and healing methods.

- Practitioners of Kalaripayattu also possess intricate knowledge of pressure points on the human body and healing techniques that incorporate the knowledge of Ayurveda and Yoga.

- Unlike other parts of India, warriors in Kerala belonged to all castes.

- Women in Keralite society also underwent training in Kalaripayattu, and still do so to this day.

Related articles:

- Indigenous Games to be a part of Khelo India Youth Games 2021: Click here

India-Japan MoU in ICT

Part of: GS Prelims and GS -II – International Relations

In news

- India and Japan signed MoU to enhance cooperation in the field of Information and Communications Technologies.

- The Department of Telecom and Japan’s Ministry of Communications will enhance mutual cooperation in the field of 5G technologies, telecom security, submarine optical fiber cable system to islands of India, spectrum management, smart cities, high altitude platform for broadband in unconnected areas, disaster management and public safety etc.

Department of Telecommunications (DoT) seeks inputs from telcos on use of radio frequency spectrum

Part of: GS Prelims and GS-III – Infrastructure

In news

- The Department of Telecommunications (DoT) has sought inputs from telcos and other industry experts on the sale and use of radio frequency spectrum over the next 10 years, including the 5G bands.

Important value additions

- 5G or fifth generation is the latest upgrade in the long-term evolution (LTE) mobile broadband networks.

- 5G mainly works in 3 bands, namely low, mid and high frequency spectrum — all of which have their own uses as well as limitations.

- While the low band spectrum has shown great promise in terms of coverage and speed of internet and data exchange, the maximum speed is limited to 100 Mbps (Megabits per second).

- The mid-band spectrum offers higher speeds compared to the low band, but has limitations in terms of coverage area and penetration of signals.

- The high-band spectrum offers the highest speed of all the three bands, but has extremely limited coverage and signal penetration strength.

- Internet speeds in the high-band spectrum of 5G has been tested to be as high as 20 Gbps (giga bits per second), while, in most cases, the maximum internet data speed in 4G has been recorded at 1 Gbps.

Related articles:

- Spectrum Auctions: Click here

- BRICS 5G Innovation Base: Click here

Follow-On Public Offers

Part of: GS Prelims and GS-III – Economy

In news

- SEBI recently relaxed the framework for follow-on public offers (FPOs).

- The move will help promoters of companies to raise funds more easily through this route.

Key takeaways

- The applicability of minimum promoters’ contribution norm and the subsequent lock-in requirements for the issuers making the FPO have been removed.

- Earlier, promoters were mandated to contribute 20% towards a FPO.

- Besides, in case of any issue of capital to the public, the minimum promoters’ contribution was required to be locked-in for three years.

- Relaxation would be available for those companies which are frequently traded on a stock exchange for at least three years.

- Also, such firms should have redressed 95% of investor complaints.

Important value additions

The Securities and Exchange Board of India (SEBI)

- It is the regulator of the securities and commodity market in India owned by the Government of India.

- It was established in 1988 and given statutory status through the SEBI Act, 1992.

- SEBI is responsible to the needs of three groups:

- Issuers of securities

- Investors

- Market intermediaries

- Functions:

- Quasi-legislative – drafts regulations

- Quasi-judicial – passes rulings and orders

- Quasi-executive – conducts investigation and enforcement action

- Powers:

- To approve by−laws of Securities exchanges.

- To require the Securities exchange to amend their by−laws.

- Inspect the books of accounts and call for periodical returns from recognised Securities exchanges.

- Inspect the books of accounts of financial intermediaries.

- Compel certain companies to list their shares in one or more Securities exchanges.

- Registration of Brokers and sub-brokers

Related articles:

- Mutual Funds (MF) Risk-o-meter becomes effective: Click here

- SEBI eases Fund-raising norms for firms: Click here

Unchecked flow of untreated industrial effluent increases pollution in Gujarat rivers

Part of: GS Prelims and GS-III – Environment; Pollution

In news

- The unchecked flow of untreated industrial effluent into rivers in Gujarat has led to increasing pollution in the Sabarmati, Mahisagar, Narmada, Vishwamitri and Bhadar.

Key takeaways

- According to data from the Ministry of Environment and Forest (MoEF), the Sabarmati is among the most polluted rivers in the country.

- Gujarat ranks fourth among the top five States with highly polluted rivers, with as many as 20 rivers in the critically polluted category.

- As per the official parameters, if the chemical oxygen demand (COD), which indicates organic pollutant load, is higher than 250 mg per litre, then it should not be released into the rivers.

- Most of the Gujarat rivers where the effluents are dumped into, the COD level is in the range of 700 to 1000 mg per litre.

- While Dissolved Oxygen (DO) level (indicating the health of a river) in perennial rivers like Mahisgar should be in the range of 6 to 8 mg per litre, it is actually below 2.9 mg per litre.

DRDO hands over Motor Bike Ambulance ‘Rakshita’ to CRPF

Part of: GS Prelims and GS-III – Defence & Security & Sci & Tech

In news

- DRDO hands over Motor Bike Ambulance ‘Rakshita’ to CRPF.

Key takeaways

- Institute of Nuclear Medicine and Allied Sciences (INMAS), Delhi based DRDO laboratory, handed over Rakshita to Central Reserve Police Force (CRPF).

- It is a bike-based casualty transport emergency vehicle.

- Rakshita is fitted with a customized reclining Casualty Evacuation Seat (CES), which can be fitted in and taken out as per requirement.

- The bike ambulance will help in overcoming the problems faced by Indian security forces and emergency healthcare providers.

- It will provide life-saving aid for evacuation of injured patients from low intensity conflict areas.

- This bike ambulance is useful not only for the paramilitary and military forces but has potential civil applications too.

FAO Food Price Index

Part of: GS Prelims and GS-III – Economy

In news

- According to the Food and Agriculture Organization’s (FAO), World food prices rose for a seventh consecutive month in December, with all the major categories, barring sugar, posting gains last month.

Key takeaways

- The Food and Agriculture Organization’s (FAO) food price index is a measure of the monthly change in international prices of a basket of food commodities.

- It consists of the average of five commodity group price indices [cereal, vegetable, dairy, meat and sugar], weighted with the average export shares.

- It averaged 107.5 points in December versus 105.2 in November.

- For the whole of 2020, the benchmark index averaged 97.9 points, a three-year high and a 3.1% increase from 2019.

Important value additions

FAO

- The Food and Agriculture Organization of the United Nations is a specialized agency of the United Nations that leads international efforts to defeat hunger and improve nutrition and food security.

- Its Latin motto, fiat panis, translates to “let there be bread”.

- Headquarters: Rome, Italy

- Founded: 16 October 1945, Quebec City, Canada

- Parent organization: United Nations Economic and Social Council

New Anubhava Mantapa

Part of: GS Prelims and GS-I – Culture

In news

- Karnataka Chief Minister laid the foundation stone for the ‘New Anubhava Mantapa’ in Basavakalyan.

- It is the place where 12th century poet-philosopher Basaveshwara lived for most of his life.

Key takeaways

- The ₹500 crore project would be completed within two years.

- The project would highlight the teachings of Basaveshwara.

- Basavakalyan is an important pilgrim centre for Lingayats.

- The New Anubhava Mantapa, will be a six-floor structure in the midst of the 7.5 acre plot and represent various principles of Basaveshwara’s philosophy.

- It will showcase the 12th Century Anubhava Mantapa (often referred to as the “first Parliament of the world”) established by him in Basavakalyan, where philosophers and social reformers held debates.

- The building will adopt the Kalyana Chalukya style of architecture.

Important value additions

Basaveshwara

- He was born in Bagevadi (of undivided Bijapur district in Karnataka) during 1131 AD.

- He was the 12th century philosopher and social reformer who gave a unique spiritual path to mankind.

- He is the founding saint of the Lingayat sect.

- His spiritual discipline was based on the principles of:

- Arivu (true knowledge),

- Achara (right conduct),

- Anubhava (divine experience)

- His practical approach and act of establishment of ‘Kalyana Rajya’ (Welfare state) brought a new status and position for all the citizens of the society, irrespective of class, caste, creed and sex.

- He established the Anubhava Mantapa, which was a common forum for all to discuss the prevailing problems of socio, economic and political areas.

- It was the first and foremost socio-religious Parliament of India.

- On 14th November 2015, the Prime Minister of India also inaugurated the statue of Basavanna along the bank of the river Thames at Lambeth in London.

Miscellaneous

Sulawesi

- In Indonesia, heavy rain is hampering the search operation for survivors following a powerful earthquake on Sulawesi island.

- Sulawesi is an island in Indonesia.

- It is situated east of Borneo, west of the Maluku Islands, and south of Mindanao and the Sulu Archipelago.

- The Strait of Makassar runs along the western side of the island and separates the island from Borneo.

- Within Indonesia, it is smaller than Sumatra and larger than Java Island.

- Indonesia sits on the Pacific “Ring of Fire” where tectonic plates collide, and the country has a history of devastating earthquakes and tsunamis.

Furfura Pilgrimage

- Furfura pilgrimage site was in news owing to it becoming the epicentre of Muslim politics in West Bengal.

- Furfura Sharif (also known as Furfura, Phurphura, Furfura Darbar Sharif) is a village in Hooghly District, West Bengal.

- It is a holy place for Bengali Muslims.

- According to locals, this is the second most prominent mazar in the country after Ajmer Sharif in Rajasthan.

Harike Wetland

- Winter migratory water birds using the central Asian flyway have started making a beeline to Punjab’s Harike wetland, offering a delight for bird lovers.

- Harike Wetland is the largest wetland in northern India in the border of Tarn Taran Sahib district and Ferozepur district of Punjab.

- The wetland and the Harike lake were formed by constructing the headworks across the Sutlej river in 1953.

- It has been designated as one of the Ramasar sites in India.

(Mains Focus)

ECONOMY/ GOVERNANCE

Topic:

- GS-3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

- GS-2: Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

Bad Bank

Context: With commercial banks set to witness a spike in NPAs, or bad loans, in the wake of the contraction in the economy as a result of the Covid-19 pandemic, Reserve Bank of India (RBI) Governor Shaktikanta Das recently agreed to look at the proposal for the creation of a bad bank.

What’s a bad bank and how does it work?

- Idea of Bad Bank: Technically, a bad bank is an asset reconstruction company (ARC) or an asset management company that takes over the bad loans of commercial banks, manages them and finally recovers the money over a period of time.

- Utility of Bad Bank: The bad bank is not involved in lending and taking deposits, but helps commercial banks clean up their balance sheets and resolve bad loans in

- Working of Bad Bank: The takeover of bad loans is normally below the book value of the loan (provides certain margin to ARC). The bad bank subsequently tries to recover as much as possible using its expertise in stressed asset resolution.

- Support of Government: The bad bank concept is in some ways similar to an ARC but is funded by the government initially, with banks and other investors co-investing in due course. The presence of the government is seen as a means to speed up the clean-up process.

- US-based Mellon Bank created the first bad bank in 1988.

Merits of Having Bad Bank–

- Banks’ Burden is Reduced: The burden of recovering those loans is reduced for other banks.

- Specialisation leads to faster recovery: Speed of recovery will be better as Bad Bank’s main work is recovery and they are specialised in that.

- Positive Impact on Financial Sector: Bad Bank will help improve the banking sector’s health and fasten the recovery aspects of ailing by putting back frozen assets back into economic circulation.

- Increased Profitability of Banks: Bad Bank increases profitability of other banks as they can focus more on lending, acquiring more customers and upgrading technology without spending too much time on recovery or resolution of bad loans

- Feasibility: Bad banks can make profits as they usually keep high margin before acquiring the bad loans. The concept of Bad Bank has been implemented in other countries including Sweden, Finland, France and Germany.

Demerits of Bad Bank-

- Shifting of Problem: Former RBI Governor Raghuram Rajan had opposed the idea of setting up a bad bank in which banks hold a majority stake. He was of the opinion that bad bank idea as merely shifting loans from one government pocket (the public sector banks) to another (the bad bank).

- Reckless Lending: Other banks may not concentrate on the quality of loans as they always an option of shifting bad loans to ARC/ Bad Bank. This leads to doling out loans without proper diligence leading to reckless lending

- Efficacy Debate: Bad banks may not acquire critical loans which are difficult to recover and only concentrate on easily recoverable loans. As a result, troubled Commercial banks continue to face the issue of bad loans. There is also the fear that it end up as another case of throwing good money after bad.

- Profitability of Banks: High margin of Bad banks may curtail the profits of other banks which can in turn impact their lending capabilities.

- Moral Issues: Due to pressure bad banks may employ some unethical ways to recover loans. Another issue is that other banks may not show the actual position of loan accounts by doing window dressing.

What has been the stand of the RBI with regard to resolving stressed loans?

- Viral Acharya, when he was the RBI Deputy Governor, had said it would be better to limit the objective of these asset management companies to the orderly resolution of stressed assets, followed by a graceful exit.

- Acharya suggested two models to solve the problem of stressed assets.

- The first is a private asset management company (PAMC), which is said to be suitable for stressed sectors where the assets are likely to have an economic value in the short run, with moderate levels of debt forgiveness.

- The second model is the National Asset Management Company (NAMC), which would be necessary for sectors where the problem is not just one of excess capacity but possibly also of economically unviable assets in the short to medium terms.

- While the RBI did not show much enthusiasm about a bad bank all these years, there are signs that it can look at the idea now. Recently, Governor Das indicated that the RBI can consider the idea of a bad bank.

Do we need a Bad Bank now?

- The idea gained currency during Raghuram Rajan’s tenure as RBI Governor.

- The RBI had then initiated an asset quality review (AQR) of banks and found that several banks had suppressed or hidden bad loans to show a healthy balance sheet.

- However, the idea remained on paper amid lack of consensus on the efficacy of such an institution.

- Now, with the pandemic hitting the banking sector, the RBI fears a spike in bad loans in the wake of a six-month moratorium it has announced to tackle the economic slowdown.

How serious is the NPA issue in the wake of the pandemic?

- The RBI noted in its recent Financial Stability Report that the gross NPAs of the banking sector are expected to shoot up to 14.8% of advances by September 2021, from 7.5% in September 2020

- Among bank groups, the NPA ratio of PSU banks, which was 9.7% in September 2020, may increase to 16.2% by September 2021 under the baseline scenario.

- The K V Kamath Committee, which helped the RBI with designing a one-time restructuring scheme, also noted that corporate sector debt worth Rs 15.52 lakh crore has come under stress after Covid-19 hit India, while another Rs 22.20 lakh crore was already under stress before the pandemic.

- This effectively means Rs 37.72 crore (72% of the banking sector debt to industry) remains under stress. This is almost 37% of the total non-food bank credit.

- The panel led by Kamath, a veteran banker, has said companies in sectors such as retail trade, wholesale trade, roads and textiles are facing stress. Sectors that have been under stress pre-Covid include NBFCs, power, steel, real estate and construction. Setting up a bad bank is seen as crucial against this backdrop

Why is it crucial to tackle toxic loans?

- Banks and other financial institutions are the key drivers of economic growth, as they are the formal channels of credit.

- As things stand, lenders, particularly the state-owned ones, are saddled with massive bad loans.

- Growing NPAs has made Banks risk-averse and eroded their capacity to lend to help spur economic recovery from the shock of the covid-19 pandemic that has roiled the world.

- Banks will find it tough and exorbitantly expensive to raise capital from the market if the asset-quality trajectory remains uncertain, delaying and even jeopardizing, economic growth.

Has the banking system made any proposal with regard to Bad Bank?

- The banking sector, led by the Indian Banks’ Association, had submitted a proposal in May 2020 for setting up a bad bank to resolve the NPA problem, proposing equity contribution from the government and banks.

- The proposal was also discussed at the Financial Stability and Development Council (FSDC) meeting, but it did not find favour with the government which preferred a market-led resolution process.

- The banking industry’s proposal was based on an idea proposed by a panel on faster resolution of stressed assets in public sector banks headed by former Punjab National Bank Chairman Sunil Mehta.

- Sunil Mehta panel had proposed a company, Sashakt India Asset Management, for resolving large bad loans two years ago.

- The idea of a bad bank was discussed in 2018 too, but it never took shape.

- During the pandemic, banks and India Inc were also pitching for one-time restructuring of loans and NPA reclassification norms from 90 days to 180 days as relief measures to tackle the impact of the lockdown and the slowdown in the economy.

- Currently, loans in which the borrower fails to pay principal and/or interest charges within 90 days are classified as NPAs and provisioning is made accordingly.

Will a bad bank solve the problem of NPAs?

- Complements Previous Measures: Despite a series of measures by the RBI for better recognition and provisioning against NPAs, as well as massive doses of capitalisation of public sector banks by the government, the problem of NPAs continues in the banking sector, especially among the weaker banks. Having a Bad Bank will complement other measures taken by RBI & government to clean up banking sector.

- Helps solve economic aftershocks of Pandemic: As the Covid-related stress pans out in the coming months, proponents of the concept feel that a professionally-run bad bank, funded by the private lenders and supported the government, can be an effective mechanism to deal with NPAs.

- Experience from Other Countries: Many other countries had set up institutional mechanisms such as the Troubled Asset Relief Programme (TARP) in the US to deal with a problem of stress in the financial system in the wake of 2008 financial crisis.

Conclusion

Banks and other financial institutions are the key drivers of economic growth. However, many borrowers may find it difficult to service their loans, requiring lenders to set aside capital to cover those losses. A bad bank can free them up to start lending. However, adequate measures need to be put in place so as to overcome the pitfalls of bad bank

(TEST YOUR KNOWLEDGE)

Model questions: (You can now post your answers in comment section)

Note:

- Correct answers of today’s questions will be provided in next day’s DNA section. Kindly refer to it and update your answers.

- Comments Up-voted by IASbaba are also the “correct answers”.

Q.1 Mukundpura CM2 meteorite was found in which of the following city?

- Jaipur

- Nagpur

- Ranchi

- Raipur

Q.2 Which of the following is incorrect about Kalaripayattu?

- It originated in Kerala.

- It is one of the oldest forms of martial arts.

- Only men are allowed to practice the art.

- Practitioners possess intricate knowledge of healing techniques that incorporate the knowledge of Ayurveda and Yoga.

Q.3 Where is Harike Wetland situated?

- Himachal Pradesh

- Punjab

- Jammu & Kashmir

- Rajasthan

Q.4 Anubhava Mantapa is associated with which of the following philosopher of India?

- Bhartrhari

- Ghosha

- Yajnavalkya

- Basaveshwara

ANSWERS FOR 18th January 2021 TEST YOUR KNOWLEDGE (TYK)

| 1 | D |

| 2 | A |

Must Read

On govt. powers to combat vaccine hesitancy:

On economic sustainability of mining in India:

On reading new US President Biden in Delhi: