IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS + MAINS FOCUS)

National Commission for Allied and Healthcare Professionals Bill, 2021

Part of: GS Prelims and GS – II – Policies and interventions; Health; Education

In news

- The Lok Sabha cleared the National Commission for Allied and Healthcare Professionals Bill, 2021.

- It was passed by the Rajya Sabha last week.

Key takeaways

- The Bill seeks to regulate and standardise the education and practice of allied and healthcare professionals.

- Definition of ‘allied health professional’: An associate, technician, or technologist trained to support the diagnosis and treatment of any illness, disease, injury, or impairment.

- Such a professional should have obtained a diploma or degree under this Bill.

- Definition of a ‘healthcare professional’: A scientist, therapist, or any other professional who studies, advises, research, supervises, or provides preventive, curative, rehabilitative, therapeutic, or promotional health services.

- Such a professional should have obtained a degree under this Bill.

- Allied and healthcare professions as recognised categories: Life science professionals, trauma and burn care professionals, surgical and anaesthesia related technology professionals, physiotherapists, and nutrition science professionals.

- The Bill sets up the National Commission for Allied and Healthcare Professions. It will

- frame policies and standards for regulating education and practice,

- create and maintain an online Central Register of all registered professionals, and

- providing for a uniform entrance and exit examination, among others.

- The Commission will constitute a Professional Council for every recognised category of allied and healthcare professions.

- Within six months from the passage of the Bill, state governments will constitute State Allied and Healthcare Councils.

India TB Report

Part of: GS Prelims and GS-II – Health

In news

- According to the India TB report, in 2020, there were 18.05 tuberculosis notifications, which was a fall of 24% from 2019 due to the disruptions caused by the pandemic.

- Released by: Health Ministry.

Key takeaways

- Between January and February 2020, there were 6% more cases reported than in 2019.

- As a result of the lockdown, notifications in the public sector fell by 38% and 44% in the private sector in April and May.

- Of the reported 24.04 lakh TB cases in 2019, treatment success was 82%, mortality rate was 4%.

- The approved budget toward the programme was decreased from ₹3,333 crores in 2019-20 to ₹3,110 crore in 2020-21.

- The report said 20,892 (42%) of patients were initiated on a shorter MDR-TB regimen at the time of diagnosis.

- This is a significant decline from 2019.

116th Meeting of the Permanent Indus Commission

Part of: GS Prelims and GS – II – International Relations

In news

- After a gap of more than 2.5 years Indian and Pakistani delegations began the 116th Meeting of the Permanent Indus Commission (PIC).

Key takeaways

- PIC is a bilateral commission consisting of officials from India and Pakistan.

- Objective: To implement and manage the goals, objectives and outlines of the Indus Waters Treaty (IWT) which was signed in September 1960 with World Bank standing guarantee for any dispute resolution.

- Recent meeting coincided with the National Day of Pakistan.

- It is being viewed as part of the broader process of normalisation of bilateral ties between the two countries

Do you know?

- National Day of Pakistan commemorates the March 23, 1940 Lahore Resolution which paved the way for the creation of Pakistan.

No proposal to implement Panchayat system in Sixth Schedule areas of Assam

Part of: GS Prelims and GS – II – Constitution

In news

- The Union Ministry of Home Affairs (MHA) informed the Lok Sabha that “presently, there is no proposal to implement panchayat system in Sixth Schedule areas of Assam”.

Important value additions

Sixth Schedule of the Constitution

- It protects tribal populations and provides autonomy to the communities through creation of autonomous development councils that can frame laws on land, public health, agriculture and others.

- Presently, 10 autonomous councils exist in Assam, Meghalaya, Tripura and Mizoram.

- Specified tribal areas of Assam: North Cachar Hills, Karbi Anglong and the Bodoland Territorial Area

- Specified tribal areas of Meghalaya: Khasi Hills, Jaintiya Hills and Garo Hills

- Tribal Areas in Tripura

- Specified tribal areas of Mizoram: Chakma, Mara and Lai districts

Constitution (125th Amendment) Bill, 2019

- In January 2019, the Union Cabinet approved amendments to increase the financial and executive powers of the autonomous councils.

- The Constitution (125th Amendment) Bill, 2019, was subsequently introduced in the Rajya Sabha in February 2019, that provides for elected village municipal councils.

- The Bill that is still active proposes that the State Election Commissions would hold elections to the autonomous councils, village and municipal councils.

e-Tendering Portal-PRANIT

Part of: GS Prelims and GS – III – Infrastructure

In news

- Power Grid Corporation of India Limited (POWERGRID), a central PSU under Ministry of Power has established an e-Tendering Portal-PRANIT.

Key takeaways

- It will lead to less paperwork and ease of operation, making the tendering process more transparent.

- Certified by: Standardisation, Testing and Quality Certification Directorate (STQC), Ministry of Electronics and Information Technology

- POWERGRID is now the only organization in India to have an eProcurement solution on SAP Supplier Relationship Management (SRM), complying with all applicable requirements relating to security and transparency as stipulated by STQC.

(Mains Focus)

ECONOMY/ GOVERNANCE

Topic:

- GS-2: Government Policies and Schemes for the development of various sectors

- GS-3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development

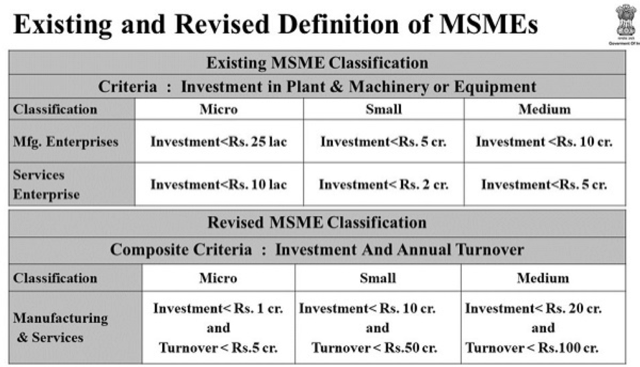

Empowering MSMEs digitally

Context: A significant major contributor to the India growth story is going to be manufacturing. Manufacturing by small units, cottage units and MSMEs, if effectively facilitated, will be the game changer.

Benefits of MSMEs

- Contribution to GDP: Nearly 6.3 crore MSMEs in India contribute one-third to the GDP of the country

- Livelihood to large sections of society: MSME sector is a critical source of livelihood and provides nearly 110 million jobs

- Regional Balanced Development: As per data from the Ministry of MSME, almost 51% of Indian MSMEs are based in rural areas. Empowering them and helping them grow will bridge the urban-rural divide in our country.

- Huge Potential & Focus of government: The government of India (in 2019) envisioned that the sector would account for half of India’s GDP and add 50 million fresh jobs over the next five years.

Issues Faced by MSMEs

- Untapped Potential: MSMEs contribute 55% and 60% to the GDP of Germany and China respectively is a clear indication that India still has a long way to go in its MSME journey.

- Credit supply shortage to MSMEs: The formal credit available to this sector is ₹16 trillion. The viable credit gap is ₹20 trillion against a total demand of ₹36 trillion.

- Lack of Formalisation Amongst MSMEs: Almost 86% of the manufacturing MSMEs operating in the country are unregistered. Even today, out of the 6.3 crore MSMEs only about 1.1 crores are registered with Goods and Services Tax regime.

- Technological Disruption: India‘s MSME sector is based on outdated and inefficient technology, which hampers its productivity & competitiveness. New technologies like Artificial Intelligence, Data Analytics, Robotics and related technologies (collectively called as Industry Revolution 4.0) is a bigger challenge for MSMEs than for organized large-scale manufacturing.

- Bureaucratic Hurdles: Getting construction permits, enforcing contracts, paying taxes, starting a business and trading across borders continue to constrain doing business.

- Scaling issues: The MSME space is virtually a micro space formed by a plethora of small and local shops and hence, scaling them up is a problem, especially when fund access is challenging.

For MSMEs to be sustainable and effective, the need of the hour is

- Better automation in the production process for greater efficiencies on the input side

- More channels for accessing greater markets and opportunities to become a part of the national and global supply chains.

- E-commerce marketplaces are today the best possible enablers for this transformation at minimal cost, innovation and investment

MSMEs and E-Commerce

- Aligned with Atmanirbhar Bharat Abhiyan: The Prime Minister has given the slogan of “vocal for local” and spoken several times about his vision of Atmanirbhar Bharat. E-commerce can contribute significantly in achieving this vision

- Growing E-commerce Space in India: Studies suggest that the India’s e-commerce market is expected to expand to USD 84 billion by 2021 from USD 24 billion in 2017.

- Access to larger markets: E-commerce allows for products even from hinterlands to get to the national market, thus, providing opportunities to artisans and small sellers from Tier-2/3 towns to sell online to customers beyond their local catchment.

- Enhances Supply Chain Efficiency: By investing in supply chains, the e-commerce sector provides opportunities for MSMEs to partner them in supply and delivery networks and thus help improve their supply chain effeciences

- Promotes Entrepreneurship: Start-ups and young brands are also finding opportunities to enter into e-commerce sector by connecting with MSMEs and build national brands and even going global.

- Additional income generation: Many offline stores are also adopting e-commerce to leverage these opportunities and the traditional and modern retail models are moving towards more offline and online collaborations. All these leads to increased business and thus additional income

What steps are required in building a robust E-commerce-MSME sector?

- Ease of Doing Business online

- First, we need to address the roadblocks that the e-commerce sector suffers in terms of ease of doing business online.

- Sellers on e-commerce marketplaces do not get advantage of GST threshold exemption (of Rs 40 lakh) for intra–state supplies that offline sellers enjoy because they have to “compulsorily register” even though their turnover is low.

- Doing away with Physical Presence Requirement

- The government would do well in simplifying “Principal Place of Business” (PPoB) requirement especially for online sellers by making it digital and not requiring physical presence to expand their reach outside their home state.

- Today, the sellers, as in offline, are required to have a physical PPoB which, given the nature of e-commerce, is not practical.

- It is better to replace physical PPoB with Place of Communication.

- Eliminating the need for state specific physical PPoB requirement will facilitate sellers to get state-level GST with a single national place of business.

- Handholding support

- MSMEs needs to be provided handholding support to understand how e-commerce functions.

- The government can collaborate with e-commerce entities to leverage their expertise and scale to create special on-boarding programmes, hold series of awareness sessions, provide common but important services like imaging and cataloguing, etc.

- These can be provided by state governments.

- Tweaking Policies & Schemes

- Equally important is to examine the existing schemes and benefits for MSMEs, which were formulated with an offline, physical market in mind, and tweak them to include the special needs to leverage online sales channels.

- For example, MSMEs could be given fiscal incentives to access markets and invest in digital marketing. The objective is to incentivise those who shift to the digital mode.

- There is a need to dovetail the skilling policy and programmes with the requirements of the e-commerce sector to meet future demand of the sector.

- Build infrastructure

- Building infrastructure — both physical and digital infrastructure is important for digital transformation.

- The road and telecom network will facilitate not just access to the consumer but also enable the seller from remote areas to enter the larger national market as well as the export market.

- A robust logistic network and warehouse chains created by e-commerce platforms enable similar access and reach.

- The National Logistics Policy should focus on e-commerce sector needs.

- Export Potential

Government needs to take specific steps to increase exports via e-commerce like

- Identify products that have potential for the export market

- Connect e-commerce with export-oriented manufacturing clusters

- Encourage tie-ups with sector-specific export promotion councils

- Leverage existing SEZs to create e-commerce export zones.

- Leveraging Existing Indian Postal Network

- India Posts can play a significant role by creating e-commerce specific small parcel solutions at competitive rates, building a parcel tracking system, and partnering with foreign post offices to enable customs clearances.

- E-Commerce and Foreign Trade Policy (FTP):

- The Foreign Trade Policy should identify the areas required by online sellers to succeed in global markets and include e-commerce export specific provisions in the upcoming revised policy.

- It may include: Specific policy provisions providing incentives for e-commerce exports and Enabling end to end digitization for e-commerce exports.

Conclusion

MSMEs if effectively facilitated by digitisation, will be the game changer to accelerate economic growth, employment, income levels and enhance supply chain efficiencies. Digital proficiency for MSMEs is vital to set foot in the online market successfully. Without that, the sector cannot be future ready.

Connecting the dots:

- Production Linked Incentive Scheme

(TEST YOUR KNOWLEDGE)

Model questions: (You can now post your answers in comment section)

Note:

- Correct answers of today’s questions will be provided in next day’s DNA section. Kindly refer to it and update your answers.

- Comments Up-voted by IASbaba are also the “correct answers”.

Q.1 The causative agent of tuberculosis is:

- Virus

- Bacterium

- Malnutrition

- Protozoan

Q.2 Consider the following statements:

- Indus Waters Treaty (IWT) was signed in 1960 between India and Pakistan.

- World Bank was the standing guarantee for any dispute resolution.

Which of the above is or are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Q.3 Sixth Schedule of Indian COnstitution deals with which of the following?

- administration of tribal areas in Assam, Meghalaya, Tripura and Mizoram

- administration of tribal areas in parts of India

- Emoluments of Chief Justice of India

- Anti-defection law

ANSWERS FOR 24rd March 2021 TEST YOUR KNOWLEDGE (TYK)

| 1 | D |

| 2 | D |

| 3 | C |

Must Read

On fiscal stimulus by US:

On UNHRC Resolution on Sri Lanka:

On water pollution: