IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS + MAINS FOCUS)

NMM and HPC facilities result in a 50-fold increase in its economic benefits: NCAER Report

Part of: GS Prelims and GS-III – Science and technology

In news

- National Council of Applied Economic Research (NCAER) Report on “Estimating the economic benefits of Investment in Monsoon Mission and High Performance Computing (HPC) Facilities” was recently released.

- Released by: Ministry of Science and Technology

- With an initial investment of Rs. 1,000 Crores, NMM and HPC facilities result in a 50-fold increase in its economic benefits.

Key takeaways of the report

- A total of Rs. 1000 crores has been invested in setting up National Monsoon Mission(NMM) and High performance Computing (HPC) facilities by Government of India.

- 76% of the livestock owners are using weather information for taking decisions on modification of shelter; vaccination against seasonal disease; and fodder management.

- 82% of fishermen reported using Ocean State Forecast (OSF) advisories every time before venturing into sea.

Important value additions

National Monsoon Mission

- Launched by: Ministry of Earth Sciences in 2012.

- Aim: To improve the forecasting skills by setting up a state-of-the-art dynamic prediction system for monsoon rainfall different time scales.

- NMM builds a working partnership between the academic and research and development (R&D) organisations, both national and international.

- Its augmentation with High Performance Computing facilities has helped the country in achieving a paradigm shift in weather and climate modelling for operational weather forecasts.

Lakhs of people benefit through Tele-Law

Part of: GS Prelims and GS-II – Governance

In news

- Tele-Law was in the news recently.

- Almost 4 Lakh beneficiaries having received legal advice under this through CSCs (Common Service Centres).

Important value additions

Tele-Law programme

- It was launched by Department of Justice in 2017 to address cases at pre–litigation stage.

- Under this programme, smart technology of video conferencing, telephone /instant calling facilities available at the vast network of Common Service Centres at the Panchayat level are used to connect the vulnerable communities with the Panel Lawyers for seeking timely and valuable legal advice.

- It is proactively outreached to groups and communities through a cadre of frontline volunteers provided by NALSA and CSC- e Gov.

Statements recorded by officers under the NDPS Act cannot be treated as confessions: SC

Part of: GS Prelims and GS-II – Judiciary

In news

- The SC has given its ruling on whether statements recorded under Section 67 of the Narcotics Drugs and Psychotropic Substances (NDPS) Act can be admissible as confessional statements during criminal trials.

Key takeaways

- The majority judgment ruled that statements recorded by officers under the NDPS Act cannot be treated as confessions.

- The majority view held that if confessional statements made under the Act are held as the basis to convict a person, it would be a direct infringement of constitutional guarantees

- The court also held that when a reference is made to “police officers”, it does not only mean a police officer belonging to a state police force but includes officers who may belong to other departments.

- The ruling will impact evidence in several cases, including the alleged drugs case being investigated by the Narcotics Control Bureau (NCB) where actor Rhea Chakraborty and 24 others have been named as accused.

Pandemics to emerge more often: New Report by IPBES

Part of: GS Prelims and GS-II – Health & GS-III – Science and technology

In news

- In a new report released by the IPBES, the authors have warned that future pandemics will emerge more often, they’ll spread more rapidly, do more damage to the world and kill more people than COVID-19, unless significant measures are taken.

Key takeaways of the report

- The report notes that COVID-19 is at least the sixth pandemic to have taken place in the last century since the Great Influenza Pandemic of 1918.

- Three of the pandemics were caused by influenza viruses, one by HIV followed by SARS and COVID-19.

- While the current pandemic’s origins lie in microbes carried by animals, like all pandemics, its emergence has been entirely driven by human activities.

- There are over 1.7 million currently ‘undiscovered’ viruses that exist in mammals and birds, out of which up to 827,000 could have the ability to infect people.

- More than 70% of emerging diseases, such as Ebola, Zika and Nipah, are caused by microbes found in animals that spill over due to contact among wildlife, livestock and people.

- About 30% of emerging infectious diseases are attributed to land use change, agricultural expansion and urbanisation.

- The report suggests that pandemic risk can be lowered by reducing the human activities that drive loss of biodiversity, by greater conservation of protected areas and through measures that reduce unsustainable exploitation of high biodiversity regions.

Important value additions

Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem (IPBES)

- It is an intergovernmental organization established to improve the interface between science and policy on issues of biodiversity and ecosystem services.

- Established by: United Nations

- It functions independently.

- Formation: 2012.

- Headquarters: Bonn, Germany.

Community in news: Miyas of Assam

Part of: GS Prelims and GS-I – Society

In news

- Recently, a proposed Miya museum reflecting the culture and heritage of the people living in char-chaporis has stirred up a controversy in Assam.

Important value additions

Miyas of Assam

- The ‘Miya’ community comprises descendants of Muslim migrants from East Bengal (now Bangladesh) to Assam.

- They came to be referred to as ‘Miyas’, often in a derogatory manner.

- The community migrated in several waves — starting with the British annexation of Assam in 1826, and continuing into Partition and the 1971 Bangladesh Liberation War.

- Their Migration has resulted in changes in demographic composition of the region.

- Years of discontent among the indigenous people led to the six-year-long (1979-85) anti-foreigner Assam Agitation to weed out the “illegal immigrant”, who was perceived as trying to take over jobs, language and culture of the indigenous population.

Char-chaporis

- Char-chaporis are shifting riverine islands of the Brahmaputra.

- These are primarily inhabited by the Muslims of Bengali-origin.

- A char is a floating island while chaporis are low-lying flood-prone riverbanks.

- While Bengali-origin Muslims primarily occupy these islands, other communities such as Misings, Deoris, Kocharis, Nepalis also live here.

Computation of maintenance to estranged wife will include child care: SC

Part of: GS Prelims and GS-I – Society & GS-II – Judiciary

In news

- The Supreme Court recently ruled that Computation of maintenance to estranged wife will include child care.

Key takeaways

- The Supreme Court said if an estranged wife gave up her job to take care of children and the elderly in the family, then this will have to be taken into consideration by the family court while quantifying monthly interim maintenance payable to her by the husband.

- The court also found that pleas for grant of interim maintenance were pending in courts for years even though the law stipulated a 60-day window, from the date of issuance of notice by the court to a husband on the estranged wife’s application, for grant of maintenance.

- This is the first time that the highest court has considered the sacrifices made by career women in taking care of children.

- The SC ruled that this would be an added component for enhancing the grant of interim compensation to her, so that she could lead a life almost akin to what she was used to when all was well in the matrimonial home.

- Normally, the courts take into account the husband’s income and assets while quantifying interim maintenance to an estranged wife.

- As of now, Neither the Hindu Marriage Act nor the Protection of Women from Domestic Violence Act specified the date from which interim maintenance was to be granted, leading to exercise of discretion by family courts.

ENHANCED PINAKA Rocket successfully flight tested

Part of: GS Prelims and GS-III – Defence and Security

In news

- Enhanced PINAKA rocket has been successfully flight tested from Integrated Test Range, Chandipur off the coast of Odisha.

- Developed by: Defence Research and Development Organisation, DRDO

Key takeaways

- The enhanced Pinaka along with guidance Pinaka will cover the range between 60 and 90 km.

- It will be deployed by the Indian Army.

- Enhanced version of the Pinaka rocket would replace the existing Pinaka Mk-I rockets which are currently under production.

Miscellaneous

COVID-19 Shri Shakti Challenge

- MyGov in collaboration with UN Women, launched the COVID-19 Shri Shakti Challenge in April 2020.

- Objective: To encourage and involve women led startups to come up with innovative solutions that can help in the fight against COVID19 or solve problems that impact a large number of women.

- This challenge was hosted on the Innovate platform of MyGov that called for applications from women led startups as well as startups who have solutions that address issues faced by a larger number of women.

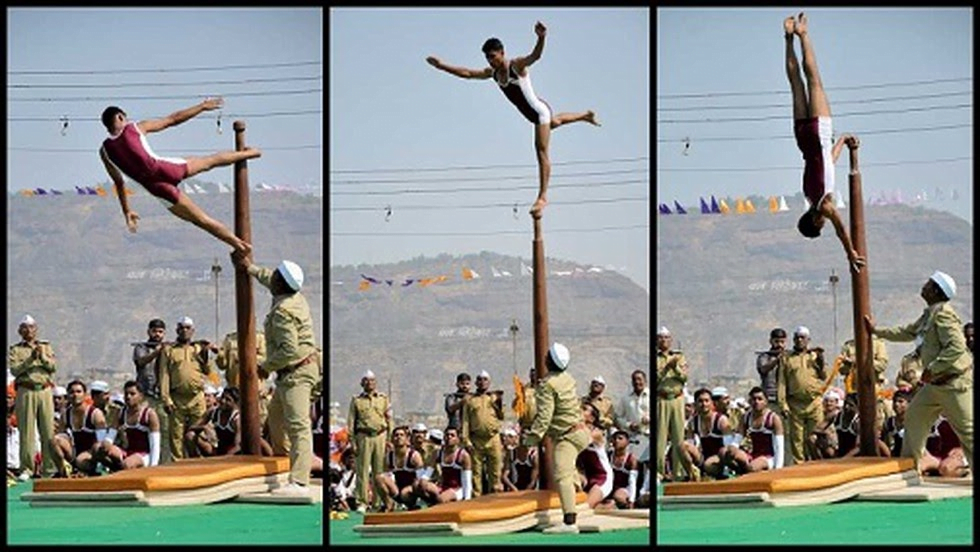

Mallakhamb

- This ancient Indian form of sports is drawing in a steady stream of players in the USA due to the efforts of a couple named Chinmay Patankar and Pradnya Patankar.

- Mallakhamb is one of the few games that is played against gravity.

- It functions on a synergy of mind and body, employing every muscle in a way that enables a person to develop speed, stamina and better health.

- The name derives from the pole used by wrestlers for practising their skills.

- Nevertheless, there are two other Mallakhamb styles such as ‘rope mallakhamb’ and ‘hanging mallakhamb’.

- Its origin can be traced to earlier part of the 12th century.

- A mention of wrestlers exercising on wooden poles is found in the Manasholas, written by Chalukya, in 1153 AD.

- It was revived late in the 19th century by Balambhatta Dada Deodhar, physical instructor to Bajirao Peshwa II.

Leishmania donovani

- Dr Susanta Kar, Senior Scientist, Molecular Parasitology and Immunology, CSIR-CDRI, Lucknow is chosen for this year’s Prof.A N Bhaduri Memorial Lecture Award by Society of Biological Chemists (India) for his contributions towards defining the survival tactics of Leishmania Donovan.

- Leishmania Donovani is a protozoan parasite that infects macrophages.

- It is a causative agent of visceral leishmaniasis (Kala Azar), a lethal infectious disease affecting millions worldwide.

(MAINS FOCUS)

ECONOMY/ GOVERNANCE

Topic: General Studies 2,3:

- Fiscal Policy and Government Budgeting

- Functions and responsibilities of the Union and the States, issues and challenges pertaining to the federal structure

The financial capacity of States is being weakened

Context: Through various means the Union government has substantially reduced the fiscal resource capacity of the States.

States need resources to deliver the developmental aspirations of its citizens but unfortunately, the financial capacity of the States is structurally being weakened. Some of the factors that has caused this weakness are:

- Declining Actual devolution

- Finance Commissions recommend the share of States in the taxes raised by the Union government. Their recommendations are normally adhered to.

- The year 2014-15 commenced with a shock: actual devolution was 14% less than the Finance Commission’s projection. Subsequent devolutions have been consistently less every year, ending the period 2019-20 with a whopping -37%

- Between 2014-15 and 2019-20, the States got ₹7,97,549 crore less than what was projected by the Finance Commission.

- This is an undeniable and substantial reduction of the fiscal resource capacity of the States.

- Shrinking the divisible pool

- Various cesses and surcharges levied by the Union government are retained fully by it. They do not go into the divisible pool. This allows the Centre to raise revenues, yet not share them with the States.

- CAG has also recently highlighted the misuse of Cess pool by Union Government. For details click here

- When taxes are replaced with cesses and surcharges, as has been done repeatedly by the government in the case of petrol and diesel, the consumer pays the same price. But the Union government keeps more of that revenue and reduces the size of the divisible pool. As a result, the States lose out on their share.

- Between 2014-15 and 2019-20, cesses and surcharges has increased from 9.3% to 15% of the gross tax revenue of the Union government

- In 2019-20 alone, the Union government expected ₹3,69,111 crores from cesses and surcharges. This will not be shared with the States.

- This government has exploited this route to reduce the size of the divisible pool.

- GST Shortfall

- The ability of the States to expand revenue has been constrained since the Goods and Services Tax (GST) regime was adopted.

- Under the GST (Compensation to States) Act, states are assured compensation for the gap between revenues at a compounded growth rate of 14 per cent over the base year revenue of 2015-16 and the actual revenues from GST for five years ending June 2022 through levy of cess on demerit and sin goods

- GST compensation to States will end with 2021-22. But cesses will continue.

- During 2019-20, the cess collected was ₹95,444 crore. With the abnormal exception of this year, the years ahead will generate similar or more cess revenue.

- Due to COVID-19 induced lockdown, it is expected that there will be nearly ₹3 lakh crore GST shortfall to the States and the Centre is saying that it will to only compensate ₹1.8 lakh crores.

- On the other hand, states have been arguing that the Union government should borrow this year’s GST shortfall in full and release it to the States. The entire loan borrowed can be repaid out of the assured cess revenue that will continue to accrue beyond 2022.

Consequences

- Reduced Grants: Apart from the streams discussed above, Central grants are also likely to drop significantly this year. For instance,₹31,570 crore was allocated as annual grants to Karnataka. Actual grants may be down to ₹17,372 crore.

- Revenue Shortfall: Due to all these reasons, the States may experience a fall of 20%-25% in their revenues this year.

- Increased borrowings by States: To overcome such extreme blows to their finances and discharge their welfare and development responsibilities, the States are now forced to resort to colossal borrowings. Repayment burden will overwhelm State budgets for several years.

- Social Impact: After paying loans and interest, salaries and pensions, and establishment expenses, there will be little available for development and welfare. As a result, adverse consequences will be felt in per capita income, human resource development and poverty

Conclusion

States are at the forefront of development and generation of opportunities and growth. Strong States lead to a stronger India. The systematic weakening of States serves neither federalism nor national interest.

ECONOMY/ GOVERNANCE

Topic: General Studies 2, 3:

- Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation

Sugar Industry: Need for export subsidy

Context: Union Commerce and Industry Minister Piyush Goyal’s announced that the central government is not considering an extension of its export subsidy for the 2020-21 sugar season.

The industry has warned of a ‘vertical collapse’ in the sector due to excessive stock, whose ramification can be felt in the years to come.

Why is the sugar industry rooting for exports even before the start of the season?

- At the start of the (October-November) sugar season, the industry draws up its balance-sheet and takes into consideration the expected production, the carry forward stock of last season, minus domestic consumption and exports, if any.

- This sugar balance-sheet determines the availability of sugar for the next season.

- In case of unusually high stock, ex-mill prices remain low for the present season as well as for the upcoming season, which result in liquidity crisis for the sugar sector.

| 1 | Opening Stock this season (2020-21) | 107 lakh tonnes |

| 2 | Annual Production Estimation (2020-21) | 326 lakh tonne |

| 3 | Estimated Diversion for Ethanol production | 20 lakh tonnes |

| 4 | Total available sugar balance in this season (2020-21) = (1+2)-3 | 413 lakh tonnes |

| 5 | Estimated Domestic Consumption in this season | 260 lakh tonnes |

| 6 | Opening stock of next season (season of 2021-22) = (4-5) | 153 Lakh tonnes |

- This unusually high stock in the next season, without an export incentive like a government subsidy, will result in a vertical collapse of the sector.

- One way of correcting this inventory is to promote export of at least 50 lakh tonne of sugar. Then the opening stock would be 105 lakh tonne, providing the mills a healthy inventory as well as liquidity from exports

Why are mills reluctant to export sugar without a government subsidy?

- The mills’ reluctance stems from the gap between cost of manufacturing and the current price of raw sugar in international markets.

- Sugar contracts at international markets are trading at Rs 21-22 per kg, while the cost of production is at Rs 32.

- The price mismatch has ruled out any export prospects as this would lead to further loss for the mills.

- Ironically, mills are facing this problem at a time when Indian sugar has made its mark in the international markets.

- Last season, India has reported record sugar export of 60 lakh tonne, of which 57 lakh tonne have already left the the country. The remaining consignment is expected to leave by the end of December.

How did the mills manage to export sugar last season?

- The record export level last season was possible only because of the subsidy programme offered by the central government.

- Mills were promised a transport subsidy of Rs 10.448 per kg of sugar exported.

- This subsidy had helped mills bridge the difference between production costs and international prices.

- Also, the Union Ministry of Food and Civil Supplies was strict about compliance, which led to mills toeing the line in terms of exports.

- A higher demand in international markets had also seen Indian mills reporting good exports.

Have last season’s exports helped mills generate enough liquidity?

- No. The central government is yet to release the export subsidy due to the mills and the total due is as high as Rs 6,900 crore.

- Individual mills had taken loans to facilitate exports and now they have to pay interest to the banks.

- Unpaid interest of Rs 3,000 crore for maintaining buffer stock has also hit hard the balance sheet of mills.

- The Covid-19 pandemic has further delayed the release of subsidy, which has led to many mills not having sufficient liquidity at the start of the season.

But why can’t mills concentrate on ethanol production, given the government’s emphasis on the fuel additive?

- Recently, the central government has announced a Rs 1-3 per litre rise in the procurement price of ethanol. This is the signal given by the government to mills to divert cane towards production of ethanol rather than sugar.

- Last year, the central government had announced an interest subvention scheme for mills to augment production of ethanol.

- But diversion to ethanol, although a much-needed move, will require time to materialise, to augment the capacity (building physical infrastructure)

- With the present capacity, mills can produce 426 crore litres of ethanol, which would require diversion of 15-20 lakh tonnes of sugar.

Conclusion

- While the government’s move to encourage mills towards ethanol production is certainly welcome, it would require more capital and time.

- For the current season, in case exports are not made viable, not only will India lose its market share, but mills will certainly feel the liquidity crunch.

Connecting the dots:

- MSP in age of Surplus: Sugarcane Pricing and Milk Pricing

(TEST YOUR KNOWLEDGE)

Model questions: (You can now post your answers in comment section)

Note:

- Correct answers of today’s questions will be provided in next day’s DNA section. Kindly refer to it and update your answers.

- Comments Up-voted by IASbaba are also the “correct answers”.

Q.1 National Monsoon Mission is launched by which of the following ministry?

- Ministry of agriculture

- Ministry of Science and Technology

- Ministry of Earth Sciences

- Ministry of Electronics and Information Technology

Q.2 Which of the following diseases are caused by microbes found in animals that spill over due to contact among wildlife, livestock and people?

- Ebola

- Zika

- Nipah

- HIV

Select the correct code:

- 1 and 4 only

- 1 and 3 only

- 1 and 2 only

- 1, 2 and 3 only

Q.3 Where is the headquarters of Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem situated?

- Germany

- France

- Norway

- Switzerland

ANSWERS FOR 4th November 2020 TEST YOUR KNOWLEDGE (TYK)

| 1 | B |

| 2 | A |

Must Read

About Star campaigners in Elections and ECI:

About fixing the rules of economy:

About arrest of Republic TV Journalist: