IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS + MAINS FOCUS)

Supercomputer Param Pravega

Part of: Prelims and GS-III -Science and technology

Context: The Indian Institute of Science (IISc.) has installed and commissioned Param Pravega.

Key takeaways

- It is one of the most powerful supercomputers in India, and the largest in an Indian academic institution, under the National Supercomputing Mission (NSM).

- The system is expected to power diverse research and educational pursuits. It has a supercomputing capacity of 3.3 petaflops (1015 operations per second).

- It has been designed by the Centre for Development of Advanced Computing (C-DAC).

- A majority of the components used to build this system have been manufactured and assembled within India.

What is the National Supercomputing Mission (NSM)?

- The mission was announced in 2015.

- NSM envisaged setting up a network of 70 high-performance computing facilities with an aim to connect national academic and R&D institutions across India over a seven-year period at an estimated cost of Rs 4500 Crores.

- Parent Body: Ministry of Electronics and IT (MeitY) and Department of Science and Technology (DST).

- Nodal Agencies of NSM– Centre for Development of Advanced Computing (C-DAC), Pune, and the Indian Institute of Science (IISc), Bengaluru.

- Under NSM, the long-term plan is to build a strong base of 20,000 skilled persons over the next five years who will be equipped to handle the complexities of supercomputers.

- In 2020, a RTI reply revealed that India has produced just three supercomputers since 2015 under NSM

- PARAM Shivay installed in IIT-BHU, Varanasi with 837 TeraFlop capacity

- Second one at IIT-Kharagpur with 1.66 PetaFlop capacity

- PARAM Brahma at ISER-Pune, has a capacity of 797 TeraFlop

News Source: TH

Punaura Dham

Part of: Prelims and GS-I Culture

Context: As per the request received from the State Government of Bihar, Ministry of Tourism has included Punaura Dham in the Ramayana circuit of Swadesh Darshan Scheme.

- The destination of Punaura Dham has been recently included under PRASHAD Scheme of the Ministry of Tourism.

- Punaura Dham, considered to be the birthplace of Hindu Goddess Sita.

- The shrine compound has a Ram Janki temple, a pond called Sita Kund and a hall.

PRASHAD Scheme

- The ‘National Mission on Pilgrimage Rejuvenation and Spiritual Augmentation Drive’ (PRASAD).

- Launched by: Ministry of Tourism (2014-15).

- It was changed from PRASAD to “National Mission on Pilgrimage Rejuvenation and Spiritual, Heritage Augmentation Drive (PRASHAD)” in October 2017.

- Objective:

- Holistic development of identified pilgrimage destinations;

- Rejuvenation and spiritual augmentation of important pilgrimage and heritage sites;

- Follow community-based development and create awareness among the local communities;

- Strengthen the mechanism for bridging the infrastructural gaps.

Swadesh Darshan Scheme

- It is a Central Sector Scheme launched in 2014 -15.

- Objective:

- Integrated development of theme based tourist circuits in the country;

- To position the tourism sector as a major engine for job creation

- The Ministry of Tourism provides Central Financial Assistance (CFA) for infrastructure development of circuits.

News Source: TOI

Statue Of Equality

Part of: Prelims and GS-I History

Context: Indian Prime Minister will inaugurate the Statue of Equality, a gigantic statue of Ramanujacharya on the outskirts of Hyderabad.

Who was Ramanujacharya?

- Born in 1017 in Sriperumbudur in Tamil Nadu, Ramanujacharya is revered as a Vedic philosopher and social reformer.

- He travelled across India, advocating equality and social justice.

- Ramanuja revived the Bhakti movement, and his preachings inspired other Bhakti schools of thought.

- He is considered to be the inspiration for poets like Annamacharya, Bhakt Ramdas, Thyagaraja, Kabir, and Meerabai.

- He went on to write nine scriptures known as the navaratnas, and composed numerous commentaries on Vedic scriptures.

Why is it called the Statue of Equality?

- Ramanuja was an advocate of social equality among all sections of people centuries ago.

- He encouraged temples to open their doors to everyone irrespective of caste or position in society at a time when people of many castes were forbidden from entering them.

- He took education to those who were deprived of it.

- His greatest contribution is the propagation of the concept of “vasudhaiva kutumbakam”, which translates as “all the universe is one family”.

News source: IE

(News from PIB)

Chandrayaan-3

Part of: Prelims and Mains GS-III: Space Science & technology

In News: Chandrayaan-3 is scheduled for launch in August 2022.

- Same configuration like Chandrayaan-2 but it will not have an orbiter. The orbiter launched during Chandrayaan-2 will be used for Chandrayaan-3.

- Chandrayaan-3 is critical for ISRO as it will demonstrate India’s capabilities to make landings for further interplanetary missions.

- The Chandrayaan-3 takes cues from the first Chandrayaan mission launched in October 2008 that made major discoveries including finding evidence of water on the lunar surface.

What happened to Chandrayaan-2?

- Chandrayaan-2, India’s second mission to the Moon, had failed to make a soft-landing on the lunar surface.

- The lander and rover malfunctioned in the final moments and crash-landed, getting destroyed in the process

Key information gathered till now

- Presence of water molecules on moon which is the most precise information about water till date.

- Presence of Minor elements: Chromium, manganese and Sodium have been detected for the first time through remote sensing.

- Information about solar flares: A large number of microflares outside the active region have been observed for the first time. It shall help in understanding the mechanism behind heating of the solar corona.

News Source: PIB

India’s Stand at COP-26

Part of: Prelims and Mains GS-III: Climate Change

In news: The Government of India has articulated and put across the concerns of developing countries at the 26th session of the Conference of the Parties (COP26) to the United Nations Framework Convention on Climate Change (UNFCCC) held in Glasgow, United Kingdom. Further, India presented the following five nectar elements (Panchamrit) of India’s climate action:

- Reach 500GWNon-fossil energy capacity by 2030.

- 50 per cent of its energy requirements from renewable energy by 2030.

- Reduction of total projected carbon emissions by one billion tonnes from now to 2030.

- Reduction of the carbon intensity of the economy by 45 per cent by 2030, over 2005 levels.

- Achieving the target of net zero emissions by 2070.

Key Points:

- The transfer of climate finance and low-cost climate technologies have become more important for implementation of climate actions by the developing countries.

- The ambitions on climate finance by developed countries cannot remain the same as they were at the time of Paris Agreement in 2015.

- Just as the UNFCCC tracks the progress made in climate mitigation, it should also track climate finance.

- India understands the suffering of all other developing countries, shares them, and hence raises the voice of developing countries.

- The mantra of LIFE- Lifestyle for Environment to combat climate change was shared: Lifestyle for Environment has to be taken forward as a campaign to make it a mass movement of Environment Conscious Lifestyles. The message conveyed by India was that the world needs mindful and deliberate utilization, instead of mindless and destructive consumption.

- As a part of its overall approach, India emphasized the foundational principles of equity, and common but differentiated responsibilities and respective capabilities.

- All countries should have equitable access to the global carbon budget, a finite global resource, for keeping temperature increase within the limits set by the Paris Agreement and all countries must stay within their fair share of this global carbon budget, while using it responsibly.

- India also called on the developed countries for climate justice, and for undertaking rapid reductions in emissions during the current decade so as to reach net zero much earlier than their announced dates, as they have used more than their fair share of the depleting global carbon budget.

Many nations in the World have applauded the five nectar elements (Panchamrit) of India’s climate action.

News Source: PIB.

(Mains Focus)

HEALTH/ ECONOMY

- GS-2: Government policies and interventions for development in Health sectors and issues arising out of their design and implementation.

- GS-3: Budgeting

Budget’s missed healthcare opportunity

Context: The Covid pandemic has amply demonstrated the health sector’s direct and indirect intersectoral impacts.

- Given the learnings of the pandemic, it was reasonable to expect a “health-centred” budget but it was not the case.

- The budget’s main focus is on increasing capital expenditures for expanding the economic infrastructure under the PM Gati Shakti scheme.

Pandemic induced Poverty and Hunger

- An estimated Rs 70,000 crore have been spent by the people out-of-pocket in this short time for medical treatment that the government ought to have provided.

- Spending at a time when earnings were down, pushed millions below the poverty line.

- As a result, hunger has emerged as a major issue placing India low on the malnutrition and hunger index rankings.

How did Budget deal with Healthcare Sector?

- Low Proportion of GDP: The budget allocation for 2022-23 is Rs 83,000 crore, up by 16.4 per cent over last year’s Rs 71,268 crore. Health budget have been stuck at about 1.5 per cent of the GDP.

- On average, OECD countries are estimated to have spent 8.8% of GDP on health care in 2018.

- Marginal Increase for NHM: The budget for the flagship National Health Mission that funds all health initiatives in partnership with the states has been increased from Rs 36,576 crore to Rs 37,000 crore.

- Symbolic Focus on mental health: Government announced establishing 23 telehealth centres of excellence for mental health. However, the mental health budgetary allocation was increased only nominally — from Rs 597 crore to Rs 610 crore

- Mental health impacts over 6-8% of our population and is a major unaddressed epidemic, estimated to cost the economy $1.03 trillion and accounting for 2,443 disability-adjusted life years per 1 lakh population — equal to cardiovascular diseases and more than stroke or COPD.

- Budget outlays for public hospitals has increased by 30%— from Rs 7,000 crore to Rs 10,000 crore — though the much-needed investment for strengthening the surveillance system has a nominal 16.4% increase.

- Underfunding of Health Insurance: The flagship Ayushman Bharat health insurance scheme (PMJAY) continues to be grossly underfunded at Rs 6,412 crore — the same as last year.

- Investment in health research: It has seen a miserable 3.92 per cent increase from Rs 2,663 crore to Rs 3,200 crore.

Why NHM needed much larger boost in funding?

- It is under the NHM that all disease control programmes and reproductive and child health programmes including immunisations are implemented.

- These programmes pertain to ailments that cost little to treat, but are life and death for the large masses of the poor

- Covid resulted in an over 30% shortfall of coverage under all these programmes giving rise to fears of drug-resistant HIV and tuberculosis and left lakhs of children unprotected from vaccine-preventable diseases.

- These programmes required a much bigger boost alongside strategies to ensure they are insulated from another viral outbreak.

Criticisms of Government’s Healthcare Budget

- The government policy focus has been on digitisation of health system instead of enhance the availability of doctors and nurses and access to drugs and diagnostics.

- Addressing mental healthcare problem requires the implementation of the Mental Health Act through an infusion of substantial money, ideas and imagination so as to address the issues of

- shortage of trained human resources

- expensive drugs and services are scarce

- unavailability of services in most parts of the country.

- PMJAY had, quite strangely, spent only Rs 3,199 crore (out of Rs 6,412 crore) despite the huge medical needs people faced on account of the pandemic. Therefore, there is a need to focus on implementation.

- This year, the health budget was required to build the required resilience so that India never goes through the disruptions that it witnessed. Sadly, it contained neither a vision nor a direction towards bridging the glaring gaps in the health system.

Conclusion

Given that India too needs a massive building up of its economy to ensure a minimum quality of life for all its people, we need to envision a transformative change by attacking inequality, disease and ignorance by investing in health, education, nutrition and employment to ensure equal opportunities.

Connecting the dots

ECONOMY/ GOVERNANCE

- GS-2: Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

- GS-3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Budget: Critical Analysis of Fiscal Consolidation

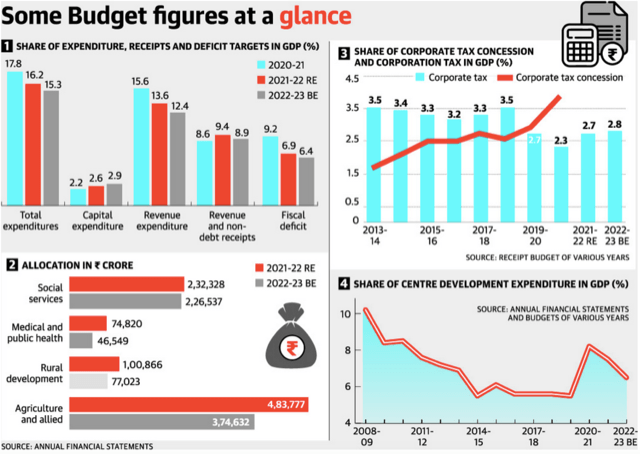

Context: The Union Budget for FY23 has projected a fiscal deficit of 6.4% of nominal GDP, a narrowing from the 6.9% assumed in the revised estimates of FY22.

- Finance Minister said the move was consistent with the broad path of fiscal consolidation announced in 2021 in order to reach a fiscal deficit level below 4.5% by 2025-26.

What was the economic context to this year’s Budget formulation?

- Sharper reduction in Labour Incomes: Though every economic crisis involves sharp reduction in output growth rate, the uniqueness of the present crisis in India lies in the sharper reduction in labour income as compared to profits.

- Low Consumption: The consequent reduction in income share of labour was associated with fall in consumption-GDP ratio as well as absolute value of consumption expenditure during the pandemic.

- While the GDP in 2021-22 is estimated to attain the pre-pandemic level, real consumption expenditure remains to be lower as compared to 2019-20.

- Pre-Pandemic Slowdown: The slowdown during the pandemic was itself preceded by what turned out to be the longest episode of growth slowdown in the Indian economy since the liberalisation period.

What were the broad challenges with the budget 2022?

- The first challenge is specific to the pandemic and pertained to the need of undertaking policies that boosts labour income and consumption expenditure.

- The second challenge pertained to addressing the structural constraints of the Indian economy that restricted growth even during the pre-pandemic period.

How has the Budget fared in this backdrop and what are the key shortcomings?

Continuing with the objective of fiscal consolidation, the Budget falls short of addressing both the above said challenges. There are three distinct features of this fiscal consolidation process.

1. Revenue Expenditure Cut Down as path for Fiscal Consolidation

- Firstly, while share of revenue and non-debt receipts in GDP has remained more or less unchanged, the objective of fiscal consolidation has been sought to be achieved primarily by reducing the expenditure-GDP ratio (see figure 1).

- The brunt of this expenditure compression fell on revenue expenditure.

- The allocation of capital expenditure as a share of GDP has been marginally increased in 2022-23 as compared to 2021-22. Additional capital expenditure could be financed either by postponing fiscal consolidation process or by increasing revenue.

- However, the budget has sought to increase capital expenditure and achieve fiscal consolidation by reducing the allocation for revenue expenditure-GDP ratio.

2. Labour Income not given boost

- Secondly, since the bulk of the revenue expenditure comprises of expenses in social and economic services like subsidies, reduction in the allocation for revenue expenditure has adversely affected the income and livelihood of labour (see figure 2).

- For example, allocation for both agriculture and allied activities and rural development registered a sharp decline in nominal absolute terms in 2022-23 as compared to 2021-22.

3. Increased Tax Concessions

- Thirdly, despite sharp increase in profits during the pandemic, the corporate tax-GDP ratio has continued to remain below the 2018-19 level due to tax concessions.

- The last decade registered a sharp rise in the share of corporate tax concessions in GDP, which reached its peak at 3.9% by 2020-21 (see figure 3).

- As a result, corporate tax-GDP ratio registered a decline particularly since 2018-19 when corporate tax-ratio declined sharply from 3.5% to 2.7%.

- Despite the objective of fiscal consolidation, the corporate tax ratio continues to remain low and restrict revenue receipts.

What are the implications for development spending?

- The objective of fiscal consolidation along with the inability to increase revenue receipts has posed a constraint on development expenditure.

- With non-development expenditure comprising of interest payments, administrative expenditure and various other components, the brunt of expenditure compression has fallen on development expenditure.

- Figure 4 shows the trend in share of centre’s development expenditure (development expenditure is calculated as the sum of expenditures on social services and economic services) in GDP since 2008-09.

- While the decade of 2010s was characterised by different governments meeting fiscal targets by adjusting their expenditure, it registered a sharp decline in the development expenditure ratio till the advent of the pandemic in 2019-20.

- The fiscal stimulus implemented in the first year of the pandemic brought about a brief recovery in 2020-21.

- The fiscal consolidation strategy carried out in the last years has once again led the development expenditure ratio to slide downward.

- The reduction in the allocation for development expenditure ratio for 2022-23 reflects reduction in the allocation for food subsidies, national rural employment guarantee program, expenditure in agriculture, rural development and social sector.

- The reduction in the allocation for development expenditure would have adverse impact on labour income and consumption expenditure.

- The positive impact of higher capital expenditure on the recovery process would be largely curtailed by the adverse impact of more than proportionate fall in revenue expenditure.

What are the prospects of export-led growth?

- Given the fiscal consolidation strategy of the Government, the prospect and extent of economic revival at the present remains heavily dependent on external demand.

- Despite the limited recovery in exports in the last few quarters, the possibility of sustained economic recovery relying exclusively on the export channel appears to be bleak at the present as different countries have already started pursuing fiscal consolidation.

Conclusion

- What the Indian economy lacks at the moment is an effective policy instrument that can boost labour income and aggregate demand.

Can you attempt this?

Analyse the relevance of FRBM Act for a developing economy like India. Also elaborate on the recommendations of the N K Singh panel in this regard

(Down to Earth: Agriculture)

Feb 1: Union Budget 2022-23: Agriculture sees little cause for cheer – https://www.downtoearth.org.in/news/agriculture/union-budget-2022-23-how-will-kisan-drones-benefit-farmers-experts-ask-81371

TOPIC:

- GS-3: Agriculture

Union Budget 2022-23: Agriculture sees little cause for cheer

Context: Union Budget 2022-23 released February 1, saw limited focus on the agriculture sector and related policies.

What did the Budget say?

- The overall allocation increased by a meagre 4.4 per cent for the year, even as important schemes for crop insurance and minimum support price (MSP) saw a drastic slashing of funds.

- The Budget speech saw no mention of the Union government’s ambitious plan to double farm incomes, which reaches its deadline this year (2022).

- The overall allocation for the sector increased marginally to Rs 132,513.62 crore in 2022-23, from the 2021-22 revised estimates (RE) of Rs 126,807.86 crore.

- However, the Market Intervention Scheme and Price Support Scheme (MIS-PSS) was allocated Rs 1,500 crore, 62 per cent less than Rs 3,959.61 crore in revised estimates (RE) of FY 2021-22.

- The Pradhan Mantri-Annadata Aya Sanrakshan Abhiyan (PM-AASHA) saw an even deeper cut. It was allocated just Rs 1 crore for the year as against an expenditure of Rs 400 crore in 2021-22. Both schemes ensure MSP-based procurement operations in the country, especially for pulses and oilseeds.

Cut in the Pradhan Mantri-Annadata Aya Sanrakshan Abhiyan (PM-AASHA)

- The reductions come at a time when an assured MSP continues to be one of the key demands of farm unions that ended their year-long protest against the Union government’s three agricultural laws related to marketing reforms and stocking of essential commodities. The protest ended on the Centre’s assurance that a committee on MSP would be established.

- Either the government is anticipating that prices of pulses and oilseeds will remain expensive (due to the ongoing food inflation) in 2022-23 and will not be sold at MSP

- The other reason could be that it is looking to wind up the scheme — an indication that is not faring well. But the low allocation is questionable on the grounds that the government has been saying that it will procure under MSP and talking about nutrition security.

Cut in the food and nutritionál security

- The Budget document mentions an aim to provide special emphasis on pulses and nutri cereals, beyond 2021-22, to achieve self-sufficiency in these crops along with nutritional security.

- However, even allocation under food and nutritionál security has come down to Rs 1,395 crore from Rs 1,540 crore in RE 2021-22.

- The ‘Distribution of Pulses to state / Union territories for Welfare Schemes’ that aims to dispose pulses procured for utilisation under midday meals, public distribution system, among others, saw an allocation of just Rs 9 crore.

- The 2021-22 budget estimate for the same was Rs 300 crore but actual expenditure was Rs 50 crore. This shows that the government is not anticipating procurement and distribution of pulses at MSP.

- 16.3 million farmers benefited from 120.8 million tonnes of paddy and wheat procurement at MSP in 2021-22. This is a reduction from the 19.7 million farmers that benefited from procurement of 128.6 million tonnes in 2021.

- The Rs 2.37 lakh made in direct payments for the procurement is also less than the Rs 2.48 lakh crore made in 2020-21.

Other Cuts

- Allocation for Pradhan Mantri Fasal Bima Yojana (PMFBY) or crop insurance scheme was also reduced marginally to Rs 15,500 crore for this year from Rs 15,989 crore in 2021-22. This is significant in the backdrop of a gradual fall in the number of farmers under the scheme as they do not find it useful.

- Allocation to the Agriculture Infrastructure Fund (AIF) increased to Rs 500 crore in 2022-23 from Rs 200 crore in RE for 2021-22. It was, however, Rs 900 crore in last year’s budget estimate.

- The Rs 1 lakh crore AIF was announced in May 2020 as part of the Atmanirbhar Bharat Abhiyan and was meant for spending over the subsequent six years. However, experts said its dismal expenditure indicated poor implementation.

Bright Spot: Rashtriya Krishi Vikas Yojana (RKVY) & PM-KISAN

- The programme has been restructured to include schemes like:

- Pradhan Mantri Krishi Sinchai Yojna-Per Drop More Crop

- Paramparagat Krishi Vikas Yojna

- National Project on Soil and Health Fertility

- Rainfed Area Development and Climate Change

- Sub-Mission on Agriculture Mechanization including Management of Crop Residue

- These schemes were earlier a part of the Green Revolution programme. This scheme has been running since 2007-08 and allocations had reduced over the years. But the government has resurrected it in this budget, which is a welcome step. The scheme will give more autonomy to states and they can prioritise their spending under this.

- Allocation under PM-KISAN, which provides income support by way of cash benefit to all land holding farmers, has also increased marginally to Rs 68,000 crore from Rs 67,500 crore last year.

Can you answer the following questions?

- Does agriculture see little cause for cheer in this year’s budget? Discuss

(TEST YOUR KNOWLEDGE)

Model questions: (You can now post your answers in comment section)

Q.1 Consider the following statements regarding Supercomputer Param Pravega?

- It is the first supercomputer designed by the Centre for Development of Advanced Computing (C-DAC).

- It was developed under the National Supercomputing Mission (NSM).

Which of the above is or are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Q.2 Consider the following statements regarding PRASHAD scheme:

- It was launched by Ministry of Education

- The destination of Punaura Dham has been recently included under PRASHAD Scheme which is located in Bihar.

Which of the above is or are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Q.3 Statue of equality is a gigantic statue of Which of the following?

- Raja Rammohan Roy

- Ramanujacharya

- Mahatma Gandhi

- Lala Lajpat Rai

ANSWERS FOR 4th Feb 2022 TEST YOUR KNOWLEDGE (TYK)

| 1 | B |

| 2 | B |

| 3 | B |

Must Read

On India-China relations:

On crypto assets and regulation:

On anti-scientific beliefs: