IASbaba's Daily Current Affairs Analysis

IASbaba’s Daily Current Affairs (Prelims + Mains Focus)- 2nd March 2018

Archives

(PRELIMS+MAINS FOCUS)

Tiger Conservation

Part of: Mains GS Paper III- Environment, Conservation

Key pointers:

- In November 2010, the first “Tiger Summit” in St Petersburg, Russia, endorsed a Global Tiger Recovery Programme aimed at reversing the rapid decline of tigers, and doubling their numbers by 2022.

- India was one of the 13 tiger range countries that participated in the gathering, at which leaders committed to “drawing up action plans to strengthen reserves, crack down on poachers and provide financial assistance to maintain a thriving tiger population”.

Concern:

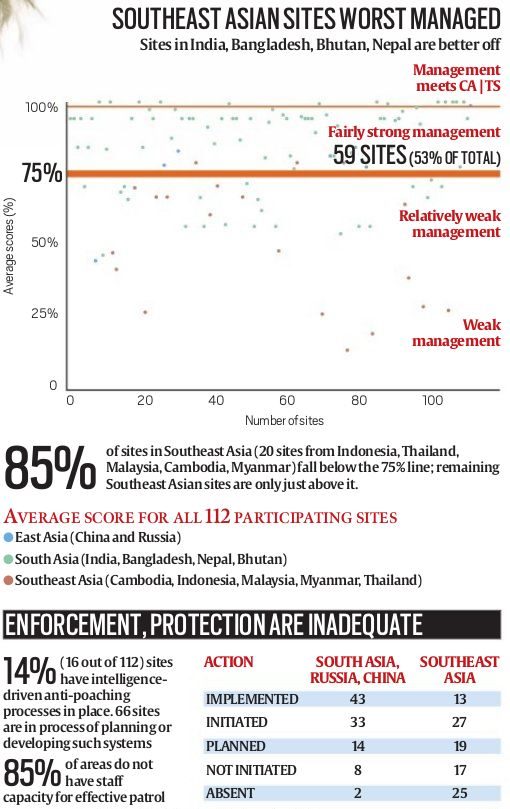

- A rapid survey across 112 tiger conservation areas in 11 range countries has now shown that at least a third of these areas are at severe risk of losing their tigers due to poor management.

- Three of the 13 countries, Laos, Vietnam, and Cambodia have lost all their tigers.

Pic credit: http://images.indianexpress.com/2018/03/toger-explained.jpg

Reasons behind:

- Three-quarters of the surveyed sites had insufficient staff and lacked adequate management infrastructure.

- Efforts to stop poaching, manage community relations, and ensure safe havens for tigers and other wildlife are not up to the mark.

- Very few sites had intelligence-driven anti-poaching processes in place.

Article link: Click here

National Financial Reporting Authority

Part of: Mains GS Paper III- Indian Economy

Key pointers:

- As part of the government’s effort to strengthen oversight of the audit profession, the Union Cabinet paved the way for an independent regulator.

- The regulator can now investigate both chartered accountants and their firms.

- The move comes nearly five years after the company law provided for such a body to strengthen oversight of the audit profession.

- Till date, there was no legal framework to punish errant CA firms, but now the National Financial Reporting Authority (NFRA) will fill this legal lacuna.

- The NFRA’s scope is being limited to cover CAs and CA firms involved in audit of listed companies and certain large unlisted companies.

NFRA:

- Will act as an independent regulator for the audit profession

- Oversight of auditors in respect of all public interest entities will shift to NFRA

- NFRA will have a Chairman, three full-time members and a Secretary

Article link: Click here

Fugitive economic offenders Bill, 2018

Part of: Mains GS Paper III- Indian Economy

Key pointers:

- It will be introduced in Parliament soon.

- Its enactment will force fugitive economic offenders to return to India to face trial for scheduled offences.

- This would also help banks and other financial institutions achieve higher recovery from financial defaults committed by such fugitive economic offenders.

- Cases in which the total value involved in such offences is Rs. 100 crore or more will come under the purview of this Bill

- The Bill will help in laying down measures to deter economic offenders from evading the process of Indian law by remaining outside the jurisdiction of Indian courts.

- All cases under this proposed law will be tried under the PMLA Act and the administrator will sell the fugitive’s properties to pay off the lenders.

- It will override all other legislation, and will lead to confiscation of all the assets (including benami assets) of the fugitive in India.

Who is fugitive economic corridor?

If any individual who has committed a scheduled offence and against whom an arrest warrant has been issued by a competent court leaves the country, refuses to return to face criminal prosecution, he will be termed as a fugitive economic offender.

Article link: Click here

(MAINS FOCUS)

NATIONAL

TOPIC:

General Studies 2:

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

General Studies 3:

- Conservation, environmental pollution and degradation, environmental impact assessment

Reducing carbon footprint in India through Emission trading scheme

Background:

With hot summers, warm winters, increasing diseases, famines and droughts, and violent acts of nature, we can see how climate change is affecting our daily lives.

To join other nations in the war on carbon, India needs to undertake a comprehensive approach, which can be done by establishing an emissions trading scheme (ETS).

Emission trading scheme:

An ETS is a market-based mechanism where a cap is set on the amount of carbon dioxide or other greenhouse gases that can be emitted by covered entities.

The emitters can either reduce their emissions to adhere to the cap or buy additional allowances from other entities to compensate for their deficiency.

One allowance gives the right to the holder to emit one tonne of carbon. Imagine that ‘X’ emits 120 tonnes of carbon per annum. The ETS sets a cap of 100 tonnes of carbon per annum (equivalent to 100 allowances) on it. ‘X’ would have the option to either reduce its emissions to 100 tonnes of carbon or buy 20 allowances to cover the difference.

Regulator to implement the ETS:

A separate and independent regulatory authority must be set up to implement the ETS.

- The authority would ensure that the ETS is insulated from the political influence of climate sceptics.

- The authority must strive to educate emitters about ETS and inform them of cheap methods to reduce their carbon footprint.

- It must act as a ‘technical consultant’ when the emitters submit their ‘compliance plans’.

- It must also plan for contingencies and be ready to use the tools at hand to prevent market failure.

Inclusion or exclusion of industries under the ETS:

- Highly carbon-intensive industries (such as the coal sector) would have to be included under the ETS to maintain its effectiveness.

- With respect to the other industries, State governments must be empowered to add to the list of covered entities after giving due weight to factors such as area-specific emission profiles, financial position of the entities, impact on the economy, and administrative costs.

For instance, in Delhi, the commercial sector emits 30% of the city’s total carbon emissions, and in Ahmedabad the sector accounts for a mere 4% of total emissions.

It would be reasonable to cover the commercial sector in Delhi under the ETS due to its large contribution to emissions.

It would not make sense to cover the same sector in Ahmedabad, as the authority would have to bear unreasonable administrative costs to administer the ETS.

Ensuring compliance:

The ETS must obligate the emitters to design a ‘compliance plan’, setting out its own medium and long-term goals, with an explanation of how it would achieve them.

The big emitters must be required to adhere to their compliance plans, and sanctions must be imposed in case of any non-compliance.

It is imperative to maintain the price of the allowances within a certain desirable range. If the price of the allowances is too high, it may result in increased non-compliance and force the emitters to reduce output, thereby hurting the economy.

Controlling price volatility:

There are three suggested measures for controlling price volatility: safety valve trigger, price-based market stability reserve (MSR), and banking.

A ‘safety valve trigger’ mechanism:

If prices touch a predetermined level, actions are initiated to drive them down.

For instance, under the U.S. Regional Greenhouse Gas Initiative, if the price of the allowances touches $10 after 14 months from the beginning of the programme, the compliance period is extended by one year. This mechanism allows the emitters to average out their emissions.

For instance, say emitter ‘X’ (with a cap of 100 tonnes of carbon per annum) emitted 110 tonnes of carbon in the first year (due to sudden increase in the demand in the economy) and 90 tonnes of carbon in the second year. If the safety valve is triggered in the first year, X’s average annual emissions would be 100 tonnes, and X would not be required to buy any additional allowances.

Price-based market stability reserve (MSR):

In the MSR, a certain number of allowances are released in the market if the price of the allowance hits a predetermined level.

Once the additional allowances are released in the carbon market, the supply would increase, leading to a reduction in the price of the allowances.

Banking:

It offers respite to the emitters on an individual basis.

An emitter, in anticipation of high prices, would be allowed to ‘bank’ his unused allowances for the next compliance period.

However, such banking must be restricted to consecutive compliance periods and to a certain percentage of total emissions.

Conclusion:

India can be part of the global mission to curb climate change through the above-mentioned Emission trading scheme. The government should explore this option.

Connecting the dots:

- What do you mean by Emission Trading Scheme(ETS)? Does India need one? Discuss.

INTERNATIONAL

TOPIC: General Studies 2:

- India and its neighbourhood- relations.

- Bilateral, regional and global groupings and agreements involving India and/or affecting India’s interests

- Effect of policies and politics of developed and developing countries on India’s interests

Mastering the Indian Ocean

Background:

China has decided to become a major player in the Indian Ocean Region (IOR). Smartly playing its economic and diplomatic cards, China has established a chain of maritime footholds in Myanmar, Sri Lanka and Pakistan, and acquired its first overseas military base in Djibouti last year.

Recent developments in positive direction:

- India’s recent agreement with Oman providing access, for “military use and logistical support” in the new Port of Duqm, has raised hopes that India is, belatedly, strengthening its maritime posture in the Indian Ocean Region (IOR).

- There have been other significant developments too; like President Ram Nath Kovind’s visit to Djibouti and its recognition by India.

- The conclusion of an Indo-Seychelles agreement for creation of air and naval facilities on Assumption Island; and

- The agreement with the UAE for joint naval exercises.

Issue- Lack of over-arching vision:

China has been releasing defence white papers every two years. Accordingly, Beijing has built a powerful navy that will soon overtake the US navy in numbers, lagging behind only in capability.

New Delhi, on the other hand, has shown no tangible signs of strategic thinking or long-term security planning, as evident from a total absence of defence white papers or security doctrines to date.

The navy did spell out, in 2004-05, its own vision of India’s maritime interests and challenges through a maritime doctrine and a maritime strategy. But, in the absence of higher strategic guidance in the form of a national-level document, they are of limited utility.

Thus, the absence of an over-arching vision which conceptualises the IOR in a 50-75 year perspective that has led to the neglect of maritime issues critical to India’s vital interests.

Examples:

- The Chabahar port project should have been completed long ago, notwithstanding US sanctions;

- The offer of Agalega Islands from Mauritius should have been taken up years ago;

- the Maldives imbroglio should have been pre-empted.

- Our disregard of distant Mozambique and Madagascar remains a huge maritime “missed opportunity”.

The IOR strategic agenda may be soon taken out of India’s hands as the chairmanship of two important bodies, the Indian Ocean Rim Association (IORA) and the Indian Ocean Naval Symposium (IONS) devolves on the UAE and Iran respectively.

Conclusion:

In order to herald a renewed impetus to India’s maritime outreach and for the actualisation of Prime Minister Narendra Modi’s 2015 “Sagar” vision, we need to have a coherent Indian maritime grand strategy.

Connecting the dots:

- One of the important challenge in mastering the India Ocean is lack of a long-term strategic vision, unlike China. Critically analyze.

MUST READ

Mapping the Chinese century

Is AI a danger to humanity?

The government’s role in conract farming

Fiscal stress and revenue generation from Aadhaar

Let’s not teach towards the test