IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS + MAINS FOCUS)

Government approves advisory for management of Human-Wildlife Conflict across the country

Part of: GS Prelims and GS-III – Environment

In news

- The Standing Committee of National Board of Wildlife (SC-NBWL) has approved the advisory for management of Human-Wildlife Conflict (HWC) in the country.

- The advisory makes important prescriptions for the States/ Union Territories for dealing with Human-Wildlife conflict situations and seeks expedited inter-departmental coordinated and effective actions.

Key measures approved

- Empowering gram panchayats in dealing with the problematic wild animals as per the section 11 (1) (b) of Wildlife (Protection) Act, 1972.

- Utilising add-on coverage under the Pradhan Mantri Fasal Bima Yojna for crop compensation against crop damage due to HWC.

- Augmenting fodder and water sources within the forest areas.

- Payment of a portion of ex-gratia as interim relief within 24 hours of the incident to the victim/family.

- Prescribing inter-departmental committees at local/state level.

- Adoption of early warning systems

- Creation of barriers

- Dedicated circle wise Control Rooms with toll free hotline numbers which could be operated on 24X7 basis.

- Identification of hotspots and formulation and implementation of special plans for improved stall-fed farm animals etc.

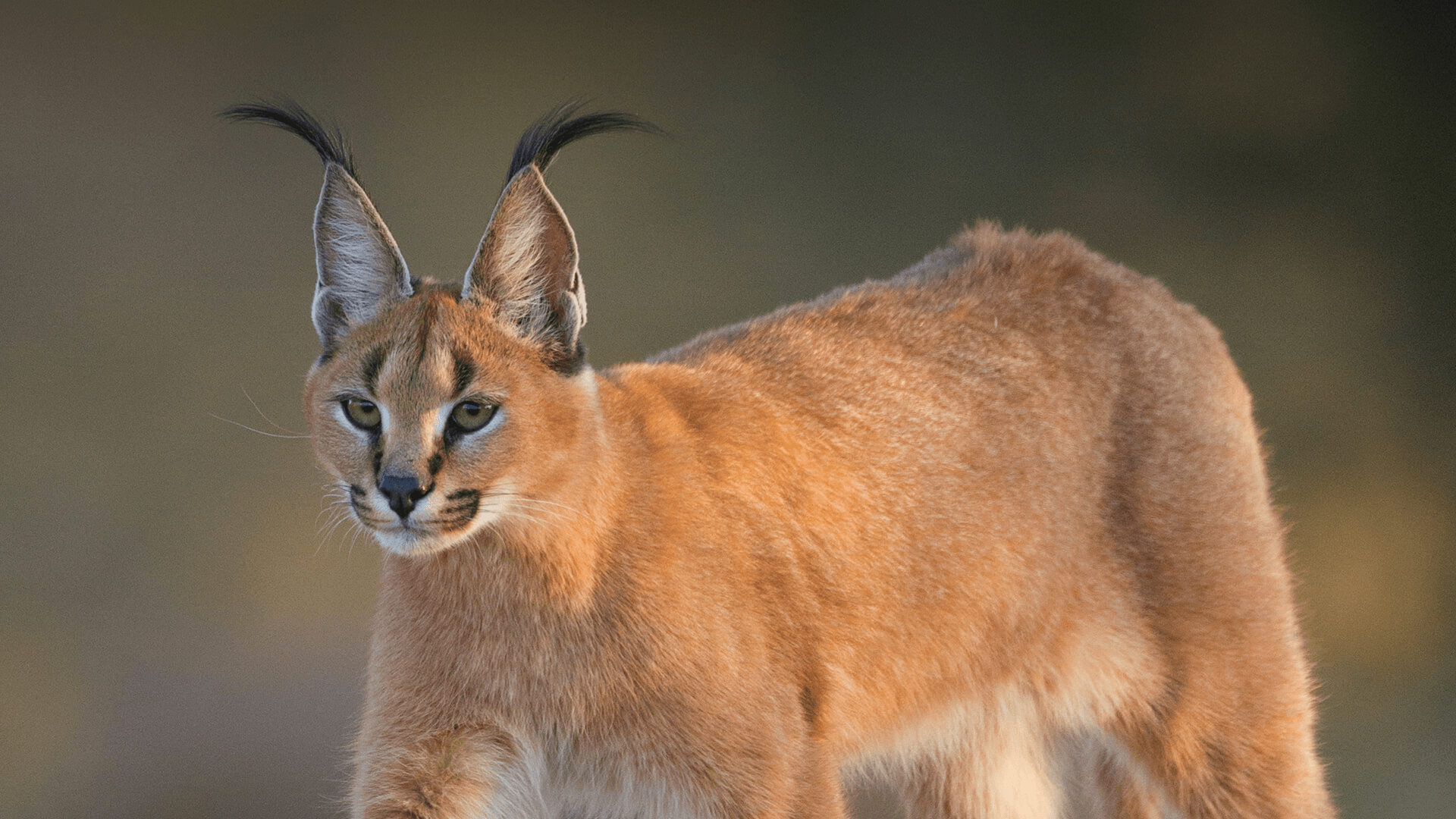

- Inclusion of Caracal, a medium size wild cat found in some parts of Rajasthan and Gujarat, into the list of critically endangered species

Do you know?

- The National Board for Wildlife (NBWL) is constituted by the Central Government under Section 5 A of the Wildlife (Protection) Act, 1972 (WLPA).

- The Standing Committee of NBWL considers proposals after a series of levels of scrutiny and have recommendations of the State Chief Wildlife Warden, State Government and the State Board for Wildlife.

- During the meetings of SC-NBWL, the views of the expert members are taken into consideration before arriving at decisions.

Important value additions

The caracal

- It is a medium-sized wild cat native to Africa, the Middle East, Central Asia, and India.

- It is Typically nocturnal.

- The caracal is highly secretive and difficult to observe.

- It is territorial.

- It lives mainly alone or in pairs.

- The caracal is a carnivore

- Caracals were tamed and used for hunting in ancient Egypt.

- In India, the caracal occurs in Sariska Tiger Reserve and Ranthambhore Tiger Reserve.

- IUCN Red List: Least Concern since 2002

- Threats: Habitat loss due to agricultural expansion, the building of roads and settlements

- CITES status: (1) African caracal populations – Appendix II; (2) Asian populations – Appendix I.

Longitudinal Ageing Study of India (LASI) Wave-1, India Report released

Part of: GS Prelims and GS-I – Society

In news

- Longitudinal Ageing Study of India (LASI) Wave-1,India Report was recently released.

- Released by: Ministry of Health and Family Welfare

Key takeaways

- LASI will provide an evidence base for national and state level programmes and policies for elderly population.

- A unique feature of LASI is the coverage of comprehensive biomarkers.

- No other survey in India collects detailed data on health and biomarkers together with information on family and social network, income, assets, and consumption.

- LASI is a full–scale national survey of scientific investigation of the health, economic, and social determinants and consequences of population ageing in India.

- The LASI, Wave 1 covered a baseline sample of 72,250 individuals aged 45 and above and their spouses including 31,464 elderly persons aged 60 and above and 6,749 oldest-old persons aged 75 and above from all States and Union Territories (UTs) of India (excluding Sikkim).

- It is India’s first and the world’s largest ever survey that provides a longitudinal database for designing policies and programmes for the older population.

- The evidence from LASI will be used to further strengthen and broaden the scope of National Programme for Health Care of the Elderly.

- It will also help in establishing a range of preventive and health care programmes for older population and most vulnerable among them.

Do you know?

- In 2011 census, the 60+ population accounted for 8.6% of India’s population, accounting for 103 million elderly people.

- Growing at around 3% annually, the number of elderly age population will rise to 319 million in 2050.

- 75% of the elderly people suffer from one or the other chronic disease.

- 40% of the elderly people have one or the other disability and 20% have issues related to mental health.

‘Accelerating Quality Production, Post-Harvesting, Value Addition & Export of Coriander from India’: World of Coriander webinar

Part of: GS Prelims and GS-III – Agriculture

In news

- Recently, the World of Coriander webinar ‘Accelerating Quality Production, Post-Harvesting, Value Addition & Export of Coriander from India’ was organized.

- Organized by: The Spices Board of India and DBT-SABC Biotech Kisan Hub in collaboration with ICAR-NRCSS, RSAMB and Kota Agriculture University

Key takeaways

- The Hadoti region of South-East Rajasthan and Guna district of Madhya Pradesh are known for coriander (Coriandrum sativum L.) production and contributes major share in coriander export from the country.

- Ramganj APMC Mandi located at Kota district is the largest coriander mandi in Asia, and thus Ramganj is also known as the ‘Coriander city’.

- Recently, Ministry of Food Processing Industries (MOFPI) has assigned ‘Coriander’ to the district of Kota in the list of One District One Product (ODOP).

Do you know?

- Coriander is a spice produced from the round, tan-colored seeds of the coriander plant (Coriandrum sativum).

- All parts of the plant are edible, but the fresh leaves and the dried seeds (as a spice) are the parts most traditionally used in cooking.

- It is also known as Chinese parsley, dhania or cilantro.

New Industrial Development Scheme For Jammu & Kashmir (J&K IDS, 2021) approved

Part of: GS Prelims and GS-II – Policies and Interventions & GS-III – Industries

In news

- The Cabinet Committee on Economic Affairs (CCEA) has approved a scheme for the Industrial Development of Jammu & Kashmir.

- The scheme is approved with a total outlay of Rs. 28,400 crore upto the year 2037.

Key takeaways

- It is a Central Sector Scheme for the development of Industries in the UT of J & K.

- Objective: To generate employment which directly leads to the socio economic development of the area.

The following incentives would be available under the scheme:

- Capital Investment Incentive at the rate of 30% in Zone A and 50% in Zone B on investment made in Plant & Machinery (in manufacturing) or construction of building and other durable physical assets(in service sector) is available.

- Capital Interest subvention: At the annual rate of 6% for maximum 7 years on loan amount up to Rs. 500 crore for investment in plant and machinery (in manufacturing) or construction of building and all other durable physical assets (in service sector).

- GST Linked Incentive: 300% of the eligible value of actual investment made in plant and machinery (in manufacturing) or construction in building and all other durable physical assets (in service sector) for 10 years. The amount of incentive in a financial year will not exceed one-tenth of the total eligible amount of incentive.

- Working Capital Interest Incentive: All existing units at the annual rate of 5% for maximum 5 years. Maximum limit of incentive is Rs 1 crore.

Key Features of the Scheme:

- Scheme is made attractive for both smaller and larger units.

- Smaller units with an investment in plant & machinery upto Rs. 50 crore will get a capital incentive upto Rs. 7.5 crore and get capital interest subvention at the rate of 6% for maximum 7 years.

- The scheme aims to take industrial development to the block level in UT of J&K, which is the first time in any Industrial Incentive Scheme of the Government of India.

Related articles:

- Forest Rights Act in J&K: Click here

- PM-JAY SEHAT for J&K: Click here

(Mains Focus)

ECONOMY/ GOVERNANCE

Topic: General Studies 3:

- Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Seven key takeaways from the latest GDP data

Context: After Second Quarter results of FY21 where India experienced the first technical recession, government has released the First Advance Estimates (FAE) for the current financial year.

What are the First Advance Estimates of GDP? What is their significance?

- For any financial year, the Ministry of Statistics and Programme Implementation (MoSPI) provides regular estimates of GDP.

- The first such instance is through the FAE. The FAE for any particular financial year is typically presented on January 7th.

- Their significance lies in the fact that they are the GDP estimates that the Union Finance Ministry uses to decide the next financial year’s Budget allocations.

- The FAE will be quickly updated as more information becomes available.

- On February 26th, MoSPI will come out with the Second Advance Estimates of GDP for the current year.

How are the FAE arrived at before the end of the concerned financial year?

The FAE are derived by extrapolating the available data. The sector-wise estimates are obtained by extrapolating indicators such as

- Index of Industrial Production (IIP) of first 7 months of the financial year

- Financial performance of listed companies in the private corporate sector available up to quarter ending September, 2020

- The 1st Advance Estimates of crop production,

- The accounts of central & state governments,

- Information on indicators like deposits & credits, passenger and freight earnings of Railways, passengers and cargo handled by civil aviation, cargo handled at major sea ports, sales of commercial vehicles, etc., available for first 8 months of the financial year.

How is the data extrapolated?

- In the past, extrapolation for indicators such as the IIP was done by dividing the cumulative value for the first 7 months of the current financial year by average of the ratio of the cumulative value of the first 7 months to the annual value of past years.

- So if the annual value of a variable was twice that of the value in the first 7 months in the previous years then for the current year as well the annual value is assumed to be double that of the first 7 months.

- However, this year, because of the pandemic there were wide fluctuations in the monthly data. Moreover, there was a significant drop, especially in the first quarter, on many counts. That is why the usual projection techniques would not have yielded robust results.

- As such, MoSPI has tweaked the ratios for most variables.

What are the key takeaways from the First Advance Estimates for 2020-21?

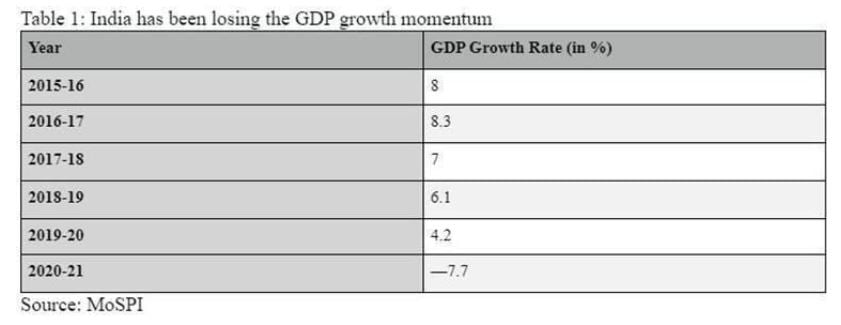

- GDP Growth Rate

- India has been losing GDP growth momentum (see above Table 1)

- Unprecedented Contraction: According to FAE, India’s GDP will contract by 7.7 per cent in 2020-21. This is a sharp one considering that India has registered an average annual GDP growth rate of 6.8 per cent since the start of economic liberalisation in 1992-93.

- Pandemic Factor in First Half of Year: But, a big reason for the contraction this year has been the disruption caused by Covid-induced lockdowns which saw the economy contract by almost 24% in the first quarter (April, May and June) and by 15.7% during the first half (H1) of the year

- Expectation of Recovery in Second Half of Year: However, in the second half of the current financial year — that is, October to March — the government expects the economy will produce almost exactly the same amount of goods and services that it produced in the second half of the last financial year (2019-20).

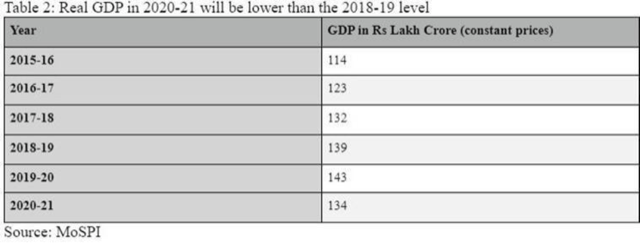

- Absolute levels of Real GDP (see above Table 2)

- In the H1 of 2020-21, India produced goods and services worth Rs 60 lakh crore — much lower than the Rs 71 lakh crore worth of goods produced in H1 of 2019-20.

- In H2 of 2020-21, MoSPI expects GDP to be worth Rs 74.4 lakh crore, which is roughly the same as the GDP in H2 of 2019-20 — about Rs 74.7 lakh crore

- Lower than 2018-19 level: At Rs 134.4 lakh crore, India’s real GDP — that is, GDP without the influence of inflation — in 2020-21 will be lower than the 2018-19 level. In other words, from the start of the next financial year, India would first have to raise its GDP back to the level it was at in 2019-20 (Rs 143.7 lakh crore).

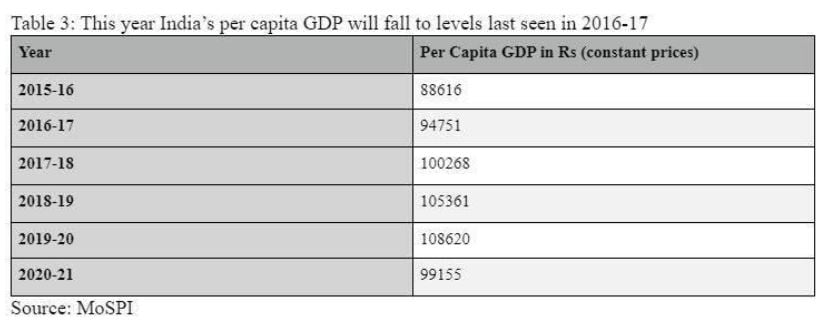

- Per Capita GDP (see above Table 3)

- Significance of Per Capita GDP: While the GDP provides an all-India aggregate, per capita GDP is a better variable if one wants to understand how an average India has been impacted.

- Erosion of three years of Progress: India’s per capita GDP will fall to Rs 99, 155 in 2020-21 — last seen four years ago during 2016-17. In fact, while the overall real GDP will fall by 7.7 per cent, per capita real GDP will fall by 8.7 per cent.

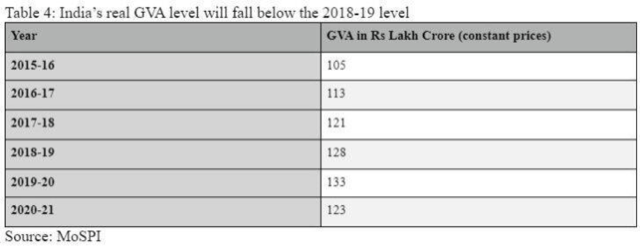

- Absolute level of real Gross Value Added (or GVA) (see above Table 4)

- Significance of GVA: The Gross Value Added provides a picture of the economy from the supply side. It maps the value-added by different sectors of the economy such as agriculture, industry and services. In other words, GVA provides a proxy for the income earned by people involved in the various sectors.

- Fall in GVA below 2018-19 level: At Rs 123.4 lakh crore, India’s real GVA level, too, will fall below the 2018-19 level.

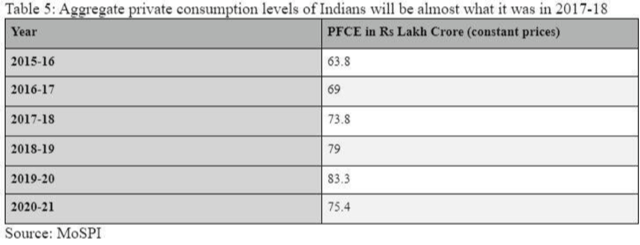

- Absolute level of Private Final Consumption Expenditure (PFCE) (see above Table 5):

- Significance of PFCE: The biggest demand for goods and services comes from private individuals trying to satisfy their consumption needs. Typically this would include all the things — be it a toothpaste or a car — that people buy in their private individual capacity. This demand is called PFCE and it constitutes over 56% of the total GDP.

- 9.5% decline from 2019-20 levels: PFCE levels of 2020-21 will be 75.4 lakh crores which is nearly 9.5% fall from 2019-20 level (83.3 lakh crores). This will be almost what they were in 2017-18.

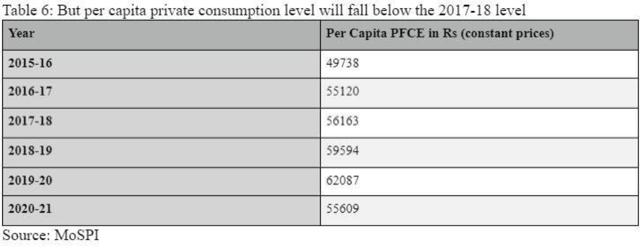

- Per capita PFCE (see above Table 6)

- Significance: Just like per capita GDP, the per capita PFCE is also a relevant metric as it shows how much does an average Indian spend in his/her private capacity. Typically, with rising incomes standards, such consumption levels also rise

- 10.4% decline from 2019-20 levels: It is estimated that per capita PFCE of 2020-21 will be at Rs 55,609 (at 2019-20 it was Rs 62,807). The estimation for this financial year is far below even the 2017-18 level (56,163 Rs).

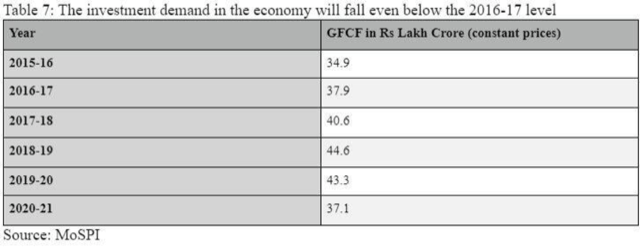

- Absolute level of Gross Fixed Capital Formation (GFCF) (see above Table 7):

- Second biggest component of GDP is called GFCF and it measures all the expenditures on goods and services that businesses and firms make as they invest in their productive capacity. So if a firm buys computers and software to increase the overall productivity then it will be counted under GFCF.

- This type of demand accounts for close to 28 per cent of India’s GDP. Taken together, private demand and business demand account for almost 85 per cent of all GDP.

- Fallen to five year low: at Rs 37 lakh crore, GFCF (or the investment demand in the economy) has fallen even below 2016-17 level.

ECONOMY/ GOVERNANCE

Topic: General Studies 3:

- Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

- Infrastructure: Energy, Ports, Roads, Airports, Railways, Telecommunications etc

Spectrum Auctions

Context: The Department of Telecommunications (DoT) said on Wednesday (January 6) that auctions for 4G spectrum in the 700, 800, 900, 1,800, 2,100, 2,300, and 2,500 MHz bands will begin from March 1.

What are spectrum auctions?

- Role in Communications: Devices such as cellphones and wireline telephones require signals to connect from one end to another. These signals are carried on airwaves, which must be sent at designated frequencies to avoid any kind of interference.

- Ownership of Spectrum: The Union government owns all the publicly available assets within the geographical boundaries of the country, which also include airwaves.

- Need for Auction: With the expansion in the number of cellphone, wireline telephone and internet users, the need to provide more space for the signals arises from time to time. To sell these assets to companies willing to set up the required infrastructure to transport these waves from one end to another, the central government through the DoT auctions these airwaves from time to time.

- Validity of Spectrum: These airwaves are called spectrum, which is subdivided into bands which have varying frequencies. All these airwaves are sold for a certain period of time, after which their validity lapses, which is generally set at 20 years.

Why is spectrum being auctioned now?

- Previous Auction: The last spectrum auctions were held in 2016, when the government offered 2,354.55 MHz at a reserve price of Rs 5.60 lakh crore. Although the government managed to sell only 965 MHz – or about 40 % of the spectrum that was put up for sale – and the total value of bids received was just Rs 65,789 crore.

- Licences expire in 2021: The need for a new spectrum auction has arisen because the validity of the airwaves bought by companies is set to expire in 2021. In the spectrum auctions scheduled to begin on March 1, the government plans to sell spectrum for 4G in the 700, 800, 900, 1,800, 2,100, 2,300, and 2,500 MHz frequency bands.

- Importance of Reserve Price: The reserve price of all these bands together has been fixed at Rs 3.92 lakh crore. Depending on the demand from various companies, the price of the airwaves may go higher, but cannot go below the reserve price.

Who are likely to bid for the spectrum?

- Existing Players: All three private telecom players, Reliance Jio Infocomm, Bharti Airtel, and Vi are eligible contenders to buy additional spectrum to support the number of users on their network.

- Foreign Players: Apart from these three, new companies, including foreign companies, are also eligible to bid for the airwaves. Foreign companies, however, will have to either set up a branch in India and register as an Indian company, or tie up with an Indian company to be able to retain the airwaves after winning them.

What will the bidding cost the three existing companies?

- Both Bharti Airtel and Vi have repeatedly expressed their inability to shell out a lot of money – either to buy new spectrum or to renew the old spectrum licences that they already hold.

- Most analysts expect Bharti Airtel to renew some of its old spectrum, but to not bid for new spectrum at all.

- On Vi, all analysts expect that the company may not participate at all in this auction, given the cash flow constraints it is facing.

- Reliance Jio is likely to not only renew the 44 MHz spectrum that it had bought from Reliance Communication, but to also bid for additional spectrum in the 55 MHz band owned by the latter in the upcoming auctions.

- To this end, Reliance Jio will incur a total capital expenditure of Rs 240 billion at reserve prices, and would require to make an upfront payment of nearly Rs 60 billion, if it were to opt for the long term deferred payment plan.

What is the Impact of lukewarm response by existing private players?

- Below par revenue collection: Government may not be able to get the expected revenue from its spectrum auction, like it happened in 2016.

- Impacts Budget Estimation: Below par performance in auctions may impact the budget estimation which takes into account the revenues from this source.

- Fiscal Situation of Telecoms: The unenthusiastic participation by existing players also reflects the tight fiscal position of telecom companies which they are in, that may further impact the roll out of 5G in India

How will the deferred payment plan work?

- As part of the deferred payment plan, bidders for the sub-1 GHz bands of 700, 800 and 900 MHz can opt to pay 25 per cent of the bid amount now, and the rest later.

- In the above-1 GHz bands of 1,800, 2,100, 2,300, and 2,500 MHz frequency bands, bidders will have to pay 50 per cent upfront, and can then opt to pay the rest in equated annual instalments.

- The successful bidders will, however, have to pay 3 per cent of Adjusted Gross Revenue (AGR) as spectrum usage charges, excluding wireline services.

Conclusion

Spectrum auction in India has turned into a buyer’s market. There is expectation of minimal competition, with operators picking up spectrum that provides best value for money instead of focusing on renewing all their expiring spectrum

(TEST YOUR KNOWLEDGE)

Model questions: (You can now post your answers in comment section)

Note:

- Correct answers of today’s questions will be provided in next day’s DNA section. Kindly refer to it and update your answers.

- Comments Up-voted by IASbaba are also the “correct answers”.

Q.1 Consider the following statements regarding Caracal:

- IUCN Red List status is Least Concern

- National Board for Wildlife (NBWL) has decided to include of Caracal into the list of critically endangered species.

Which of the above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Q.2 Where is Sariska Tiger Reserve located?

- Madhya pradesh

- Uttar Pradesh

- Sikkim

- Rajasthan

Q.3 Consider the following statements regarding Coriander:

- Ministry of Commerce has assigned ‘Coriander’ to the district of Kota in the list of One District One Product

- Only Guna district of Madhya Pradesh contributes major share in coriander export from the country.

Which of the above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

ANSWERS FOR 7th January 2021 TEST YOUR KNOWLEDGE (TYK)

| 1 | A |

| 2 | D |

| 3 | A |

| 4 | C |

Must Read

On the mob attack on U.S. Capitol:

On the avian flu outbreak:

About Personal Data Protection Bill: