UPSC Articles

ECONOMY/ POLITY/ GOVERNANCE

Topic:

- GS-2: Constitutional bodies and their responsibilities

- GS-3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment; Government Budgeting

Fifteenth Finance Commission (15th FC)

Context: In Nov 2017, this 15th Finance Commission was set up. The recommendations of the 15th Finance Commission will cover a period of five years starting from 1st April 2020. This Commission was headed by Shri N.K.Singh, former Member of Parliament and former Secretary to the Government of India.

The commission was required to submit two reports, one for 2020-21 and the second covering the period of five years from 2021-22 to 2025-26

Basis for extension

- First, the abolition of Statehood to Jammu and Kashmir required the Commission to make an estimation excluding the Union Territory.

- Second, the deceleration in growth and low inflation has substantially slowed down the nominal GDP growth making projections for medium term risky.

- Finally, poor revenue performance of tax collection and more particularly Goods and Services Tax combined with the fact that the compensation agreement to the loss of revenue to the States was effective only two years of the period of 15FC posed uncertainties

If not for extension, making medium-term projections in the current scenario would have entailed serious risks.

For Interim Report on 2020-21: Click here

Key Points of the 15th Finance Commission report for 2021-26 tabled in Parliament are

- Vertical Devolution -Devolution of Taxes of the Union to States-

- It has recommended maintaining the vertical devolution at 41% – the same as in its interim report for 2020-21.

- It is at the same level of 42% of the divisible pool as recommended by the 14th Finance Commission.

- It has made the required adjustment of about 1% due to the changed status of the erstwhile State of Jammu and Kashmir into the new Union Territories of Ladakh and Jammu and Kashmir

- In XVFC’s assessment, gross tax revenues for 5-year period is expected to be 135.2 lakh crore. Out of that, Divisible pool (after deducting cesses and surcharges & cost of collection) is estimated to be 103 lakh crore.

- States’ share at 41 per cent of divisible pool comes to 42.2 lakh crore for 2021-26 period.

- Including total grants of Rs. 10.33 lakh crore (details later) and tax devolution of Rs. 42.2 lakh crore, aggregate transfers to States is estimated to remain at around 50.9 per cent of the divisible pool during 2021-26 period.

- Total XVFC transfers (devolution + grants) constitutes about 34 per cent of estimated Gross Revenue Receipts of the Union leaving adequate fiscal space for the Union to meet its resource requirements and spending obligations on national development priorities.

- Horizontal Devolution (Allocation Between the States):

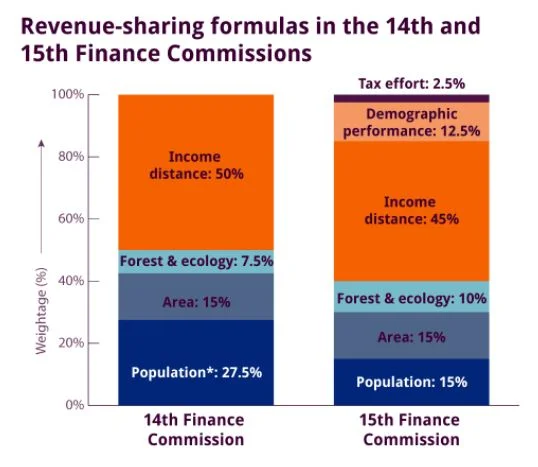

- For horizontal devolution, it has suggested 12.5% weightage to demographic performance, 45% to income, 15% each to population and area, 10% to forest and ecology and 2.5% to tax and fiscal efforts.

- On horizontal devolution, while XVFC agreed that the Census 2011 population data better represents the present need of States, to be fair to, as well as reward, the States which have done better on the demographic front, XVFC has assigned a 12.5 per cent weight to the demographic performance criterion.

- XVFC has re-introduced tax effort criterion to reward fiscal performance

- Revenue Deficit Grants to States:

- Revenue deficit grants emanate from the requirement to meet the fiscal needs of the States on their revenue accounts that remain to be met, even after considering their own tax and non-tax resources and tax devolution to them.

- Revenue Deficit is defined as the difference between revenue or current expenditure and revenue receipts, that includes tax and non-tax.

- It has recommended post-devolution revenue deficit grants amounting to about Rs. 2.94 lakh crores over the five-year period ending FY26.

- The number of states qualifying for the revenue deficit grants decreases from 17 in FY22, the first year of the award period to 6 in FY26, the last year.

- Performance Based Incentives and Grants to States:

These grants revolve around four main themes.

- The first is the social sector, where it has focused on health and education.

- Second is the rural economy, where it has focused on agriculture and the maintenance of rural roads.

- The rural economy plays a significant role in the country as it encompasses two-thirds of the country’s population, 70% of the total workforce and 46% of national income.

- Third, governance and administrative reforms under which it has recommended grants for judiciary, statistics and aspirational districts and blocks.

- Fourth, it has developed a performance-based incentive system for the power sector, which is not linked to grants but provides an important, additional borrowing window for States.

- Fiscal Space for Centre:

- Total 15th Finance Commission transfers (devolution + grants) constitutes about 34% of estimated Gross Revenue Receipts to the Union, leaving adequate fiscal space to meet its resource requirements and spending obligations on national development priorities.

- Provided range for fiscal deficit and debt path of both the Union and States.

- Additional borrowing room to States based on performance in power sector reforms.

- XVFC has recognised that the FRBM Act needs a major restructuring and recommended that the time-table for defining and achieving debt sustainability may be examined by a High-powered Inter-governmental Group.

- This High-powered Inter-Governmental Group could also be tasked to oversee the implementation of the 15th Finance Commission’s diverse recommendations.

- State Governments may explore formation of independent public debt management cells which will chart their borrowing programme efficiently.

- Grants to Local Governments:

- The total size of the grant to local governments should be Rs. 4.3 lakh crore for the period 2021-26.

- Of these total grants, Rs. 8,000 crore is performance-based grants for incubation of new cities and Rs. 450 crore is for shared municipal services.

- A sum of Rs. 2.3 lakh crore is earmarked for rural local bodies, Rs.1.2 lakh crore for urban local bodies and Rs. 70,051 crore for health grants through local governments.

- Urban local bodies have been categorised into two groups, based on population, and different norms have been used for flow of grants to each, based on their specific needs and aspirations.

- Basic grants are proposed only for cities/towns having a population of less than a million. For Million-Plus cities, 100 per cent of the grants are performance-linked through the Million-Plus Cities Challenge Fund (MCF)

- MCF amount is linked to the performance of these cities in improving their air quality and meeting the service level benchmarks for urban drinking water supply, sanitation and solid waste management.

- Health

- XVFC has recommend that health spending by States should be increased to more than 8 per cent of their budget by 2022.

- Given the inter-State disparity in the availability of medical doctors, it is essential to constitute an All India Medical and Health Service as is envisaged under Section 2A of the All-India Services Act, 1951.

- The total grants-in-aid support to the health sector over the award period works out to Rs. 1 lakh crore, which is 10.3 per cent of the total grants-in-aid recommended by XVFC. The grants for the health sector will be unconditional.

- XVFC has recommend health grants aggregating to Rs. 70,051 crore for urban health and wellness centres (HWCs), building-less sub centre, PHCs, CHCs, block level public health units, support for diagnostic infrastructure for the primary healthcare activities and conversion of rural sub centres and PHCs to HWCs. These grants will be released to the local governments.

- Defence and Internal Security

- The Union Government may constitute in the Public Account of India, a dedicated non-lapsable fund, Modernisation Fund for Defence and Internal Security (MFDIS). The total indicative size of the proposed MFDIS over the period 2021-26 is Rs. 2.3 lakh crore.

- Disaster Risk Management

- Mitigation Funds should be set up at both the national and State levels, in line with the provisions of the Disaster Management Act.

- The Mitigation Fund should be used for those local level and community-based interventions which reduce risks and promote environment-friendly settlements and livelihood practices.

- XVFC has recommended the total corpus of Rs.1.6 lakh crore for States for disaster management for the duration of 2021-26, of which the Union’s share is Rs. 1.2 lakh crore and States’ share is Rs. 37,552 crore.

- XVFC has recommended six earmarked allocations for a total amount of Rs. 11,950 crore for certain priority areas, namely, two under the NDRF (Expansion and Modernisation of Fire Services and Resettlement of Displaced People affected by Erosion) and four under the NDMF (Catalytic Assistance to Twelve Most Drought-prone States, Managing Seismic and Landslide Risks in Ten Hill States, Reducing the Risk of Urban Flooding in Seven Most Populous Cities and Mitigation Measures to Prevent Erosion).

Connecting the dots:

- N K Singh Committee report on FRBM review