IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS & MAINS Focus)

Syllabus

- Prelims –Defence

Context: Recently, INS Trishul arrived at Durban port in South Africa to commemorate the 130th anniversary of the incident at Pietermaritzburg railway station when Mahatma Gandhi was evicted from a train.

About INS Trishul:-

- It is the second frigate of the Talwar class of the Indian Navy.

- The guided missile frigate joined the arsenal of the Indian Navy in 2003.

- Built in Russia under an Indo-Russian joint production.

- These missile frigates are modified Krivak III class frigates from Russia.

- It has a displacement capacity of 4,000 tons and a speed of 30 knots and is capable of accomplishing a wide variety of naval missions, primarily, finding and eliminating enemy submarines and large surface ships.

- Due to the use of stealth technologies and a special hull design, the resulting frigate features reduced radar cross section (RCS) as well as electromagnetic, acoustic and infrared signatures.

Pietermaritzburg railway station incident

- On the night of June 7, 1893, Mohandas Karamchand Gandhi, then a young lawyer in South Africa was thrown off the train’s first-class compartment at Pietermaritzburg station despite having the ticket.

- This happened because he refused to give up his seat as ordered after being told that it was for ‘whites-only’.

- The incident led him to develop his Satyagraha principles of peaceful resistance and mobilize people in South Africa and in India against the discriminatory rules of the British.

- Satyagraha: the term is derived from ‘satya’ (truth) and ‘agraha’ (insistence or truth-force).

- Its practitioners are called Satyagrahis

MUST READ: India and Mahatma Gandhi

SOURCE: HINDUSTAN TIMES

PREVIOUS YEAR QUESTIONS

Q.1) Consider the following in respect of the Indian Ocean Naval Symposium (IONS): (2017)

- Inaugural IONS was held in India in 2015 under the chairmanship of the Indian Navy.

- IONS is a voluntary initiative that seeks to increase maritime cooperation among navies of the littoral states of the Indian Ocean Region.

Which of the above statements is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Q.2) With reference to `Astrosat’, the astronomical observatory launched by India, which of the following statements is/are correct? (2016)

- Other than the USA and Russia, India is the only country to have launched a similar observatory into space.

- Astrosat is a 2000 kg satellite placed in an orbit at 1650 km above the surface of the Earth.

Select the correct answer using the code given below.

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Syllabus

- Prelims – History

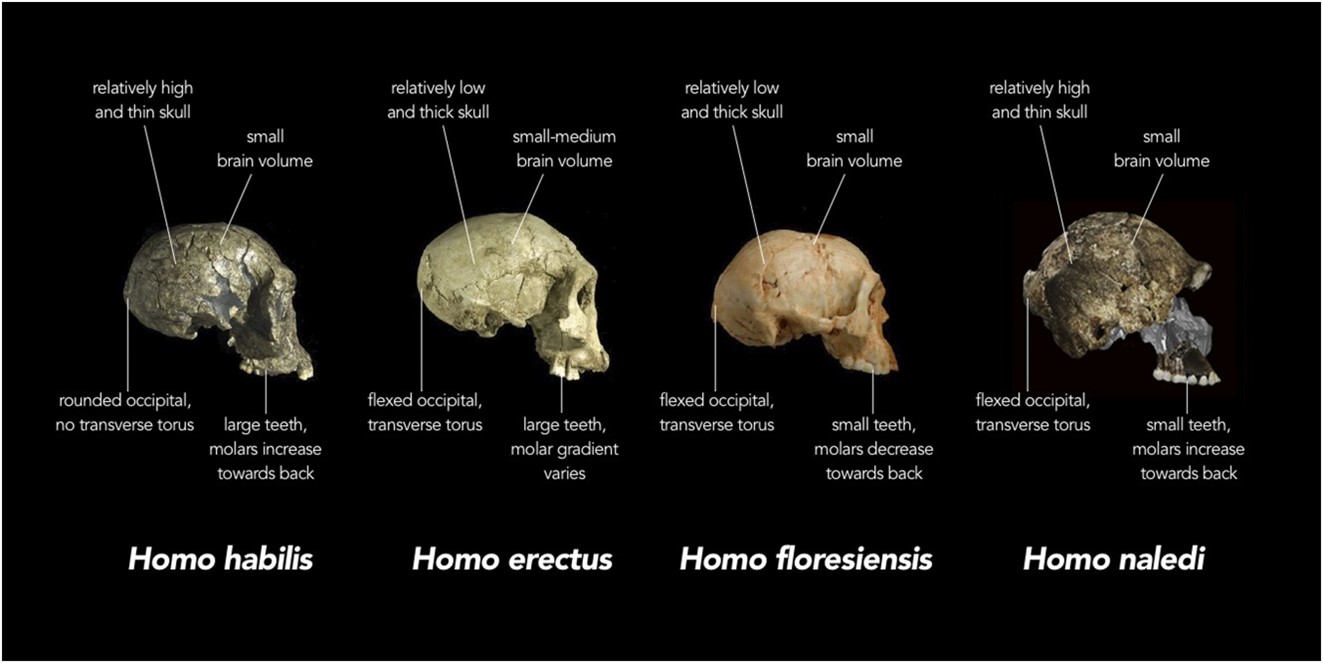

Context: Recent evidence suggests that Homo Naledi buried their dead.

About Homo Naledi:-

IMAGE SOURCE: pinterest.com.au

- Homo naledi is an extinct human species that lived hundreds of thousands of years ago.

- Homo Nalediis a species of human discovered in the Rising Star cave system, a UNESCO World Heritage Site in South Africa in 2013.

- Homo naledi exhibits a combination of primitive and modern features and is not a direct ancestor of modern humans.

- They are believed to have existed between 300,000 to 200,000 years in Southern Africa. (UPSC CSE: Palaeolithic Cave Paintings in NCR)

- They walked upright.

- Their shoulders were built for climbing.

- Their teeth were shaped like that of older primates.

- One of the most interesting things was that their brain size was between 450 to 600 cubic centimetres (Small brain). It was one-third of that of modern humans.

About the Study:

- Homo Naledi buried their dead, which would challenge existing notions about advanced mortuary behavior.

- Modern Humans exhibit a unique behavior among primates by burying their dead, which sets them apart from other animals. This behavior is known as Mortuary behavior, characterized by social acts and a complex understanding of death.

- Previously, the earliest evidence of Mortuary behavior was found among Neanderthals and modern humans, occurring more than 100,000 years after Homo naledi.

- Homo naledi may have created rock art in Rising Star Cave. This is intriguing because rock art has traditionally been associated with Homo sapiens and other large-brained ancestors.

- The report describes engravings in the form of deeply impressed cross-hatchings and geometric shapes such as squares, triangles, crosses and X’s.

- Additionally, a rock-like object found near a Homo naledi body suggests it could be a stone tool.(UPSC MAINS: Cave paintings).

- Homo naledi used fire strategically for illumination during mortuary and engraving activities in the cave.

Burial tradition in India:-

- It is said that the practice of burying dead people started some 3000 years ago in India.

- Megaliths or large stones were used to indicate the place where the dead were buried.

- We still find this practice in various cultures of India.

- 3000 years ago, people living in southern regions, Kashmir, and the Deccan plateau were involved in such burial practices.

- The people who died were buried with the help of pots known as Red and Black Ware.

Megalith Sites in India

- Nilaskal – Karnataka

- Hire Benkal- Kerala

- Chamber Tomb: Hire Benakal- Karnataka

- Dolmens: Hire Benakal– Karnataka

- Hanamsagar– Karnataka

- Kudakkallu Parambu– Kerala

- Junapani- Maharashtra

MUST READ: Bhimbetka cave

SOURCE: THE INDIAN EXPRESS

PREVIOUS YEAR QUESTIONS

Q.1) Consider the following pairs: (2021)

Historical place Well-known for

- Burzahom Rock-cut shrines

- Chandraketugarh Terracotta art

- Ganeshwar Copper artefacts

Which of the pairs given above is/are correctly matched?

- 1 only

- 1 and 2

- 3 only

- 2 and 3

Q.2) Which one of the following statements is correct? (2021)

- Ajanta Caves lie in the gorge of the Waghora River.

- Sanchi Stupa lies in the gorge of the Chambal River.

- Pandu – Lena cave shrines lie in the gorge of the Narmada River.

- Amaravati Stupa lies in the gorge of the Godavari River.

Syllabus

- Prelims –Economy

Context: The government recently announced the removal of the procurement ceiling for tur, urad and masur dal under the price support scheme.

About the Price support scheme:-

- The scheme is for procurement, through NAFED.(UPSC CSE: NAFED and APMC)

- Under PSS, NAFED undertakes procurement of oil seeds, pulses and cotton when prices fall below the MSP

- Procurement under PSS is continued until prices stabilize at or above the MSP.

- Farmers can avail the benefit of the scheme by selling their produce at support price in Agricultural Produce & Livestock Market Committee (APMC) centres.

- The Central Government reimburses the loss incurred by NAFED in undertaking such operations.

NAFED:-

- It was established in 1958.

- It is registered under the Multi-State Co-operative Societies Act, 2002.

- It is the apex organization of marketing cooperatives for agricultural produce in India.

- It undertakes the procurement as and when prices fall below the MSP.

- It is at present, one of the largest procurement as well as marketing agencies for agricultural products in India.

Objectives:-

- To organize, promote and develop marketing, processing, storage of agricultural, horticultural, and forest produce.

- To distribute agricultural machinery, implements and other inputs.

- To act and assist for technical advice in agricultural production.

Minimum Support Price (MSP)

- The MSP are announced at the beginning of the sowing season crops based on the recommendations of the Commission for Agricultural Costs and Prices (CACP). CACP: is an attached office of the Ministry of Agriculture and Farmers Welfare

- It is at least one-and-a-half times the cost of production incurred by the farmers.

- Objective: to support the farmers from distress sales and to procure food grains for public distribution.

- Cabinet Committee on Economic affairs declares MSP.

- Crops under MSP:-

- The Centre currently fixes MSPs for 23 farm commodities based on the CACP’s recommendations.

- 7 cereals: paddy, wheat, maize, bajra, jowar, ragi and barley

- 5 pulses: chana, arhar/tur, urad, moong and masur

- 7 oilseeds: rapeseed-mustard, groundnut, soyabean, sunflower, sesamum, safflower and nigerseed

- 4 commercial crops: cotton, sugarcane, copra and raw jute

- Fair and remunerative price (FRP) for sugarcane

MUST READ: Minimum Support Prices (MSP) for copra season 2023

SOURCE: TIMES NOW

PREVIOUS YEAR QUESTIONS

Q.1) Which of the following activities constitute a real sector in the economy? (2022)

- Farmers harvesting their crops.

- Textile mills converting raw cotton into fabrics.

- A commercial bank lending money to a trading company.

A corporate body issuing Rupee Denominated Bonds overseas

- 1 and 2 only

- 2, 3 and 4 only

- 1, 3 and 4 only

- 1, 2, 3 and 4

Q.2) In India, which of the following can be considered as public investment in agriculture? (2020)

- Fixing Minimum Support Price for agricultural produce of all crops

- Computerization of Primary Agricultural Credit Societies

- Social Capital Development

- Free electricity supply to farmers

- Waiver of agricultural loans by the banking system

- Setting up cold storage facilities by the governments.

In India, which of the following can be considered as public investment in agriculture?

Select the correct answer using the code given below:

- 1, 2, and 5 only

- 1, 3, 4, and 5 only

- 2, 3, and 6 only

- 1, 2, 3, 4, 5 and 6

Syllabus

- Prelims –Economy

Context: Recently, the SAT quashed an order of SEBI, which had earlier cancelled licence of Brickwork Ratings’, a credit rating agency. .

About Securities Appellate Tribunal (SAT):-

- It is a statutory body created under the provisions of the SEBI Act, 1992.

- It has only one bench, which sits in

- Jurisdiction: the whole of India

- Composition of the SAT: It consists of a Presiding Officer and two other members.

- Appointment of the Presiding Officer: by the Central Government in consultation with the Chief Justice of India or his nominee.

- Powers: it has powers similar to a civil court.

- Appeals from its orders can be challenged in the Supreme Court.

- Key Functions:-

- To hear and dispose of appeals against orders passed by the Securities and Exchange Board of India (SEBI) or by an adjudicating authority under the Act. (UPSC CSE: SEBI)

- To exercise jurisdiction, authority and powers conferred on the SAT by or under this Act or any other law for the time being in force.

- To hear and dispose of appeals against orders passed by the Pension Fund Regulatory and Development Authority (PFRDA). (UPSC CSE: NPS)

Pension Fund Regulatory and Development Authority (PFRDA):-

- It is a pension regulatory authority, which was established in 2003.

- It is a statutory body established under PFRDA Act, 2003.

- Ministry: Ministry of Finance

- HQ: New Delhi

- Function: It promotes old age income security by establishing, developing and regulating pension funds.

- It protects the interests of subscribers to schemes of pension funds and related matters.

- To hear and dispose of appeals against orders passed by the Insurance Regulatory Development Authority of India (IRDAI).

Insurance Regulatory Development Authority of India (IRDAI):-

- It is an autonomous and statutory body established under the IRDA Act 1999.

- The apex body supervises and regulates the insurance sector in India.

- Objective: To protect the interests of policyholders, to regulate, promote and ensure orderly growth of the insurance industry in India.

- Nodal Ministry: Ministry of Finance

- Head Office:

- Composition: IRDAI is a 10-member body. It has a Chairman, five full-time members, and the Government of India appoints four part-time members..

Functions:-

- To have a fair regulation of the insurance industry while ensuring financial soundness of the applicable laws and regulations.

- Registering and regulating insurance companies.

- Protecting policyholders’ interests.

- Licensing and establishing norms for insurance intermediaries.

- Regulating and overseeing premium rates and terms of non-life insurance covers.

MUST READ: Securities and Exchange Board of India (SEBI) extends trading ban on Agri commodities

SOURCE: BUISINESS STANDARD

PREVIOUS YEAR QUESTIONS

Q.1) Consider the following statements: (2022)

- In India, credit rating agencies are regulated by the Reserve Bank of India.

- The rating agency popularly known as ICRA is a public limited company.

- Brickwork Ratings is an Indian credit rating agency.

Which of the statements given above is correct?

- 1 and 2 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Q.2) With reference to the ‘Banks Board Bureau (BBB)’, which of the following statements is correct? (2022)

- The Governor of RBI is the Chairman of BBB.

- BBB recommends the selection of heads for Public Sector Banks.

- BBB helps Public Sector Banks develop strategies and capital-raising plans.

Select the correct answer using the code given below:

- 1 and 2 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Syllabus

- Prelims –Important Institutions

Context: Recently, the NHAI started shifting the toll plaza from Jagjitpura to a new location on the Jalandhar-Barnala stretch of the national highway.

About the National Highways Authority of India (NHAI):-

IMAGE SOURCE: 91wheels.com

- National Highways Authority of India (NHAI) was set up under NHAI Act, 1988.

- It is an autonomous organization that looks after the management of the complete network of National Highways in the country. (UPSC MAINS: Investment model for the highway sector)

- Ministry: Ministry of Road Transport and Highways

- HQs: New Delhi

- Composition: Chairman, and not more than five full-time Members and four part-time Members.

- They are appointed by the Central Government.

Functions:-

- It has been entrusted with the National Highways Development Project (NHDP). NHDP is India’s largest-ever Highways Project in a phased manner.

- NHAI takes care of other minor projects for development, maintenance and management.

- NHAI maintains the National Highways network to global standards and cost-effective manner.

- Collecting fees or tolls on National Highways. (UPSC CSE: Char Dham Highways)

- Developing and providing consultancy and construction services on a national and international level.

- Advising the Central government on issues related to National Highways.

- Formulating and implementing schemes for National Highways development.

National Highways Development Programme (NHDP)

- National Highways Development Programme (NHDP) was launched in 1998 with the objective of developing roads of international standards which facilitate smooth flow of traffic. It envisages creation of roads with enhanced safety features, better riding surface, grade separator and other salient features.

- The programme is being implemented in the following seven phases;

- Phase I: Phase I consists of Golden Quadrilateral network comprising a total length of 5,846 km which connects the four major cities of Delhi, Chennai, Mumbai & Kolkata and 981 km of North-South and East-West corridor .NS-EW corridor connects Srinagar in the north to Kanyakumari in the south and Silchar in the east to Porbandar in the west. Phase I also includes improving connectivity to ports.

- Phase II: Phase II covers 6,161 km of the NS-EW corridor (The total NS-EW corridor consists of 7,142 km) and 486 km of other NHs.

- Phase III: Four-laning of 12,109 km of high-density national highways connecting state capitals and places of economic, commercial and tourist importance.

- Phase IV: Upgradation of 20,000 km of single-lane roads to two-lane standards with paved shoulders.

- Phase V: Six-laning of 6,500 km of four-laned highways.

- Phase VI: Construction of 1,000 km of expressways connecting major commercial and industrial townships.

- Phase VII: Construction of ring roads, by-passes, underpasses, flyovers, etc. comprising 700 km of road network

MUST READ: Drone Survey Mandatory for All National Highways Projects

SOURCE: HINDUSTAN TIMES

PREVIOUS YEAR QUESTIONS

Q.1) With reference to the “Tea Board” in India, consider the following statements: (2022)

- The Tea Board is a statutory body.

- It is a regulatory body attached to the Ministry of Agriculture and Farmers Welfare.

- The Tea Board’s Head Office is situated in Bengaluru.

- The Board has overseas offices in Dubai and Moscow.

Which of the statements given above is correct?

- 1 and 2

- 2 and 4

- 3 and 4

- 1 and 4

Q.2) Steel slag can be the material for which of the following? (2020)

- Construction of base road

- Improvement of agricultural soil

- Production of cement

Select the correct answer using the code given below:

- 1 and 2 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Syllabus

- Prelims –Economy

Context: Recently, an RBI-appointed committee has recommended the extension of Deposit Insurance and Credit Guarantee Corporation (DICGC) cover to Prepaid Payment Instrument (PPI) holders.

About Prepaid Payment Instrument (PPI) holders:-

- PPIs are instruments that facilitate the purchase of goods and services.

- These include financial services, remittance facilities, etc. (UPSC CSE: Bharat Bill Payment System (BBPS))

- Prepaid instruments can be issued as smart cards, magnetic stripe cards, internet accounts, internet wallets, mobile accounts, mobile wallets, paper vouchers and any of the instruments used to access the prepaid amount. (UPSC CSE: Non-Bank PSPs to Join Centralised Payment System )

- Three types Types of PPIs:-

- Closed System PPIs: These PPIs are issued by an entity for facilitating the purchase of goods and services from that entity only.

- They do not permit cash withdrawals.

- The operation of such instruments does not require approval by the RBI.

- The most common example of a closed system PPI is a brand-specific gift card.

- Semi-closed System PPIs: banks (approved by RBI) and non-banks (authorized by RBI) issue these PPIs.

- They are for the purchase of goods and services at merchant locations, which have a specific contract with the issuer to accept the PPIs as payment instruments.

- Open System PPIs: These PPIs are issued only by banks (approved by RBI).

- These are used at any merchant for the purchase of goods and services.

- Cash withdrawal at ATMs / Points of Sale (PoS) terminals / Business Correspondents (BCs) is allowed through such PPIs.

Deposit Insurance and Credit Guarantee Corporation (DICGC)

- The merger of Deposit Insurance Corporation (DIC) and Credit Guarantee Corporation of India Ltd. (CGCI) in 1978 resulted in the formation of DICGC.

- It is a statutory body under the Deposit Insurance and Credit Guarantee Corporation Act, 1961.

- It serves as a deposit insurance and credit guarantee for banks in India. It protects deposit accounts up to a INR 5 lakh per bank account holder.If a deposit balance of a bank account holder in a single bank exceeds INR 5 lakh, the DICGC will pay up to INR 5 lakh, comprising interest and principal, if the bank goes bankrupt.

- It is a fully owned subsidiary of

- The RBI governs it.

- Coverage of DGCI:-Banks including regional rural banks, local area banks, foreign banks with branches in India, and cooperative banks, are mandated to take deposit insurance cover with the DICGC.

- Types of Deposits Covered:-DICGC insures all bank deposits, such as saving, fixed, current, recurring, etc. The following types of deposits are not covered under DICGC:-

- Deposits of foreign Governments.

- Deposits of Central/State Governments.

- Inter-bank deposits.

- Deposits of the State Land Development Banks with the State co-operative banks.

- Any amount due on account of any deposit received outside India.

- Any amount which has been specifically exempted by the corporation with the previous approval of the

MUST READ: UPI and NPCI Regulation

SOURCE: INDIAN EXPRESS

PREVIOUS YEAR QUESTIONS

Q.1) With reference to Ayushman Bharat Digital Mission, consider the following statements: (2022)

- Private and public hospitals must adopt it.

- As it aims to achieve universal health coverage, every citizen of India should be part of it ultimately.

- It has seamless portability across the country.

Which of the statements given above is/are correct?

- 1 and 2 only

- 3 only

- 1 and 3 only

- 1, 2 and 3

Q.2) In India, the Central Bank’s function as the “lender of last resort” usually refers to which of the following? (2021)

- Lending to trade and industry bodies when they fail to borrow from other sources

- Providing liquidity to the banks having a temporary crisis

- Lending to governments to finance budgetary deficits

Select the correct answer using the code given below

- 1 and 2

- 2 only

- 2 and 3

- 3 only

Syllabus

- Prelims –Geography

Context: Mahua ladoos, prepared by Odisha tribal women have showed huge revenue success in recent times.

About Mahua ladoos:-

- The tribal women in Odisha’s Kandhamal district use mahua flowers to prepare various delicious varieties of food. Mahua flowers are mainly used for brewing local liquor, are popular across India

- Around 120 tribal women members of the state’s Van Dhan Vikas Kendras prepare laddus, cakes, jam, toffees, pickles, squash, pakodas and biscuits using dry mahua flowers, which they supply, in the local market to earn revenues.

- Mahua laddus are in high demand compared to other products.

- The laddu is prepared using ingredients such as cashew, rasi, groundnut, jaggery, and mahua flowers.

Van Dhan Vikas Kendras:

- These are set up under the Pradhan Mantri VanDhan Yojana(PMVDY).

- They aim to promote Minor Forest Products (MFPs) -centric livelihood development of tribal gatherers and artisans.

- Minor forest produce are economic commodities growing naturally in a forest and sold for purposes other than timber and fuel. Examples include bamboo, wild honey, gum, lac, waxes, resins etc.

- These Kendras would act as common facility centres for procurement cum value addition to locally available MFPs.

Pradhan Mantri VanDhan Yojana(PMVDY):-

- It was launched in 2018.

- It is an initiative of the Ministry of Tribal Affairs and TRIFED.

- Objective: to improve tribal incomes through the value addition of tribal products.

- It is a Market Linked Tribal Entrepreneurship Development Program for forming clusters of tribal Self-Help-Groups (SHGs) and strengthening them into Tribal Producer Companies.

MUST READ: Mahua Tree/Madhuca longifolia

SOURCE: DOWN TO EARTH

PREVIOUS YEAR QUESTIONS

Q.1) Consider the following statements about Particularly Vulnerable Tribal Groups (PVTGs) in India: (2019)

- PVTGs reside in 18 States and one Union Territory.

- A stagnant or declining population is one of the criteria for determining PVTG status.

- There are 95 PVTGs officially notified in the country so far.

- Irular and Konda Reddi tribes are included in the list of PVTGs.

Which of the statements given above is correct?

- 1, 2 and 3

- 2, 3 and 4

- 1, 2 and 4

- 1, 3 and 4

Q.2) With reference to organic farming in India, consider the following statements: (2018)

- ‘The National ‘Programme for Organic Production’ (NPOP) is operated under the guidelines and ‘directions of the Union Ministry of Rural Development.

- ‘The Agricultural and Processed Food Product Export Development Authority ‘(APEDA) functions as the Secretariat for the implementation of NPOP.

- Sikkim has become India’s first fully organic State.

Which of the statements given above is/are correct?

- 1 and 2 only

- 2 and 3 only

- 3 only

- 1, 2 and 3

Manual Scavenging in India

Syllabus

- Mains – GS 1 (Social Issues) and GS 2 (Governance)

Context: According to the Ministry of Social Justice and Empowerment’s recent report, only 66% of districts in a country are free of manual scavenging.

About manual scavenging:

- The Act of Manual Scavenging refers to manually cleaning, carrying, and disposing of, or handling in any manner, human excreta in an insanitary latrine.

- In 2013, the definition of manual scavengers was also broadened to include people employed to clean septic tanks, ditches, or railway tracks.

Status of manual scavenging:

- As per 2011 Census of India, there were over 740,000 households in the country where manual scavenging was still being practiced.

- This practice is often associated with the caste system in India, where people from lower castes, such as Dalits, are forced to engage in manual scavenging.

- According to the National Commission for Safai Karamcharis, a total of 482 manual scavengers died while cleaning sewers and septic tanks across India between 2016 and 2019.

- The Safai Karamchari Andolan, an advocacy group working to eradicate manual scavenging, estimates that there are still around 1.8 million manual scavengers in India.

- 233 people died due to accidents while undertaking hazardous cleaning of sewer and septic tanks from 2019 to 2022.

- Haryana had the highest number of deaths at 13, followed by Maharashtra with 12 and Tamil Nadu with 10.

Reasons for the Prevalence of Manual Scavenging:

Indifferent Attitude:

- A number of independent surveys have talked about the continued reluctance on the part of state governments to admit that the practice prevails under their watch.

Social Issue:

- The practice is driven by caste, class and income divides.

- It is linked to India’s caste system where so-called lower castes are expected to perform this job.

- In 1993, India banned the employment of people as manual scavengers (The Employment of Manual Scavengers and Construction of Dry Latrines (Prohibition) Act, 1993), however, the stigma and discrimination associated with it still linger on.

- This makes it difficult for liberated manual scavengers to secure alternative livelihoods.

Issues due to Outsourcing:

- Many times, local bodies outsource sewer-cleaning tasks to private contractors. However, many of them unreliable operators do not maintain proper rolls of sanitation workers.

- In case after case of workers being asphyxiated to death, these contractors have denied any association with the deceased.

Issues associated with manual scavenging:

- Manual scavenging is a “dehumanizing practice” which has been carried on in the country with a background of historical injustice and indignity suffered by the manual scavengers.

- It constitutes problems that encompass domains of health and occupation, human rights and social justice, gender and caste, and human dignity.

- Manual scavenging and deaths of people trapped in flooded sewer lines continue to be a reality though the practice was banned.

- The workers were made to work in the most hazardous way.

- There was not enough protective gear and tech support and they continue to do it manually.

- Other issues are Poverty and Caste-discrimination.

Constitutional provisions against manual scavenging in India:

- Human dignity is an inalienable right, which forms a part of the fundamental right to life (Article 21– Maneka Gandhi vs. Union of India) as per the Constitution of India.

- The following is a list of provisions under the Indian Constitution, which is supposed to cater to the rights of equality, respect, and dignity before the law.

- Article 14 is about equality before the law, which should not be denied to any individual in India.

- Article 15 provides that no discrimination be permitted based on the place of birth of a person, race, religion, caste, and sex. Manual scavengers, however, face discrimination because of their caste all their lives.

- Article 16 of the Indian Constitution, in matters of public employment guarantees equal opportunity to all its citizens.

- Article 17 has provision for the abolition of untouchability, it is guaranteed under this constitutional provision to all.

- Article 19(1) (g) gives every citizen the right to practice any profession or to carry on any occupation, trade or business of their choosing.

- Article 21 guarantees the protection of life and personal liberty to all the citizens living in India.

- Apart from these, some other rights, which safeguard the manual scavengers as SC or ST, under the Indian Constitution, are Article 46 and Article 338.

Supreme Court’s Judgements:

- The apex court itself had reinforced the prohibition and directed the rehabilitation of people, traditionally and otherwise, employed as manual scavengers in its judgment in Safai Karamchari Andolan and Others vs. Union of India.

- The judgment had called for their “rehabilitation based on the principles of justice and transformation”.

Initiatives taken by the Govt.

- NAMASTE scheme: The scheme for rehabilitation of manual scavengers has now been merged with the NAMASTE scheme for 100% mechanisation of sewer work.

- The Union Budget for 2023-24 showed ₹100-crore allocation for the NAMASTE scheme and no allocation for the rehabilitation scheme.

- Manual scavenging as defined under Section 2 (1) (g) of the “Prohibition of Employment as Manual Scavengers and their Rehabilitation Act, 2013 (MS Act, 2013)” is prohibited with effect from 6.12.2013.

- No person or agency can engage or employ any person for manual scavenging from the above date.

- Any person or agency who engages any person for manual scavenging in violation of the provisions of the MS Act, 2013 is punishable under Section 8 of the above Act, with imprisonment upto 2 years or fine upto Rs. One Lakh or both.

- Under Swachhta Udyami Yojana of National Safai Karamcharis Finance and Development Corporation, concessional loans are provided to safai karamcharis, manual scavengers, their dependants, the Urban Local Bodies, and other agencies responsible for cleaning, for procurement of sanitation related instruments/vehicles.

- A short-duration training programme (RPL) is organised for the sanitation workers wherein they are trained in safe and mechanised cleaning practices.

Source: The Hindu

Syllabus

- Mains – GS 2 (Governance) and GS 3 (Economy)

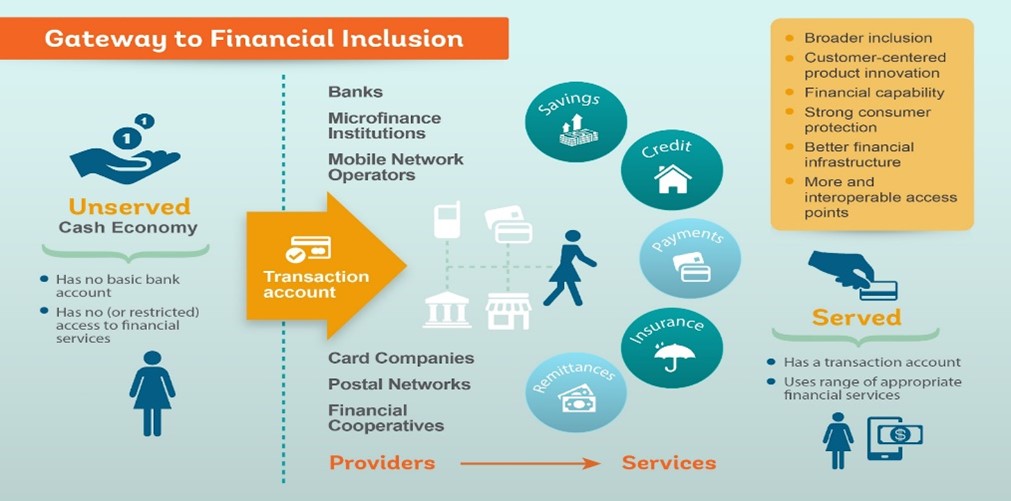

Context: In June 2023, the Reserve Bank of India (RBI) Governor launched a Financial Inclusion Dashboard, named Antardrishti.

About Antardrishti:

- The dashboard will provide the required insight to assess and monitor the progress of financial inclusion by capturing relevant parameters.

- The dashboard, presently intended for internal use in the RBI, will further facilitate greater financial inclusion through a multi-stakeholder approach.

About Financial Inclusion:

- According to the world bank, financial inclusion means that individuals and businesses have access to affordable financial products and services that meet their needs.

- Accessibility, affordability and availability of financial services are 3 pillars of financial inclusion.

- It is a method of offering banking and financial solutions and services to every individual in the society without any form of discrimination.

- The concept of financial inclusion was first introduced in India officially in 2005 by the Reserve Bank of India.

The objectives of financial inclusion are to provide the following:

- A basic no-frills banking account for making and receiving payments

- Saving products (including investment and pension)

- Simple credit products and overdrafts linked with no-frills accounts

- Remittance, or money transfer facilities

- Micro insurance (life) and non-micro insurance (life and non-life)

- Micro pension and

- Financial Literacy.

Significance of Financial Inclusion:

- Financial inclusion strengthens the availability of economic resources and builds the concept of savings among the poor.

- Financial inclusion is a major step towards inclusive growth. It helps in the overall economic development of the underprivileged population.

- In India, effective financial inclusion is needed for the uplift of the poor and disadvantaged people by providing them with the modified financial products and services.

Challenges to financial inclusion in India:

- Socio-economic factors: Financial exclusion is related to the social conditions of low-income households, who are not able to access the available financial products and services.

- Various constraints such as low income, low savings and generally low levels of awareness hinders financial inclusion.

- Geographical factors: A review by the Rangarajan Committee shows that financial exclusion is highest among households in the Eastern, North -Eastern and Central areas of the country partly due to poor infrastructure.

- This coupled with remoteness and less population in some areas resulting is in problems with access.

- Limited availability of appropriate technology: The key driver of financial inclusion is the proliferation of stable and reliable Information and Communication Technology (ICT).

- The lack of infrastructure and cost effective technology for facilitating transactions at the doorstep is a hindrance to financial inclusion.

- Perception of obligation: The financial institutions are reluctant to serve small value and unprofitable customers with irregular income.

- Banks perceive inclusion as an obligation rather than a business opportunity.

- This discourages banks from providing financial services to low income individuals.

- Lack of documents: Another factor preventing them from accessing formal financial institutions are the requirement of various document proof.

- The poor generally lack documents such as Aadhaar card, income certificate, birth certificate, address proof etc.

- Financial illiteracy: The absence of basic education prevents people from following even simple information related to financial inclusion.

- The rural population as a result, relies mostly on the informal sector for availing finance at high rates, which lead to the vicious circle of poverty and debt repayment.

- Penetration: At present, only about 5% of India’s 6 lakh villages have bank branches. There are 296 under-banked districts in states with below-par banking services.

- Thus, bank reach is poor in rural areas leading to financial exclusion.

Steps taken to achieve Financial Inclusion:

Government of India Initiatives:

- PM Mudra Yojana – for small loans to non-corporate businesses

- PM Jan Dhan Yojana

- Insurance scheme – PM Suraksha Bima Yojana and Jeevan Jyoti Beema Yojana

- Pension Scheme – Atal Pension Yojana, Pradhan Mantri Kisan Maan Dhan Yojana, Pradhan Mantri Shram Yogi Mann Dhan Yojana (PM-SYM)

- Nandan Nilekani Panel on deepening of Digital Payments

- Kisan Credit Card

Initiatives by the RBI:

- National Strategy for Financial Inclusion (NSFI) 2019-24

- Payment Infrastructure Development Fund (PIDF)

- ATM infrastructure

- Project Financial Literacy

Way Forward:

The availability of banking facilities and strong bank branch network are the major facilitators of developmental activities. A strong and sturdy financial system is a pillar of economic growth, development and progress of an economy. The problem of financial exclusion needs to be tackled if we want our country to grow in an equitable and sustainable manner.

Source: Business Standard

Practice MCQs

Q1.) With reference to Pradhan Mantri VanDhan Yojana, consider the following statements:

- It is an initiative of the Ministry of Tribal Affairs and TRIFED.

- It includes only Major Forest Products.

Which of the statements given above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Q2.) With reference to the National Highways Authority of India, consider the following statements:

- It is entrusted with collecting fees or tolls on National Highways.

- NHAI is an executive body.

Which of the statements given above is/are incorrect?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Q3.) With reference to the Securities Appellate Tribunal (SAT), consider the following statements:

- It has only one bench, which sits in Delhi.

- It can take appeals of SEBI only.

Which of the statements given above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Comment the answers to the above questions in the comment section below!!

ANSWERS FOR ’ 8th June 2023 – Daily Practice MCQs’ will be updated along with tomorrow’s Daily Current Affairs.st

ANSWERS FOR 7th June – Daily Practice MCQs

Q.1) – b

Q.2) – d

Q.3) -d